Elevator pitch

In reforming unemployment benefit systems, the policy debate should be on the appropriate level of benefits, the subsidies needed for people who cannot contribute enough, and how to finance the subsidies, rather than on whether unemployment insurance or individual unemployment savings accounts are better. Unemployment insurance finances subsidies through implicit taxes on savings, while individual savings accounts with solidarity funds finance subsidies through payroll taxes. Taxes on certain consumption goods and real estate could be considered as well and could be less distortionary.

Key findings

Pros

Unemployment benefits can help individuals find better jobs than when there is no insurance.

Unemployment benefits can support aggregate demand in times of crisis.

Unemployment insurance can lead to more income redistribution and better protection of workers.

Individual savings accounts can improve incentives to search for jobs because savings that are not used to finance unemployment benefits can be used to finance investments or higher pensions.

Cons

Unemployment insurance can reduce incentives to search for jobs, thus increasing both the length of unemployment spells and the rate of unemployment.

Individual savings accounts might not provide sufficient protection to workers, particularly those with low levels of human capital who face a higher probability of unemployment.

Individual unemployment savings accounts reduce incentives to keep jobs when the mandate to save is too high or the interest rate on savings is not competitive.

Contribution rates to finance meaningful benefits can be high in individual savings accounts.

Author's main message

Neither unemployment insurance nor individual savings accounts are inherently more efficient. The policy choices that matter are: the level of benefits, which reflects social choice and varies with the level of development; the subsidies needed to protect people unable to contribute enough on their own; and the taxes used to finance these subsidies. Taxes on savings or on wages are just two options. Combining them with others, such as consumption taxes, is likely to strike a better balance between worker protection and incentives to work.

Motivation

To increase flexibility for employers and better protect workers against the risk of unemployment, some developing countries have been considering establishing or reforming unemployment benefit systems, largely based on severance pay. Policy discussions often revolve around whether to adopt an unemployment insurance scheme or individual unemployment savings accounts.

Unemployment insurance schemes are risk-pooling arrangements financed on a pay-as-you-go basis. Essentially, workers and employers contribute to a fund that then pays benefits to those who become unemployed. Contributions do not adjust for individual risk profiles. This arrangement therefore involves considerable implicit and systematic income redistribution: some individuals contribute more than they take out (taxing their contributions or “savings”), while others contribute less (receiving a subsidy). At the other extreme are individual unemployment savings accounts through which workers self-insure based on their contributions and those of their employer. Contributions are directly linked to benefits, with no transfers between plan members. The system is fully funded (assets equal liabilities) at all times. An element of solidarity can be introduced to increase or prolong the benefits of vulnerable workers through payroll taxes, general revenues, or a combination of both.

The relevant policy choice, however, is not between unemployment insurance and individual savings accounts. The two systems are simply particular cases of a more general design. The real trade-off for policymakers is between better work incentives and better protection, and the key policy choices concern the appropriate level of benefits, subsidies for people who cannot contribute enough, how to finance the subsidies, and the administrative arrangements needed to minimize fraud and abuse.

Discussion of pros and cons

Differences between unemployment insurance and individual savings accounts

Proponents of unemployment insurance emphasize its risk-pooling and solidarity components. Critics highlight potential negative labor market effects—particularly in countries with large informal sectors—as individuals would have fewer incentives to seek or take jobs, or would prefer to work informally. Individual savings accounts are likely to generate better work incentives but are less likely to provide sufficient benefits to workers who go through long unemployment spells. They also require high contribution rates to pay meaningful benefits.

A common misconception is that the main difference between the two arrangements is that individual savings accounts, as the name implies, are based on individual accounts, while unemployment insurance relies solely on a common pool. In practice, unemployment insurance systems, like any well-run social insurance program, also require keeping track of individual accounts that register the contributions of employers and employees, as well as any benefits paid.

