Elevator pitch

Recent research has revealed enormous variation in performance and growth among firms, which both drives and is driven by large reallocations of inputs and outputs across firms (churning) within industries and markets. These differences in firm-level outcomes and the associated turnover of firms affect many economic policies (both labor- and non-labor-oriented), on both a microeconomic and a macroeconomic scale, and are affected by them. Properly evaluating these policies requires familiarity with the sources and consequences of firm-level variation and within-industry reallocation.

Key findings

Pros

Enormous differences in firm-level performance and reallocations within industries are common facets of production economics.

Dispersion and turnover shape the micro- and macroeconomic phenomena that interact with various policies.

Microeconomic policies that affect and are affected by firm-level variation and churning include hiring or investment regulations, taxes, and subsidies.

Macroeconomic policies tied to firm-level dispersion and reallocation include national trade policies and laws and regulations that shape the allocation of production across businesses within industries or markets.

Cons

Much of what is known about variation in firm-level outcomes and within-industry reallocation comes from data collected by national statistical agencies for constructing aggregates, not expressly for learning about dispersion and churning.

Considerably more could be learned from expressly designed data collection, but this would be expensive and involve budget tradeoffs.

Author's main message

Familiarity with the nature of variation in firm-level performance and growth and the accompanying turnover of firms within an industry is important for effectively evaluating a range of economic policies affecting labor and other markets, because both micro- and macroeconomic phenomena and policies affect and are affected by firm-level dispersion and reallocation.

Motivation

Just about anywhere economic and business researchers look, they find immense dispersion in performance across businesses, even among those that operate in the same, narrowly defined market. While people have noted and sought to explain performance differences across companies for as long as companies have existed, only in the past couple of decades have the data necessary to systematically investigate these differences become available. The patterns that have been documented have surprised many and reshaped views of several economic phenomena.

Discussion of pros and cons

The systematic study of dispersion in firm-level outcomes has been facilitated by the recent expansion in micro-level data on producers’ economic activities. Over the past two decades, national statistical agencies began making available the micro-level surveys that form the basis of their publicly released tabulations (such as industrial production and gross domestic product).

This expansion in access has occurred worldwide, with producer-level microdata now available for a host of countries ranging from low- to high-income, north to south, and small to large. The breadth of coverage allows researchers to identify universal patterns while also making it possible to test whether patterns that differ across settings relate to economy-specific factors.

While business and economic researchers have used such data to explore a wide array of issues, a common thread—regardless of the sector, time period, or country—is the immense dispersion in performance and growth across businesses, even within narrowly defined industries.

Exploring the causes and consequences of this dispersion has led to many new insights that have influenced how business researchers and economists in several fields—industrial organization, corporate strategy, macroeconomics, labor, corporate finance, trade, and others—think about firms, markets, and the policies that affect them.

Dispersion and firm-level outcomes: Some facts

Some numbers can put the amount of dispersion in perspective. Firms vary considerably in size, typically adhering closely to characteristically “fat-tailed” distributions (read: high-variance distributions). Size is typically measured by sales or an input such as employees.

Consider company size in the US. While the average-size firm has about 20 employees, there are almost 5,000 companies with more than 2,000 employees and about 500 companies with more than 20,000 employees. Similar variation is observed in revenue.

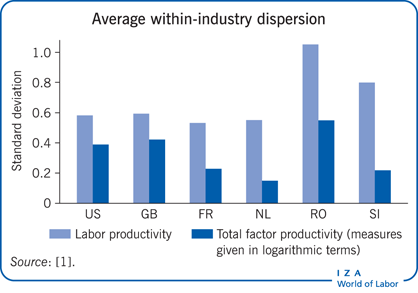

Companies also vary greatly in productivity—the efficiency with which they convert inputs into outputs. Using firm-level data for the US and several European countries, a recent study documented large within-industry differences in labor productivity (measured in revenue per worker) and total factor productivity (measured in revenue per unit of combined labor, capital, and materials inputs) in all of these countries [1]. It is not unusual to find labor productivity ratios across firms within an industry on the order of 3 to 1 and total factor productivity ratios on the order of 2 to 1. These total factor productivity ratios indicate that in the typical narrowly defined industry (for example, saw blade manufacturing, sporting goods stores, or direct mail advertising), one firm is able to produce and sell twice as much output as another with the same amount of measured inputs. The US and Europe are not unusual in this regard. Even larger within-industry productivity differences have been observed in developing countries like China and India.

