Elevator pitch

Globally, the share of income going to labor (the “labor income share”) is declining. However, this aggregate decline hides more than it reveals. While the labor income share has decreased for low-skilled workers, this has been concurrent with an increase for high-skilled workers. Globalization leading to a growing skill premium and an increasing complementarity between capital and skill through the advancement of technology explains the polarization of labor income shares across the skill spectrum.

Key findings

Pros

A decline in the labor income share suggests growing disparity in personal incomes.

An increasing capital–labor ratio lowers the labor income share when capital and labor are substitutes.

The labor income share for high-skilled workers has increased over the past few decades.

Globalization can improve the labor income share.

Cons

The unequal distribution of personal income from non-labor sources could undermine the relationship between labor income shares and personal income.

Most studies show capital and labor as complements, which suggests an increase in the labor income share with increasing capital–labor ratio.

The labor income share for low-skilled workers has declined over the past few decades.

Shifts in income shares between industries and increased product market concentration caused by globalization can decrease the labor income share.

Author's main message

A large body of recent research has documented a global decline in the labor income share. Growing concern over this trend in general, coupled with the fact that a disproportionate share of this decline is found among low-skilled workers, has encouraged debate about fair distribution of personal incomes. The widening gap in the labor income share by skills suggests that globalization and technological progress may be driving forces. Policies aimed at skill enhancement and job creation for low-skilled workers could minimize welfare loss stemming from the declining share of labor income.

Motivation

The functional distribution of income has long been a topic of concern for economists. Until recently, the share of national income going to labor (the “labor income share”) has been seen to be constant. This constancy has been described as “the most surprising, yet best-established fact” [1], or “the stylized fact” [2] of long-term economic growth. However, in recent years, a large body of research has documented a global decline in the labor income share. Growing concern over this decline has sparked an ongoing dialogue about fair distribution of personal incomes. While it is true that the labor income share has decreased for low-skilled workers, this has coincided with an increased share for high-skilled workers. The literature offers several explanations but there is little consensus on the drivers of the decline in the labor income share. This article critically evaluates the role of capital accumulation and globalization as potential drivers of this phenomenon. It also highlights issues related to measurement of the labor income share and discusses some policy frameworks to benefit low-skilled workers.

Discussion of pros and cons

The global decline in the labor income share

Recent studies draw attention to a global decline in the labor income share that is the part of value added allocated to labor. An analysis of 50 countries finds that 29 showed a decrease in labor share of GDP between 1994 and 2014 [3]. While these are predominantly developed countries, the downward trend in the labor income share can also be recognized in many emerging countries. Debate surrounding the potential causes and effects of this downward trend is alive and well among researchers and policymakers alike. It is thus worthwhile to gain a deeper understanding of the differences between sectoral labor income share trends [4].

On average, labor receives the smallest income share in the agricultural sector in all regions except the Middle East, North Africa, and sub-Saharan Africa. In East Asia and the Pacific and North America, the labor income share is largest in the services sector, whereas in Europe and Central Asia, the manufacturing sector shows the greatest labor share. This wide range of situations demonstrates the high amount of regional diversity at the sector level. There is also considerable variation in estimates of labor income share within each region and broad category of sectors. This variation can be seen both in absolute terms and with changes over time. On average, the labor income share in manufacturing has fallen in the majority of countries and has been accompanied by a rise in the share for both agriculture and services. Additionally, on average, the labor income share in developing countries is slightly smaller than that in developed countries [4].

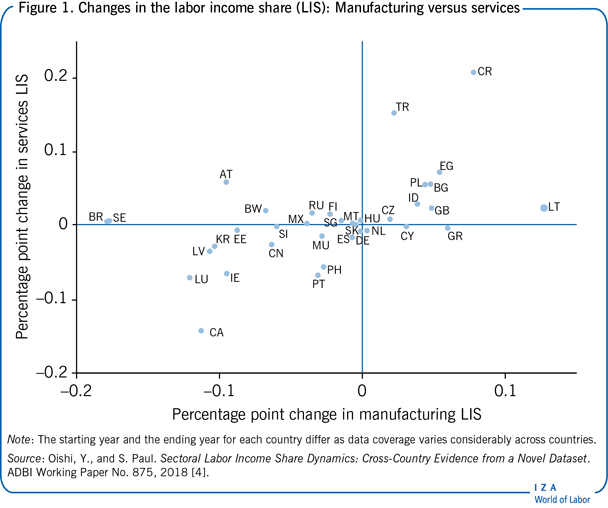

At the sectoral level, labor income shares have declined in seven out of ten major industries worldwide, with the largest decline in the tradable sectors such as manufacturing, transportation, and communication [3]. The government service sector accounts for the largest share of labor income at 46%, whereas public utilities and mining have the smallest shares of labor income at 16% and 20%, respectively [4]. Figure 1 shows changes in the relative labor income shares for the manufacturing and services sectors for 37 countries [4].

