Elevator pitch

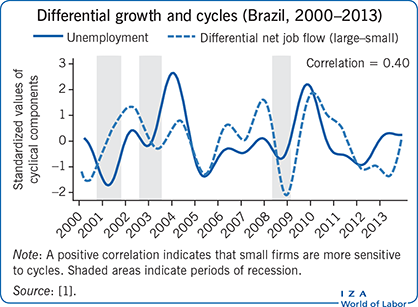

The discussion on how economic activity affects employment in large and small businesses is critical for the formulation of labor policies, especially during recessions. Knowing how firm size is related to job creation and job destruction is important to design effective policies aimed at dampening employment fluctuations. Recent evidence for developed countries indicates that large firms are proportionately more sensitive to cycles than small firms; however, this pattern is not confirmed for periods of credit constraint or in a developing country context, where small businesses might be more sensitive due to more extreme credit constraints.

Key findings

Pros

Recent evidence for developed countries suggests that large businesses might be more sensitive to cycles, but age and credit constraints affect this dynamic.

Credit constraint has a stronger impact on small businesses and is an important factor influencing their employment volatility during economic cycles.

There is robust evidence based on linked employer-employee microdata for a developing country context.

Evidence suggests that small businesses may be more sensitive to economic fluctuations in developing country contexts.

Cons

There is no consensus in the literature about the sensitivity of small and large firms to business cycles.

Even though business productivity is key to understanding the relationship between firm size and economic fluctuation, results on productivity are still missing.

Evidence for developing countries is based on data for the formal sector in Brazil and neglects firm age, which is necessary to better understand the factors influencing employment fluctuations.

Results for developing countries do not explore sectoral and regional variations in employment fluctuations; additional studies are needed to provide more reliable results.