There is also massive variation across firms in changes over time. For example, the standard deviation of annual sales growth rates across US companies is around 50% [2]. This implies that in a typical year, fully one-third of firms can expect to see their revenues either grow very quickly (by 60% or more) or shrink very quickly (by 40% or more). Enormous changes on an annual basis are not unusual. Similar patterns hold for growth in firms’ inputs.

Variation extends to firm startups and closures as well. Average annual gross firm entry and exit rates were over 5% in a sample of 16 countries [3]. In other words, at least one in 20 firms operating in a given year did not exist in the previous year. Another one in 20 did not survive to operate in the following year. Entering and exiting firms include many small businesses with only a few employees, but there is also plenty of turnover—entry plus exit rates—among larger companies. Gross entry and exit rates among firms with at least 20 employees were on the order of 3–8% in most industrial countries and more than 10% in some transition economies [3].

As with firm size and productivity differences, most of this growth dispersion is within narrowly defined markets. For example, less than 10% of the variation in US manufacturing plants’ growth over ten years (whether measured by revenues, employment, or assets) can be explained by the industry in which they operate [4]. Knowing which industry a business operates in has little predictive power over its fortunes. Companies commonly shrink or shut down even in quickly growing industries, while other companies grow despite being in contracting industries. Industry is not destiny.

Dispersion and firm-level outcomes: Some implications

All this firm-level variation means that even the most seemingly humdrum industries are likely to be constantly churning cauldrons of activity below the surface. Small net changes at the industry level can hide large gross changes at the firm level.

Consider the entry and exit rate figures described above, for example. It isn’t unusual to see a net change near zero in the number of companies operating within an industry [3]. That net number is unlikely to reflect a lack of dynamism, but rather roughly equal numbers of new and closing firms. Job flows exhibit similar patterns. Firm-level gross job creation and destruction rates within US manufacturing industries are about 10%, for instance [5]. That is, 10% of an industry’s jobs in a given year didn’t exist in the previous year, while another 10% can be expected to disappear by the coming year. Thus, hidden beneath the slow drawdown in net manufacturing employment in the US over the past few decades were very robust gross job flows that were moving economic activity and employees from shrinking companies to expanding ones in the same industry.

The sort of patterns observed in US manufacturing have been documented in many other sectors and countries. This means that the typical industry experiences an amount of micro-level reallocation that is far in excess of any shifts necessary to account for the industry’s net change. For example, an industry with a 1% net growth in jobs would need only a gross job creation rate of 1% if no jobs are destroyed in the industry at the same time. Yet this is rarely observed. More typically, 1% net growth will reflect a gross job creation rate of, say, 10% and an accompanying job destruction rate of 9%. A much greater share of the industry’s jobs (and probably the workers who fill them) are affected by churning than the minimum necessary to move the industry as a whole.

Is this excess turnover wasteful? Shifting workers, jobs, and capital across firms is costly, after all. If there is typically much more of this shifting than is needed to account for net growth (or net decline), is all the extra reallocation of inputs and activity a costly redundancy?

The evidence on this question is clear. No, it is not all wasteful. Turnover is largely beneficial. Reallocations of economic activity across businesses—again, even within narrowly defined industries—are generally in a direction conducive to greater economic efficiency, as churning systematically favors high productivity (more efficient) producers. There is a rich body of evidence that more efficient businesses are significantly more likely to grow and survive than their less productive competitors. Furthermore, companies that enter markets are systematically more efficient than those leaving it.

