Elevator pitch

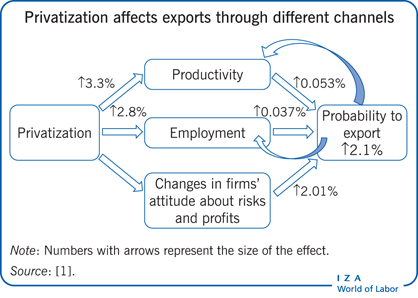

The privatization of state-owned enterprises (SOE) in transition economies has often been found to improve employment and productivity of privatized SOEs, despite policymakers’ fears regarding possible job cuts. This positive effect can be enhanced if privatization also promotes firms’ exports. A recent firm-level analysis of China reveals that privatization has indeed a positive effect on export propensity, employment, and productivity in both the short and long term. The effect mostly stems from changes in firms’ attitudes about profits and risks due to competitive pressure.

Key findings

Pros

The privatization of SOEs in transition economies increases employment and productivity.

The probability that firms export increases due to privatization, primarily because their attitudes about risks and profits change.

Privatization may lead to a virtuous cycle among productivity, exports, and employment.

Restrictions on marginal ownership and institutional reforms help maximize the benefits of privatization.

Cons

The estimated effect of privatization on export propensity is based primarily on small- and medium-sized SOEs.

There is hardly any empirical evidence on the effects of privatization for large SOEs.

Because the estimated effect of privatization is drawn mostly from China and the former Soviet Union, it is not clear whether the results can be applied to privatization in less developed countries.

Author's main message

Governments in transition and emerging economies should not fear the potential negative effects of privatization on employment; instead, they should recognize its positive impacts on employment and productivity. Moreover, privatization promotes exports, which in turn generates a virtuous cycle between employment, productivity, and exports. To maximize its benefits, privatization should be associated with restrictions on how involved managers can be in the ownership of privatized firms and institutional reforms should be implemented that promote trade openness, financial freedom, and anti-corruption.

Motivation

Since the 1990s, a large number of state-owned enterprises (SOEs) in transition economies have been privatized. Although some policymakers fear that privatized firms cut jobs when they face competitive pressure from the market economy, privatization has been found to improve both productivity and employment in many transition economies [2], [3]. This evidence implies that competitive pressure improves privatized firms’ productivity, which, in turn, leads to the expansion of production and employment.

This argument favoring the positive effects of privatization on employment is strengthened if privatized firms can penetrate foreign markets and expand production further through exports. Moreover, because firms can learn new knowledge from foreign markets by exporting, exporters are likely to achieve sustainable productivity growth, which generates more jobs.

However, there are theoretically several channels of the effects of privatization on firms’ decisions to export, some of which are positive while others are negative. Therefore, whether privatization encourages exports and thereby increases its effect on employment is an empirical question.

This article focuses on the case of China to examine the effect of privatization, while also touching on evidence from the former Soviet Union. This is primarily because China is one of the world’s largest transition economies and still has a large number of SOEs. This examination could provide important policy implications with respect to China's further privatization. However, it should be noted that the results from China might not be applicable to other countries, for example, less developed countries with a substantial number of SOEs.

Discussion of pros and cons

The effects of privatization on exporting decisions

The privatization of SOEs can affect their propensities to export for the following reasons. First, because SOE managers have distorted incentives (e.g. managers may be incentivized to maximize profits for themselves, rather than for their firms) and are less exposed to competitive pressure, privatized firms may be able to more quickly adopt strategies to compete in global markets [1], [4]. Second, privatized firms that become more productive and larger as a result of competitive pressure are more likely to serve foreign markets; this is the case because productive privatized firms can afford the initial costs of marketing and production adaptation needed to enter foreign markets. This concept is supported by new trade theory with heterogeneous firms [5] and corresponding empirical evidence [6]. Third, and as the primary negative influence, the privatization of SOEs may tighten their credit constraints, as state ownership is frequently associated with soft budget constraints (i.e. SOEs can easily receive credit from the government) [1], [7]. As such, when privatized SOEs do not receive sufficient credit because of tightened credit constraints, they are less likely to initiate exports because they cannot finance the initial export costs [8]. Note that the first reason mentioned represents a direct channel between privatization and exports, while the second and third represent indirect channels, through productivity, size, and financial constraints.

