Elevator pitch

The discussion on how economic activity affects employment in large and small businesses is critical for the formulation of labor policies, especially during recessions. Knowing how firm size is related to job creation and job destruction is important to design effective policies aimed at dampening employment fluctuations. Recent evidence for developed countries indicates that large firms are proportionately more sensitive to cycles than small firms; however, this pattern is not confirmed for periods of credit constraint or in a developing country context, where small businesses might be more sensitive due to more extreme credit constraints.

Key findings

Pros

Recent evidence for developed countries suggests that large businesses might be more sensitive to cycles, but age and credit constraints affect this dynamic.

Credit constraint has a stronger impact on small businesses and is an important factor influencing their employment volatility during economic cycles.

There is robust evidence based on linked employer-employee microdata for a developing country context.

Evidence suggests that small businesses may be more sensitive to economic fluctuations in developing country contexts.

Cons

There is no consensus in the literature about the sensitivity of small and large firms to business cycles.

Even though business productivity is key to understanding the relationship between firm size and economic fluctuation, results on productivity are still missing.

Evidence for developing countries is based on data for the formal sector in Brazil and neglects firm age, which is necessary to better understand the factors influencing employment fluctuations.

Results for developing countries do not explore sectoral and regional variations in employment fluctuations; additional studies are needed to provide more reliable results.

Author's main message

There is an active literature on employment cyclicality and business size, though it is mostly based on results for developed countries where the evidence suggests that larger firms are more sensitive to cycles, meaning that larger employers hire proportionately more during expansions and fire more during recessions. However, recent studies indicate that firms’ age, movements from non-employment to employment and credit constraint might lead to higher cyclicality of small firms, particularly in developing countries. Hence, further research is needed to devise more context specific policies for dealing with firm sensitivity during business cycles.

Motivation

What types of firms, small or large, shed proportionately more jobs during times of economic downturns and hire more during booms? This question motivates an important line of research that seeks to explain the factors behind the dynamics of employment creation and destruction in small and large businesses. The prevailing view based on recent data for developed countries is that large firms are proportionately more sensitive to business cycles, implying that they hire more excessively during booms and fire more rigorously during recessions.

However, recent studies provide new insights about the dynamics between firm size and business cycles. From these studies, different patterns emerge with respect to hiring workers out of unemployment during economic booms and are related to the size and age of firms and the severity of credit constraint, all of which might lead to higher employment cyclicality of small firms. Some of these studies explore regional-level data variation. These studies generate more robust results and suggest that the above mentioned factors (firm’s age and credit constraints) do indeed influence the dynamics between firm size and cycles. Hence, the result that larger firms are more sensitive to cycles seems not to be observed in all circumstances. Furthermore, little is known about employment dynamics and firm size over business cycles in developing countries. However, the scant evidence available does indicate that small firms behave quite differently in developing countries than in the more developed world.

As such, policymakers can benefit greatly from improved knowledge about the factors that might influence small and large firms’ employment dynamics during business cycles in both developed and developing countries. In particular, recent evidence seems to indicate that credit is an important factor to be taken into account when devising policies that aim to dampen employment fluctuations and minimize the economic and social costs of job losses during economic downturns in both developing and developed countries.

Discussion of pros and cons

The behavior of firms during business cycles provides critical information needed to formulate effective labor market policies to protect jobs during recessions. An important aspect of the research into this topic involves empirical regularities found in the relationship between firm size and business cycles. In other words, this field of study aims at providing evidence on employment fluctuation by firm size in response to business cycle conditions. A firm is considered more sensitive to business cycles when its employment activity responds more strongly to the cyclical condition of the economy. This article focuses on this aspect, and adopts the assumption found in the literature that the level of firm productivity is positively associated with firm size. It classifies small and large businesses as those having fewer than 50 and more than 500 employees, or as those being in the first and last quintiles of the wage distribution, respectively.

The consensus drawn during the 1990s was that small firms were proportionately more sensitive to business cycles [2]. This view was based mainly on the idea that small firms were likely to be more credit constrained than large firms during periods of economic contraction. However, the supporting evidence generated in the early 1990s faced an important limitation: it was based on repeated aggregated cross-section data that did not allow following the same firms over time. This presented a potentially serious issue: when small firms grow during times of economic boom, they increase their number of workers and might grow beyond the threshold that defines the small firm category. Likewise, large and medium-sized firms might contract during recessions, reducing their workforce and thereby enter the small firm classification. This issue is called “reclassification bias” and has an impact on the calculations used to assess the cyclicality of different sized firms during business cycles. Reclassification bias occurs in data sets without longitudinal links (firms and individuals cannot be tracked throughout the years) in cases when firms are reclassified into larger size groups during economic expansion and the opposite during recession. Due to this bias and the emergence of robust new data that allows for more detailed analyses, the previous consensus from the 1990s that smaller firms are more sensitive to cycles has been called into question.

