Elevator pitch

Women’s representation on corporate boards, political committees, and other teams is increasing, in part because of legal mandates. Understanding the effects of gender diversity in terms of economic performance is important to assess the impact of these changes. Data on team dynamics and gender differences in preferences (risk-taking behavior, taste for competition, prosocial behavior) show how gender composition influences group decision-making and subsequent performance through channels such as investment decisions, internal management, corporate governance, and social responsibility.

Key findings

Pros

Gender diversity leads to broader representation of preferences.

Diversity policies help promote equal opportunities and make up for past inequities.

Promoting diversity could help break down cultural barriers.

Greater female participation might encourage other better prepared women.

Cons

The transition to greater diversity has adversely affected performance, at least in the short term, due in part to adjustments in team dynamics.

The short-term decline in performance is often attributed to team members’ skill mismatch and team interactions.

There is evidence that endogenously formed teams are hard to sustain and that they revert to less diversity.

Legislative mandates might be ineffective and counterproductive if committees with a larger share of women are less likely to select female candidates.

Author's main message

The success of policies that promote gender diversity depends on the outcomes being measured and how quickly the policies are implemented. There is evidence of a negative impact on performance in the short term. However, this does not necessarily reflect the potential positive long-term influence on gender equality and better representation of women’s preferences. The adverse results are explained by changes in the decision-making process and team dynamics, and in some cases by the inexperience of (new) female team members. As gender diversity becomes the norm, these problems may fade.

Motivation

Team composition is a rising theme in the economics literature. One branch looks at the impact of the expanding participation of women on corporate boards, political commissions, and other teams. Women’s presence can both alter group preferences and influence group dynamics. To the extent that some committees are responsible for high-level decision-making, women’s participation might reduce the achievement gap between the genders in positions of high responsibility.

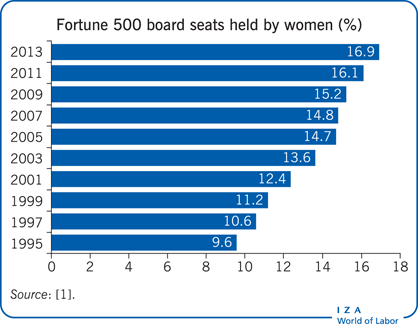

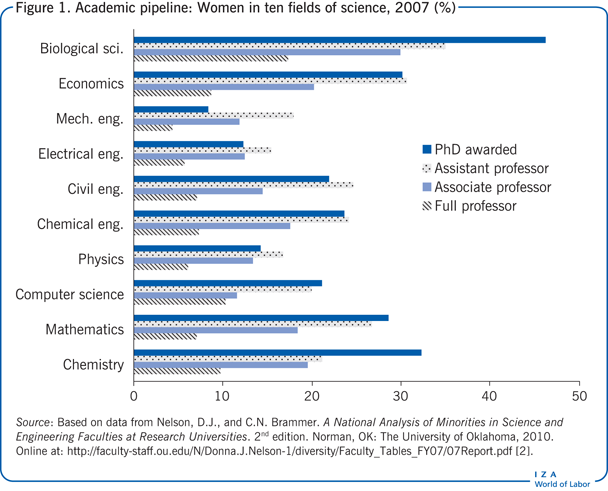

Gender diversity is relevant from a policy perspective. Laws requiring organizations to have more female representation would help women reach top positions. The gender gap in educational attainment and achievement has been closing, and yet women with the same education and experience as men are underrepresented in senior positions. In the US, for example, women now receive more than 30% of MBAs and 50% of PhDs, and they make up half of law school graduates. However, women are less visible in high-ranking roles. In 2011, women accounted for 16% of directors on corporate boards in the US and 12% in Europe. It is rare for firms to have more than one female director, suggesting tokenism. The situation in academia is similar. Among the top 100 US universities, women make up just 4.4–12.3% of full professors in math-intensive fields (see Figure 1). In politics, women fill 33% or more of parliamentary seats in only 19 of 189 countries.

What do we know about the implications of gender composition and gender diversity in teams? What are the empirical findings for the impact of gender diversity on performance and group decision-making?

