Elevator pitch

Economists typically predict that people are inherently selfish; however, experimental evidence suggests that this is often not the case. In particular, delegating a choice (such as a wage) to the performing party may imbue this party with a sense of responsibility, leading to improved outcomes for both the delegating entity and the performing party. This strategy can be risky, as some people will still choose to act in a selfish manner, causing adverse consequences for productivity and earnings. An important issue to consider is therefore how to encourage a sense of responsibility in the performing party.

Key findings

Pros

Delegating the choice of wage (as well as effort) to the worker leads to higher earnings for both firms and workers as determined through laboratory experimentation.

Social comparisons concerning delegation rights affect workers’ behavior; this suggests that people intrinsically care about their social perception within the working environment.

When one is responsible for the determination of an outcome, as is encouraged by the delegation of responsibility to workers, one tends to behave more pro-socially (i.e. cooperatively).

Cons

Both the delegator and the performing party can strategically take advantage of delegation in order to advance anti-social (or selfish) goals.

Giving responsibility to a self-interested party regarding expected effort has its risks, since he or she may not choose to exert high levels of effort, leading to a situation in which the delegator will suffer.

Empirical evidence on the effects of wage delegation is scarce, since only a handful of firms have, in real life, delegated the decision about wage setting to their employees.

Author's main message

Laboratory evidence suggests that productivity increases when a worker is afforded the right to set his/her own wage. This can lead to improved returns for both the firm and the worker. However, it is important to consider the potential negative effects of selfish workers, as well as of advantageous delegators. Still, delegating choices regarding pay or other decisions in the workplace may pay dividends. A key aspect related to delegation is the associated handover of responsibility. Accordingly, having decision-making responsibility can lead to more pro-social (or cooperative) behavior.

Motivation

Labor productivity is a vital component of a firm’s profits. The standard economic approach recommends controlling the self-interested worker to the greatest extent possible, and to provide direct financial incentives to encourage productivity. However, a worker’s performance is often difficult to observe (let alone control) on the job, presenting a situation in which the labor contract is often incomplete—“an incomplete contract is a contract that has gaps, missing provision[s], and ambiguities. The contract has thus to be completed for instance by renegotiation or by the courts” [1]. If effort is costly and workers are considered selfish and cannot be observed, then they will exert the minimum possible effort, regardless of the wage. And yet, exerting control can actually decrease a firm’s profits, since control signals distrust and weakens pro-social impulses [2]. Thus, it is worthwhile to further examine the impacts of increased delegation under various conditions in the workplace.

Discussion of pros and cons

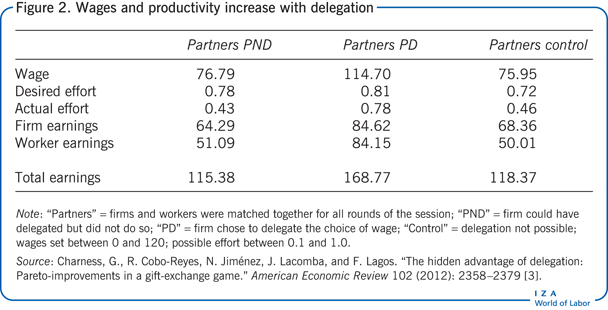

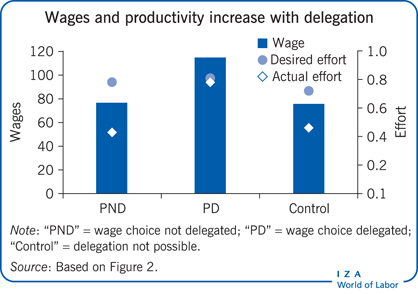

The idea that delegation can be beneficial has its origins in the underlying notion of responsibility. If a person feels responsible for determining the outcome, the notion of responsibility says that they are more likely to exhibit pro-social (cooperative) behavior. This was first established using experimental data [3] and there are now several articles supporting this claim [4], [5], [6], [7]. In the particular case of the employer−employee relationship, effort is typically considered unobservable, so that the worker has some latitude concerning the level of effort contributed, and thus bears some degree of responsibility for the outcome. However, this degree of responsibility is significantly increased when the firm voluntarily permits the worker to choose both the expected effort and the received wage [4]. This result can be seen in the Illustration and in Figure 2.

