Elevator pitch

The growth in the number and in the size of remittances and the stability of these monetary transfers have made them a prime target for policymakers. Because remittance flows go directly to households in emigrants’ home countries, one has to wonder about their effects on household decision-making, particularly in relation to the number of children to have. While this is household specific, when considered at the community and country level, there are significant policy implications for remittance-receiving economies. Therefore, it is crucial to more fully understand the relationship between remittance inflows and fertility rates.

Key findings

Pros

Remittance inflows increase fertility if children are considered a form of investment for future financial support (replacing social security).

By acting as an income boost, remittance inflows increase fertility if children are considered “normal goods.”

Remittance inflows allow receiving families to set up small, family-run businesses, which dictates the need for a larger family to secure future help.

Remittance inflows allow for the expansion of dwellings that could accommodate more children.

Cons

If a portion is spent on human capital development, such as nutrition, health services, and education, remittance inflows can decrease fertility.

Remittance inflows decrease fertility if children are considered “inferior goods.”

Remittance inflows mitigate against poverty, leading to lower fertility rates.

Remittances allow recipients to set up small, family-run businesses, which reduce the need for children as investments for the future and offer women work opportunities, reducing fertility rates.

Remittance inflows shape the type of migration that occurs by increasing the likelihood of brain drain, which reduces fertility rates.

Author's main message

It is difficult to assess the effects of remittances and the social and financial links they form between emigrants and households in their home countries. Social links relay the norms emigrants encounter abroad and attach to their remittances; key among these is the number of children families have, which can rise or fall. Financial links economically improve households, which then include fertility decisions and remittances in their financial planning. The latter causes a brain drain as more household members emigrate in search of jobs. The challenge for policy is how to benefit from the stability remittances offer, while countering their impact on demographics.