Discussion of pros and cons

Expected benefits and potential shortcomings

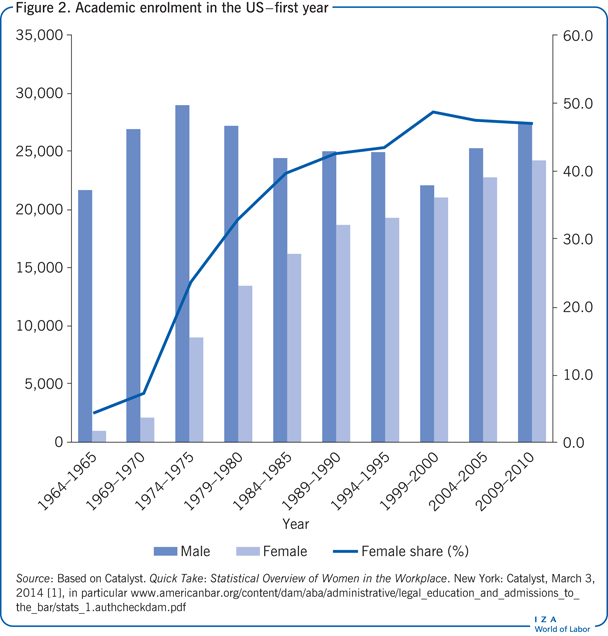

A common motive for promoting gender diversity in teams is that it can advance equal opportunities for women and make up for past inequities. The gender gap in educational attainment is closing—for example, college enrolment of women has risen dramatically in the US since 1964 (see Figure 2), and today more women than men graduate from college. Still, gaps in educational achievement and labor market outcomes persist. Policies promoting diversity are intended to make society fairer, faster. While such policies are often controversial—and there is concern about a mismatch between the roles these policies expect women to fill and women’s preparation—greater female representation might become a model for other women, who will be better prepared.

In addition to equal opportunity, another motive for promoting gender diversity is the expectation that a greater female presence on teams will broaden preferences so that they are more representative of society as a whole. Women in positions of power might adopt policies that better match women’s preferences or help women. For example, women might choose more flexible work hours or promote public expenditures that benefit women more and that can increase female leadership, reducing gender discrimination in the long term.

Another reason for policymakers and researchers to care about gender diversity is that more diversity could enhance a team’s effectiveness. Women and men bring different preferences and viewpoints to the table, which could alter the dynamics of the group.

At the individual level, economics research points to gender differences in a number of dimensions, such as attitude toward risk, preferences for competition, and social values [3], and the psychology literature notes differences in performance when men and women work together or compete. The presence of women changes group dynamics. Groups are known to have idiosyncrasies. For example, group polarization is a widely documented phenomenon: Groups make decisions that are more extreme than the average of the individual views in the group [4].

Empirical evidence: Gender diversity and performance

Understanding whether an organization’s performance is influenced by its gender diversity is central to the debate about gender parity on boards and committees. Economic theory has focused on team diversity with respect to ability but not gender. The impact of imposed gender diversity on team performance would depend on why gender diversity did not arise spontaneously.

For example, if firms and those voting to appoint board members were already optimizing board composition before the change, then profits would be expected to decrease. Because groups typically form endogenously, an empirical understanding of the link between diversity and performance is more difficult to establish. If more-diverse teams perform better, it is tempting to conclude that more diversity is rewarding.

This might be because groups that are more diverse are more entrepreneurial and perform well because of their diversity. However, the reverse could also be the case. Teams that were already performing well might be at greater liberty to behave in ways that are not necessarily profit-maximizing, such as implementing gender diversity policies. Establishing the causal link between diversity and group performance is thus problematic.

Team formation is a function of many parameters. The ideal setting for studying the causal relationship between team diversity and performance is one that captures the complexity of endogenous team formation, while observing external (exogenous) influences on team composition (such as policy mandates to include women). Some studies have used instrumental variables techniques—tools to estimate causal relationships—to assess the effect on team performance of exogenous changes in gender composition in different settings [5], [6].

One study explored the influence of team gender composition on economic performance using a large online business game [5], [7]. In the game, played by groups of three, teams take on the role of general manager of a beauty-industry company competing in a market composed of four other simulated companies. Two identical competitions occur in parallel, one involving undergraduate students and the other MBA students.

Although the setting is not natural, certain features lend themselves to the study of gender diversity in teams:

Firstly, reverse causality is not a concern. Teams are formed endogenously, without any performance history, and, more importantly, remain fixed for the entire game.

Secondly, the game simulates the real-world business environment as closely as possible. MBA students are also relevant, as they are likely to play a key role in real-world business management.

The sample is large and broadly representative: three editions of the game, 2007–2009, yielding a total of 37,914 participants, organized into more than 16,000 teams from 1,500 universities in some 90 countries. Teams formed by three women are significantly outperformed by any other gender combination, in both the undergraduate and the MBA competitions. Performance, as measured by the stock price index, was lowest in these teams by a large margin: about 0.17 standard deviation from the mean in both competitions.

