Elevator pitch

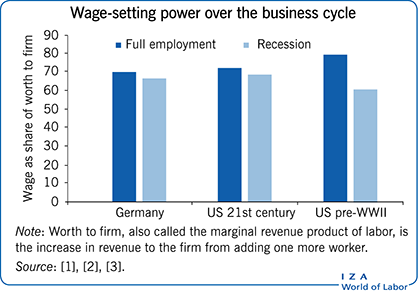

Traditional models of the labor market typically assume that wages are set by the market, not the firm. However, over the last 15 years, a growing body of empirical research has provided evidence against this assumption. Recent studies suggest that a monopsonistic model, where individual firms and not the market set wages, may be more appropriate. This model attributes more wage-setting power to firms, particularly during economic downturns, which helps explain why wages decrease during recessions. This holds important implications for policymakers attempting to combat lost worker income during economic downturns.

Key findings

Pros

A monopsony model may better characterize the labor market than the standard competitive model.

Empirical evidence supports the monopsonistic perspective that firms have wage-setting power, and that an increase in this power decreases wages during a recession.

The monopsony model implies that employment may vary less over the business cycle, reducing the severity of recessions.

The existence of increased firm wage-setting power calls for policies to stabilize workers’ earnings during an economic downturn, such as a temporary payroll tax cut.

Cons

Most studies that find evidence of firm wage-setting power do not have random variation in wages, possibly biasing results.

While there exists strong evidence consistent with a monopsonistic model of wage-setting, there is less direct evidence of firms’ of monopsony power to set wages.

A temporary payroll tax cut for workers experiencing wage declines could have unintended consequences, effectively subsidizing wage cuts.

Weaker firms may survive an economic downturn due to increased wage-setting power, decreasing the “cleansing” effect of a recession.