Motivation

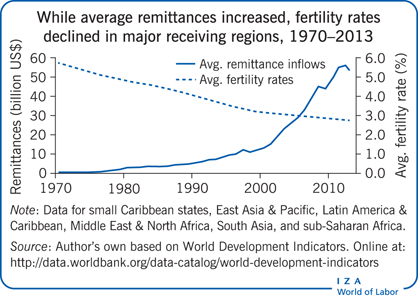

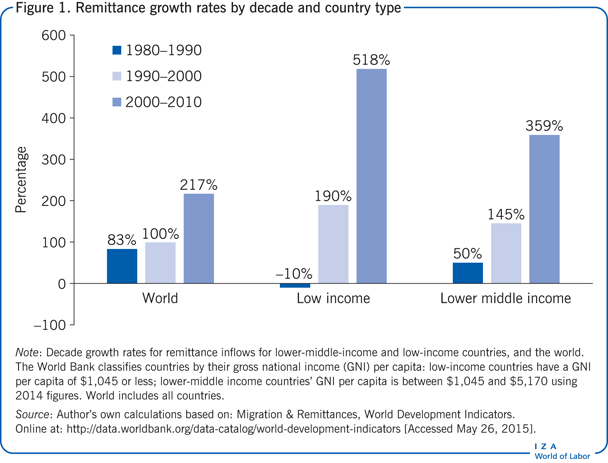

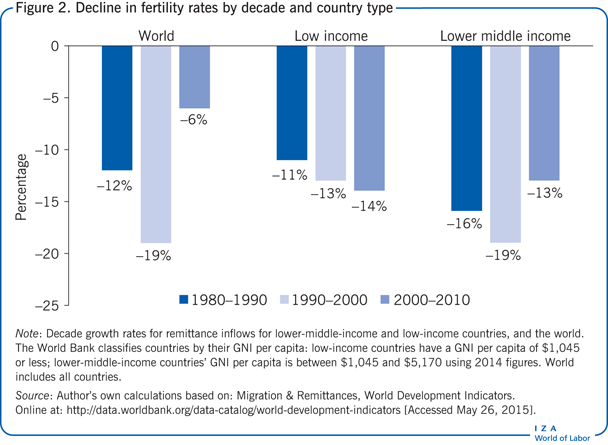

Remittance flows have grown over the past few decades, in terms of their overall size and relative share of the gross domestic product (GDP) of several receiving economies. The Illustration shows that between 1996 and 2013, the yearly remittance average was at least $10 billion and as much as $58 billion each, while the average fertility rate declined by approximately 40% over the same period. Figure 1 shows that recorded remittance inflows grew by at least 100% during the 1990s, more than 200% from 2000 to 2010, and even persevered through the 2008 financial crisis. Low-income and lower-middle-income countries recorded the largest remittance growth rates in the 1990s and 2000s. In 2013 alone, the share of GDP attributed to remittances was between 10% and 20% for the top ten receiving countries. But, while remittances to low- and lower-middle-income countries have increased since the 1980s, fertility rates have decreased by at least 11% each decade since then (see Figure 2).

Why would one wonder whether remittance inflows are affecting fertility rates? For many, remittances are a more reliable source of funds than (or even replace) social security benefits; they are seen as an income boost, can improve financial standing, and can reflect the norms and values of the emigrants’ host countries. They also alter the consumption behavior of receiving households, thereby affecting health and educational expenses, which in turn influence fertility decisions. But, isolating the effect of remittances on fertility remains a challenge.

Discussion of pros and cons

For lower-income households, managing volatile incomes often means one (or more) household member(s) must go abroad to secure better job opportunities and a future stream of income. In this sense, emigration and ultimately remitting money back home is considered a household financial strategy. The same process could be part of broader household decision-making, which also includes a number of factors that ultimately influence family planning. How can remittance inflows affect the fertility rates of receiving households?

Remittance inflows are monetary transactions between emigrants in host countries and households in emigrants’ countries of origin. The frequency and amount of these remittances means that emigrants maintain close communication with their families back home. In this way, in addition to money, they also transmit ideas, behaviors, and habits they acquire in the host countries to the household members left behind. The implicit assumption is that the transmission of monetary remittance inflows dictates a certain interaction (or perhaps even act as leverage) between emigrants and receiving members, which could be channeling new social norms (including fertility norms) that emigrants are experiencing in their host countries. So remittance flows influence household decision-making in two distinct ways: financial and social. Both provide direct and indirect channels that sway fertility in opposing directions; also, both bring significant difficulties in understanding the relationship between remittances and fertility. While the transfer of social norms from emigrants to family members left behind is potentially correlated with fertility behavior, the focus, here, is on the monetary (financial) dimension of remittances as they influence the decisions families make on the number of children they have.

Remittances can increase fertility through financial channels

There are several ways monetary remittances can alter the decision to have children. In terms of direct effects, households in the country of origin can view remittance inflows as a substitute for the lack of (or poor) social security benefits. The demand for children assumes that children are household assets and that there are no other venues through which to earn and save money [1]. So, for the household financial strategy to work, households invest in the number of children in the hope of securing a constant flow of future remittance transfers. This decision does not have to be a one-time (static) thing and could easily change over the passage of time, updated as the head of the household takes into account such dynamic factors as the age differences and relationships between siblings and other household members. Children have incentives to remit money back home if they expect something in return, such as an inheritance, social recognition within the local community, or other lucrative opportunities [2]. This brings us to the role of the motivation to remit.

Emigrants send money back home for reasons that are mainly governed by the two extremes of pure altruism and pure egoism. Altruistically inclined emigrants place significant weight on the well-being of household members back home, while self-interested emigrants remit for investment and insurance purposes. Both extremes allow remittances to act as a safety net for receiving households. But while an altruistic emigrant is mainly concerned about household members’ welfare, an egoistic emigrant is thinking about a future inheritance or his or her social status in their country of origin in the event of future plans for returning there. Evidence from Cameroon shows that remittances may not offer adequate income for the elderly in terms of social security insurance; however, during bad times remittances do alleviate financial pressures on farmers [2].

