Elevator pitch

The shadow (underground) economy plays a major role in many countries. People evade taxes and regulations by working in the shadow economy or by employing people illegally. On the one hand, this unregulated economic activity can result in reduced tax revenue and public goods and services, lower tax morale and less tax compliance, higher control costs, and lower economic growth rates. But on the other hand, the shadow economy can be a powerful force for advancing institutional change and can boost the overall production of goods and services in the economy. The shadow economy has implications that extend beyond the economy to the political order.

Key findings

Pros

High taxes and social security contributions and heavy regulation are the main drivers of the shadow economy.

Resources not being used in the official economy can be used in the shadow economy to increase overall supply of goods and services.

Opinions on how to deal with the labor force in the shadow economy differ widely.

Governments try to encourage firms to move out of the shadow economy by improving public institutions.

Fostering stronger popular participation in government decision-making, expanding elements of direct democracy, and eliminating corruption can also reduce the shadow economy.

Cons

The shadow economy is hard to measure, and different methods yield different results.

Some measurement difficulties occur because the shadow economy is not clearly defined.

By worsening fiscal deficits and reducing infrastructure investment, the shadow economy reduces welfare and economic growth.

The shadow economy can undermine state institutions, leading to more crime and less support for institutions, ultimately threatening economic and political development.

Trying to reduce the shadow economy through punitive fines and tighter controls is costly and not very effective.

Author's main message

The shadow economy should not be seen as solely an economic problem, to be resolved by attacking the symptoms through higher fines and tougher controls. A country-specific analysis of causes and consequences is necessary in order to develop policy measures appropriate to the country’s level of development. Policymakers should view illicit work as a signal of the need to decrease the attractiveness of the shadow economy through better regulation, a fair and transparent tax system, and more efficient institutions (good governance). Organized crime, corruption, and illegal employment should nevertheless be fought through stricter controls and enforcement.

Motivation

The causes, effects, and problems generated by the increasing activity in the shadow economy in developed countries are controversial and have been extensively discussed. Due to still-high unemployment rates in some European countries, and budget stringencies, as well as rising disappointment with economic and social policies, the EU Commission and Parliament have undertaken broad initiatives, including EU-wide surveys, to better understand and fight the growth of the shadow economy, as have many national governments.

But these efforts involve several difficult decisions. While tax evasion by the wealthy, social fraud, and illegal hiring lead to widespread public indignation, illicit workers provoke much less outrage, even though, as some politicians argue, their behavior is anti-social, leading to higher unemployment and social injustice. But what about part-time illicit work in the evening (“moonlighting”)? Surveys find that roughly half the population of Germany, Norway, Sweden, and the UK tolerates such activity and would even engage in it, given the opportunity. Illicit work is especially widespread in the household sector. In Germany, for example, nine out of ten households employ their domestic help illegally.

The guidelines laid down by the EU Commission in its pan-European employment strategy for combating illicit work call for countries to exchange “good practice models” and to coordinate their efforts at the EU level, including stricter controls and harsher sanctions.

Benchmarking can be helpful in finding new ways of dealing with illicit and undeclared work, but measures rarely go beyond attacking the symptoms. Harsher sanctions alone will not end illicit work. This article suggests a more effective and less costly two-pillar strategy. New results from research in economic psychology and behavioral economics, for example, show that intrinsic motivations and values have a much stronger impact than the perceived or actual detection rate.

Discussion of pros and cons

Shadow economy and illicit work

The starting point of nearly all controversies concerning the shadow economy is how to define it or how to estimate its size [1]. Since the term “shadow economy” comprises numerous economic activities, it is difficult to provide a formal definition. For example, the definition must distinguish between goods and services produced and consumed within the household, “soft” forms of illicit work (moonlighting), illegal employment, and social fraud, as well as criminal economic activities. In general, the shadow economy can be understood to encompass the economic activities of individuals that are outside official norms and formal institutions. Because the transactions are illegal—the goods or services themselves are not necessarily illegal to own or to trade through other, legal channels—the market is forced to operate outside the formal economy and its institutions, both public and private.

From the point of view of economic policy, the shadow economy activities that are particularly relevant are those related to value added. Estimating the value of these activities requires distinguishing between the output of illegal and legal activities and the illegal and legal production and distribution of the output of these activities. Common motives for operating in the shadow economy are to trade contraband, avoid taxes and registration costs, or skirt price controls. Typically, the shadow economy, as the totality of such activity, is referred to as a complement to the official economy.