Effects of privatization: Evidence from China

In China, SOEs have gradually been privatized since the early 1990s, due to the central government’s concern about its considerable debt. Privatization was accelerated in 1995, when the government endorsed the policy of “grasp the large, let go of the small” [9]. Under this policy, a large number of small- and medium-sized SOEs were privatized, whereas large SOEs—such as the China FAW Group in the automobile industry and the China Sinopec Group in the petrochemical industry—remained state-owned. Accordingly, the share of SOEs responsible for urban employment dropped drastically from 78% in 1978 and 61% in 1990 to only 17% in 2013 (Figure 1). Research has shown that such privatization improved productivity, as measured in total factor productivity (TFP) or labor productivity. For example, the average TFP of privatized SOEs relative to that of private firms increased from 60% to 77% after privatization [9].

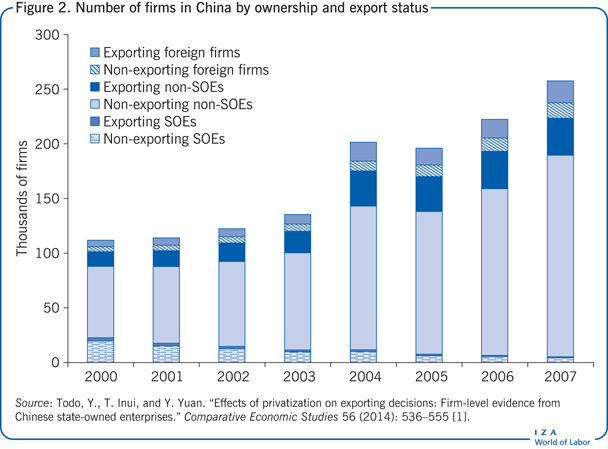

A recent study investigates the effect of privatization on export propensity in China [1]. The analysis uses a rich firm-level data set for the manufacturing sector in the 2000–2007 period. This dataset is quite large and covers 100,000–250,000 firms each year, including all SOEs and private firms with annual sales of five million yuan (approximately US$750,000) or more. Figure 2 shows rapid growth in the number of firms in China during that period. It clearly illustrates that the number of SOEs decreased because of privatization, while the number of private domestically owned exporters (indicated by solid blue bars) increased substantially.

To examine whether the decrease in the number of SOEs did in fact cause the increase in the number of exporters, a special estimation method (propensity score matching estimation) is employed to compare the probability of exporting for privatized firms with that for SOEs with similar characteristics. The difference between the two groups should indicate a sound estimate of the effect of privatization on export propensity.

The result of this analysis shows that privatization indeed increases the probability of exporting in the year of privatization by 2.1 percentage points [1]. The average probability that a current non-exporting SOE becomes an exporter in the next year is only 2.4%. Therefore, the result indicates that 4.5% (2.1 + 2.4) of non-exporting privatized firms start exporting in the year after privatization. In other words, privatization of previously non-exporting SOEs roughly doubles their probability of exporting. Thus, although an increase of 2.1 percentage points in the probability of exporting may appear small at first glance, the privatization effect on export propensity is in fact quite large when compared with the low average probability of starting to export.

Decomposing the effects of privatization of Chinese SOEs on exports

What are the channels of this effect on exporting decisions? As mentioned, candidates include changes in incentives, productivity and firm size, and credit constraints. Although obtaining good measures of firms’ incentives to grow and the degree of competitive pressure from the market is difficult, it is possible to measure other channels. For example, the productivity level can be measured by labor productivity (value added per worker) or TFP, whereas firm size can be measured by the number of employees or sales. The degree of credit constraints can be evaluated based on the ratio of long-term liability to total assets, which measures how much credit firms can receive given their assets.

Using these measures, privatization has been found to increase TFP by 3.3% and employment by 2.8% in the year of privatization, but it has not been shown to affect the ratio of long-term liability (not due within one year) to assets [1]. Therefore, privatization should indirectly increase export propensity through improved productivity and firm size, while it may not discourage export propensity because it does not appear to result in tightening credit constraints for privatized firms.

To further quantify each channel’s importance, an analysis on the determinants of export decisions has been conducted in [1]. When productivity and employment increase by 1%, the probability of exporting has been found to increase by 0.016 and 0.013 percentage points, respectively. Thus, privatization that increases productivity by 3.3% raises the probability of exporting by 0.053 (3.3 × 0.016) percentage points. Similarly, privatization raises the probability of exporting by 0.037 percentage points through an employment increase of 2.8%. As such, the effects of privatization on exporting decisions through the channels of improved productivity and increased size are quite small, the sum of which is only 0.090 percentage points out of the total increase due to privatization of 2.1 percentage points.

