Elevator pitch

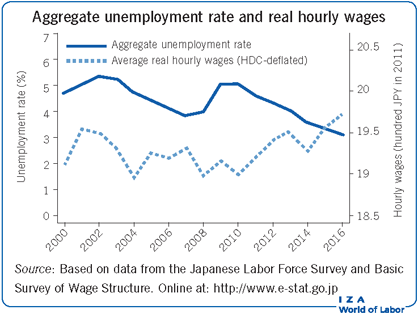

As the third largest economy in the world and a precursor of global trends in population aging, Japan’s recent experiences provide important lessons regarding how demographic shifts affect the labor market and individuals’ economic well-being. On the whole, the labor market has shown a remarkable stability during the recent financial crisis, despite decades of economic stagnation and sluggish real wage growth. Rapid population aging, however, has brought substantial changes to individuals in the labor market, most notably among women, by augmenting labor demand in the healthcare services industry.

Key findings

Pros

Japan’s aggregate unemployment rate has been relatively stable and low.

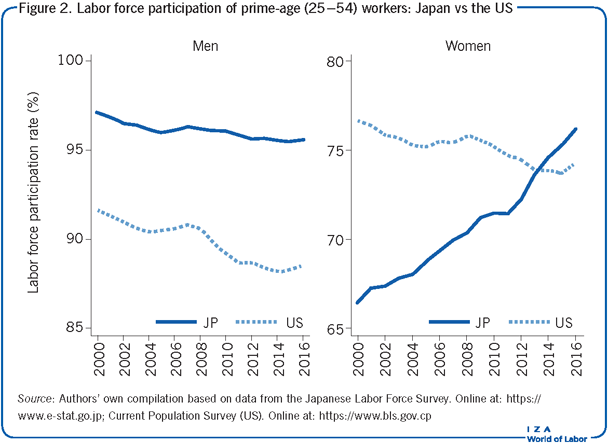

Women’s employment is increasing quickly while the employment rate for men remains high.

Japan’s gender wage gap is shrinking.

Average real wages have been growing recently, most notably among Japan’s women.

The magnitude of wage inequality in Japan remains relatively small.

Cons

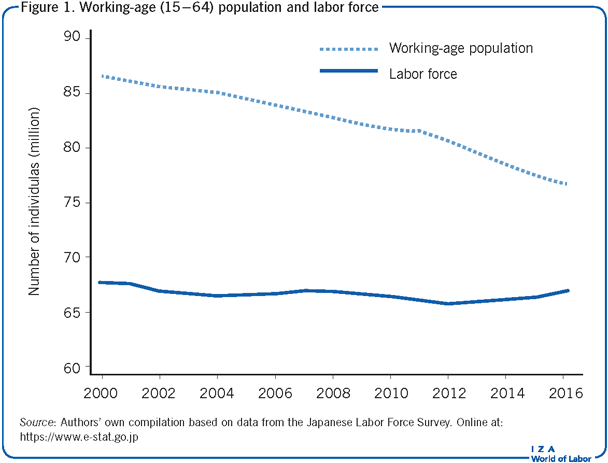

Japan’s working-age population has been declining rapidly.

Rising employment among women in Japan coincides with a decline in the marriage rate, which may further accelerate population decline.

Japan’s gender wage gap remains substantial.

Wage inequality among men in Japan has increased at the upper end of the wage distribution.

Job stability in Japan has declined as jobs with fixed-term contracts have become more prevalent.

Author's main message

Japan used to be known for relatively low labor force attachment among women. In the early 2000s, however, the employment rate for women began to surge, reflecting rapid population aging and growing labor demand in the healthcare services industry. Moreover, aggregate labor market outcomes remained steady during the last recession, with a relatively high labor force participation rate and a low unemployment rate. Despite the good news, major difficulties remain in the labor market, including a substantial gender wage gap, declining job stability, rising inequality at the upper end of the wage distribution, and falling real wages among young male workers.