The relationship between firm size and business cycle sensitivity

A recent increase in the availability of large linked employer–employee microdata has opened a wide array of possibilities to test theoretical models and to provide more robust and reliable results on the issue of firm size and cyclical conditions. This has led to a new set of findings for developed countries, which contrast the results of earlier studies that used typically aggregated data. Accordingly, these new findings indicate that larger firms, rather than smaller ones, are more sensitive to economic cycles [3]. The use of longitudinal microdata (in contrast to aggregate data) allows researchers to circumvent the serious reclassification bias problem mentioned above and to test whether the so-called “job-ladder mechanism” can explain this finding [3].

A series of studies was published after 2008 that presented new empirical evidence for a set of OECD countries (Canada, Denmark, France, the UK, and the US), and included extensive evidence at both the regional and sectoral levels for the US. These studies all show that larger firms are more sensitive to cycles than smaller firms [3], [4] and [5]. These findings are related to poaching observed in the employment dynamics, as predicted by the dynamic job-ladder model [6]. According to this model, where firm size is positively related to productivity, less productive (and thereby smaller and low-wage) firms hire proportionately more during recessions and periods of high unemployment due to a higher availability of workers willing to accept lower wages. As unemployment rates decline during economic expansion, more productive large firms increase wages and “poach” workers from smaller firms, restricting the employment growth of the latter during economic expansions. These two patterns are based on the idea that less productive (smaller) firms are more constrained in the wage level they can offer their employees, whereas more productive (larger) firms can offer higher wages. During recessions, the available labor supply is greater, thus making it less necessary for firms to compete for a limited pool of workers.

The dynamics related to poaching would thus indicate that larger firms are more sensitive to business cycles, as their hiring practices put a limit on smaller firms’ ability to expand their workforce during economic booms. On the other hand, small firms’ ability to hire low wage workers during recessions affords them a buffer during those periods [5], [6]. It is important to note that the job-ladder mechanism alone does not guarantee that large business will be more cyclically sensitive. This is because net hires, the difference between hires and dismissals, by large firms through poaching during expansions might be compensated by increased net hires by small firms from unemployment. In other words, even though small firms might lose workers to large firms that are willing to pay higher wages, they may be able to fill those poached positions by hiring from the pool of unemployed workers.

The studies mentioned in the previous paragraph combined with the emergence of longitudinal employer-employee linked data have stimulated the production of studies focusing on business size, job flows and cyclical conditions. More recent studies have contributed to this line of research and provided more insights about the issue of firm size and sensitivity to cycles [1], [7], [8], [9], [10]. Importantly, this new wave of studies also provides robust results based on microdata that allow researchers to control for reclassification bias. These findings improve researchers’ knowledge and contribute to the current debate for a number of reasons.

Firstly, new evidence decomposes net employment growth by firm size into net poaching from other firms and hires from unemployment [7]. This decomposition provides a more detailed view on whether large businesses poach workers from small firms or hire from the pool of unemployed during periods of economic expansion. Importantly, not only the number of employees is used as a proxy for firm size, but also wage levels, which is argued to be a better proxy for productivity as wage captures marginal products of labor units. Empirical results are supportive of the job-ladder mechanism, indicating that high wage (large) firms do poach workers from low wage (small) firms. Despite this result showing that the job-ladder mechanism is in force, it does not necessarily mean that higher wage firms are more cyclically sensitive, as employment in low wage firms might be compensated by proportionately more hiring from unemployment.

Secondly, distinguishing between firm size and age is very important to understand the relationship between cyclical conditions and firm size, as younger firms have less access to credit markets and rely more heavily on personal sources of finance. When the analysis distinguishes between firm size and age, the results indicate that the greater sensitivity of large firms relative to small firms to cyclical conditions is mainly driven by maturity of firms [9]. In other words, the idea that larger firms are more cyclically sensitive receives greater support when the analysis is restricted to a subset of smaller and older firms, suggesting that smaller and younger firms may be more sensitive than previously thought [8].