Churning therefore serves a purpose beyond simply accounting for whatever net change is necessary to meet the growth or decline of the broader market. It also reallocates economic activity from less to more productive firms, making the industry more efficient. This process appears to work more strongly during expansions than recessions, as labor churn is procyclical [6].

What drives this beneficial reallocation? Many factors influence the process, from how well input markets operate to the regulatory environment and the nature of information transmission among producers. One of the strongest drivers is competition in output markets.

Competitive pressures from other companies or from potential startups can drive a sort of Darwinian selection process: the less efficient firms shrink or are shoved out, while the strongest companies expand. In addition to this selection process, competition can increase industry-level productivity by prodding companies to improve their own capabilities lest they be cast out of the market. Economist Sir John Hicks once remarked, “The best of all monopoly profits is a quiet life.” Quiet industries are stagnant ones; competition can ensure the churning necessary to reward good performance and punish poor performance.

Researchers using firm-level microdata from many industries, time periods, and different countries have found these processes to be pervasive [7], [8]. Perhaps the most observationally stark cases are those in which industries that were suffering from considerable misallocation experienced market reforms that spurred reallocation toward more efficient companies. Misallocation in this context means with the more efficient firms smaller than average and the less efficient firms larger than average. Examples of this include:

the manufacturing sectors of Central and Eastern European countries during their transition to a market economy in the 1990s;

Chile around a period of major trade reforms in the late 1970s and early 1980s; and

the US steel industry during the advent and growth of minimill technology in the 1960s.

Dispersion and firm-level outcomes and evaluating policies

To summarize: huge variations in firm-level outcomes are typical even within industries, these differences drive very active turnover that reallocates economic activity across individual producers within industries and markets, and this reallocation usually occurs in a direction that rewards higher productivity producers. How should these facts, documented extensively in the past 20 years, shape policy evaluation?

At the microeconomic level

From a microeconomic perspective, understanding the enormous dispersion in firm-level outcomes and the associated churning is vital for shaping policy on:

wage dispersion;

employment flows;

business dynamics;

productivity growth;

technological change;

industry evolution; and

other economic forces.

Consider the seemingly straightforward issue of explaining why some companies are successful while others are not. An older perspective, shaped before the recent research on the extensive dispersion in firm-level outcomes, would have attributed differences in companies’ fortunes to overall market conditions in the firms’ operating environments—whether an industry is growing or shrinking, whether new technologies have been introduced, whether the prices of key inputs have changed, and so on. Yet companies that operate in the same markets and use the same production technologies still perform at vastly different levels. So any answer to the question of what drives performance differences—and by extension, what policies influence the process—has to originate at a much more granular level. (Recent work on the sources of performance differences is summarized in [8].)

From a policymaking perspective, this means that policy impacts may be misread or misunderstood if the sources of firm-level idiosyncrasies are not fully understood. Consider the effects of a subsidy designed to encourage firms to hire more workers, such as a tax credit for hiring. The impact of this kind of policy on overall hiring will depend on the distribution of the gaps between individual firms’ desired and optimal employment levels.

This gap can vary widely across firms. Some companies in the industry will be contracting, even if the industry is growing. They are likely to be completely unresponsive to such a policy. Other companies will have only a small gap. Because they are already about where they want to be, they might adjust a little because of the policy but would not be expected to respond strongly. Still other companies, for various reasons, will be seeking to expand quickly. Because they have large a gap between desired and actual input levels, the policy might induce a large response from them.

The large firm-level variation means that the tax credit’s overall effect on hiring in the industry will depend on how many firms are in each of the three broad groups described above (of course, the variation in firm “types” is richer than these three groups imply). Industries with a relatively high number of companies in the first or second groups—those seeking to contract or those near their desired input levels—will respond weakly, if at all, while industries with relatively more firms in the expanding group will respond more strongly. (Though even there, idiosyncrasies matter for the effectiveness of the policy: the hiring gaps could be so large that these companies would hire extensively even if there were no tax credit. In this case, the credit will result in costly reimbursements for hires that companies would have made anyway.) A policy evaluation that does not recognize and account for this sort of company-level dispersion and the variation in the responses it creates will miss these effects.

