Elevator pitch

The relationship between retirement plan type and job mobility is more complex than typically considered. While differences in plan features and benefit structure may directly affect employees’ mobility decisions (“incentive effect”), the type of plan offered may also affect the types of employees a given employer attracts (“selection effect”), thereby affecting mobility through a second, indirect channel. At the same time, some employees may not be able to accurately assess differences between plan types due to limited financial literacy. These factors have implications for policymakers and employers considering retirement plan offerings.

Key findings

Pros

The relationship between higher job mobility and increased prevalence of defined contribution plans is in part driven by employee preferences for higher job mobility.

The choice structure governing a transition between a defined benefit and a defined contribution plan is key for employee enrollment outcomes.

A firm considering a transition from a defined benefit to a defined contribution plan needs to consider the effects on existing employees separate from new employees.

Cons

Evidence shows that employees place low value on additional defined benefit plan benefits, which may be in part due to low financial literacy.

Even employees who make an active choice (i.e. complete paperwork) between a defined benefit and defined contribution plan at a given employer are highly influenced by which plan the employer selects as the default plan (i.e. plan enrollment if no choice is made).

More research is needed on retirement plan valuation by employees just starting their careers.

Author's main message

Governments and employers considering a transition between defined benefit and defined contribution plans need to consider how different types of employees value the various features of the plans. Given that many employees may struggle to understand which retirement plan is right for them, a key consideration in any transition is how the choice is structured, including the default terms that specify the plan outcome if no active choice is made. Setting the default plan differently across employees based on characteristics—such as age or tenure—could offer better value to specific employees and help reduce retirement plan-related job mobility.

Motivation

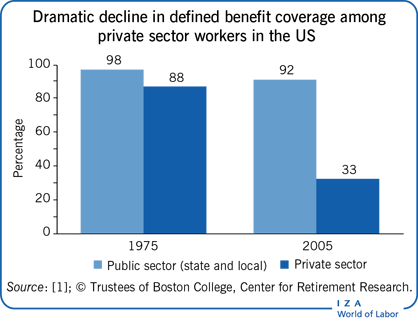

There has been a dramatic change in the retirement plan landscape over the past several decades. Since the late 1970s, defined contribution (DC) plans have been on the rise while coverage of employees by defined benefit (DB) plans has declined. In the US, DC plans started in 1978 and today are the dominant retirement plan. According to the US Bureau of Labor Statistics, 59% of employees are covered by a DC plan while just 28% of employees are covered by a DB plan. The change in retirement plan offering has been particularly stark for private sector employees, for which coverage by DB plans was 88% in 1975 and declined to 33% by 2005 [1]. While coverage has remained high for public sector employees in the US—going from 98% coverage in 1975 to 92% coverage in 2005—threats to reduce or eliminate DB pensions loom (see the Illustration).

While employer-provided retirement plans are a critical source of retirement savings for employees in the US, the role of employer-provided plans in retirement savings varies across OECD countries [2]. Notwithstanding, the increase in DC plans and decline in DB plans is by no means exclusive to the US. For example, as of 2013 eight times as many UK employees were accruing retirement benefits in a DC plan compared to those accruing benefits in a DB plan.

This dramatic change in the retirement plan landscape is potentially of key importance to the labor market given that these plans are inherently different in their benefit accrual and distribution structure.

DB plans provide employees with a stream of annual benefits in retirement in a formulaic fashion based on employees’ salary, years of tenure, and retirement age. These benefits are also typically characterized by strong vesting rules (e.g. the employee is eligible for the benefit only after 10 years of service) and back-loaded accrual such that benefits depend on the last (or largest) salary years, thereby providing disproportionately greater benefits to employees who stay with the employer until the end of their careers compared to those who leave mid-career.

In contrast, DC plans specify an annual contribution to an individual retirement account that is managed by the employee, who is responsible for contribution, investment, and distribution decisions. While employers make contributions to the plan as a part of this benefit, these contributions are often tied to employee contributions in the form of an employer match. Employee contributions to DC plans vest immediately, while employer contributions often vest in a short time, such as after one year. Besides this relatively short vesting requirement, the benefit structure of DC plans is neutral in terms of an employee's tenure (i.e. there is no added incentive or disincentive to remain at the firm as tenure increases).