Thirdly, some studies explore regional-level data variation, which overcomes a limitation related to having a relatively small number of observations in national analyses and controls for region and year specific characteristics [7], [9]. The use of region-level heterogeneity generates more robust results, indicating that the job-poaching related to job-ladder models does not necessarily mean that high wage firms are more sensitive to business cycles if they experience a smaller decline in net hires from unemployment than low wage firms during recessions [7]. More empirical evidence is needed to confirm whether low wage firms indeed hire proportionately more unemployed workers than high wage firms during recessions. Studies that explore regional-level data variation have a less definitive answer regarding the net change in employment between high and low wage firms during recessions.

Fourthly, one interesting common characteristic in recent studies for the US is the indication that the job-ladder mechanism stopped working after the 2008 Great Recession [7], [9], [10]. This seems to indicate that under conditions of extreme credit crunch, access to finance constraints are more binding on low wage and small firms, leading to a wave of layoffs that reverses the empirical results related to the job-ladder mechanism. These results send a message that theoretical models that guide public policy must include credit constraint as a major variable that influences employment dynamics during economic fluctuations. This is particularly true if one wants to understand what is happening in developing countries, which inherently have less developed credit markets that might impose tighter credit constraints on smaller business.

Finally, and related to the previous point, recent studies provide initial results for a developing country context. Evidence from developing countries is important because the combined effect of credit constraint and poaching is likely to vary across countries with different levels of development, meaning appropriate policy responses will also vary by context. Importantly, more evidence for developing countries should explore sector and regional variation in employment data to produce more robust results.

Evidence for a developing country context

As the combined effect of credit constraint and poaching varies across countries in different stages of development, employment cyclicality in small or large firms is likely to respond differently to business cycles in developed versus developing countries too. However, little is known about the employment dynamics among different sized firms over business cycles in developing countries. One microdata set that includes longitudinal employer-employee links from Brazil provides an opportunity to explore this issue and presents direct evidence on the job-ladder mechanism in a developing country context.

The study on Brazil uses employment series and differential net job flow rates (e.g. the net job flow rate in large firms minus the net job flow rate in small firms) that are constructed using the Annual Social Information Report (RAIS), which covers the entirety of the formal sector [1]. Importantly RAIS allows for the classification of establishments by their size at the beginning of the analyzed period, either by the number of employees or wage level. Therefore, it isolates the effects of the job creation and destruction due to business cycles and controls for reclassification bias. In other words, the size of establishments is fixed at the beginning of the analysis and business are not reclassified as the economy expands or contracts. The study’s results are based on a continuous (balanced – i.e. the number of establishments in the data is the same across each time period) monthly longitudinal employment series for the period from January 2000 to December 2013, which encompasses about half a million establishments and 11 million workers. The balanced panel at establishment level is then aggregated to calculate the differential net job flow rates.

Following the established literature on this topic, the measure of firms’ relative performance is given by the differential net job flow rates, which is calculated as the difference in employment growth rates between large and small businesses. This method follows the recent literature on the topic [3], [7]. Moreover, the classification of establishments using the wage distribution is advantageous, as wages drive the job-ladder model.

The aim of the study is to observe how the differential net job flow rates correlate with a business cycle measure. Specifically, how do deviations from the trend (cyclical component) of the differential net job flow rates correlate with the cyclical component of a business cycle measure? The unemployment rate is the main business cycle measure used in this study, as it is linked to the theoretical arguments that determine the cyclicality of employment in small and large businesses in the job-ladder models mentioned earlier.

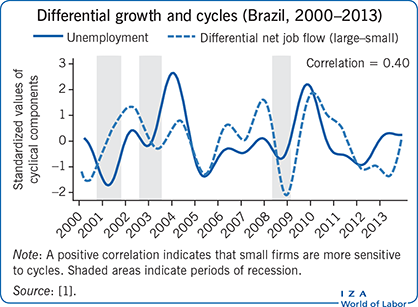

The Illustration presents the correlation between the cyclical components of the differential net job flow rates and unemployment. The shaded areas identify Brazil’s economic recessions. If the cyclical component of the differential net job flow rates is negatively correlated with the business cycles (but positively correlated with unemployment), then employment in small businesses is more sensitive to cycles. The cyclical component of the relative business size performance presents a decline around recessions and a sharp increase afterward. Thus, the differential net job flow rate series seems to be counter-cyclical and suggests that small businesses are more sensitive to cycles; in other words, small establishments shed proportionally more jobs than large businesses in recessions and create proportionally more jobs during expansions.

