Elevator pitch

Entrepreneurship is essential to job creation and to productivity growth and therefore is an important matter for government policy. However, policymakers face a difficult challenge because successful growth for a few firms—which cannot easily be identified in advance—is accompanied by widespread failure for most other new firms. Predicting which firms will fail and which will succeed is nearly impossible. Instead of futilely trying to pick winners, governments can play a useful role in facilitating the growth of the most promising firms by setting the conditions for efficient trial-and-error experimentation across firms.

Key findings

Pros

Because a few, typically young firms grow rapidly and account for much of job creation, finding an effective way to support their growth is important.

Predicting which firms will fail and which will succeed is virtually impossible, so policymakers are better off striving for the more modest goal of helping high-growth-potential firms.

Policies that make it easier to engage in trial-and-error experimentation are typically more effective than trying to pick winners.

An enabling environment for entrepreneurs, banks, and investors can support high-growth-potential firms and weed out failures.

Cons

Some support will inevitably go to failing start-ups and lead to considerable job destruction.

A focus on complementary institutions to support high-growth-potential firms requires changes across multiple fronts (from bankruptcy to employment protection legislation), which can be challenging to implement.

Collecting comprehensive data on entrepreneurship is difficult.

Predicting which firms will fail and which will succeed is virtually impossible.

Author's main message

New firms account for a disproportionate share of aggregate job creation in advanced economies. Yet most firms fail, and it is immensely difficult to predict which firms will succeed. Policymakers can set the right conditions so that capital and other resources flow to firms with high growth , even if this implies initially supporting firms that ultimately fail. Policy can focus on supporting complementary institutions that promote trial-and-error experimentation both by increasing the chances that promising firms get further funding and by facilitating the efficient shutting down of firms when they do not meet their potential.

Motivation

A large proportion of net job creation and productivity growth in advanced economies comes from the continuous process of firm entry and exit, as new, more efficient firms displace incumbents in what is now commonly known as “creative destruction” [2]. Start-ups, most of which are small, play a key role in this process. Because of this vital role, financing constraints among small businesses is a major policy concern in most countries. For example, the US Small Business Administration provided business loan subsidies totaling $350 million in 2012, in addition to grants and subsidies provided through the Small Business Innovation Research program. Similarly, the EU program for Competitiveness of Enterprises and Small and Medium-sized Enterprises has a budget of €2.3 billion. Financial intermediaries are fundamental in facilitating the process of creative destruction by allocating capital to more promising firms. Government policy can substantially influence the effectiveness of this process through the incentives it creates for financial intermediaries.

Discussion of pros and cons

Dynamics of entry and post-entry performance

New firms account for a disproportionate share of aggregate job creation in advanced economies. For example, in the US start-ups account for an average of 20% of aggregate gross job creation annually, and high-growth firms—most of which tend to be young—account for almost 50% of job creation [2]. While young firms are responsible for a large share of job creation, they are also responsible for a large share of job destruction. That is because young firms are much more likely to fail than older firms: about half of all business entrants fail within four years of entry, and three-quarters fail within the first ten years.

Considerable job loss accompanies business failure. In the US, on average, more jobs are destroyed in failing firms than are created by surviving firms that grow, implying negative net job creation for existing firms (Figure 1). The net increase in job creation for the economy as a whole is therefore due to start-ups (firms of age zero, which are thus not displayed in Figure 1) creating more jobs than the net loss of jobs from existing firms.

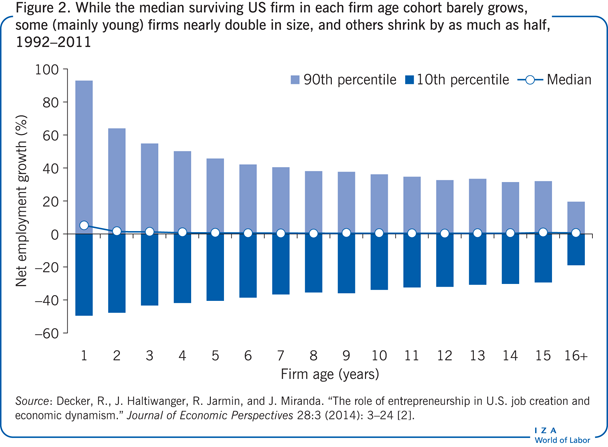

While the failure of some firms and the destruction of jobs in those firms combined with the entry of new firms and the creation of new jobs are an important part of the net change in jobs, another important part occurs as result of job creation and destruction in existing firms. Thus, the averages documented in Figure 1—where failing firms destroy more jobs than are created by existing firms that grow—mask substantial differences in performance among surviving firms.