Due to these inherent differences in structure pertaining to tenure, a natural question to consider is whether these plans differentially affect job mobility. Because a decline in average job tenure has coincided with the change in the retirement plan landscape, particularly in the private sector [3], it is often thought that trends in job mobility are related to the change in plan offerings. Namely, the positive relationship between higher job mobility and higher DC coverage may be directly due to plan incentives affecting employee mobility decisions because DC plan benefits do not disproportionately increase with tenure. This is known as the “incentive effect.”

Alternatively, it is possible that the direction of influence runs the other way. Namely, an increase in job mobility may have increased the demand for DC plans relative to DB plans by employees, leading to greater coverage of employees by DC plans. This latter effect is known as the “selection effect” and implies that the relationship between plan type and mobility is due to employees with greater mobility tendencies seeking out employers with DC plans (relative to those with DB plans).

Understanding the relationship between retirement plan type and job mobility is key for policymakers and employers across OECD countries as they assess labor market patterns more broadly, but more specifically if they are considering making a switch to a DC plan away from an existing DB plan.

Discussion of pros and cons

Evidence of job mobility and plan type

The relationship between job mobility and retirement plan type has been a subject of interest in the economics literature for decades. The early literature on this topic was largely inconclusive, in part because the newness of the DC plans prevented a full examination of differences across levels of tenure. Earlier work on the topic finds no difference in the relationship between job-to-job mobility and plan type; instead, the authors conclude that employees are less likely to leave employers that offer either a DC or a DB plan. A subsequent study finds that employees covered by a DC plan have lower average job tenure than those in a DB plan. This result is at least in part driven by the increased popularity of DC plans over time [4].

More recent research uncovers evidence of a positive relationship between job mobility and participation in a DC plan (compared to a DB plan). In particular, when careful attention is paid to the relationship between plan type, tenure, and job mobility, there is evidence of higher rates of job exit for employees in DC plans relative to those in DB plans among employees with five to ten years of tenure [4]. Evidence from US federal employees also shows higher mobility among mid-career employees after the federal government moved from an all-DB retirement plan to a hybrid plan, consisting of a new DC plan and a lower-payout DB plan [5]. Finding that differences in mobility emerge mid-career suggests that plan incentives may affect mobility. In other words, differences in the incentives for continued employment between the two plans affect employee mobility decisions mid-career, such that a DC plan induces higher mobility than a DB plan.

Alternatively, it is possible that employees with greater expectations for mobility mid-career self-select into employers that offer DC plans (or plans that have a DC component). Hedonic theory proposes that non-wage aspects of compensation can play a key role in affecting the type of employees attracted to an employer. The basic idea is that compensation is composed of wages and non-wage benefits. By making a decision over the mix of wages and non-wage benefits, employers affect the type of employees they attract. In the context of retirement plans, this implies possible differences in the type of employees attracted to employers with a DC plan compared to those with a DB plan based on the employees’ underlying tendency for mobility. Understanding whether and to what extent mobility differences by plan type are due to incentives versus selection is important for understanding whether the introduction of a DC plan causes greater mobility (i.e. incentive effect), or if the DC plan simply better aligns with employees’ existing preferences for mobility (i.e. selection effect).

The authors of a 2017 study directly tackle the question of whether the relationship between job mobility and plan type is driven by selection versus incentive effects using a novel context in which an employer transitions between retirement plans [6]. As part of the transition, existing employees could choose to continue with the original DB plan as their retirement plan, or switch to the DC plan going forward. While the terms of this transition may seem standard, the novel aspect is what occurred if no active choice was made (i.e. plan enrollment if no choice is made): employees below the age of 45 were automatically enrolled in the DC plan, while employees aged 45 or above were automatically kept in the DB plan. An earlier study on the topic finds that these default terms dramatically affect enrollment outcomes; employees who were just younger than 45 had a 60 percentage point higher likelihood of enrolling in the DC plan than employees who were just older than 45 [7].

