Elevator pitch

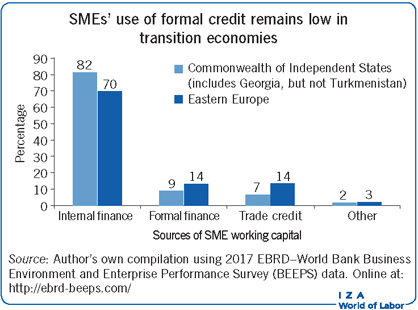

Although small- and medium-sized enterprises (SMEs) represent more than 90% of all enterprises and play an important role in employment generation, they lack access to affordable formal finance. Conventionally, market failures and information imperfections are seen as major causes of this misallocation. However, the role of social and political factors in resource allocation, including access to formal finance, has recently become more widely accepted. Firm-level evidence from post-communist economies, for example, shows that political connectedness improves access to bank credit, but is not associated with enterprise growth.

Key findings

Pros

Access to formal finance is skewed against SMEs in favor of large firms.

Market failures and information imperfections do not fully explain why the distribution of formal finance is skewed against smaller enterprises.

Political connections play an important role in gaining access to formal finance.

Evidence shows that formal financing is associated with faster firm growth than informal financing, and that smaller enterprises benefit more from improved access.

Cons

Recent data show that a substantial portion of SMEs in post-communist countries offer bribes to public officials relatively frequently.

Political connectedness exacerbates misallocation of formal finance, often in favor of enterprises with closer links to government officials, which are usually larger and wealthier.

Although political connectedness improves firms’ access to formal finance, most recent country-level case studies find that the practice is not positively associated with firm performance and growth.