Considering this theory, by delegating the selection of wages to its employees, a firm signals greater trust in its workers, potentially leading to overall benefits. A case in point is that of Semco, a Brazilian manufacturer company, which for some time has allowed workers to set their own salaries and working hours, and has subsequently experienced a great deal of financial success. In the US, Skyline lets some workers pick their salary, and in Spain, Claravision (an optical company) also allows some workers to set their own wages. While it is still unclear whether these firms have definitively benefited from these policies, they appear to think so.

Of course, these examples provide only anecdotal evidence, which is helpful as a first indicator, but may not always be reliable. A more useful approach is to attempt to establish causality. In this regard, laboratory experiments present the best means for providing evidence by varying only one element within a controlled environment, and subsequently observing whether that single element affects behavior.

Laboratory testing of delegation’s effect on labor outcomes

Evidence seems to support the idea that delegation is a beneficial tactic [4], [5]. The basic structure during the relevant experiments included a firm endowed with 240 monetary units and a feasible wage from 0 to 120. In the first experiment, each firm was paired with one worker for 15 periods, while in the second experiment, each firm was paired with two workers for 15 periods. In the control treatment, the firm chooses the wage and the worker chooses the effort—there is no delegation possible; in the delegation treatment, the firm can choose to delegate the wage choice to the worker—but is not obliged to do so.

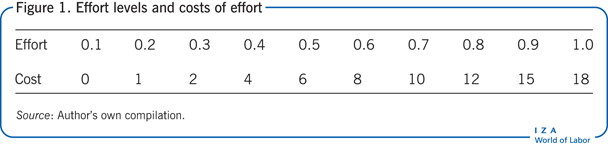

The combination of wage and effort determines outcomes and monetary payoffs for both employer and employee in each period. The firm’s outcome is a function of the total available units (240) minus the wage selected or assigned to the first worker multiplied by the effort expounded by the first worker. The same is done for the wage and effort levels of the second worker associated with the firm and the sum of those two figures is divided by two. The worker’s payoff is essentially defined by the worker’s wage minus the cost of effort (represented by an increasing relationship between effort expounded and costs to the worker for said effort) minus 20. The wage range is from 20 to 120 for each individual worker. The feasible effort levels and the associated costs of effort are as described in Figure 1.

Subjects play for 15 periods. A firm is anonymously paired with the same two workers for all periods, and this is common information to all participants. Additionally, we consider that the wage level is bounded. Thus, we assume a maximum wage (w = 120) that is lower than the firm’s redemption value of 240, in order to prevent the worker from appropriating the firm’s entire endowment.

It is observed that workers choose very high wages when the decision about wages is delegated to them, but they also choose higher effort (see Figure 2). The experimental results thus support the main hypothesis that the decision to delegate leads to higher returns for both firms and workers.

Additionally, we see that a worker’s effort is sensitive to whether the worker received the right to choose his or her own wage, suggesting that delegation has intrinsic motivational effects on the worker. The observed pattern is stable over time, with a fairly consistent difference shown between effort contributed and wage choices in the “delegation” case (PD: the firm chose to delegate the choice of wage) compared to the others (i.e. PND or “no-delegation” case: the firm could have delegated but did not do so; “Control” case: delegation was not possible). Figure 2 shows the breakdown of the observed pattern according to each case type.

These results differ from many laboratory studies with a known end period, where effort provided will often diminish in the last periods, to the extent that workers expend higher effort during early periods to gain strategic or reputational advantages. This phenomenon could also occur in the field environment. However, a worker may wish to switch to another firm at the end of the relationship when this is known, perhaps moderating any such effects in the field.

As can be seen in Figure 2, wages were near the maximum possible in the delegation case; while this would appear to hurt the firm, the effort level (a proxy for productivity) is roughly 75% higher in the delegation case. Thus, workers earn about 75% more when the wage choice is delegated, while the firms earn about 30% more. The wages and effort in the no-delegation and control cases were nearly identical. One might expect that effort in the no-delegation case would be lower, since failing to delegate when feasible could be seen as distrust, but the results did not bear this out. Accordingly, the wages and effort levels in the no-delegation and control cases were nearly identical.