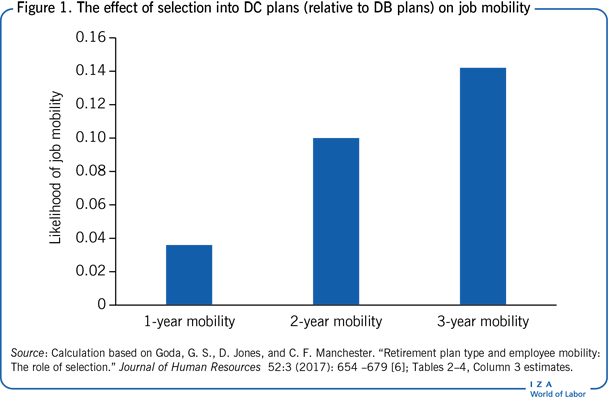

This dramatic effect of the choice structure on plan enrollment (addressed again later) allows the more recent study's authors to plausibly separate mobility differences due to selection from those due to incentive effects because the default terms induced random variation in plan enrollment between otherwise similar employees [6]. The authors find evidence of positive selection into the DC plan based on mobility tendencies, concluding that at least part of the positive relationship between job mobility and the DC plan found in the literature is likely driven by selection.

Figure 1 shows estimates of how selection into a DC plan (relative to a DB plan) leads to higher job mobility over one-, two-, and three-year time horizons. These findings provide compelling evidence that employee preferences for job mobility contribute to the positive relationship between DC plan offerings and increased job mobility.

Further, the 2017 study finds evidence that the incentive effect of the DC plan is negative, meaning that if existing employees were switched to a DC plan for future accruals without choice, their job mobility would have reduced [6]. While this negative effect is counter to expectations given the structure of DB and DC plan benefits in terms of how they accrue with tenure, this finding highlights the multi-dimensional differences between the two plans. In particular, an employee may find contributions to a DC plan more valuable compared to additional accrual in a DB plan because of the loan and withdrawal provisions typically available for DC plans. In addition, the individual-account aspect of DC plans provides employees with tangible and transparent information on its value (i.e. employees can see the dollar value of the benefit on their account balance statements); this is not the case for DB plans.

Employee valuation of defined benefit and defined contribution plans

Once more referring back to the 2017 study, its findings point to the importance of employee preferences in understanding the relationship between plan type and mobility [6]. At the same time, they raise the question as to how much employees value DB and DC plans. Recent evidence supports the idea that employees may face challenges in gauging the value of DB plan benefits. A study from 2015 investigates how much value employees place on DB benefits in the context of public sector employees (in this particular case teachers) in the US [8]. Using information on how employees responded to an opportunity to purchase additional DB benefits, the author finds that teachers value an additional $1.00 in DB benefits the same as $0.20 in current compensation. This number does not reflect the value these employees place on their full DB plan; instead, it is the value placed on additional DB benefits. The author perceives the low implied value of additional DB benefits as being inconsistent with the view that public sector employees have strong preferences for receiving a substantial part of their lifetime pay in this form of deferred compensation. Other researchers also find evidence that employees place a low value on additional DB benefits [9].

This finding must be placed in the context of other research on the known challenges individuals face in accurately assessing the value of a stream of income, which is called the “annuity puzzle.” A recent study shows evidence of an asymmetry in the evaluation of annuities such that individuals report they are willing to buy an annuity at a price that is much less than they are willing to sell [10]. The difference in price is greatest for those with less education, lower financial literacy, and lower levels of numeracy. The authors conclude that the results are consistent with individuals being “reluctant to engage in an annuity transaction if they have difficulty in ascertaining the value” [10], p. 29. This is likely a contributing factor to the low value employees place on the opportunity to buy additional DB benefits found in the 2015 study.

When examining DC plans, one piece of evidence that may indicate how much employees value DC plan benefits is the participation rate in these plans. Prior to widespread adoption of automatic enrollment provisions, participation rates in DC plans tended to be modest. For example, a 2001 study finds that, prior to automatic enrollment, participation rates at the studied firm were as low as 48% despite a generous matching contribution of up to 6% of the employee's pay [11]. As with DB plans, financial literacy may play a role here, given that many employees—in the US and across other OECD countries—have low financial literacy [12]. One critical component of financial literacy needed to assess the value of contributions made to DC plans is having an understanding of compound growth; this has been shown to be positively related to wealth accumulation at retirement [13].