Motivation

Aging populations pose challenges to the fiscal sustainability of many countries as a consequence of shrinking workforces and increasing costs for social insurance programs. Understanding how demographic shifts affect the labor market is crucial for designing various government programs, including public pension and healthcare systems. This article documents and examines the recent experiences of a forerunner of global trends in population aging: Japan.

Discussion of pros and cons

Population and labor force

Starting from the mid-1990s, Japan has witnessed a sharp decline in its working-age population (aged 15–64). As Figure 1 shows, the size of the working-age population declined between 2000 and 2016 by slightly less than 10 million, from 86.6 to 76.7 million. The speed of the decline was the fastest among OECD countries. Notwithstanding the precipitous fall in the working-age population, the size of the labor force remained relatively stable during this period, decreasing only by about one million, from 67.7 to 66.7 million. Interestingly, the size of the labor force increased between 2012 and 2016.

The stability of the labor force reflects the fast-increasing labor force participation rate (LFPR) among prime-age women (aged 25–54). While the LFPR among prime-age women was somewhat stagnant during the 1990s, it rose by nearly 10 percentage points, from 66.5% to 76.1%, between 2000 and 2016 (See Figure 2). Consequently, the LFPR among prime-age Japanese women surpassed that of their US counterparts around 2013. The contrast between the two countries became more conspicuous after the Great Recession, as the LFPR among prime-age adults declined sharply in the US but not in Japan. Together with the relatively stable LFPR among men, the rising LFPR among women played a primary role in sustaining the labor force size. Indeed, the labor force would have decreased by about an additional 3.5 million if the LFPR among women had stayed constant at the 2000 level.

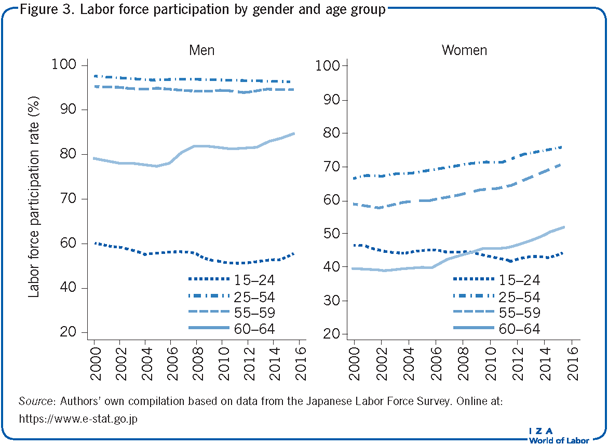

In recent years, the LFPR among older workers (aged 60–64) has also increased. Starting from 2006, the government legally mandated that employers must offer continuous employment to workers above the age of 60 until they reach their social security pension starting age, which ranges from 60 to 65 depending on gender, pension type, and year of birth. Interestingly, the older workers’ LFPR has increased since around 2006, as Figure 3 documents. Indeed, one study finds that the employment mandate enacted in 2006 has increased employment among men in their early 60s [1]. The LFPR, however, has notably increased not only among older men but also among women since around 2006.

The share of married individuals in the population of prime-age women declined from 75.0% to 67.3% between 2000 and 2016. At the same time, the LFPR among married women increased rapidly from 59.4% to 70.6%, whereas the LFPR among single women stayed at a constant high level of around 89%. Delayed marriage does not, therefore, explain the progress of prime-age women in the labor market by itself. So, why has the LFPR among married women increased recently? There could be multiple reasons, including rising wages among women, declining fertility, falling earnings among male spouses, and reforms of family policies as supply-side factors; and demand shifts favoring female workers induced by transitions in the industrial structure, with declining manufacturing and expanding service sectors.