Figure 2 documents these differences. It shows that while the median surviving firm in each firm age cohort barely grows, some firms—particularly young ones—nearly double in size, and others—also particularly young ones—shrink by as much as half. This variability in growth rates within firm age cohorts declines as firms get older. Combining these statistics leads to a clearer picture of firm growth and failure and job creation and destruction: most start-ups fail, the median surviving firm barely grows, some start-ups shrink substantially, but a few firms survive and grow exceptionally fast. These few rapidly growing firms not only contribute disproportionately to aggregate job creation, but they are also engines of productivity growth and thus central to the good economic performance of advanced economies.

High-growth firms versus high-growth-potential entrepreneurs

Which are these high-growth firms that contribute disproportionately to aggregate job creation? And is there a way to identify them in advance that could help policymakers direct capital and other resources toward them? Because only a small share of firms ever become high-growth firms, testing theories about how best to support entrepreneurship requires comprehensive company-level data, which are typically collected through a census. For now, these data sets are available only for the US and several European countries, so the discussion in this paper focuses on high-growth entrepreneurs in these countries.

Predicting high-growth firms

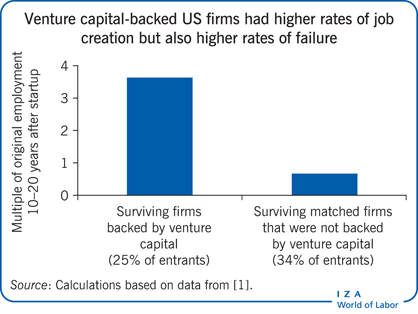

Identifying which firms will become high-growth firms seems difficult, if not impossible, for several reasons. First, even high-profile new firms such as those that commercialize new technologies and are backed by venture capital investors are not immune to failure. In fact, the high rates of failure on the one hand and the simultaneous high growth of the surviving firms on the other seem to be even more stark among venture capital-backed firms. Comparing the post-entry performance of venture capital-backed firms in the US that started up over 1986–1997 with a set of similar, but non-venture-capital-backed firms (comparison firms in the same industry and region and with the same starting level of employment) shows that 66% of the comparison firms had failed by 2007; and that (as is the case for the firms in the Illustration) the 34% that survived and grew did not create enough jobs to replace all the jobs destroyed by the firms that failed [1]. By 2007, employment in the 34% of surviving firms accounted for only 67% of the original employment of the non-venture-capital-backed entrants. On the other hand, while 75% of the venture capital-backed entrants failed, the 25% that survived to 2007 generated 364% of the original employment of the entering firms.

Thus, venture capital-backed firms seem to exhibit higher rates of growth but also higher rates of failure. In fact, more than half the investments of even highly successful venture capital investors are liquidated at amounts below the cost of investment, while 5–10% of start-ups generate more than half the gross return of venture capital funds [1]. However, which of these start-ups will become high-growth firms cannot be known in advance. For example, scores assigned at the time of investment by the partners at a top-tier venture capital firm with investments across the world were barely correlated with outcomes, highlighting how even successful venture capital investors cannot accurately distinguish the start-ups that will become high-growth firms from the start-ups that will fail.

Second, while venture capital-backed entrepreneurs are clearly important for productivity growth, they account for an extremely small proportion of new firms in the economy and, moreover, are not solely responsible for all the high-growth firms. Even in the US, where the venture capital market is mature, under 0.5% of new firms receive venture capital funding each year—the predominant source of finance for such high-growth ventures. In Europe, this proportion is even smaller.

Productivity growth arises not only from entry and exit, but also from improvements in current methods of production. Yet, firm-specific forces that are hard to observe seem to determine which businesses achieve rapid productivity growth or declines. For example, the dominant factor determining survival seems to be variation in demand faced by seemingly very similar producers. This demand variation seems hard to predict, again highlighting why it is so hard to identify high-growth new ventures upfront.

Assessing high-growth potential

While it is hard, if not impossible, to accurately predict which firms will be high-growth firms, there is better evidence on an ability to assess which are high-growth-potential firms. These are firms that may fail but that, if they succeed, have a high likelihood of growing rapidly. That is, they exhibit a strong “up-or-out” pattern and are unlikely to remain small if they survive and are unconstrained in the ability to grow.