Limited financial literacy and possible hesitation by employees to engage in decisions about a benefit they may not fully understand has important implications for policymakers and employers considering a transition from DB to DC plans. Namely, the choice structure of a plan transition is likely to have a dramatic effect on plan enrollment outcomes.

Choice architecture and plan transitions

It is now well-established that the structure of a choice environment—including order of choices, number of choices, and which choice is the default—also known as “choice architecture,” has powerful effects on outcomes. While rational models of economic behavior expect such facets of the decision to have minimal effects on outcomes, study after study shows that these features matter in important ways in a variety of contexts, including retirement plans. Research on the powerful effect of default terms in the context of employer-provided retirement plans started with the above-mentioned 2001 study, which finds that switching the choice structure of DC plan enrollment from a traditional opt-in choice to an opt-out choice for employees increases plan participation by approximately 50% [11].

As mentioned earlier, research indicates that choice structure has substantial effects on employee outcomes in the context of an employer transitioning between DB and DC plans [7]. In this research case, the default terms varied based on the age of the employee: the default choice for employees aged 45 or older was to continue in the DB plan as the default selection; alternatively, those younger than 45 were automatically enrolled in the DC plan if no active choice was made. The data show an abrupt jump in enrollment that corresponded with the switch in the default plan: employees who had the DC plan as the default were 60 percentage points more likely to enroll in the DC plan relative to those who had the DB plan as the default. Interestingly, approximately 45% of employees eligible for the transition made an active choice (i.e. filled out paperwork); yet, nearly 70% of those who made an active choice chose the default plan that was assigned to them based on their age. Stated differently, the default terms influenced plan outcomes directly by affecting those who failed to make a choice as well as indirectly by anchoring the enrollment decision among those who made an active choice.

Limitations and gaps

Determining the relationship between job mobility and retirement plan type has been challenging due to the fact that employees are not randomly assigned to plans (or to employers offering different plans). This has made it difficult to determine whether the inherent differences in the features of DB and DC plans with respect to job tenure induce differences in job mobility, or whether it is employee preferences for retirement plans that do not penalize job mobility that has led to the rise in DC plans. Recent evidence that exploits variation in plan enrollment due to choice architecture suggests that employee preferences are a key part of the story [6]. Even so, further evidence across a variety of contexts is needed to better grasp the situation, including a better understanding of selection and incentive effects among employees without a legacy DB plan (i.e. not just among existing employees).

In addition, employer-provided retirement plans need to be understood in the context of a broader compensation offering, including the structure of wage and non-wage benefits. For instance, employers may use retirement plans as a method of deferred compensation to incentivize employees to put forth costly effort. Therefore, a decline in DB plan offerings in the private sector compared to the public sector may be in part related to change in how effort is incentivized.

Summary and policy advice

Recent research shows compelling evidence of a positive relationship between job mobility and enrollment in a DC plan relative to a DB plan, particularly for mid-career employees. Deep investigation of the relationship between plan type and job mobility suggests that employee preferences for a plan that accommodates greater mobility is in part driving this effect. At the same time, research on limited financial literacy points to the challenges many employees face in trying to value benefits provided by retirement plans. This has two important policy implications.

First, policymakers and employers considering a plan transition need to pay careful attention to how the transition is handled in terms of communicating with employees and determining how the choice is structured (i.e. the choice architecture). Given the hesitation by individuals to engage in transactions involving DB-like streams of benefits [10], outreach efforts to help employees make their choice are critical. These efforts could be paired with choice architecture that sets the default plan differently across employees based on characteristics that are related to the relative value of the two plans—such as age or tenure.

Second, those contemplating a transition need to separately consider how the transition is likely to affect existing employees compared to new hires in determining the overall effects of a plan transition on mobility and retention. While augmenting a legacy DB plan with DC contributions has been shown to increase employee retention [6], selection effects will likely lead to differences in the underlying mobility tendencies between employees hired under a DB plan compared to those hired under a DC plan. Paying careful attention to the anticipated incentive and selection effects is key for understanding the likely effect of a plan transition on employee mobility.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [6].

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Colleen Flaherty Manchester