The decomposition analysis summarized in Figure 3 indicates that privatized firms are more likely to engage in exporting than SOEs mainly because of factors other than productivity, firm size, or credit constraints. These other factors most likely include changes in firms’ attitudes about profits and risks due to changes in the incentives that they encounter. Privatized firms are no longer protected by the government and are exposed to competitive markets; as such, they must expand their business to survive. One way to expand is to export to foreign markets. Moreover, privatized firms may be more willing to take risks than SOEs, which may lead to increased exporting, as discussed in the following example [1].

A recent paper using firm-level data for Japanese small- and medium-sized enterprises finds that risk-loving firms are more likely to export and that the effect of risk preferences on exporting decisions is far greater than the effects of productivity and firm size [10]. This evidence from Japan emphasizes that psychological factors might play an important role in determining export decisions, which is consistent with the evidence from China, as the latter also highlights changes in non-productivity or non-size factors, possibly including firms’ incentives and attitudes as important channels of the positive effects of privatization on export propensity.

Long-term effects of privatization

Although the above analysis finds that privatization promotes exports in the year after privatization occurs, whether the effect persists in the long term remains unclear. Some exporters may stop exporting within a few years after starting, while others might expand and continue to export. In China, 30% of new exporters in 2001 stopped exporting the next year, and more than half of them stopped exporting within the next four years [1]. Therefore, there is uncertainty about the duration of the effect of privatization on exporting decisions. Privatized firms may overestimate their competitiveness in foreign markets, attempting to expand too aggressively and thus may not be able to survive in the foreign market.

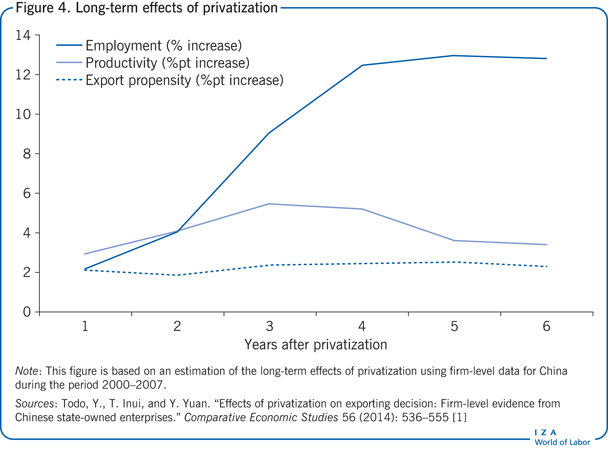

However, this last point has not proven to be the case in practice. The analysis of longer-term effects finds that the positive effects of privatization do not diminish significantly for three years (Figure 4) [1]. Accordingly, the point estimate of the privatization effect on export propensity is stable over time, at approximately 2 percentage points. Moreover, the effect of privatization on productivity and employment found in [1] increases over time; privatization increases productivity and employment one year after privatization by 2.2% and 2.9%, and six years after that by 12.8% and 3.4%, respectively. However, the increased productivity and firm size still lead to only a small effect on exporting decisions. Using the figures in Figure 3, the increase in productivity and firm size six years after privatization results in a 0.25 percentage point increase in the probability of exporting, whereas privatization leads to a total increase of 1.7 percentage points. Therefore, even in the long term, effects of privatization on exporting decisions are mostly due to other factors, such as changes in incentives, rather than productivity and firm size.

These findings imply that privatization likely generates a virtuous cycle among productivity, exports, and employment. Competitive pressure from the market associated with privatization seems to improve productivity and export propensity. When privatized firms expand their export activities they tend to acquire new foreign knowledge (“learning by exporting”), thus further improving their productivity. In turn, firms can remain competitive in export markets because of their increased productivity. As a result of increased productivity and export propensity, sustainable employment growth (the virtuous cycle) can be achieved.

Governance structure after privatization

Although the above evidence from China and Japan shows that privatization may encourage export propensity, improved managerial strategies and institutional quality should also be incorporated to maximize the benefits from privatization. For example, the extent of managerial ownership and control after privatization can vary. In some firms, top managers own most of their stocks, and few outsiders, including foreign investors, are on the board of directors; the opposite is true in other firms.

Managerial ownership can have two opposing effects on export propensity. On the one hand, it gives managers an incentive to increase profits, thus raising export propensity, in particular when profits are distributed to owners depending on their ownership share. On the other hand, managers with considerable ownership and control may not choose to pursue market-oriented strategies, including expansion to foreign markets, but may instead employ a strategy of enhancing their political power through conglomerate building. This is particularly prevalent when managers are able to utilize political power to monopolize firms’ profits.