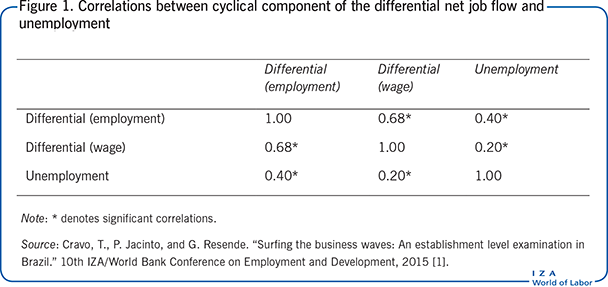

Figure 1 complements the Illustration by showing correlations between the cyclical component of the two versions of the differential net job flows and unemployment (which is a counter-cyclical measure). The differential net job flows based on wages are also positively correlated with the cyclical component of unemployment, indicating that small businesses shed more jobs in times of high unemployment and hire proportionally more than large businesses when the economy expands and the unemployment rate declines. This result is in line with other studies for Brazil [1], [11].

This discussion presented in this article indicates that more research is needed to explain the factors influencing the stylized facts in developed and developing countries. The job-ladder mechanism alone does not determine the sensitivity of employment in small and large firms to cycles; other factors such as a firm’s age and workers’ movements from unemployment to employment should be better understood. It should be noted that this study does not provide evidence about how these factors affect the job ladder mechanism in developing countries. Evidence from the US shows that credit constraint is a particularly important aspect that might lead to higher cyclicality of smaller firms [7], [9], [10]. As it is well known that small firms in developing economies are more credit constrained, further studies are needed to investigate the extent to which this aspect influences the cyclical sensitivity of firms in different developing contexts, as shown in Figure 1 for Brazil.

Limitations and gaps

There are still gaps in understanding the employment cyclicality of different-sized businesses. Unemployment is a key factor influencing employment dynamics in small and large businesses and the literature indicates a need to better understand whether high unemployment is caused by structural or cyclical factors, as the best policy response to negative shocks will differ accordingly [12]. Moreover, the evidence for both developed and developing countries fails to explore how small and large businesses respond to business cycles, depending on whether unemployment is structural or cyclical.

Another limitation relates to recent studies’ use of employment and wages as a proxy for firm size, and their assumption that size is positively related to productivity. Observing productivity directly, without use of a proxy, would overcome this limitation. As such, it is paramount that the literature provides direct evidence for the employment dynamics by firm size using productivity, which has not yet been done.

Moreover, there are other gaps specific to the literature on developing countries. The available evidence does not take into account firms’ age, which is an important factor that can be related to productivity and also affect the relationship between firm size and cycles. Finally, the results presented in this study are based on data for the formal sector only; thus, results cannot be directly generalized to the whole economy. This is particularly relevant, as the informal sector in developing countries often represents a large share of their overall economies.

Summary and policy advice

There is an active debate about whether small or large enterprises are more sensitive to economic cycles in developed countries. Recent studies suggest that the job-ladder mechanism is an important factor that might determine that large firms have a higher employment sensitivity to cycles than smaller ones, which is not confirmed by the latest empirical studies. Other aspects such as firm age, transition from unemployment to employment and credit constraint may contribute to a higher employment sensitivity of small businesses.

Considering a developing country context, data from Brazil show that smaller businesses are indeed more volatile during economic cycles, a result that might be influenced by smaller firms facing more severe credit constraints. The clear pattern seen in Brazil, however, stands in contrast to much of the recent evidence from developed countries. This suggests that the effects may vary considerably across different development contexts.

Overall, there is no clear consensus within the literature on the sensitivity of small and large firms to economic cycles. As such, additional studies should be conducted in varied contexts, particularly in other developing countries, to provide policymakers with a broader evidence base from which to design informed policy.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for their many helpful suggestions on earlier drafts. This article is based on previous work of the author and current research being carried out with co-authors Paulo Jacinto (PUCRS, Brazil) and Guilherme Resende (IPEA, Brazil) [1]. Access to the data provided by the Ministry of Labor is gratefully acknowledged.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Tulio A. Cravo

Job-ladder mechanism

Defining firm size and differential net job flow rates

Source: Christiano, L. J., and T. J. Fitzgerald. “The band pass filter.” International Economic Review 44 (2003): 435–465.