The real difference between the two systems is that benefits are delinked from the value of individual contributions in unemployment insurance, while in individual savings accounts total benefits cannot exceed the account balance. Consequently, “pure” individual savings accounts cannot run a negative balance, while accounts in traditional unemployment insurance often do. The unemployment insurance system functions because accounts with a surplus (those of workers who pay more than their expected cost of unemployment) finance accounts with a deficit. In other words, unemployment insurance works because the accounts with a positive balance are taxed at a 100% rate. This tax can reduce incentives to take formal jobs. In addition, the system subsidizes those who are unable to contribute enough to finance their own benefits. These subsidies can reduce incentives to find jobs. The tax and subsidy are zero in the case of individual savings accounts, which is why the system generates better incentives.

In principle, taking the level of benefits as given, an unemployment insurance system can be transformed into individual savings accounts by replacing the tax on savings with a tax on wages (Chile, for instance, finances redistribution with a tax on wages as well as through general revenues). Individuals with positive account balances can withdraw the savings when they retire or when the savings reach a predetermined level. Those with negative balances receive subsidies financed by a tax on wages. This financing mechanism is likely to generate positive job-search incentives, particularly for workers with the potential to generate substantial savings.

At the same time, however, the higher tax on wages for all workers, particularly the less well educated, could increase the tax wedge (the difference between the total cost of labor and take-home pay) and reduce incentives to take formal sector jobs or to create jobs. The policy is also likely to be regressive, benefiting workers with higher levels of human capital and low unemployment rates. For other workers, the tax would reduce the subsidies they receive relative to unemployment insurance. But there are alternatives to the tax on wages, such as consumption or property taxes.

Effects on protection of workers and labor market outcomes

The evidence on the merits and disadvantages of unemployment insurance and individual savings accounts is mixed for developing countries. Unemployment insurance and individual savings accounts are usually compared on the level of protection they offer workers and how they affect incentives to find and keep jobs—their impact on labor market outcomes. Pure individual savings accounts provide less protection to workers, particularly low-skilled workers—who tend to contribute less, can have more frequent periods of unemployment, and therefore might not accumulate adequate savings. Because benefits are often paid as a lump sum, there is a risk that workers will overconsume and run out of savings before finding a job. In addition, since benefits are financed only out of savings, contribution rates are usually high (see also How do unemployment insurance savings accounts work?).

There is less agreement on the effects of each system on labor markets, particularly in countries with large informal sectors. Most evidence comes from high-income countries and is mixed. Studies show that unemployment spells and the unemployment rate tend to increase with the level and duration of benefits [2], [3]. Unemployment benefits can boost the welfare of individual workers, particularly where insurance markets are inefficient and risk aversion is high [4]. But the income effect can be considerable for liquidity-constrained households and can reduce incentives for job search.

At the same time, more generous benefits can give workers more flexibility to search for jobs and lead to better job matches. Recent analyses for European countries confirm this argument [5]. Thus, two effects are at play: lower incentives to take jobs, which can reduce employment levels and output, and the possibility of better job matches, which can increase overall economic productivity. The net welfare effect is difficult to quantify.

The evidence for developing countries is more limited. Some early studies for Brazil showed little effect of unemployment benefits on unemployment rates. If anything, benefits increased the share of self-employment over wage employment. More recent analyses using job-search models for Malaysia also suggested that the main effect of unemployment insurance was to reduce the share of formal employment.

But there is also evidence from Argentina showing that, as many people expect, the duration of the unemployment spell increases with the level and duration of the unemployment benefit, with duration of benefits having the greater impact. At the same time, there is little evidence that unemployment benefits help workers find better jobs—for instance, jobs that pay higher wages. If anything, only the level of the benefit, but not its duration, seems to have some effect on wages. The implication would be that it is better to offer “more” during a short period of time than a little over a long period.

Less is known about the effects of individual unemployment savings accounts on labor markets. The main advantage over unemployment insurance is that workers have stronger incentives to seek and take jobs because benefits are financed out of individual savings [6]. This seems to be the case, for instance, in Chile. Because balances in individual accounts can increase the value of pensions at retirement and, under some conditions, finance investments in education or home purchases, workers are less likely to exhaust their savings if there are work alternatives.