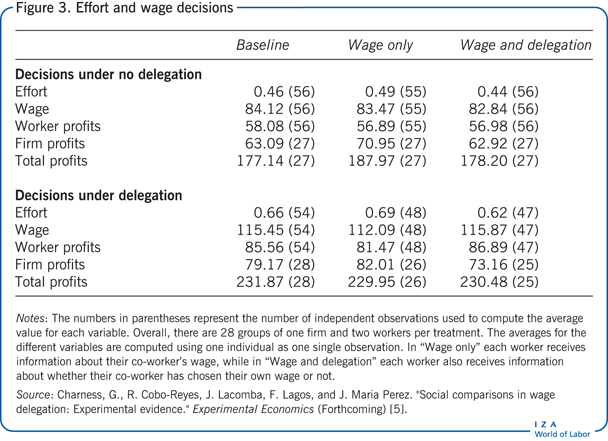

Figure 3 shows that this pattern is also found in the two-person–one-firm setting [5], which is perhaps more realistic, and also affords the possibility of observing the effect when the firm delegates the wage choice to one worker but not the other; this setting could ideally be adapted to larger firms in the future. Additional data (not shown in Figure 3) indicate that wage-choice rights are intrinsically valued, since effort choices are higher with delegation, after controlling for the wage.

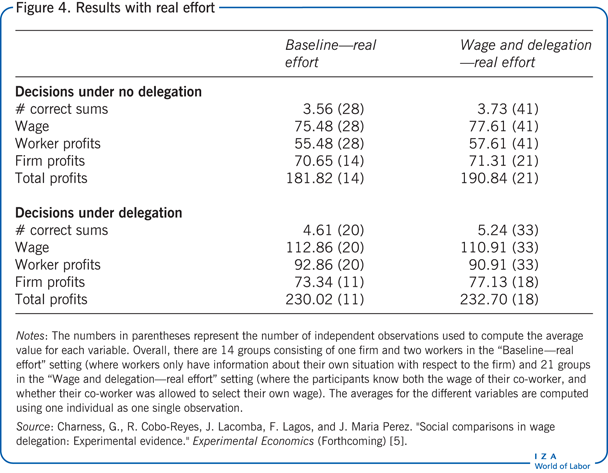

The experiment also included a treatment involving “real effort”; participants added up five two-digit numbers, where the number of sums completed affected the firm’s earnings. This “real effort” treatment allows the participants to simulate actual effort on behalf of the firm (in the form of number of sums completed), as opposed to the traditional approach where effort is simply stated by the participants, along with an associated cost of effort. The observed patterns involving real effort were similar to the previous results that did not include real effort, as seen in Figure 4.

The bottom line is that when a (trusted) worker is given the right (the responsibility) of choosing his or her own wage, he or she will choose a very high wage but will also choose a high effort level. With the payoff structure used, everyone earns more money.

Delegating wage setting rights to workers benefits all parties

Laboratory results show that both workers and firms earn more when the firm delegates the selection of wages to the worker. Despite the fact that the workers’ self-selection of wages is near the maximum in the delegation case, both workers and the firm benefit due to a corresponding 75% increase in the workers’ effort level. This results in an increase in workers’ earnings of about 75%, while firms’ profits rise by about 30%. The results do not support the traditional assumption that effort would be lower under the no-delegation conditions.

A related argument suggests that delegation also leads to higher profits for both firms and workers when there is more than one worker for each firm; this is arguably a more realistic case, and the result is reassuring regarding the robustness of the advantage of delegation.

Workers’ social comparisons positively affect effort

Laboratory evidence shows that workers place high value on having the right to choose their own wages [4]. Panel data regressions also show that effort is higher when one receives the right to delegate one’s own wage, while effort is markedly lower for workers who do not receive this right when their co-worker does. This can be an important consideration in the field, where workers know each other and would most likely feel more strongly about this than laboratory subjects. For workers, knowing that they would receive the right to choose their own wages could be seen as a reward for being a trusted worker. This strategy could be employed by firms as an additional means of incentivizing workers, potentially leading to increased effort and overall profits.