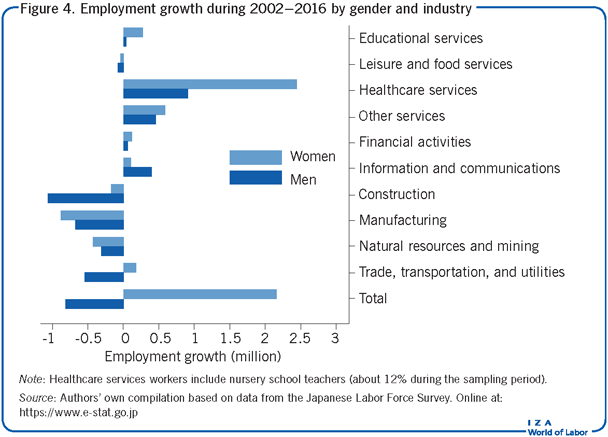

Employment growth

The surging LFPR among women coincides with rapid employment growth among them. Between 2002 and 2016, the number of employed women increased by about 2.2 million (8.33%), while men’s employment declined by about 0.8 million (2.17%), as Figure 4 demonstrates. Employment growth for both genders is concentrated in service industries, most strikingly in the healthcare services industry. Women’s employment in healthcare services increased sharply, by about 2.5 million. Consequently, about 21.6% of female workers were employed in the healthcare services industry in 2016. Men’s employment in healthcare services increased by 0.9 million, partially offsetting the quickly falling employment in the construction and manufacturing industries.

The fast-growing elderly population appears to be a main driver of the rising employment in the healthcare services industry. To cope with the increasing demand for healthcare services, the government recently implemented several policy reforms in the universal health insurance system. One example is the introduction of the “long-term care insurance” system in 2000, which provides affordable, home-based nursing care services to the elderly in need. Since the policy reform, there has been a rapid increase in the use of home-based care services, which raised labor demand for care workers.

Japan’s recent experiences suggest that population aging may have profound influences not only on the labor supply but also on labor demand. Traditionally, healthcare sectors in Japan, similarly to those of many other countries, tend to employ more women than men. As long as this trend continues, population aging may contribute to narrowing down the gender employment gap even further.

Unemployment

The aggregate unemployment rate in Japan rose steadily over a decade of economic stagnation during the 1990s. The unemployment rate was 4.7% at the outset of the new century, slightly higher than the US rate. While the unemployment rates of the two countries evolved similarly during the early 2000s, a striking divergence emerged thereafter. In particular, while the US economy underwent soaring unemployment during the Great Recession, Japan’s aggregate unemployment rate did not exhibit radical upheavals, never exceeding the previous peak level.

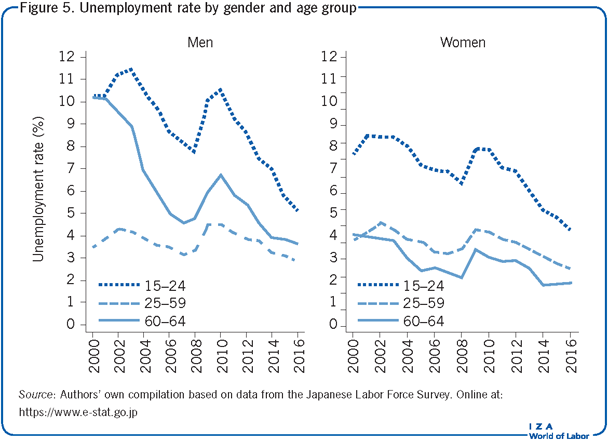

The stability of the aggregate unemployment rate is not a mere artifact of the relative scarcity of young workers, among whom unemployment rates tend to be higher than the average. As Figure 5 indicates, the unemployment rate among youth (aged 15–24) did not skyrocket in Japan during the Great Recession, unlike in other OECD countries. In 2009, the youth unemployment rate reached 10.3% for men and 8.2% for women, yet this was far lower than the US average youth unemployment rate of 17.6%. Japan’s youth unemployment rate declined steadily from 2010; it reached 5.4% for men and 4.6% for women in 2016, ranking, on average, the lowest among OECD countries [2].