But, if poorly designed, individual savings accounts also have the potential to increase turnover beyond efficient levels. High mandates to save can create incentives for workers to leave their jobs and get back some of the savings, and below-market interest rates on savings can have the same effect, particularly when access to credit is constrained and individuals cannot “dis-save.” For example, in Brazil turnover seems to have increased considerably as a result of the system of individual savings accounts [2].

Key policy parameters

The main recommendation, then, is to view unemployment insurance and individual savings accounts as two extremes of a more general design, where the key policy choices concern:

the level of benefits;

the subsidies required to finance benefits for individuals without enough savings capacity;

the taxes needed to finance these subsidies; and

the administrative arrangements needed to minimize fraud and abuse.

Defining benefits

The mandate of an unemployment benefits system has four key parameters: the replacement rate, the duration of benefits, the minimum benefit, and the ceiling on covered earnings. There are no formulas or universal standards to set the value of these parameters; choices often reflect social preferences. There are, nonetheless, general principles that can ensure that the mandate is adequate and affordable.

Replacement rate and duration

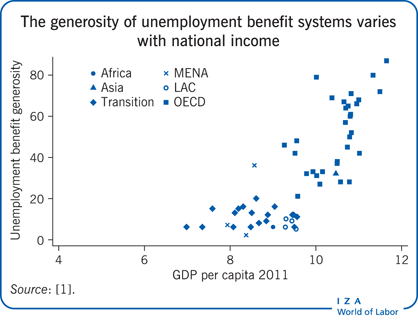

The challenge is to strike the right balance between adequately protecting workers and holding down cost—both the direct effects on labor supply and the tax burden. Benefits vary widely and tend to increase with income per capita. In general, developing countries might want to start with modest system mandates, understanding that contributory unemployment benefits are not the correct mechanism to provide income protection to the long-term unemployed or those facing structural barriers to employment.

Minimum unemployment benefit

When incomes are very low, even a high replacement rate will not be enough to maintain a basic level of consumption. Therefore, countries frequently define a minimum unemployment benefit. In Brazil, for instance, the minimum benefit is equal to the minimum wage. In China, the minimum benefit varies by region and falls between the minimum wage and the minimum living allowance.

An important policy choice is how to anchor the minimum unemployment benefit. In theory, the minimum benefit would need to be below the minimum wage so that low-skilled workers have stronger incentives to find jobs. In practice, the minimum wage is often subject to political influence and set “too high.” An alternative is to use economy-wide average earnings as a reference and target a minimum benefit that is around 30% to 40% of this target—also a reference for the level of the minimum wage in the literature. Another anchor could be the poverty line.

Ceiling on covered earnings

Countries set ceilings on covered earnings to limit the mandate of the unemployment benefit system for high-income individuals. The assumption is that they have other sources of earnings (savings and insurance) to manage unemployment and other risks, and that any redistribution within the system should focus on low-income workers. One possibility is to cap covered earnings at 2.5–3 times average earnings (across countries, a very small share of workers have earnings that are more than three times the average).

Financing the system

Financing an unemployment benefit system has two components: an individual contribution or savings rate, part of which can be paid by the employer; and taxes to finance the redistributive component (to pay for accounts with negative balances). Several tax options can be considered:

a tax on savings;

a payroll tax (paid by the employer);

a tax on wages earned (paid by the worker and not linked to any benefit); and

general revenues mobilized by other taxes.

Taxes on savings, consumption, or labor

Allowing individuals to withdraw at least part of the contributions that accumulate in their accounts after a minimum level of savings is attained or to add them to their pension after retirement can improve incentives to contribute and work. A pre-condition, of course, would be to ensure that savings are remunerated at a competitive rate.