In the case where receiving households (monetarily) view children in the same way they view nominal goods (goods whose value is measured in current dollars), children can be viewed as either “normal goods” or “inferior goods.” The debate over whether children are normal versus inferior goods started with Gary Becker’s seminal work on depicting children as consumption goods. In the case where children are viewed as “normal goods,” any increase in income would mean the household could afford more children and be expected to increase their family size, thus yielding a larger number of children. In contrast, in the case where children are viewed as “inferior goods,” as incomes increase, households would be expected to reduce their family size, thus yielding fewer children. The argument for children being inferior goods is that wealthier households can afford contraception, but also the opportunity cost of child rearing increases with higher income earnings, so that the demand for children decreases. This argument is usually put forward in relation to women, because as women’s incomes rise, the amount of earnings they would forgo should they choose to stay home and rear children also rises. There is plenty of evidence in favor of children being inferior goods. However, in some instances, for example when the emigrant is the husband, an income shock can positively affect fertility [3]. So, with the diversity of migration decisions, even though the resulting income boost to receiving households generally results in decisions to have fewer children, one cannot ignore the possibility of children also being viewed as normal goods where an increase in household income results in the decision to expand family size.

Remittance inflows improve the receiving household’s access to credit. Remittances also offer a substitute to formal credit sources [4]. For example, when faced with a health-related shock, Mexican households with at least one member living in the US did not resort to borrowing, but instead relied on remittance inflows. Easier access to this informal source of credit (or credit expansion) also allows for greater incentives for debt accumulation to invest in more children as a hedge against future bad times [5]. Receiving households use these current remittance flows, from the first household members who emigrated, to invest in more children who will in turn offer old-age support for the remaining household members.

Credit expansion through remittances creates two other opportunities that could indirectly contribute to the number of children in the receiving household [6]. First, remittance inflows can provide seed money to start small, owner-operated businesses that offer self-employment and allow for higher and potentially stable future earnings. Household owners of small businesses opt to increase their family size because they can afford to, but also to secure future help. Second, remittances allow receiving households to improve their household situation, either by expanding the size of their current dwelling or upgrading amenities in their existing home. When the Cuban government authorized private home ownership in 2011, remittances allowed receiving households to purchase larger accommodations with plenty of space in which to raise bigger families [6].

Remittances can increase fertility through social channels

When remittances alleviate the receiving household’s budget constraints, they can also alter reproductive behavior through social channels. This is because, as much as their financial link is important, remittance flows also carry social norms and values from the host countries emigrants are residing in back to their country of origin. Arguably, monetary transfers reflect to a certain extent the emigrant’s level of attachment to home [7]. From a logistics point of view, remittances require a certain level of communication between the sender (emigrant) and the receiver (household in the country of origin). A higher frequency of remittances increases the opportunities to communicate. This increased communication, in turn, increases the probability that the remittance-sending emigrant also sends along the values and ideas he or she encounters in the host country. In addition, larger amounts of remittances tend to increase the emigrant’s bargaining power in terms of shaping household-level decision-making in the country of origin [7]. That is, emigrants who frequently send home sums of money and also those who send home large sums of money might have expectations of the household that include a family size that could go in either direction, depending on the fertility norm of the emigrant’s host country.

Remittances can decrease fertility through financial channels

Most of the channels discussed above positively contribute to fertility. Under certain circumstances, however, the same channels can decrease the number of children households decide to have. This is because remittances can have a substitution effect on fertility that is opposite to the income effect. For instance, receiving households can spend a portion of this new money on developing the human capital of the members still at home. Human capital development means investing in resources that increase human (labor) productivity, the most common types of investment being education and training, nutrition, and health care. Here, households invest in the quality of the current household members as opposed to investing in their quantity. In this context, a large share of remittances is usually spent on consumption needs of the receiving household and also on non-durable goods, such as food and clothing. The portion spent on health services could include family planning procedures (like contraception) and other medicines, such as life-saving vaccines and antibiotics. With remittances, members of the receiving household can now afford better nutrition and can see a medical specialist if the need arises. Affording medical care and nutritious food is the first component of human capital development. Affording contraception directly controls the number of children; affording other medical care and nutritious food improves child health and lowers infant and child mortality rates. Lower mortality is a contributing factor to a decline in fertility rates as families can depend on the fact that more (if not all) of their children stand a better chance of surviving into adulthood.