Responsibility for outcomes increases pro-social behavior

Another argument in favor of delegation is that it fits into the established experimental pattern, which suggests that imbuing an agent with the responsibility for determining an outcome will cause many agents to become more pro-social, which in turn leads to higher productivity and a greater sense of loyalty to the organization. An example comes from sports: If there is a referee responsible for a ruling, players may well posture or point out that an event has occurred on the field. However, if the player or players themselves make the ruling (more likely at the amateur level, but still seen in professional tennis), there is more of a tendency for honesty. Again, firms may wish to involve workers more in the decision process to enhance their sense of responsibility

Exploiting delegation rights for personal gain

In contrast to the many positive findings regarding the link between delegation in the workplace and higher worker effort and mutual earnings, there is an alternate side of delegation that can lead to self-serving behavior. Imagine that one is a landlord, but does not wish to be directly involved in an eviction. The landlord is likely to delegate this duty to an agent in order to deflect the perceived responsibility for the action (a form of “blaming the messenger”). In this case delegation is not an indicator of trust, but is in actuality a selfish act by the delegator.

Some recent experimental work demonstrates this principle by showing how punishment changes when a person making an unfair choice delegates the final choice to another party [6]. One party is identified as a dictator, a second party is a potential agent, a third party is the recipient, and the fourth party can punish. The agent is obligated to buy the right to dictate if the first party wishes to sell it, at whatever price is charged (the price is known to all parties). The results show that the fourth party punishes dictators less frequently for being overly selfish when another person is involved in the choice process. This is true even when it is known to all that the intermediary has no option—the intermediary must pay the maximum price and so in turn must charge the other parties the maximum price, or take a loss.

Current theories of fairness would not predict that intermediation affects punishment, since they do not include any element that would include this factor. Thus, when it is possible to delegate, punishment is ineffective in restraining self-interest. So, in the field, the management of a firm may wish to delegate the duty of communicating wage cuts to the workers. This may also reflect why firms often hire consultant agencies to enforce job cuts.

A related study [7] sets up a game in which the first player (the dictator) can decide between a fair and an unfair allocation of an amount of money between him- or herself and two other parties (in a labor setting, this could potentially be two different employees). This player can alternatively delegate this choice to a fourth party who must then act. The monetary payoffs to the first and the fourth party are perfectly aligned, so that selfish players would prefer an unfair allocation, as they would then receive a higher monetary payoff. However, two other players (the recipients) receive lower payoffs if the unfair allocation is chosen. Each recipient could then choose costly punishments for either the dictator, the fourth party, or the other recipient. The results show that attribution for the wage-setting responsibility in the eyes of the recipients can be effectively shifted to another party; this can constitute a strong motive for the delegation of a decision right. The principle here is “blame avoidance.” If the dictator delegates the decision right and the fourth party selects the unfair allocation, it is largely the latter that is punished. Dictators anticipate this result, so that it is fairly rare for a dictator to personally choose the unfair allocation. A treatment without punishment demonstrates that the choice to delegate is primarily driven by a concern for punishment, since the choice to delegate is three times more frequent in the treatment where punishment is possible. Here, and as is typical in experimental games, punishment involves sacrificing some of one’s own money to reduce the payoff of the entity being punished.

When does delegation lead to lower effort?

Delegation might be a risky strategy though, given that some workers will simply be selfish (assuming that their efforts are not observable, so that firing is not an option). Such workers will choose minimal effort, so that the firm will lose by delegating the right of wage determination. The policy employed at the firms mentioned previously (Semco, Skyline, and Claravision), is to only delegate the wage-determination right to trusted employees, who are considerably less likely to take advantage of the firm. Where to draw the line for this determination is clearly not the easiest choice for a firm and may be a bit treacherous.

Further considerations when delegating responsibility

When there are no external repercussions for a selfish choice, a deeper issue appears regarding the choice to delegate and the performance of the person to whom the decision has been delegated. It may be that the worker refuses to accept the delegated responsibility, or alternatively, is unaffected by social feelings, thus choosing to be selfish regardless of the situation. A selfish worker might simply choose the highest possible wage and the lowest possible effort, as would be predicted by the standard economic model when mutually anonymous parties know that they will interact just once.

However, there is a mountain of evidence demonstrating the scope of social preferences, whereby one takes into account the payoffs and the emotions of others [8]. Prominent models of this behavior include situations in which one party has the right to offer any amount of his or her endowment to another party. If the other party accepts the proposal, it is implemented. However, if the proposal is rejected, both parties receive zero. Lopsided allocations are quite frequently rejected [9], [10], [11], [12].