In classic unemployment insurance schemes, the tax on savings could be reduced by announcing to workers that part of any unused unemployment benefits would accumulate in their accounts. Reducing the tax on savings implies introducing other forms of taxation. One alternative would be to ask workers to pay a percentage of their wages into a common pool, reducing their take-home pay. This system would implicitly reduce current consumption to increase future savings.

There are potential problems with this strategy, however:

First, many workers might not want to substitute consumption for savings.

Second, and more important, while the tax on wages would be paid by all workers, long-term savings would be accrued mainly by workers with more stable jobs and longer contribution densities.

Finally, the tax on wages could reduce incentives to take formal-sector jobs and, at the margin, could reduce labor supply.

Another alternative would be to finance redistribution out of payroll taxes or general revenue. For labor market outcomes, general revenues are a better option, particularly if enough revenue can be mobilized without increasing other taxes. In essence, after setting the tax on savings, any deficits of the unemployment benefit system would be covered through general revenues. This implies budget reallocations among programs and spending categories, which could have general equilibrium economic and welfare effects. Assessing those effects requires knowing who would win and who would lose from the reallocations. To the extent that budgets include inefficient or regressive expenditures, there can be room to finance unemployment benefits.

If, at the extreme, no budget reallocation is possible, alternatives to the payroll tax would be a consumption tax or taxes on real estate. The empirical evidence on the efficiency of these taxes is limited. Studies suggest that, at least in economies with large informal sectors, a consumption tax is more efficient than a payroll tax [7]. The idea is that at any level of the payroll tax, a consumption tax can be set that delivers the same levels of real wages, economic activity, and share of formal- and informal-sector jobs but that generates more revenues at a lower tax burden. The regressive effects of a consumption tax can be avoided by taxing goods that are more likely to be consumed by wealthier households.

Enforcement arrangements

From an administrative point of view, a difficulty for developing countries is to ensure that people receiving unemployment benefits are really unemployed and not working in the informal sector. Limited institutional capacity makes it unlikely that this type of control can be put in place. A solution is to link unemployment payments to participation in active labor market programs rather than to employment status. For example, benefit recipients can be required to participate in training or job-search activities for a set number of hours a week. These services can be outsourced to private providers who are paid based on performance. New personal identification technologies can be used to monitor participation in these activities.

Limitations and gaps

While the evidence points to some general effects of unemployment insurance and individual savings accounts on labor markets, there are still too few studies for developing countries to support any definitive conclusions. The large size of the informal sector in developing countries is one complicating factor, and incentives to work can change if workers can take jobs that they do not declare while continuing to receive unemployment benefits. The unemployment rate might not increase, but the demands on the unemployment insurance system can become unsustainable as both the risk of unemployment and its duration increase.

Incentive effects also differ with the nature of the informal job. Self-employment and small-scale entrepreneurship, rather than wage employment, make up an important share of informal jobs in developing countries. Any form of unemployment benefit, but particularly individual savings accounts, that pays a lump sum can provide seed capital for transitioning into self-employment. Both unemployment insurance and individual savings accounts could contribute to creating jobs rather than reducing incentives to search for jobs. Thus, the net effects of unemployment insurance and individual savings accounts on labor markets are still unclear in countries where informal employment is extensive.

Another important limitation of the current research is that it presents unemployment insurance and individual savings accounts as two distinct systems, thus narrowing the range of policy choices. The real difference between the two systems is not individual accounts; rather, it is that unemployment insurance delinks benefits from the value of individual contributions and that in individual savings accounts total benefits cannot exceed the balance in the account. In unemployment insurance schemes accounts with surplus are taxed to finance accounts with deficits. In savings schemes there are no taxes on savings. But, as discussed above, taxes on savings are not the only mechanism to finance redistribution within the unemployment benefit system.