There is mounting evidence that firms that are small and old are not high-growth-potential firms. For surviving firms, net job creation is negative among firms that are both small and old, particularly among firms that are more than five years old and have fewer than ten employees [2]. On average, therefore, these small, older firms are contracting, even if they do not fail. Some of these firms may have had high-growth ambitions but could not achieve them (whether because of entrepreneurial ability, customer demand, or other factors). Alternatively, they may never have intended to grow and thus have already realized their (low) growth potential. For example, many people become self-employed for non-pecuniary reasons and thus have no interest in innovation or growth.

Recognizing these differences among small firms can help to reframe the issue as one of “young” businesses needing financial support instead of “small” businesses. About 90% (5.4 million) of the six million firms in the US with at least one employee have fewer than 20 employees. A further 20 million self-employed individuals run firms without any employees. Thus 25.4 million of the 26 million firms in the US are small, but few of these are young, implying that most firms can be characterized as old and small. As a result, some self-employment rankings list West Palm Beach, Florida (a popular retirement city) as the most entrepreneurial city in the US, while cities such as San Jose, California (in Silicon Valley and arguably home to more high-growth-potential entrepreneurship) rank near the bottom [3].

There is also an association between the ambition of entrepreneurs to pursue high growth and the legal form of the business in the case of incorporation but not in the case of sole proprietorships and partnerships. This association reflects the fact that the limited liability structure is both a pre-requisite for some types of capital associated with high growth (such as venture capital and private equity) and an indication that the firm anticipates raising large amounts of capital, often a sign that it wants to grow. While incorporated firms may still shrink rapidly and fail often, the firms that survive are more likely to grow rapidly than are firms in the same industry or region that are registered as sole proprietorships. Again, while this may appear obvious, it suggests that government policies that support the small neighborhood coffee shop are unlikely to have the same leverage on job creation and productivity growth as if they directed resources to higher-growth-potential firms (for example, a coffee company that incorporated in Delaware, suggesting it may want to be the next Starbucks).

Thus, while it is hard to accurately assess whether a firm will experience high growth, it may be easier to assess whether a firm has high growth potential. This is a more modest, but arguably more achievable, goal for policymakers. As will be outlined below, it also changes the framework for thinking about financial market policies.

The role of financial markets and institutions

While venture capital (and associated intermediaries such as angel investors and accelerators) often comes to mind as the primary form of finance for high-growth-potential start-ups, it accounts for only a tiny proportion of the financing of start-ups. Even for high-growth-potential start-ups, bank finance, credit cards, and home equity loans are the three most common sources of external capital in addition to the founder’s own savings [4], [5].

Financing start-ups is complicated by two factors that are not as relevant when considering the financing of older firms. First, young businesses in general and start-ups in particular often have no audited financial statements, let alone a track record of success. Thus, much of the information on whether a start-up is likely to be successful is “soft information”—information that is difficult to codify and transmit across hierarchical institutions such as banks and may be learned only over time through continuing banking relationships with the entrepreneur. For example, studies show that small firms with longer banking relationships pledge less collateral and rely less on (expensive) trade credits than firms with shorter banking relationships [6]. Thus, factors such as not having a banking relationship can affect how financially constrained a start-up may be. Second, the dominant factors determining survival among firms seem to be idiosyncratic and unpredictable (such as demand variation across producers), making it hard to identify in advance which start-ups are the most promising.

The fact that it is hard to identify high-growth firms upfront has implications for how to think about the role of capital markets in allocating resources to the most productive firms. That difficulty suggests the need for experimentation and for focusing more on the financial system and related institutions than on direct subsidies for individual firms. For policymaking, where the goal is to facilitate the most efficient allocation of resources despite the difficulty of predicting outcomes, that implies focusing on complementary institutions, paying attention to bank structure and banking competition, and understanding the government’s role as a customer (rather than a financier) of high-growth-potential businesses.

Complementary institutions

Securities laws vary across countries, reflecting differences in the legal origins of financial market laws. The degree of investor protection under the law, in turn, affects both the willingness of financial intermediaries to lend and the structure of the financial system, such as whether it is weighed more toward commercial banks or toward market-oriented financial institutions such as venture capitalists that depend on a vibrant equity market to realize returns.