Besides health services, remittance inflows are also spent on education. Arguably, education is a key predictor of demographic change. This is because this type of human capital development provides people with the knowledge and skills they need to seek new labor market opportunities and, therefore, increases labor force participation. But it also contributes to the opportunity cost of having and raising children. If emigrants contribute money to their non-migrating family members so they can improve their likelihood of joining the local labor force, remittance inflows would then lower fertility rates as women opt to enter into employment rather than giving up incomes to have and care for a higher number of children. Further, remittance inflows provide money to the receiving household so the remaining (non-migrating) children can attend school. This can be part of a long-term strategy to send a new generation of household members to work abroad, so school attendance becomes a long-term investment strategy to ensure future remittance earnings. Moreover, with the money remittances provide, households can now afford to hire labor from outside and rely less on child labor. This allows children to attend school instead of working and also reduces the household’s need to have more children to supply future workers.

Both types of spending—on health and education—increase the human capital of the non-migrating household members and lower fertility rates. In addition, the role of remittances in financial development also has an impact on fertility rates. Remittances offer a new way to finance investment, thus avoiding the existing liquidity constraints among households that cannot secure enough credit to invest in schemes that could increase their incomes [8]. Remittance monies are spent on consumption (including health and education expenses), but they also become savings or investments. When emigrants send remittances home, savvy household members now have liquidity to invest in small businesses (self-employment), local real estate, and/or other available investment schemes. For instance, the share of small- and family-run business owners in Cuba who are remittance recipients ranges between 50% and 70% [6]. These businesses offer new employment opportunities for women, therefore increasing the opportunity cost of child rearing, the same way educating women does, and also can be seen as substitutes for investing in children. Hence, in the sense that remittance inflows allow for other (than children) investment opportunities, they will also contribute to lower fertility rates.

Furthermore, evidence from countries in Latin America, Asia, and sub-Saharan Africa [9] suggests that remittance inflows have mitigating effects on poverty. Poverty is commonly referred to as one of the fundamental predictors of the quality of child health, infant and child mortality, and fertility rates. The literature on the effects of remittance inflows on poverty is quite large and covers geographically diverse areas.

In addition, remittance inflows increase the emigration likelihood of family members left behind. Among those potential future emigrants, the most educated and skilled are more likely to move abroad in search of better jobs [10]. So, one way remittance inflows increase the prospects of emigration is through improving not just the quantity but also the quality of household members’ education [11]. In this way, remittance inflows actively shape emigration into a brain drain, which in turn has the potential to reduce fertility rates in labor-exporting countries [12].

Finally, remittances also have country-level effects that can have impacts on fertility. On the one hand, remittances contribute to foreign exchange holdings, shield receiving countries from turbulent economic times, often act as catalysts for foreign investments, and lower the probability of the current account reversals that can occur when there is a financial shock, such as an exchange rate fluctuation or an external source of finance drying up [13]. Nevertheless, remittances also negatively affect the receiving country’s international competitiveness by raising the prices of locally produced goods (remittance-receiving households’ increased incomes mean they can buy more locally produced goods; the increased demand for these goods increases their prices, thereby making them less competitive compared to imports, and also on foreign markets). Both of these competing forces create an environment that could be conducive to a general feeling of happiness and optimism that leads to expanding family size, or they can be destructive in that increased feelings of instability, financial insecurity, and emotional distress lead to expanding family size to secure future remittance inflows.