Summary and policy advice

The main recommendation is not to see unemployment insurance and individual savings accounts as two very different systems, but rather to see them as two extremes of a more general design for unemployment benefits involving three fundamental sets of policy choices:

The level of benefits and of redistribution needed to provide unemployment benefits to all workers. The challenge is to strike a balance between protecting workers and avoiding too costly a system, both in its direct effect on labor supply and its tax burden. A minimum unemployment benefit may be needed for income levels so low that even a high replacement rate cannot maintain a basic level of consumption. The minimum benefits could be anchored to the minimum wage, national average earnings, or the poverty line.

The set of taxes needed to finance this redistribution. The tax on savings implicit in classic unemployment insurance schemes could be reduced by allowing workers to keep part of the benefits they do not use. Reducing this tax implies introducing other taxes, such as having workers pay into a common pool, or financing redistribution out of payroll taxes or general revenue. If reallocation of public expenditures is not possible, alternatives to the payroll tax would be consumption taxes or property taxes, although the empirical evidence on their efficiency is limited.

The administrative arrangements needed to minimize fraud and abuse. Ensuring that people receiving unemployment benefits are not working in the informal sector at the same time is beyond the administrative and enforcement capacity of most developing countries. Instead of tying benefit payments to employment status, countries could require workers to participate in active labor market programs, such as training and job-search activities.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© David A. Robalino

Unemployment insurance and individual savings accounts worldwide

Individual unemployment savings accounts, a more recent type of defined-contribution system, can be funded or be pay-as-you-go (Robalino et al., 2009). Most countries with funded individual savings accounts are in Latin America. Austria and Jordan are among the few countries outside Latin America that have individual savings accounts.

The key policy parameter when designing individual savings accounts is the contribution rate. In general, contribution rates are higher than for unemployment insurance schemes because of the need to generate meaningful benefits with individual savings. With a 3% real interest rate, for instance, workers would need to save 8% of their salaries for one year (the value of the contribution rates in most Latin American countries) to finance one month of benefits. Countries with lower contribution rates, such as Jordan (1%) and Chile (1.5%), also finance benefits from additional sources—pension funds in Jordan and a solidarity fund in Chile.Robalino, D. A., M. Vodopivec, and A. Bodor. Savings for Unemployment in Good or Bad Times: Options for Developing Countries. IZA Discussion Paper No. 4516, October 2009.

How do unemployment insurance savings accounts work?

Selected countries: Brazil, Chile, Colombia, Ecuador, Panama, Peru, Uruguay, and Venezuela.

Employers deposit a specified fraction of each worker’s earnings in a special individual savings account on a regular basis. In Chile workers are also required to make regular contributions to their accounts. Upon separation—and in most countries, regardless of the reason for separation—workers can make withdrawals from their savings accounts as they deem fit (some programs allow access before separation for health, education, and housing). In Brazil workers can access their accounts only in the case of involuntary separation, and employers are required to make an additional payment of 40% of the account balance to the individual. In all of the selected countries, positive account balances are added to old-age pensions at retirement.Several types of unemployment insurance savings accounts (UISA) programs can be distinguished:Pure UISA program, in which withdrawals are strictly limited by the balance of the UISA, that is, the balance on an individual’s UISA must always be positive. This program is identical to a prefunded severance pay program.

UISA-cum-borrowing, in which within predetermined limits, individuals can borrow money beyond their UISA balances.

UISA-cum-solidarity fund, in which upon depletion of their own accounts, individuals may receive payments from the solidarity fund.

The last two programs combine self-insurance with public insurance. The self-insurance mechanism via mandatory savings is complemented by other mechanisms to improve the adequacy of protection. The second program (UISA-cum-borrowing) does so by allowing workers, at least temporarily, to run into the red in their UISAs. Under certain circumstances (for example, upon retirement), the repayment of such borrowing can be subsidized, that is, this mechanism also allows for redistribution across plan members. In the case of the third program (USIA-cum-solidarity fund), self-insurance is augmented with an explicit redistributive component.Source: Text from Robalino, D., M. Vodopivec, and A. Bodor. Savings for Unemployment in Good or Bad Times: Options for Developing Countries. IZA Discussion Paper No. 4516, October 2009; pp. 4–5.