In recent years, unemployment rates among older workers (aged 60–64) also declined notably. In 2000, older male workers’ unemployment rate was 10.4%, much higher than the average. The relatively high unemployment might reflect the fact that most workers were required to leave their workplace at age 60 due to mandatory retirement contracts. Nonetheless, the unemployment rate among older male workers has declined substantially since around 2001, reaching 4.0% in 2016. Little is known, however, about what caused such a dramatic fall of unemployment among older male workers. One possible explanation is the recent pension reform that gradually raised the starting age of the social security pension from 60 to 65, starting from 2001. This pension reform may have reduced the value of retirement options for older workers, increased their job search efforts, and provided firms with stronger incentives to hire those workers.

Trends in hourly wages

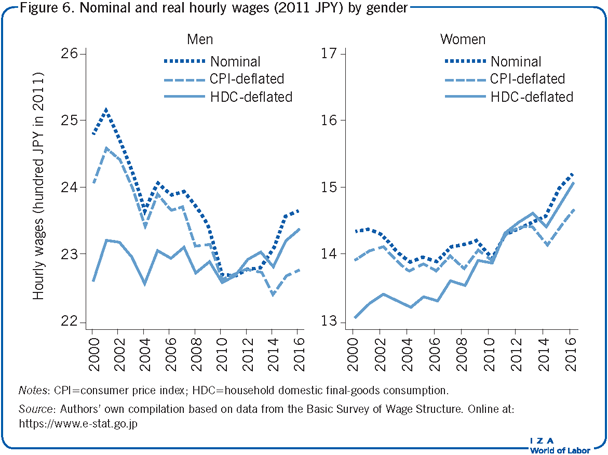

Figure 6 shows the trajectories of nominal and real wages for men and women, respectively. All wage data are taken from the Basic Survey of Wage Structure (BSWS), which provides a nationally representative sample of wage employees in Japan. To deflate nominal wages, the consumer price index (CPI) is used as well as the household domestic final-goods consumption (HDC) deflator; the latter is similar to the personal consumption expenditure (PCE) index used in the US.

Men’s nominal wages declined notably between 2000 and 2010 by about 8.2%, followed by a moderate recovery between 2010 and 2016. The disparities between the two price indices are so large that the two series of real wages for men differ markedly. In particular, between 2000 and 2016, the CPI-deflated real wages declined by about 5.1%, while the HDC-deflated real wages increased by about 3.3%. In contrast, women’s wages clearly rose, starting from around 2004. Between 2004 and 2016, the nominal wages increased by about 9.3%, while the (HDC-deflated) real wages increased by about 12.4%. That nominal wages fell while real wages increased, a remarkable phenomenon in wealthy economies, is due to the longer-term deflation in Japan that occurred during this period.

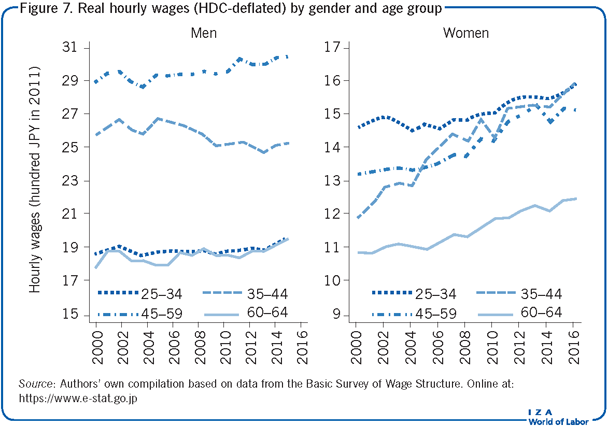

Variations in wages are not uniform across age groups. The left panel of Figure 7 shows that real wages among male workers aged 35–44 declined notably starting from around 2005, while those for other age groups slowly increased. This decline implies that age–wage profiles of recent cohorts flattened after the mid-2000s.

Women aged 35–59 used to earn substantially lower wages than women aged 25–34. This wage gap may reflect wage penalties that arise from career interruptions relating to childbearing. The real wages of women aged 35–59, however, increased sharply between 2000 and 2016, possibly due in part to the declining marriage rate within the group.

