Elevator pitch

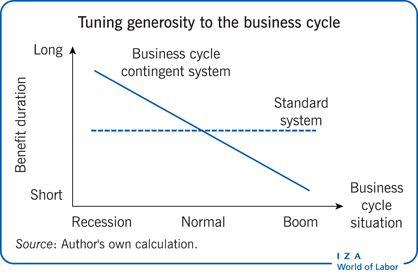

High unemployment and its social and economic consequences have lent urgency to the question of how to improve unemployment insurance in bad times without jeopardizing incentives to work or public finances in the medium term. A possible solution is a rule-based system that improves the generosity of unemployment insurance (replacement rate, benefit duration, eligibility conditions) when unemployment is high and reduces the generosity when it is low.

Key findings

Pros

The impact of unemployment insurance can be strengthened by improving its generosity in bad economic times, when the need is greatest.

Making unemployment insurance less generous during good economic times can strengthen job-search incentives.

Such flexible terms for unemployment insurance are consistent with balancing public budgets across the business cycle.

Business cycle contingencies can be implemented within a rule-based system to ensure automatic adjustments that are in tune with the business cycle.

Cons

There can be administrative difficulties in adjusting the unemployment system to the business cycle.

Determining the trigger points to release changes in the system can be difficult.

Important to calibrate the unemployment insurance system such that it does not conserve a high structural level of unemployment.

There is a risk of political bias, implying asymmetric responses over the business cycle.

Author's main message

Unemployment insurance can be made more flexible by tuning it to the level of economic activity. A flexible system provides more generous insurance when it is most needed, during periods of high unemployment, and strengthens the incentive structure by reducing benefit generosity when it is most harmful, during periods of low unemployment. Such a scheme can be rule-based, with automatic triggers and sunset clauses, and consistent with a fiscal budget balanced automatically over the business cycle.

Motivation

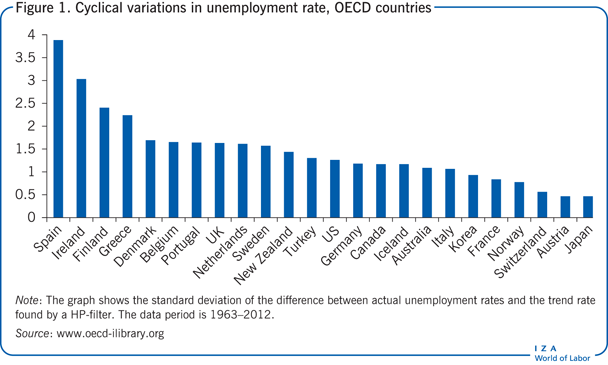

The financial crisis has called into question the adequacy of unemployment insurance schemes in many countries (see Unemployment insurance schemes). Changes in national unemployment rates are beyond an individual’s control, so there is a strong case for collective risk-sharing through insurance. Some analysts also argue that increasing unemployment benefits at times of high unemployment, by giving money to those most likely to spend it, stimulates the economy and reduces unemployment. Unemployment insurance is thus more important at such times. Unemployment rates are known to vary significantly over time (see Figure 1), and yet unemployment insurance is the same in periods with high and low unemployment. Is this optimal or should elements of the scheme vary with the business cycle situation?

Yet unemployment insurance also affects incentives to work, and generous benefits may prolong unemployment and affect wages, increasing job losses. This conflict between insurance and an incentive structure conducive to low unemployment could be reduced by linking elements of unemployment insurance (level of benefits relative to wages, benefit duration, and eligibility) to the business cycle (economy-wide fluctuations in production and employment). Benefit generosity should improve when unemployment is high, and vice versa when it is low.

Discussion of pros and cons

Theoretical arguments

Unemployment insurance schemes are designed to provide income support in case of job loss in order to smooth consumption for unemployed workers and help avoid large drops in spending in the economy. The more generous the benefits, the better the insurance against large drops in income. However, unemployment benefits have two types of cost. The direct cost is the financing cost, which in most European countries is fully or partially met through taxes. The indirect cost is the effect that unemployment benefits have on the unemployment rate through wages (which must be higher if employment benefits are high) and job search. The optimal unemployment insurance scheme balances the insurance gains against the budget and incentive costs. Whether it is optimal to make key elements of unemployment insurance contingent on the business cycle depends on how the insurance, budget, and incentive effects are linked to the business cycle.

Insurance

The value of insurance depends on whether a worker is able to self-insure (through savings, borrowing, or explicit insurance contracts) and on the kind of change that occurs in the employment situation. Evidence from a number of countries shows that the scope for self-insurance has been insufficient to cope with the consequences of the recent financial crisis. This outcome underscores why the generosity of unemployment insurance is more important for the jobless during a period of high unemployment, when finding a job is more difficult. The social value of unemployment benefit generosity is also higher in difficult economic times because more people are unemployed. It is therefore a fairly robust finding that the value of insurance rises when unemployment increases, and vice versa.