For the largest group of countries, a drop in the labor income share for both manufacturing and services is negligible. The second largest group features countries in which the labor income shares for both sectors have increased. For example, movements in the labor income share in the services sector benefit laborers in this sector in Costa Rica and Turkey the most, and those in Canada the least. On the other hand, changes in the labor income share in the manufacturing sector benefit such workers in Lithuania the most and those in Brazil and Sweden the least. While there is considerable variation in the sectoral labor income share movements across countries, the overall trends suggest a positive correlation between changes in the labor income share in manufacturing and changes in the labor income share in services. These trends are reflected in Figure 1 via the clustering of countries in the upper right and lower left corners, respectively.

The relationship between functional and personal income distribution

The study of factor income shares (i.e. labor versus capital income) plays an important role in understanding the relationship between national income and personal income, the relationship between wage inequality and wealth inequality, and concerns for equity in different sources of income [5]. In a standard framework with capital and labor as only input factors for production, the total income is composed of labor income and capital income (e.g. corporate profits). If α denotes the share of income that goes to labor, and θ denotes the employment share that depends on labor income, then the Gini coefficient (G) of the personal income distribution can be directly calculated as the difference between the two shares, i.e. G = θ – α. (A Gini coefficient of zero thereby refers to total equality, while a Gini coefficient of one refers to total inequality.) There is thus a one-to-one relationship between the level of income inequality measured by the Gini coefficient and the labor income share (α). For instance, when the labor income share increases, the personal income distribution becomes more equal with a fall in the Gini coefficient as the gap between the employment share (θ) and (α), the share of income that goes to labor, shortens. However, capital income is more unequally distributed than labor income, especially in advanced countries, and a transfer from labor income to capital income could increase inequality in personal incomes [5]. Thus, differences in the distribution of labor and capital incomes imply that the inequality in personal incomes can change independent of the functional income distribution.

The role of capital accumulation in the declining labor income share

A production function with a constant elasticity of substitution technology (that is constant percentage change in the capital–labor ratio in response to a percentage change in their prices) and constant returns to scale (meaning that output changes by the same proportion as the changes in inputs, e.g. capital and labor) shows a stable relationship between the labor income share, the elasticity of factor substitution, and the capital–labor ratio [6]. The assumption that the elasticity of substitution between capital and labor is different from one (which would indicate capital and labor can be either complements or substitutes) plays a crucial role in the movement of the labor income share. An increase in the capital–labor ratio lowers the labor income share if capital and labor are gross substitutes (i.e. when the elasticity of substitution between capital and labor is greater than one). However, an increase in the capital–labor ratio can produce an upward thrust in the labor income share if capital and labor are gross complements (i.e. when the elasticity of substitution between capital and labor is lower than one). A drop in the relative price of investment (capital) produces an increase in the capital–labor ratio, which forces the labor income share to decline when capital and labor in the production technology are substitutes [6].

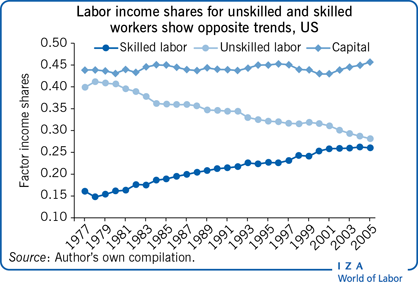

The role of capital accumulation as a driver of the labor income share requires capital and labor to be substitutes, which appears paradoxical in a world predominantly characterized by capital and labor as complements. The composition of skills in the labor force and an identification of the elasticity parameters between capital and different skills of labor can help resolve this puzzle [7]. In the presence of changing skill composition in the labor force and variation in the elasticity of substitution between capital and labor across skill levels (e.g. computers support/complement high-skilled workers while machines may replace low-skilled work, thereby making capital and labor substitutes for low-skilled workers), a decline in the relative price of capital can lower the labor income share when capital and aggregate labor are complements. With capital–skill complementarity, a decline in the relative price of capital can cause a decline in the aggregate labor income share when a decrease in the labor income share for the unskilled labor force outweighs an increase in the labor income share for skilled labor.