The gender wage gap remains substantial, although it has been shrinking. This reflects the prevalence among women of jobs with a fixed-term contract that often pay relatively low wages. In 2016, about 48.8% of female workers were employed under a fixed-term contract, compared with only 17.8% of male workers.

Wage inequality

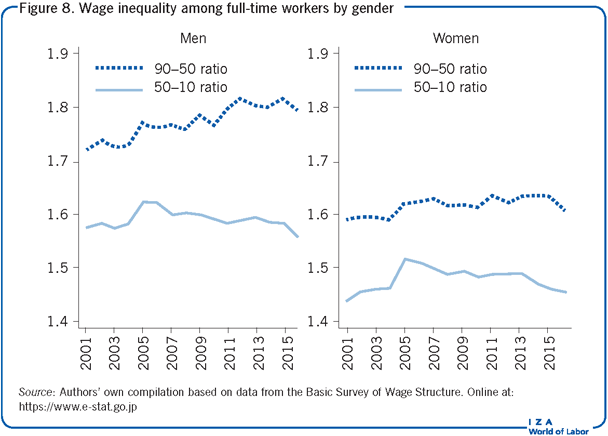

Figure 8 shows how the wage distribution has changed over time, using ratios of full-time workers’ wages at different percentiles of the distribution. In particular, 90–50 ratios (the wage at the 90th percentile divided by the median wage) and 50–10 ratios (the median wage divided by the wage at the 10th percentile) are presented for men and women, respectively.

Wage inequality has been constantly rising at the upper end of the distribution, notably among men. The authors of one study argue that the rising inequality since 2000 can be largely accounted for by an increasing share of relatively more educated and experienced workers, among whom wages are more dispersed [3]. Compared to the US, both the 90–50 ratio and the 50–10 ratio are lower, indicating that Japan’s wage distribution is relatively more concentrated around the median. The contrasts between the two countries can be partly accounted for by relatively rapid supply growth of college-educated workers in Japan, which has suppressed a wage gap between college graduates and high school graduates [4], [5]. Wage inequality among full-time workers is evidently larger for men, possibly reflecting relatively recent wage growth among them.

Limitations and gaps

The goal of this article is to document the most salient changes that the labor market in Japan has witnessed during the 2000–2016 period. While some plausible causes that may account for those changes have been pointed out, many of the arguments are still speculative. Further research is clearly needed to better understand the driving forces of such important changes in the labor market. In particular, further research is warranted to better understand why the LFPR among women has increased together with that for older men, and an interesting research agenda would be to investigate the relative importance of potential reasons why the LFPR has risen quickly among prime-age women in recent years.

The fast-rising LFPR for women and older men likely altered skill compositions among workers, which may generate non-trivial sample selection problems for identifying changes in the wage structure. The analyses of wages are entirely descriptive, and thus subject to this caveat. That being said, it would be interesting to see how rising wages among women are driven by changes in skill compositions, as well as variations in skill pricing.

Summary and policy advice

Japan’s recent labor market experiences exemplify how rapid population aging affects the structure of the labor market through an expanding healthcare services industry. As a consequence, female labor force participation is increasing and more than one in five female workers are currently employed in the healthcare services industry.

In the face of growing demand for childcare services due to rising employment among women, securing an adequate supply of healthcare workers and childcare professionals is a key policy issue. Given that the markets for healthcare and childcare services are publicly run or heavily regulated, comprehensive policy designs, including pricing of the services and training of childcare workers, are necessary. Carefully designed interventions in those industries may facilitate an efficient division of labor based on the comparative advantages of workers with heterogeneous skills and generate efficiency gains from the scale economies in providing services. Policymakers should therefore design healthcare and childcare programs in light of their potentially positive welfare effects.

Acknowledgments

The authors thank the IZA World of Labor editors for many helpful suggestions on earlier drafts. This work was supported by JSPS KAKENHI grants 15H05692, 16H06322, 16H03630, and 17K13747.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Daiji Kawaguchi and Hiroaki Mori