Two hypotheses were examined to explain the performance difference:

The sorting-by-ability hypothesis suggests that the distribution of ability at the individual level is identical in men and women but that less competent women are more likely to sort into three-women teams than less competent men are to sort into all-men teams.

The other hypothesis posits that men and women do not differ in ability or sorting patterns but that teams have different work dynamics, depending on their gender composition. Teams would be comparable in ability, but their economic performance might still differ because of differences in teamwork dynamics.

A study using an instrumental variable approach found that the performance effects are driven by work dynamics and not by sorting [5]. These results can be interpreted as the marginal effects of small interventions on endogenously formed teams. In this sense, the results are particularly informative for guiding public policies such as the imposition of quotas on existing teams.

Another study looked at the effect of gender composition on teams that are randomly formed using a business game with Dutch university students [8]. Teams with an equal gender mix performed best.

Another study, from 2012, looked at the relationship between performance and the gender composition of endogenously formed corporate boards following the passage of a law in Norway requiring that women make up at least 40% of the members on corporate boards of Norwegian firms [6]. Achieving compliance required an average turnover of 30% of board members in the 248-firm sample over 2001–2009, although initial female representation varied widely across firms.

The setting offered a natural experiment for studying the effects of gender diversity on corporate performance because it overcame the endogeneity problems that make it hard to distinguish which characteristics of boards and board members affect firm value.

The study found that an increase in women on boards led to a large negative impact on firm value. It also found that at around the time the law was announced, the average industry-adjusted stock returns for firms with no female directors was –3.54%, compared with –0.02% for firms with at least one female director, suggesting that boards were chosen to maximize shareholder value and that imposing a constraint on the choice of directors led to economically large (and statistically significant) declines in value. A 10% increase in female representation led to a 12.4% decline in value after the quota was imposed. Value is measured with Tobin’s Q (the ratio between the market value and replacement value of a physical asset).

The change in board membership happened rapidly, and the new female directors had much less corporate executive experience and were younger than the male directors. These two characteristics largely accounted for the fall in firm value. This suggests that these patterns would disappear in the long term.

Empirical evidence: Gender diversity and decision-making

Really understanding the effect of gender diversity on performance requires digging deeper into how and why gender diversity matters in a group setting, specifically how gender diversity interacts with team decision-making, which is what ultimately shapes group performance.

Gender differences in outcomes at the individual level have often been attributed to discrimination, occupational segregation, or differences in the education and training of women [9]. However, many experimental studies have looked beyond these explanations to see whether psychological attributes and preferences play a role. Those studies suggest that women are generally more risk-averse than men and less drawn to competition. Most of these studies are done at the individual level, and because groups have their own idiosyncrasies, it may not be valid to extrapolate these findings to the group level.

One experimental study has examined the interaction between gender and group choices, however, looking at whether the presence of women, or the balance between women and men, matters for group decision-making in a dictator game [10]. The game is designed to measure behavioral traits such as fairness and altruism. There are two types of players: proposers and responders.

The proposers determine the allocation of some endowment, for example a cash prize.

The responders simply receive the remainder of the endowment left by the proposer.

In the study, groups of three people divided a sum of money among themselves and a fourth person. The gender composition differed across groups. The study found that groups with a majority of women left more for the responder and also chose the egalitarian division more often than groups with a majority of men did. The most generous groups consisted of two men and one woman, suggesting that having a man in the group enhanced the generosity of women in the group.

A study of the gender composition of teams in a business-game setting investigated which decisions drive differences in performance [7]. The study found differences in investments in research and development (R&D), in pricing strategy, and in corporate responsibility. All of these contribute to differences in profits and point to differences in preference depending on group gender composition. For example, majority-women teams invested less in R&D, possibly because these teams were more conservative in their management vision. All-women teams tended to price their products higher than any other gender combination did. This pricing strategy resulted in significantly lower revenues (and profits) and much higher inventory costs. The pricing strategy is interpreted as being less aggressive than that of other teams and suggests that all-women teams are not as competitive as other teams.

The personal values of directors play an important part in executives’ decisions. A study of differences in decisions related to corporate responsibility found that three-woman teams invested significantly more in social and environmental initiatives beyond what would be optimal for profit-maximization. The decisions on social spending are consistent with evidence for US companies that increased female representation on boards leads to increased spending on environmental and corporate social responsibility concerns.