Budget

But this finding alone is not sufficient to argue that unemployment benefit generosity should rise with the unemployment rate. Both higher unemployment and greater benefit generosity raise costs. If the law requires that the unemployment insurance scheme be fully funded on a period-by-period basis, paying the higher costs implied by higher unemployment would require raising the tax or contribution rate on employed workers, even if benefit generosity is not increased. Increasing the benefit generosity would only add to these already higher costs. It is therefore likely that, under a balanced-budget requirement, a policy that considers the situation of both unemployed and employed workers will reduce the generosity of unemployment benefits as the unemployment rate rises [1].

If the unemployment benefit scheme does not require a period-by-period budget balance, the scope for greater benefit generosity in periods with high unemployment is larger. If unemployment benefits are financed through taxes, as part of the general public budget, the financing requirement should balance out across business cycles: The system will be in deficit when unemployment is high and in surplus when unemployment is low.

Spreading financing across the business cycle strengthens the possibilities for a more flexible unemployment insurance scheme. The public budget automatically stabilizes demand by raising less tax revenue and spending more on unemployment benefits (for example) in an economic downturn and raising more taxes and spending less on unemployment benefits in an economic upturn. However, because this arrangement entails a fiscal burden in bad times, budgets need to have enough space to accommodate such changes for this automatic stabilizer to operate smoothly.

Incentives

The incentive effects of unemployment benefit payments and their interactions with economic conditions are much more complicated than the insurance and budget aspects. If unemployment benefits are less distortionary when unemployment is high (and vice versa), then both the insurance and the incentive arguments support increasing benefit generosity when unemployment is high (and vice versa). As argued below, this may be the case, but not as a general statement. That does not destroy the argument being made here, however, since even if unemployment insurance is more distortionary when unemployment is high, there may still be a case for countercyclical benefit generosity if the insurance effect dominates the incentive effect.

Whether the incentive effects of the generosity of unemployment benefits rise or fall with the level of unemployment is theoretically ambiguous. Although unemployment benefits can have negative incentive effects on individuals, the overall implications depend on other factors as well—which themselves depend on the business cycle. This raises complicated issues concerning the source of business-cycle changes (changes in productivity, financial conditions, aggregate consumption, and so on), the responsiveness of the economy to change, possible failures in how the market operates, and other factors. A detailed account of the theoretical arguments is beyond the scope of this article, but the main issues covered here show why it is theoretically possible that the harmful incentive effects of unemployment insurance would be lowest when unemployment is high (and vice versa).

A potential incentive effect of unemployment insurance, extensively analyzed in the literature, is that it could reduce the intensity of the job search by unemployed workers, since the financial urge to find a job is reduced. The standard theoretical model implies that the incentive effect acts in such a way that unemployment insurance is more harmful for job-search incentives when unemployment is high. This argues against increasing benefit generosity when unemployment is high, contrary to the idea discussed above [2].

But this result depends, critically, on how the job search varies with the overall level of unemployment. The effect of benefit generosity in the standard model (which calls for lower benefit generosity when unemployment is high) derives from the empirically questionable assumption that unemployed workers search less when unemployment is high [3]. Modifying the standard model to allow for changes in the business cycle and for a budget that balances on average across the business cycle makes it possible to explain why job-search intensity is greater, not lower, when unemployment is high. This implies that the disincentive effect of benefits is low when unemployment is high, and high when unemployment is low.

In the weak economic climate that has persisted since the financial crisis of 2008–2009, it is widely agreed that the main problem underlying high unemployment is not job-search incentives but a lack of jobs. If jobs are rationed under high unemployment, there is a job-search dependency among unemployed workers, since more intensive job-searching by unemployed workers has only a marginal effect on the overall number of jobs (too many people searching for too few jobs) [4]. That means that more intensive job-searching by each unemployed worker increases the individual job-finding rate but at the cost of reduced job-finding for other unemployed workers. This implies that the incentive effect of unemployment insurance on the job-search effort of unemployed workers, and therefore on aggregate unemployment, is less important during recessions, which would tend to support the argument for greater benefit generosity when unemployment is high, and vice versa.

Finally, an important implication of increasing benefit generosity when unemployment is high (and vice versa) is the effect on the unemployment rate. Increasing benefit generosity when it affects job-search incentives the least (and decreasing it when it affects them the most) lowers the average effect on job-search incentives, which in turn lowers the average unemployment rate across the business cycle. However, this effect is achieved at the cost of greater variability in the unemployment rate, since unemployment falls more in good times owing to the reduction in benefit generosity, and vice versa in bad times. Benefit generosity that depends on the business cycle thus lowers average unemployment, but increases unemployment variability. This is a reminder that socially optimal policies do not necessarily imply less volatility in key labor market variables.