Size of shadow economies in industrial countries

Since definitions of the shadow economy vary, it is important to understand what is being analyzed and how is it being measured. Indirect and direct methods yield different estimates of the size of the shadow economy. The search for the best methods for estimating the size of the shadow economy has intensified and has focused mainly on the widely used indirect methods such as the monetary demand approach and the multiple indicators, multiple causes (MIMIC) approach [2]. Other direct approaches, based on micro data or surveys, are rarely used, because they are very complex and it is expensive to derive representative data from surveys. The differences in the results of these micro and macro approaches have been extensively discussed [3]. For the most part, this article reviews studies that take an indirect, macroeconomic approach to measuring the size of the shadow economy since most empirical studies use that approach. However, the results of two EU surveys are also briefly discussed.

The article does not deal with estimation methods (these are discussed in much of the literature referenced here, however).

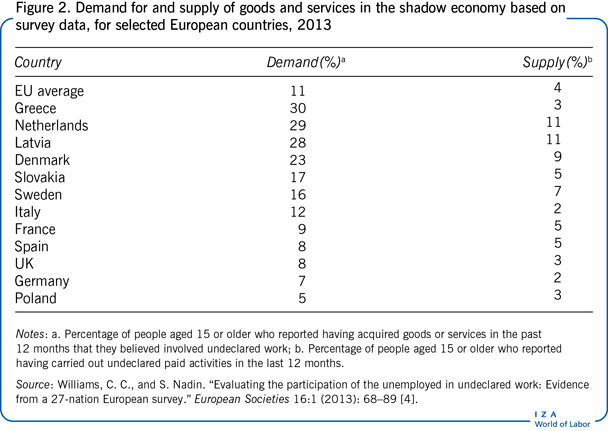

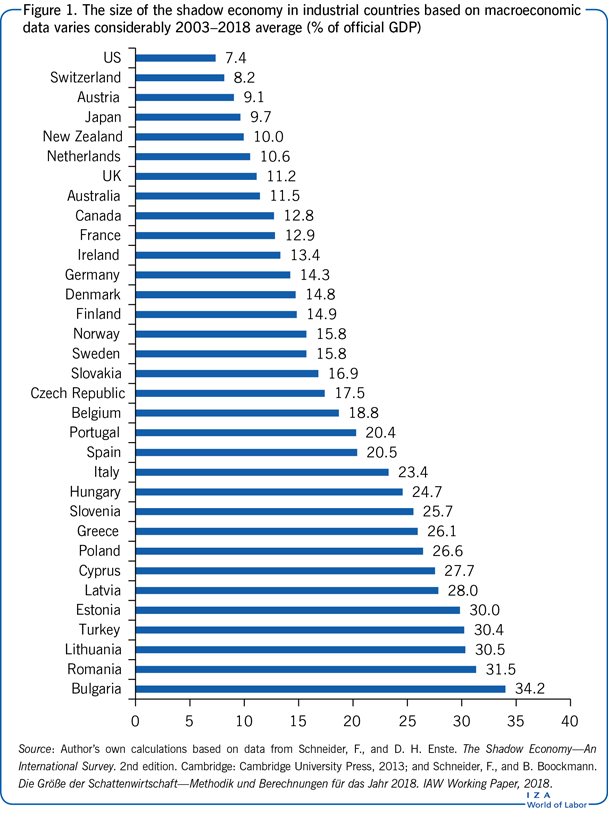

Figure 1 shows the estimated size of the shadow economies in industrial countries as a percentage of official GDP and based on macroeconomic data. Relative to official GDP, the shadow economies are much smaller in economically advanced OECD countries than in Central and Eastern European countries. Nevertheless, there are large differences even among the advanced OECD economies. Whereas in the US, Switzerland, Austria, Japan, and New Zealand the shadow economy is 10% or less of official GDP, in all Eastern European and some Southern European countries (Greece, Italy, Portugal, and Spain) the shadow economy is 20% or more of official GDP. But the size of shadow economies has been decreasing since 2003 in all countries. The shadow economy shrank, for example, from 17% to 11% (2018) in Germany, from 15% to 12% in France, and from 26% to 19% in Italy.

