Elevator pitch

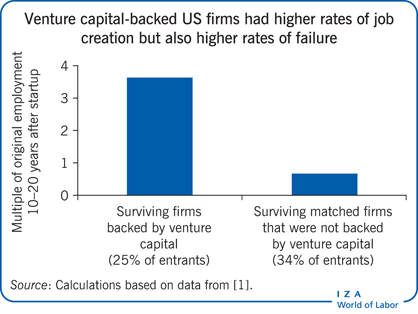

Entrepreneurship is essential to job creation and to productivity growth and therefore is an important matter for government policy. However, policymakers face a difficult challenge because successful growth for a few firms—which cannot easily be identified in advance—is accompanied by widespread failure for most other new firms. Predicting which firms will fail and which will succeed is nearly impossible. Instead of futilely trying to pick winners, governments can play a useful role in facilitating the growth of the most promising firms by setting the conditions for efficient trial-and-error experimentation across firms.

Key findings

Pros

Because a few, typically young firms grow rapidly and account for much of job creation, finding an effective way to support their growth is important.

Predicting which firms will fail and which will succeed is virtually impossible, so policymakers are better off striving for the more modest goal of helping high-growth-potential firms.

Policies that make it easier to engage in trial-and-error experimentation are typically more effective than trying to pick winners.

An enabling environment for entrepreneurs, banks, and investors can support high-growth-potential firms and weed out failures.

Cons

Some support will inevitably go to failing start-ups and lead to considerable job destruction.

A focus on complementary institutions to support high-growth-potential firms requires changes across multiple fronts (from bankruptcy to employment protection legislation), which can be challenging to implement.

Collecting comprehensive data on entrepreneurship is difficult.

Predicting which firms will fail and which will succeed is virtually impossible.