Empirical evidence

Although there are theoretical arguments in support of adapting unemployment benefit generosity to the business cycle, empirical evidence is required to dispel the ambiguity about whether there is a case for introducing such policies, and, if so, how strong the adjustments should be. While the empirical literature on the incentive effects of unemployment insurance is extensive, less work has been done on the insurance effects.

In general, it is difficult to discern the incentive effects of specific elements of labor market policies, and identifying how such effects are tied to the business cycle is even more demanding. In studies using data collected at regular intervals, a straightforward approach is to include variables capturing the business cycle. These studies suggest that benefit generosity is more distortionary when unemployment is low. However, such studies do not directly answer the question of what the effects would be of a change in unemployment insurance generosity that depends on the business cycle (holding all other factors constant).

This problem is partly overcome by using cross-country data and analyzing how the effects of structural reforms, including changes in the replacement rate (the ratio of benefit payments to previous take-home pay), depend on the business cycle [5]. The main findings are that structural reforms only gradually affect labor market outcomes, and that the effects are larger in good economic times than in bad—and faster acting. In bad times, reducing the replacement rate could even increase unemployment.

These findings suggest that the harmful incentive effects of unemployment insurance are stronger in periods with low unemployment than with high. Still, structural reforms differ from policies that are contingent on the business cycle, and cross-country evidence might not properly capture country-specific effects.

Attempts have been made to analyze business-cycle dependencies more directly. Germany’s unemployment insurance scheme extends the duration of benefits for older unemployed workers. A study exploiting this feature to analyze how extending benefits affects the duration of unemployment spells finds that the incentive effects of benefit duration are constant across business cycles [6]. Whether the result would hold if the benefit extension were applied to all unemployed workers is unknown.

Another study uses the variation across US states in benefit levels and unemployment rates to identify the relationship between the business cycle and the insurance and incentive effects of unemployment insurance [7]. It finds that the incentive costs of unemployment insurance are higher when unemployment is low but, somewhat surprisingly, that the insurance value is almost constant across the business cycle. The incentive effects are thus the main argument presented for increasing unemployment benefits when the unemployment rate rises (and vice versa). In calibrations of the optimal replacement rate, the study finds quantitatively strong effects. At an unemployment rate of 6.2%, the optimal replacement rate is 42.8%, and at an unemployment rate of 7.5% it is 61.4%.

Surprisingly, there are few studies of business-cycle contingencies in Canadian and US unemployment insurance schemes (see Business-cycle contingencies in practice). A 2013 study of benefit extensions in the US during 2009–2012 finds that the exit rate from unemployment declined and the duration of unemployment spells rose [8]. These effects are not driven by lower exits to employment but by lower exits from the labor force (for example, into further education or training, or retirement). The employment costs of benefit extensions are thus small.

A lower exit rate from the labor force reflects the insurance value of the system, since more people remain eligible for benefits. Whether there are other indirect effects of a lower exit rate from the labor force is an open question. If the lower exit rate reflects mainly reduced marginalization, it could facilitate an increase in employment when the economy recovers. But if it reflects mainly less entry into education, especially among unemployed youth, it could have long-term structural costs.

Implementing business-cycle contingencies in unemployment insurance systems

To eliminate decision and implementation lags and avoid time-inconsistency problems (it is easier to agree on extensions than contractions), contingencies in unemployment insurance systems that are based on the business cycle should be rule-based. The most obvious dimension of unemployment insurance to make contingent on the business cycle is benefit duration, but benefit levels and eligibility may also be considered (see Business-cycle contingencies in practice).

Although business-cycle contingencies in the unemployment insurance scheme strengthen automatic budget effects (automatic stabilizers), there is an important difference between such contingencies and standard automatic stabilizers, which arises as a result of the structure of tax systems and social safety nets. Since tax payments depend on current activity (consumption and income), and eligibility for unemployment benefits depends on the individual situation (unemployment), it follows that a recession, for example, automatically leads to lower revenue and higher spending.