How well the laws protect entrepreneurs also affects how much investors will support them. Laws that exempt entrepreneurs from having to fully repay lenders in the event of bankruptcy can affect access to credit. For example, a study finds that entrepreneurs are less likely to have access to credit for their start-ups in US states where bankruptcy exemptions are larger [7]. The reason is obvious: where there is less certainty of recovering a loan in the event of failure, banks are less likely to extend credit to entrepreneurs.

In Germany, the lack of an array of complementary institutions has been shown to contribute to the weak presence of biotechnology companies. Germany’s financial system is more heavily bank-oriented than the market-oriented financial system in the US, which has made it difficult for German start-ups to access financing through such means as initial public offerings (IPOs). IPOs, or the first sale of stock to the public, are often used by smaller, younger companies to finance the expansion of their business. The venture capital community in Germany is less developed, resulting in less capital available to biotechnology firms and other technology start-ups which rely more on such financing.

The flexibility of labor markets can also govern the types of projects that entrepreneurs can undertake by affecting the provision of risk capital. Start-ups must often change their business model as they test the waters to see what works and what does not. These changes frequently entail substantive adjustments in their workforce. But it is much harder for high-growth-potential start-ups to experiment in countries with strong employment protection laws. Indeed, a study has found that venture capital financing is substantially lower in European countries with stringent employment protection laws that make it harder to fire employees [8].

Recent work has also highlighted the role of business entry regulations and the social safety net in boosting “demand” for entrepreneurship. Because business entry regulations increase red tape and the cost of starting a business, entrepreneurs may be more inclined to start a business in countries that simplify procedures for starting a business. Also, because the most likely outcome for an entrepreneurial start-up is failure, countries with a strong social safety net encourage entrepreneurship and embolden entrepreneurs to experiment with new ideas because of the reduced consequences of failure for the entrepreneur.

Commercial loans, credit cards, and home equity finance

The main sources of external finance for new firms are commercial bank debt, credit card debt, and mortgage debt taken on by the entrepreneur. A growing body of work finds that small or decentralized banks have a comparative advantage in evaluating businesses by using soft information collected through multiple interactions over time. Such banks are also more likely to have appropriate incentives to act on the soft information than are, for example, branch managers in large, hierarchically structured banks in which decisions are made at a centralized level, far removed from the entrepreneur seeking a loan. Similarly, peer-to-peer lending, though still in its infancy, offers promise as a means of financing start-ups because of the ability of individuals to screen loan requests on the basis of soft information that may not be available to large banks.

Bank competition has also been shown to increase entrepreneurship by lowering the cost of external finance and increasing bank incentives to collect soft information. For example, US banking deregulation from the 1970s through the 1990s led to greater bank competition, with considerable expansion in the number of bank branches, despite the contraction in the number of banks as a result of increased merger and acquisition activity. With deregulation of interstate branch banking, which allowed banks to open branches in other states, came a large increase in start-up activity. Similar banking reforms in France resulted in increased bank lending to start-ups too. A study found that financial deregulation in the credit card industry similarly had a strong positive effect on entrepreneurship [9].

An important finding, however, is that although banking deregulation led to a reduced market share of incumbent firms over the longer term, most of the increased entry following banking sector deregulation could be characterized by a disproportionate increase in churning entry, with a greater share of start-ups failing within a few years of founding [3]. This again highlights the challenge associated with predicting which firms will be high-growth firms, while showing that democratizing business entry can have beneficial consequences in the aggregate, by allowing more high-growth-potential entrepreneurs to get financing, even if many of them fail.

Allowing entrepreneurs to borrow against their home to finance their business has the potential to ease financing constraints by providing collateral that banks can liquidate in the event of failing. This collateral can provide the comfort that banks need to lend in an environment in which the incidence of failure is high and investors cannot tell upfront which firms will be successful. However, the ability of entrepreneurs to borrow against their home also allows them to bypass the screening function of banks. This implies that the size of the response and the quality of the marginal entrant who selects into entrepreneurship because of having access to home equity financing will depend on whether high-potential firms or others were rejected by banks, leading them to rely on home equity to bypass banks’ screening function. Perhaps for these reasons, recent studies have found somewhat different impacts of home equity on entrepreneurship. One study finds a strong role for this collateral-based loan channel in France [10]. In contrast, another study finds a fairly small effect in the US during 2000–2004, a period when housing prices were rising steeply [5]. Overall, the evidence suggests that providing potential entrepreneurs with access to home equity loans can be a useful complement to commercial bank lending, although the extent to which this kind of collateral-based lending results in an increase in high-growth firms is likely to vary by context.