Data from listed firms in China, which include current SOEs and privatized firms, show an inverted “U”-shaped relationship between managerial ownership and export propensity [11]. That is, export propensity increases with the extent of managerial ownership when the extent is small and decreases when it is large. By contrast, firm-level data from former Soviet Union countries indicate that the relationship between export propensity and managerial ownership is always negative [12]. In both cases, export propensity is low when top managers on the board of directors account for much of the firm’s capital ownership. Therefore, the empirical evidence suggests that, although privatization of an SOE generally promotes its exports, the effect is smaller if its stocks are provided to the SOE’s current managers in an uncompetitive manner upon privatization. To maximize the effects of privatization, the stocks of privatized SOEs should hence be sold in a competitive stock market.

Limitations and gaps

The results from the analysis on the effect of privatization on export probability in China [1] should be interpreted with care due to the following limitations. First, the analysis focuses on manufacturing firms only. In other words, it is unclear whether the evidence can be applied to SOEs in the non-manufacturing sector, particularly the service sector; this is a significant question, as the volume of service trade amounted to 13% of world GDP in 2013 [13].

Second, and even more importantly, the analysis estimates the “average effect of the treatment on the treated”—that is, the effect of privatization on firms that were already privatized. Because privatized SOEs in China, in particular, are intentionally selected by policymakers and are more likely to be small- or medium-sized firms, the estimated effect reflects the effect on smaller SOEs more so than on larger SOEs. This does not necessarily mean that the observed effect is not applicable to the privatization of large SOEs, but further evidence focusing on large SOEs is needed to confirm (or refute) it.

In transition and emerging economies, many large firms are state-owned. Among the world’s 2,000 largest companies listed in the Forbes Global 2000 in 2011, 260 are in the BRIICS countries (Brazil, Russia, India, Indonesia, China, and South Africa). Of these 260 firms, 123 (47%) are SOEs, most of which are in the mining, energy, telecommunication, and financial sector, not in the manufacturing sector. Therefore, the effects of privatization on large SOEs (including those that are not part of the manufacturing sector) should be further investigated.

Third, the period covered in [1] is from 2000 to 2007, when China experienced an export boom and raised its ratio of exports to GDP from 21% to 34%. The results from the export boom period may not be applicable to non-boom periods because it may be difficult even for privatized firms to start exporting in periods of export stagnation.

The final issue to consider includes the geographical and economical generalizability of the relevant results. Most of the research to date has dealt with SOEs in China or the former Soviet Union countries. As such, it is not clear if those results will be applicable for other settings, particularly for less developed countries that still have substantial numbers of SOEs.

Summary and policy advice

The privatization of SOEs in transition economies is found to improve employment and productivity [2], [3]. This positive effect can be enhanced if privatization promotes firms’ exports because the expansion of exports also increases production and employment. Moreover, productivity improvement through learning by exporting can generate a virtuous cycle among sustainable exports and employment growth. A firm-level analysis for China reveals that privatization has a positive effect on export propensity, employment, and productivity, both in the short and long term [1]. Further decomposition analysis implies that the positive effect of privatization on export propensity may stem more from changes in firms’ attitudes about profits and risks as a result of competitive pressure from the market economy than from changes in productivity and firm size.

Thus, policymakers in transition governments and emerging economies should not be afraid of the potential negative effects of privatization on employment, specifically the fear that privatization will lead to job losses because firms will not be able to cope with competitive pressure after losing their SOE status. Instead, the existing evidence clearly indicates that policymakers should recognize privatization’s positive effects on employment and productivity that arise due to increased penetration of global markets. Furthermore, to maximize the benefits from privatization, restrictions on the managerial ownership of privatized firms and institutional reforms for corporate governance are needed. For example, firms’ profits should be distributed to owners according to their degree of ownership, rather than the strength of their political power, so that owners are incentivized to maximize firm profits.

Although the privatization of SOEs has progressed substantially since the 1990s, many SOEs still exist in transition and emerging economies. In China, privatization has recently slowed, although further SOE reforms were officially emphasized in the Third Plenum reform blueprint in 2013. So, how can transition and emerging countries achieve further SOE reforms? Although the privatization of SOEs is primarily a domestic issue, it can be promoted in an international framework, utilizing extended multilateral free trade agreements that require member countries to treat private firms and SOEs equally.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions for earlier drafts. The author draws heavily on his previous work for this paper, especially [1], which was conducted as part of a project on “Firm-Level Productivity in East Asia” undertaken at the Research Institute of Economy, Trade and Industry. Financial support from JSPS Kakenhi Grant (No. 25101003 and 26245037) and Waseda University is gratefully acknowledged.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Yasuyuki Todo