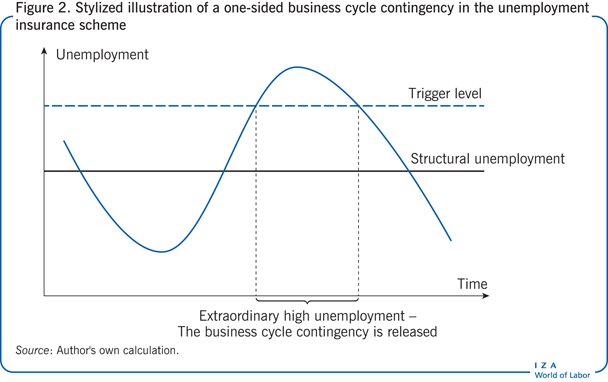

These automatic responses are one of the virtues of rule-based automatic stabilizers, because the responses arise without any lags in information-gathering, decision-making, or implementation. A business-cycle contingency in the unemployment insurance scheme is qualitatively different, however, since it depends on the economy’s aggregate situation. Such a contingency thus requires a trigger defined in terms of aggregate statistics (the unemployment rate, for example) that first have to be collected.

The setting for the trigger and the “normal” indicator in the unemployment insurance scheme is crucial, for several reasons:

First, the indicator must be easily measured, and statistics must be readily available, to minimize information lags. The indicator that determines shifts in benefit duration must accurately and promptly capture shifts in the cycle and be based on publicly available data. The aggregate unemployment rate is an obvious candidate if it is defined to adequately reflect the labor market (by including everyone who is unemployed).

Second, the trigger should activate changes in benefit generosity only when there are substantial changes in the labor market; small and temporary variations should not trigger a change.

Finally, and critically, the unemployment level that is defined as “normal” must not be too high. If the structural (average) unemployment rate is high, defining business-cycle contingencies around this as the normal level could conserve any structural problems that are causing a high unemployment rate. If substantial reforms are needed to reduce structural unemployment, introducing a business-cycle contingency could be problematic.

A simple system is to release the business cycle contingency when the actual unemployment rate exceeds the structural level by more than some trigger level (see Figure 2).

Political economy considerations

Political economy considerations also influence how business-cycle contingencies should operate. Changes in unemployment benefit generosity in response to changes in the business cycle should be automatic rather than discretionary. That minimizes lags in decisions and implementation and reduces political pressure to pursue laxer policies during periods of high unemployment that are difficult to reverse when the economy recovers.

Establishing a transparent, rule-based system with clear triggers and sunset clauses helps ensure that changes are temporary and makes the system less vulnerable to changing political preferences. Defining explicit business-cycle contingencies accommodates political pressure for less strict policies in downturns without causing the system to operate asymmetrically.

Finally, if structural reforms are called for to reduce average (“normal”) unemployment, it might be easier to win support for such policies if they have built-in business-cycle contingencies to ensure adaptation to labor market conditions.

Limitations and gaps

While both theoretical and empirical advances have been made in understanding the effects of business-cycle contingencies in unemployment insurance, there is clearly a need for more work on both the insurance and incentive effects. The theoretical challenge is to develop a model that captures the cycle of economic ups and downs and the labor market consequences. An important question is whether the driver of the overall economic cycle matters (the specific shock to the system) for the effects of unemployment insurance if insurance generosity is contingent on the business cycle. The empirical challenge is to provide information to help clarify the theoretical ambiguities and to assess the quantitative effects involved.

The difficulties in clearly identifying the effects of business-cycle dependencies on unemployment insurance systems should not be underestimated. Ultimately, the issue is whether the potential gains are worth both the administrative costs and the political economy risks. It is a huge leap to go from finding arguments in support of such contingencies to offering a detailed outline of how the system should be designed in practice.

Summary and policy advice

Common sense supports the notion that unemployment benefit generosity is more important when unemployment is high than when it is low. Theoretical arguments back this reasoning, since the value of unemployment insurance is higher in periods of high unemployment. It is also possible that the disincentive effects of unemployment insurance are smaller when unemployment is high. Thus, both insurance and incentive arguments may support greater unemployment insurance generosity when unemployment is high (and vice versa).

Such a system raises administrative issues. But it is feasible, as is clear from the Canadian unemployment insurance system, which incorporates explicit business-cycle clauses. Explicit rules linking benefit generosity to the business cycle are essential to ensure that enhanced benefit generosity is an automatic measure that kicks in when unemployment is particularly high and then is reversed when the economy improves.

Acknowledgments

The author gratefully thanks two anonymous referees, the IZA World of Labor editors, and Michael Svarer for many helpful suggestions on earlier drafts. This paper draws extensively on joint work with Michael Svarer [1], [3].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Torben M. Andersen

Unemployment insurance schemes

Sources: P. Jung, and K. Kuester. Optimal Labour-Market Policy in Recession. Research Department, Federal Reserve Bank of Philadelphia Working Paper No. 11-48, 2011; K. Stovicek, and A. Turrini. Benchmarking Unemployment Benefits in the EU. IZA Policy Paper No. 43, June 2012.