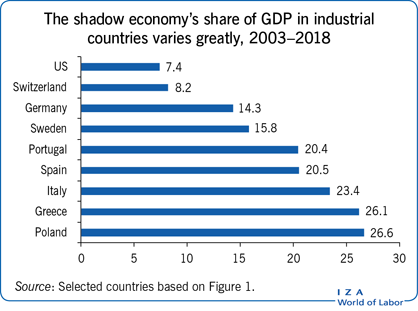

The size of the shadow economy is much smaller when measured using survey data, which are available for 2007 and 2013 for EU countries [4]. In those years, around one in ten Europeans (11%) reported having acquired goods or services in the past year that they believed were produced through undeclared work (Figure 2).

Countries varied considerably in the percentage of respondents who purchased goods or services they believed to have been produced through undeclared work. Countries with high percentages in 2013 include Greece (30%) and the Netherlands (29%). Countries with low percentages include Poland (5%) and Germany (7%). The median amount Europeans spent in 2013 on goods or services produced through undeclared work was €200. The median hourly cost for purchases of undeclared goods and services was €11, with a range from €20 in the Nordic countries to €5 in Eastern and Central Europe. The percentage of Europeans who reported purchasing undeclared services also varied by services. The highest percentages were 29% for home repairs or renovations, 22% for car repairs, 15% for home cleaning, and 11% for food. The corresponding figures for the supply of undeclared work were 19% for repairs or renovations, 14% for gardening, 13% for cleaning, 12% for babysitting, and 11% for working as wait staff in restaurants. The results are even smaller looking at the supply side. Around 4–5% of respondents in 27 EU countries reported having engaged in undeclared work during the last 12 months (in 2017 and 2013), which converts to 20 million undeclared workers.

Respondents in Cyprus hold the least tolerant views toward undeclared work, followed by the three Nordic countries, Greece, Malta, and Spain. The most tolerant views, in contrast, are found in several Eastern and Central European countries: Latvia, Lithuania, the Czech Republic, Slovakia, Poland, and Estonia. But, as the authors note, these are low estimates and only slight changes are reported between 2007 and 2013 [4].

Reasons for the shadow economy

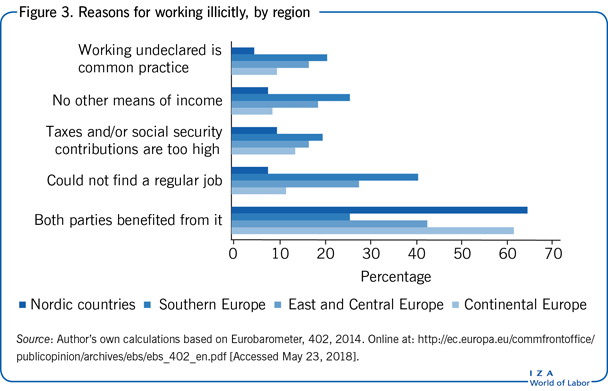

Based on survey data, the main reasons given for illicit work are “Both parties benefited from it”; “Could not find a regular job”; “Taxes and\or social security contributions are too high”; “No other means of income”; and “Working undeclared is common practice.” But there are large differences between the regions in Europe (Figure 3).

Industrial countries

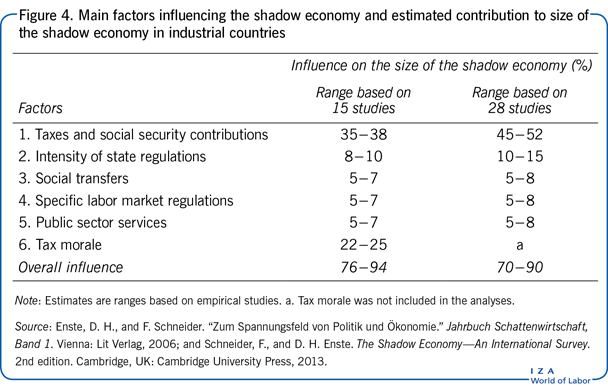

Based on scientific research in industrial countries, many factors have influenced the development of the shadow economy, but the most important, most often cited, and empirically supported are the following (Figure 4) [5]:

Tax burdens and social security contributions.

Density and intensity of regulations in the official economy, especially on labor markets, including mandated reductions in the work week, early retirement, and growing unemployment, providing more time for illicit work.

Less civic involvement and loyalty and respect for public institutions.

Weak tax morale (willingness to pay taxes), partly a result of corruption and a decline in the quality of public institutions.

