Elevator pitch

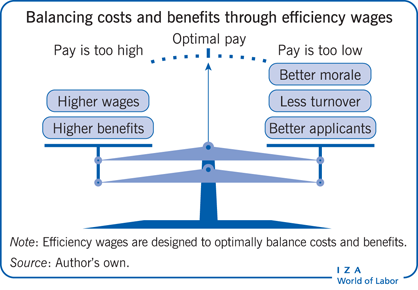

Higher wages increase labor costs but also improve the productivity of the labor force in several ways. If firms take this into account and set their wages accordingly, the resulting wages could fail to adjust demand and supply but may induce phenomena like over-education, discrimination, regional wage differentials, and a tendency for larger firms to pay higher wages. All these phenomena are quantitatively important and well-established empirically. Efficiency wage theory provides an integrated theoretical explanation rather than a sundry list of reasons, and offers an efficiency argument for progressive income taxation.

Key findings

Pros

Efficiency wage theory can provide a unified explanation for some key labor market pay and employment tendencies.

According to efficiency wage theory, progressive income taxation can be used to reduce pre-tax wage inequality.

Firms could be discouraged from employing efficiency wages by taxation strategies and labor legislation.

Collective bargaining practices may help to curtail the use of efficiency wages.

Cons

It is difficult to pinpoint selected efficiency wage effects empirically because they affect wage setting jointly with other influences.

Efficiency wage theory may complement other theoretical approaches to understand how labor markets function, but such integration is not sufficiently developed.

The relationship between efficiency wage setting, collective bargaining, and labor market institutions is insufficiently explored.

Due to efficiency wage setting, wages in a free market do not always reflect the actual costs of producing a good or service, leading to distorted consumer choices and unwarranted differences in income.