For broadly applicable tax credits for job creation, the situation is further complicated by the fact that the variations in firm-level gaps are likely to differ across industries. Any variation in the average response to the policy across industries will heighten the variability in outcomes.

At the macroeconomic level

Grasping the nature of variation in firm-level outcomes matters to economic phenomena and policies not only at the microeconomic level, but at the macroeconomic level as well. While the importance of microeconomic idiosyncrasies to aggregate phenomena had long been dismissed, under the logic that any firm-level dispersion simply averages out, a more nuanced understanding is emerging. For one, as a simple matter of accounting, understanding the nature of changes in many aggregates—employment, investment, productivity, value added, and more—is greatly aided by knowing how the firm-level processes that underlie these aggregates work.

Another prominent example of evaluating macro-level phenomena from a micro-level perspective is the impact of trade policy changes. Trade may have seen the most change in a research agenda due to the recognition of firm-level dispersion of any field in economics (an overview is in [9]).

Classic aggregate analysis implies that reducing trade barriers leads to growth in sectors with a comparative advantage and, by extension, growth of the firms within those sectors. When firms differ considerably within an industry, however, policy changes can have varied and subtle impacts. Even within sectors that, as a whole, enjoy comparative advantage, some companies benefit from reduced trade barriers while others are hurt by them, perhaps fatally.

Imagine a case where two countries each protect their domestic industry from trade competition, and each industry includes firms with different productivity (cost levels). Now suppose that the two countries open to trade with each other. The strongest (highest productivity/lowest cost) companies in each country will choose to export to exploit their efficiency advantages over a larger market. This expands sales of the new exporters but intensifies competition within each market, as the formerly protected firms now face a new set of systematically more efficient entrants. Some domestic producers that were profitable under protection are no longer profitable, and they exit as a result. Other, somewhat stronger domestic producers continue to operate but at lower profit margins. Even stronger producers begin exporting, but the profit gains from the increased sales are nullified by losses due to heighted competition. Only the very strongest companies can expect to increase both sales and profits by exporting. Productivity differences, therefore, lead to very different effects of trade barrier reductions, even within the same industry.

Another area of active macroeconomic research with rich policy implications concerns the consequences for aggregate productivity and per capita income of the misallocation of production across businesses. Various market frictions—many originating in policies or influenced by them—can lead to some firms with low productivity (low marginal products, to be exact) producing too much while others with high productivity produce too little. As a result of inefficient input use, total output is lower than it could be. (Consider, for example, a form of crony capitalism that implicitly or explicitly subsidizes inefficient but favored producers. They will become too large relative to their productivity levels while crowding out more efficient but less favored producers.) Some estimates of the size of these inefficiencies suggest that trillions of dollars may be at stake: misallocation of production activity across firms with disparate productivity levels accounts for a considerable share of the overall productivity and per capita income gaps between developing economies like China and India and those of wealthier nations. Policies that eliminate frictions or otherwise encourage production to take place where it can occur most efficiently could yield substantial gains in incomes for billions of people.

A final macro-oriented example involves a burgeoning line of research that has built a theoretical case for how even independent, idiosyncratic micro-level shocks can create aggregate fluctuations. In other words, firm-level dispersion doesn’t simply average out. Shocks to specific sectors or firms might spread and perhaps even be amplified, resulting in economy-wide effects. Understanding the sources of firm-level dispersion has two policy implications in this case.

First, while the theoretical case has been built, the quantitative importance of such phenomena is still unresolved. Doing such an assessment requires a strong grasp of the nature of firm-level dispersion.