Nevertheless, if one cannot identify whether or not a worker has an appreciable degree of social preferences, then there is a risk that delegation leads to poor outcomes for the delegating entity. However, in practice there is the possibility of screening and delegating only to individuals who have a good history with the organization; this is the policy followed by Semco.

An additional protection comes from the fact that interactions in the field are typically repeated, so there are reputational consequences regarding the choice made by the person to whom the choice has been delegated. In other words, if the manager or organization who has delegated the choice observes a poor outcome, she or he is unlikely to delegate further responsibility to that person, leading to poor subsequent outcomes for the identified selfish individual. This will tend to keep opportunism in check, especially when there is no known end to the relationship.

Still, an important concern is that it may be difficult to get people to accept responsibility. Consider the phenomenon of the diffusion of responsibility: When there are many people who could exert effort to accomplish a task, but effort from only one person is needed to do so, there is a tendency to “free ride,” i.e. to assume that someone else will complete the task. Even if one party is designated to complete the task, there may be resentment (a sense of unfairness) about having been the person selected, leading to uncooperative behavior. Thus, delegation may be less effective (or potentially even counterproductive) in this case.

In fact, the environment can be crucial for whether it pays to delegate the choice of the wage. Doing so may be relatively easy and effective in business environments where there is a sense of loyalty to the organization (e.g. as in “organizational citizenship” [13]). On the other hand, political environments may tend to be more cutthroat, with little loyalty and a short-term goal horizon. In such a situation, delegation may not be a reasonable choice, unless one can identify people who are less opportunistic and more willing to “buy in” to a sense of responsibility.

Limitations and gaps

There are, of course, some caveats to these results. Most important, the data come from laboratory experiments only, so one must be concerned about external validity, i.e. it is not certain that the results would be entirely similar in real life settings. The observed levels of profits are not necessarily representative, as these will be dependent on many factors. However, the strength of laboratory experiments is that they can cleanly identify treatment effects. Still, to improve confidence that these results are applicable in the field, one should attempt to take other realistic aspects into consideration. Additional factors that were not observed in the described experiments could involve, for example, personal relationships or the possibility of firing workers.

Summary and policy advice

Delegating the choice of wage and effort level to workers can be an effective means for inducing improved outcomes in terms of firm profitability and worker earnings. One key is to identify which individuals are likely to accept the accompanying responsibility that goes with delegation. This can be done from management’s perspective through screening or by simply observing the history of the individual and making a judgment. Delegation can be risky due to selfish behavior by one or more of the involved parties. However, the risk of counterproductive delegation is diminished in an environment where repeated interaction is a given (as in many of the lab experiments mentioned, as well as in the real world when considering long-term employment).

While delegation has clear potential benefits, it is not a panacea. Indeed, the risk of selfish behavior could be crucial in real life settings and must be considered. The risks of delegation could be manifested by employers/dictators who delegate responsibility to others in an attempt to avoid blame or retributive punishment for selfish behavior, or by employees who exploit their newfound freedom to choose their own wages and/or effort levels. In addition, it is not always possible to induce the sense of responsibility needed for successful delegation, which may lead to low effort from workers.

What can be done to avoid counterproductive delegation? Screening (delegating only to trusted workers) could be an important tool in avoiding counterproductive delegation. Additionally, a sense of common purpose is likely to improve the chances that a party will perform an activity that will help the organization (for example, a worker may spot a machine that is breaking down and take immediate action that will prevent large-scale damage to the firm), reflecting a sense of responsibility. Firms could provide better information to their employees so that the employees are more likely to develop such a sense of common purpose. Lengthening the perceived time horizon should also help, if only due to workers’ self-interest coming into play (i.e. workers would deliver greater effort to improve their own position over time).

Given the growing body of evidence, the notion of delegation is a worthwhile concept for policymakers and decision makers to consider, rather than just researchers. The judicious use of delegation in appropriate environments may well generate better labor-market outcomes.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this paper [4], [5]. Support from co-authors, Ramón Cobo-Reyes, Natalia Jiménez, Juan A. Lacomba, Francisco Lagos, and Jose Maria Perez is gratefully acknowledged.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Gary B. Charness