Government as a lender versus government as a customer

The traditional role for government in supporting business development, aside from regulating financial intermediaries, has been to provide direct subsidies to small firms or to provide guarantees for commercial bank loans made to small firms, in order to encourage private financial institutions to offer them financing. Rigorous evaluation of such programs is difficult and hence has been rare. Nevertheless, there is some evidence that such programs have the potential to encourage entrepreneurs to experiment by enabling them to engage in proof-of-concept work that can increase the likelihood of their receiving follow-on infusions of venture capital. One such program, the US Small Business Administration’s loan guarantee program, has been associated with modest job creation. A study of a French loan guarantee program found that the program led to the emergence of some successful firms but also to risk shifting from banks to the government, leading to an increase in business failures [11]. This outcome is not necessarily bad and may even be beneficial if some of the successful firms are extremely high-productivity or high-growth firms.

Overall, however, there are broader challenges associated with government involvement in the direct finance of start-ups [12]. Several political-economy realities can constrain the range of government responses, making the government an inappropriate vehicle for such investments. These include the need to balance the desires of various constituents, the difficulty of shutting down poorly performing investments, a tendency toward bureaucratic complexity, and the need to justify such investments, particularly when large sums of money are involved.

There is, however, another, often underappreciated role that government can play—that of customer, particularly for early iterations of a new technology. The US Department of Defense played a vital part in accelerating the growth of technology entrepreneurs in Silicon Valley, and the Israeli military is widely credited with contributing to the growth of Israel’s high-tech industry in a similar way [12]. An added benefit of having the government as a customer is that policymakers can have a strong positive impact on the cash flow of suppliers by accelerating payment to vendors, as the US government did in implementing its Quickpay program for small businesses in 2011.

Limitations and gaps

Because only a tiny share of new firms each year develop into high-growth firms, testing theories about how best to support entrepreneurship is challenging and requires comprehensive, company-level data. While these data sets are available for the US and several European countries through tax and unemployment insurance files, the generalizability of the findings in these countries to other settings is harder to test empirically.

In addition, less is known about the effectiveness of loan guarantee programs, which do not provide direct support to small firms but rather create incentives for banks to back more risky ventures. Studying loan guarantees could be a fruitful area of future research. So could studying new forms of funding, such as accelerators and crowdfunding or peer-to-peer lending platforms.

Summary and policy advice

Much of net job creation and productivity growth in advanced economies comes from the process of firm entry and exit, as new, more efficient firms displace incumbents, a process known as creative destruction. While young firms are responsible for a large share of job creation, they are also responsible for a large share of job destruction because young firms are much more likely to fail. About half of all new businesses fail within four years of entry, and three-quarters fail within the first ten years. Financial intermediaries can play a fundamental role in facilitating this process of creative destruction by allocating capital to more promising firms. But identifying which firms are likely to become the high-growth firms of the future that will contribute disproportionately to aggregate job creation is very difficult, if not impossible. There is better evidence, however, on the ability to identify which start-ups are high-growth-potential firms. While many if not most of these firms will be misidentified and will fail, those that succeed will have a high likelihood of growing rapidly.

Thus, the dynamics of entrepreneurship and post-entry growth imply that policymakers would do better to focus on policies that can identify high-growth-potential firms rather than on trying to pick high-growth firms in advance (and then trying to keep them alive when they perform poorly). Research has shed light on a number of elements that can improve access to capital for high-growth-potential firms, with an emphasis on providing the right incentives for financial intermediaries to back experimentation among start-ups. Because most entrepreneurial start-ups fail, providing a strong social safety net can encourage entrepreneurship and experimentation by buffering the consequences of failure. The government can also play an important role as a customer of new technologies—an area that is often underestimated but has yielded huge returns in the US and Israel, for example.

Acknowledgments

The author thanks three anonymous referees and the IZA World of Labor editors for helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article ([1]; [3]; Kerr, W., and R. Nanda. Picking the Winning Way: The Right Policy to Support Entrepreneurs. London: Vox CEPR Policy Portal, 2010; and Kerr, W., and R. Nanda. “Financing constraints and entrepreneurship.” In: Audretsch, D., O. Falck, and S. Heblich (eds). Handbook of Research on Innovation and Entrepreneurship. Cheltenham, UK: Edward Elgar, 2011; pp. 88–103). Support from the Division of Research and Faculty Development at Harvard Business School is gratefully acknowledged.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Ramana Nanda