Second, it is likely that policies can shape how micro-level shocks proliferate and are amplified (for example, through transport structures or financial networks that have themselves been shaped by policy choices). Reducing the broader, knock-on impacts of micro-level shocks can therefore be a goal of policymakers.

Limitations and gaps

Business and economic researchers have learned much about the variation of firm-level outcomes and the associated within-industry turnover—knowledge that can benefit the evaluation of policies that affect production behavior in ways both narrow and broad. Much is still unknown, however. Prominently, the exact sources of firm-level dispersion are not yet clear. Many candidate sources have been proposed, ranging from managerial practices to intangible capital to firm structure, and research has shown that subsets of these potential factors are influential in some settings. Yet it is still unclear how important each factor is overall, what features of a market or industry determine which factor is likely to be dominant in a particular setting, or whether there are complementarities between the factors (and how large, if so). As more is learned about these questions and others like them, the more accurately policymakers will be able to predict how policy choices will interact with firm-level dispersion and churning. Considerable research is under way along these lines, but for now the picture is incomplete, if still useful.

There is a more practical limit to knowledge in this area: data availability. Most of the research into firm-level dispersion and reallocation used the detailed data on production practices made available by national statistical agencies. By and large, these data were collected to construct aggregate economic statistics, like GDP, not for examining the causes and consequences of firm-level variation and churning. That the data proved useful for that purpose was a fortunate coincidence, but more directed efforts to measure micro-level production behavior would yield more precise insights into the sorts of issues discussed here. Such data could include, for example, information on management practices, investments in intangible capital, micro-level output, and factor prices. Collecting such data is costly and raises budgetary tradeoffs that cannot be ignored. Still, the amount that has been learned already—from data not expressly designed to answer such questions—suggests there could be large potential gains from further collection efforts.

Summary and policy advice

Business and economic research over the past couple of decades, enabled by recent releases of micro-level production data, has found enormous dispersion in outcomes across firms, even among those operating in the same industry or markets. This dispersion involves variation in both levels (revenues, employment, productivity) and changes (growth rates in these or other operational metrics) and is found in a wide array of industries, countries, and time periods.

This variation both causes and results from turnover within industries. Production is constantly being reallocated across firms in an industry, whether among continuing operators or through firm turnover through entry and exit. This reallocation occurs even in industries that have stable aggregate metrics. Recent research has found that this churning is typically in a direction that raises the overall productivity of the industry.

Being familiar with the nature of this dispersion is important for policies that interact with both microeconomic phenomena, such as the effect of hiring or investment subsidies targeted at particular industries or markets, and macroeconomic phenomena, such as trade policies and losses due to misallocation of production across firms. These policies shape outcomes in labor markets as well as other input and output markets.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Chad Syverson

Micro-level data versus macro- and meso-level data

Micro-level data are data collected on individual companies or at an even more dis-aggregated level, such as the individual, office, store, or factory. Countries with recently available microdata include Chile, China, Colombia, Denmark, France, Ghana, India, Indonesia, Spain, Turkey, the UK, and the US, among others. Microdata are often collected through surveys or interviews, or come from governmental administrative systems and registers. They can be distinguished from macro-level data and—even though often not clearly—from meso-level data.

Macro-level data are generally described as either aggregated or system-level data. Aggregated data are composed by combining information about characteristics of lower-level units, for instance properties of individuals, they typically include unemployment statistics, demographics, and gross domestic product. Hence, aggregated data are not measures of inherent higher-level properties but summaries of the properties of lower-level units. In contrast, system-level macro data measure characteristics of higher-level units directly, for example the properties of states and political systems. These data cannot be dis-aggregated to lower-level units and usually form political indicators such as institutional variables or regime indicators.

Meso-level data describe data on collective and cooperative actors such as commercial companies, organizations, and political parties. Sometimes the distinction between meso-, micro-, and macro-level data is not completely clear, so the distinction is often only between micro- and macro-level data.

Source: The MacroDataGuide, NSD. Online at: http://www.nsd.uib.no/macrodataguide/macro_data.html