What about the negative effects of gender quotas on firm value? A study of the effects of the Norwegian gender quota on corporate decision-making found that the quota changed the style of corporate leadership [11]. The study compared publicly listed firms in Norway with a matched sample of unlisted firms in Norway and other Nordic countries.

Most corporate decisions were unaffected after women’s board representation increased, but there were large differences in firms’ employment policies. In particular, firms affected by the quota laid off fewer employees, resulting in higher relative labor costs. Female board members might consider labor hoarding to be a more profitable long-term strategy, or they might have a greater concern for workers’ vulnerability to unemployment risk.

The effect of gender on team decision-making is likely to have several other consequences. One argument for affirmative-action policies or better enforcement of equal opportunity policies is their long-term effect on gender discrimination. Women in top positions, whether because of gender quotas or increased education and training, might influence decisions to hire or promote more women. This might lower or eliminate statistical discrimination—gender inequality stemming from stereotypes or other forms of discrimination—and in the long term enable labor markets to operate without these distortions.

A study of how the gender composition of committees affected hiring decisions for the Spanish judiciary over 1987–2007 used random assignment of candidates to evaluation committees for public examinations. (Candidates are allocated to committees through a random lottery that allows for variation in gender composition.) The study found that a female candidate was significantly less likely to be hired when she was randomly assigned to a committee with an already relatively high share of female evaluators. Each additional female committee member was associated with 2.8% decreased likelihood of hiring a female candidate and a 3.9% increased likelihood of hiring a male candidate.

The underrepresentation of women on boards and committees is often attributed to a lack of female role models and, sometimes, to discrimination in the selection process because of male dominance. The underlying argument for legislative mandates for gender parity on boards and committees is that these problems will disappear over time and the quotas can be lifted. However, in the long term, such legislative mandates might be both ineffective and counterproductive if committees with a higher share of women are less likely to select female candidates [12].

Why women seem to favor men is unclear. One hypothesis concerns taste-based discrimination: Female evaluators may be more sympathetic toward candidates of the opposite sex. Or female evaluators might overestimate male candidates’ competence (statistical discrimination) or might not share the positive discrimination tendency of male evaluators.

Limitations and gaps

The evidence of gender diversity is limited to a few settings and a short time-frame, and focuses mainly on women in high-powered positions. Since the educational attainment gap has only recently closed and women are still poorly represented in top positions, they are less likely to be representative of their group in the general population than are men. If the policy objective is to ensure that female preferences are represented, more evidence is needed from other types of jobs and other parts of the skill distribution.

Moreover, little is understood about the dynamic workings of teams and the effects of gender diversity on team dynamics. Comparing individual decision-making with team decision-making is one way to explore team dynamics, but it is difficult to observe the counterfactual—what decisions a team member would make working alone rather than in a team. Looking at how decisions are reached within a team and at the effects of gender composition on this process are promising areas of research.

Fully closing gender gaps might require sociological changes that go beyond the individual endowments of team participants, and these will take longer to achieve. The evidence on how these dynamic effects operate is limited; measuring their economic costs requires evaluating the long-term effect of gender-quota policies.

Summary and policy advice

The evidence is growing that the presence of women affects a team’s preferences, decision-making, and outcomes. This implies that policies affecting the gender composition of decision-making teams are likely to have implications beyond simply providing more opportunities for women to participate in committees. Devising such policies remains challenging, because the evidence of their effects and the precise channels through which they may operate is still limited.

There is some evidence that imposing quotas on political committees and corporate boards can negatively influence short-term business performance. This cost has to be weighed against the social welfare benefits, such as providing additional opportunities to women, expanding the set of preferences represented, and potentially narrowing the gender gap in high-skilled positions, although there is still no empirical evidence on long-term effects.

Some of the negative performance effects may be driven by the absence of a large pool of women with the education, skills, and experience in high-level committees comparable with men’s. In the long term, the adoption of quotas may narrow this gap and gradually counteract the detrimental effects, although there is evidence that some of these effects persist even when teams are composed of women and men of comparable education and experience. The limited evidence on how these dynamic effects operate makes it essential to evaluate the long-term economic effects of these policies.

Determining whether policies to boost gender parity are successful depends largely on the outcomes being measured and the time frame. The evidence so far comes mostly from corporate boards, but this is a very particular setting. Moreover, the speed at which policy is introduced and implemented also matters. Slower implementation might help change social norms and encourage women to get the appropriate education and training to contribute to a team’s success. Greater representation of women in lower-level decision-making can also increase the pool of experienced women at different levels of accountability.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Ghazala Azmat