Elevator pitch

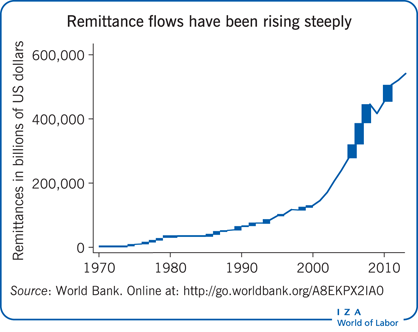

Remittances have risen spectacularly in recent decades, capturing the attention of researchers and policymakers and spurring debate on their pros and cons. Remittances can improve the well-being of family members left behind and boost the economies of receiving countries. They can also create a culture of dependency in the receiving country, lowering labor force participation, promoting conspicuous consumption, and slowing economic growth. A better understanding of their impacts is needed in order to formulate specific policy measures that will enable developing economies to get the greatest benefit from these monetary inflows.

Key findings

Pros

Remittances can increase the well-being of receiving households by smoothing consumption and improving living conditions.

Remittances can facilitate the accumulation of human capital by making possible improved sanitary conditions, healthier life styles, proper healthcare, and greater educational attainment.

Remittances can ease the credit constraints of unbanked households in poor rural areas, facilitate asset accumulation and business investments, promote financial literacy, and reduce poverty.

Cons

Remittances can reduce labor supply and create a culture of dependency that inhibits economic growth.

Remittances can increase the consumption of nontradable goods, raise their prices, appreciate the real exchange rate, and decrease exports, thus damaging the receiving country’s competitiveness in world markets.

Remittances can be curtailed, along with international migration, by escalating anti- immigrant sentiment and tougher enforcement practices in host countries, including the US and many in Europe and the Gulf region.