Remittances can decrease fertility through social channels

With the exception of migration to the Gulf region, most emigrants leave a country that has a higher fertility rate and move to a country that has a lower fertility rate. North America and Europe are the two top destinations for immigrants from all over the world; both regions have experienced tremendous drops in fertility rates over the last few decades. For instance, according to the World Development Indicators, fertility rates in the US and Canada dropped by 48% and 57%, respectively, between 1960 and 2013. Emigrants in traditional migration destinations observe and transmit host country norms, habits, and social customs back to their home countries through the expectations they attach to the monetary transfers they send, which ultimately contribute to a decrease in fertility rates. With advancements in technology and the greater prevalence of mobile devices across the globe, one expects more communication and interaction than ever before between emigrants and receiving households. The flow of information between the emigrant and non-migrating family members is instantaneous. Both parties can relay information and offer instant feedback. The opportunity to relay new social habits to origin countries has never been easier. Prompt methods of communication allow emigrants to better monitor how remittances are being spent and they can adjust the amount and/or frequency of remittances if there are concerns.

Limitations and gaps

The limitations in examining the relationship between remittance inflows and fertility rates mainly come from the challenges posed in studying the effects of remittances in general. One challenge in understanding the effects of remittance inflows is that the decision to emigrate and, ultimately, the decision to send money back home are often related to the variables of interest (for instance, fertility or health of families left behind). Another challenge researchers encounter is the difficulty in separating the effects of emigration (such as having an absent parent, sibling, or child) and the effects of money flows on the outcomes of the household in the country of origin. Evidence shows that when remittances increase household earnings, the impact on fertility can go in either direction.

Moreover, data and methodologies used differ across studies. Consequently, the results on the effects of remittances on fertility rates can vary from one study to another and often contradict each other. The existence of social channels and the transfer of norms adds significant geographical implications for studies on remittances and fertility. This means that, depending on the host country and the norms they encounter there, migrants and their remittances can exert varying influences on fertility rates back home.

Summary and policy advice

Remittance inflows are massive and still growing, stable in the face of economic crisis, and directly delivered to household members in the emigrant’s home country. In order to better take advantage of these large money flows, it is important to understand their effects on the receiving households and, ultimately, at the community and country (aggregate) level. Of particular importance is the impact of remittances on fertility rates. Decisions on family size are household-based, but have vast implications at the community level and for a country as a whole. Remittance inflows can increase the number of children a family decides to have. Remittances do this by providing the money required to support a larger family in cases where children are viewed as a form of investment for future financial support (replacing weak or non-existing social security benefits, and providing a source of informal credit), offering an income boost, allowing for the creation of the small, family-run enterprises that dictate the need for larger families to secure future help and, finally, by providing an opportunity to overcome problems inherent in homes that are too small for more children or in need of repair.

On the other hand, remittance inflows can decrease fertility rates if they are spent on human capital development, such as health (nutrition, and health services, as in family planning) and education (both quantity and quality). Remittance inflows also mitigate against poverty and offer women labor market opportunities that ultimately increase the cost of having more children in terms of the incomes forgone. And when households include remittances in their financial planning, which requires more household members to emigrate, this causes a brain drain. Further, money transfers also carry with them low/high fertility norms (depending on the emigrant’s host country) and habits that can pull fertility rates in opposing directions.

The relationship between remittances and fertility should be of utmost importance to policymakers. Emigration and remittance behavior are linked to the decisions made by emigrants’ families back home. A decline (increase) in remittances will no doubt create new incentives for emigrants and perhaps shape migration patterns for the next century.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© George Naufal

Normal goods and inferior goods

A normal good is one for which consumer demand increases when income increases. Examples include buying a new car instead of a used one, ordering a steak instead of a hamburger at a restaurant, or deciding to increase family size. The reverse is true when incomes fall.

An inferior good is one for which consumer demand decreases when income increases. Examples include buying fewer potatoes and more quinoa or having fewer children so the parent (usually the mother) can maintain the higher paying job.

Source: InvestingAnswers. Online at: http://www.investinganswers.com/financial-dictionary/economics/inferior-good-1882 [Accessed October 5, 2015].

Current account reversals

Source: Adalet, M., and B. Eichengreen. Current Account Reversals: Always a Problem? NBER Working Paper No. 11643, 2013. Online at: http://www.nber.org/papers/w11634.pdf [Accessed October 1, 2015].