Capital–skill complementarity and the labor income share by skill

Labor is heterogeneous in skills and the elasticity of substitution between capital and labor differs across different skill levels [8]. If capital can be substituted with unskilled labor more than skilled labor, then a drop in the relative price of capital would result in a larger drop in the employment of unskilled workers compared to skilled workers. This could then lead to a decline in the share of income for unskilled labor more so than for skilled labor, assuming that wages do not immediately change due to the changing composition of skills in the labor market. Since the early 1980s, the labor income share for skilled workers in the US has shown an upward trend, which suggests that the decline in the aggregate labor income share is entirely driven by the falling labor income share for unskilled workers [7]. This is consistent with capital–skill complementarity and a declining cost of capital through skill-biased technical change [6], [8]. Evidence based on a global input–output database also suggests that the labor income share has been increasing for high-skilled workers and declining for middle- and low-skilled workers [3]. A rising skill premium mainly drives the results for high-skilled workers while participation in global value chains remains the dominant factor behind the decreasing labor income share for middle- and low-skilled workers. Higher exposure to routinization of tasks (i.e. the automation of tasks where labor can be substituted by capital to the highest degree) has also played a key role in the polarization of wages and skill premium along the skill spectrum [3].

Social and economic policies can provide an upward thrust on the labor income share, especially for unskilled workers. A decline in union coverage explains about 12% of the decline in labor's share of income between 1997 and 2006 in the US manufacturing sector [9]. If unions are able to effectively raise wages, then this can have a positive impact on the labor income share by increasing the gap between growth in real wages and labor productivity growth. Concurrently, rising wages could lead to a drop in firms’ profits. Both channels assume factor and product markets to be imperfectly competitive as this ensures that there exists a gap between growth in real wages and growth in labor productivity. The role of institutional forces becomes imperative when wage gains come at the expense of profits because otherwise labor income share will continue to decline as the share of profit and capital income grows.

The role of globalization as a driver of the labor income share

There is little consensus on how globalization affects the labor income share. The so-called Heckscher-Ohlin model predicts a country to have comparative advantages in industries where a relatively abundant production factor (labor or capital) is intensively utilized. In this sense, trade should lower the labor income share in capital-abundant advanced economies but increase it in labor-abundant developing economies. On the other hand, the literature on labor imperfections and trade predicts that the income share between labor and capital will depend on the bargaining power of population groups. The removal of trade barriers could increase the relative bargaining power of capital owners as they can relocate their resources to foreign destinations with higher returns. This framework suggests that trade liberalization could be associated with a lower labor income share.

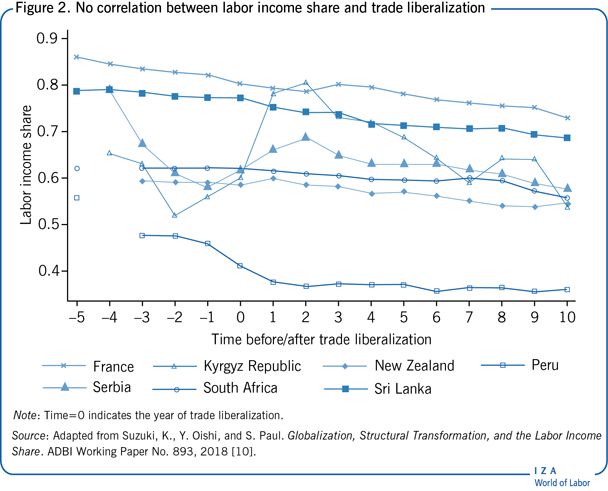

Figure 2 shows the time series plots of the labor income share for seven countries before and after trade liberalization. The year of trade liberalization varies from country to country and is normalized to zero in the figure; the preceding five years and the following ten years are numbered –5 to –1 and 1 to 10 respectively. The labor income share consistently declined throughout the period for all countries aside from the Kyrgyz Republic and Serbia. This contradicts the above hypothesis that labor income share declines following trade liberalization as the labor income share in most of the countries started to decline before the year of trade liberalization. Consequently, it is difficult to attribute this falling share to trade liberalization.

