Elevator pitch

Around nine countries currently use a national income contingent loan (ICL) scheme for higher education tuition using the income tax system. Increased international interest in ICL validates an examination of its costs and benefits relative to the traditional financing system, government-guaranteed bank loans (GGBLs). Bank-type loans exhibit poor economic characteristics: namely, repayment hardships for the disadvantaged, and default. This damages credit reputations and can be associated with high taxpayer subsidies. ICLs avoid these problems, but effective collection of debt requires a sophisticated mechanism.

Key findings

Pros

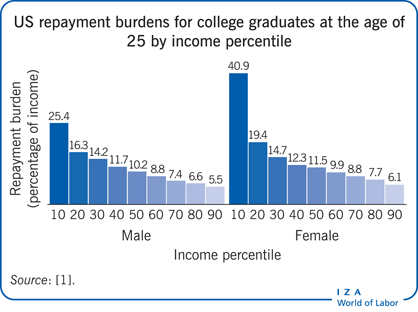

ICLs deliver consumption smoothing by reducing the burden on disposable income from student debt, particularly for those at the lower end of the earnings spectrum.

By coupling loan repayment amounts to a debtor’s actual income, ICLs provide insurance against default.

ICL debt can be efficiently collected if functional tax and personal identification systems are in place.

GGBLs provide debt default insurance for lenders but not borrowers.

Cons

GGBLs can lead to credit reputation loss for the borrower due to default.

Systems based on GGBLs create inequality in educational access due to an increased fear of future debt default by low-income prospective students.

ICLs have sophisticated administration requirements that may be unachievable for some countries.