Evidence at the sectoral level provides a more nuanced picture and suggests an association between sectoral labor income share and trade [10]. The correlation between the volume of trade (as a share of GDP) and the labor income share at key sectoral levels is negative implying that the labor share falls with an increase in the volume of trade. Such patterns of trade and sectoral income shares did not change over a period of ten years between 1995 and 2004. During this period, countries like Turkey, Poland, and Botswana showed a relatively higher share of labor income in agriculture, whereas Brazil and Austria had the highest labor income share in manufacturing. For these countries, the volume of trade was lower in respective sectors where they showed a relatively higher share of labor income following the negative correlation between the trade share of GDP. The same holds for the services sector, where Denmark and the Netherlands continued to have the highest labor income share [10]. The negative correlation in manufacturing was somewhat weaker than that in services, which could be due to a growing volume of trade in services across the globe and expansion of service sectors as countries became more advanced and richer (this is also known as the phenomenon of structural transformation). Together, these descriptive evidences suggest possible roles of structural transformation as a causal mechanism between trade reforms and the labor income share at the sectoral level.

New trade theories emphasize the role of firm heterogeneity in production. Factors such as capital intensity and skills drive productivity and determine the impact of increasing openness (i.e. when a country becomes more integrated into global trade) on the labor income share of different types of workers. It has been noted that increased import penetration would be expected to depress the labor share of domestic income if imported intermediates can be substituted more with labor than with capital from an aggregate perspective [11]. If globalization or technological changes benefit the most productive firms in each industry, product market concentration will rise as industries become increasingly dominated by superstar firms with high profits and a low share of labor in firm value added and sales. As a result, the increasing importance of superstar firms will tend to cause a fall in the aggregate labor share [12]. Offshoring of tasks from high-wage countries, facing a decline in the cost of capital, to low-wage countries could improve the labor income share in the recipient countries as labor is less likely to be substituted by capital. However, the net effect on the global labor income share depends on the types of tasks offshored from high-wage to low-wage countries, and could further worsen the global share when the labor income share in the countries receiving offshored tasks also declines [11].

Relatedly, offshoring tasks that are more capital intensive relative to other tasks in the receiving countries could also help explain the global decline of labor share as it would require less labor to perform these tasks in the receiving countries [11]. Other forces of global integration (such as participation in global value chains) together with exposure to routinization of tasks that makes labor more substitutable by capital and a drop in the relative price of capital further explain the decline in labor income share. These outcomes are consistent across advanced economies, while emerging market economies show a more varied picture. As a driver of the labor income share, decline in the relative price of capital plays a crucial role in Brazil, for example, whereas participation in global value chains has been the most dominating factor for Turkey [3].

Limitations and gaps

Estimation of the labor income share suffers from several measurement issues. First, labor income involves both wage employees and self-employed individuals; however, national accounting statistics typically record employees’ total wage bill but do not include self-employed income. Second, the net labor income share, defined as the labor income share net of adjustments to capital (e.g. depreciation in intangible capital and production taxes), no longer shows any decline in the US, for instance [13]. Third, corporate profit is one of the many sources of capital income, and the terms “capital share” and “profit share” have been interchangeably used in the literature. Distinction between these two concepts is crucial to understand the relationship between labor income share and personal income distribution since the gains from corporate profits are far less equally distributed than wages. Moreover, the extent to which the interactions of the drivers determine the changes in the labor income share remain largely unresolved. Finally, further evidence from developing countries can significantly improve understanding of the forces behind movements in the labor income share.

Summary and policy advice

The global decline in labor income share at the aggregate level hides more than it reveals, as outcomes at disaggregated levels are quite diverse. Analysis of the labor income shares by skill and sectors remains a promising area of future research. Growing skill premium with capital complementing higher skills, greater exposure to routinization, and participation in global value chains leads to polarization of wages and employment across the skill spectrum. This points to the need for policies that promote skill deepening for medium- and low-skilled workers. Short-term policies that aim to create jobs for low-skilled workers in this transitioning phase should be implemented, alongside medium- to long-term redistributive measures to prevent welfare loss from further decline in low-skilled workers’ share of income.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The responsibility for opinions expressed in this article rests solely with the author. Previous work of the author (together with Yoko Oishi and Ken Suzuki) contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [4], [7], [9], [10].

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Saumik Paul