Many empirical studies find the rising burden of taxes and social security contributions to be one of the most important drivers of the development of the shadow economy [6]. Up to half the variance of the differences in the size of the shadow economy across countries can be explained by this factor, depending on the model and number of factors included. Since taxes affect the labor-leisure choice and stimulate labor supply in the shadow economy, the distorting effect of this influence is a major concern of economists. According to economic theory, the bigger the difference between the total cost of labor in the official economy and the after-tax earnings from work, the greater the desire to reduce this difference and to work in the shadow economy. This difference depends largely on the overall burden of taxes and social security contributions in the official economy, a burden that is evaded in the shadow economy.

From this perspective, the development of the shadow economy can be seen as a reaction by individuals who feel overburdened by the state and who choose the “exit” option rather than the “voice” (voting and political participation) option. The increase in activity in the shadow economy that results from the rise in the overall tax and social security burden erodes the tax base and the viability of the social security system. In turn, that leads to a further increase in the budget deficit or to higher taxes, additional growth of the shadow economy, and gradual weakening of the foundations of the social contract. These arguments are theoretically derived and empirically based [1], [2], [5], [7].

Another important factor contributing to the growth of the shadow economy is the rise in the intensity of regulations, often measured by the number of laws and regulations, such as license requirements, labor market regulations, trade barriers, and labor restrictions on immigrants. The influence of labor regulations on the shadow economy has been extensively analyzed. Regulations boost labor costs and limit the freedom of choice for participants engaged in the official economy. Since most of these costs are shifted from employers to the employees, heavy regulation provides another motivation to work in the shadow economy [8].

Eastern and central Europe

In Eastern and Central Europe, other factors drive the shadow economy [9]. They include:

Lack of competence of official institutions (legislature, bureaucracy, courts) combined with corruption, which undermines trust in these institutions.

Weak enforcement of laws and regulations and an inability or unwillingness to protect property rights.

High costs and administrative burdens for entrepreneurs.

Low probability of being caught as an illicit worker or tax evader, which makes illicit work more attractive than work in the official economy.

Too much red tape and inefficient bureaucracy, which can make “hiding in the shadows” essential for survival or to establish a business.

Broad acceptance of illicit work, which makes it difficult to fight against it.

According to various empirical studies, the most important factor behind the growth of the shadow economy in countries in Eastern and Central Europe is the quality of institutions and corruption [9]. The quality of institutions explains much of the variance in the size of the shadow economy between Eastern and Central European countries and OECD countries.

Eastern and Central European countries with higher quality institutions also have a higher growth rate of the official economy [9].

The right combination of competent institutions and the provision of public goods on the one hand and of taxes and fees on the other is crucial for achieving economic efficiency. If the state can credibly guarantee property rights and provide adequate infrastructure and public goods that meet the needs of the people, paying taxes and fees will be better accepted and the size of the official economy will grow while that of shadow economy will shrink [9], [10].

Limitations and gaps

Analyzing the effects of a growing shadow economy is difficult and requires comprehensive empirical evidence, which is not available. Most studies focus on the influence of the shadow economy on the allocation of resources and the loss of revenue for the state [9]. But it is even more important to learn about the impact of official institutions, norms, and rules. The shadow economy is an indicator of a serious deficit of legitimacy in the rules governing official economic activities and in a weakness in the social order [7]. The exit option to the shadow economy is an important means of securing economic and social freedom and of weakening the reach of the leviathan state.

More analysis and empirical studies are needed to answer several important questions:

What amount of officially unaccounted for resources is being used for production in the shadow economy?

How large is the additional supply of goods and services in the shadow economy, and what additional indirect tax revenues does this activity generate?

How much has the shadow economy added to the public deficit and reduced investments in infrastructure?

How can corrupt and inefficient institutions be reformed to reverse the development of the “dual economy?”

Summary and policy advice

A challenge for governments

Shadow economies have grown in reaction to rising tax burdens and government regulation in industrial countries and to the lack of stable institutions in some Eastern and Central European countries. In combination with reduced tax morale and weaker loyalty to the government, empirical evidence shows that these are the most important factors contributing to the migration of jobs into the shadow economy. Vital steps for reversing this growth of the shadow economy are improving institutions and respect for government by strengthening tax morale, voice and accountability, rule of law, governance, regulatory quality, and by reducing corruption [11].

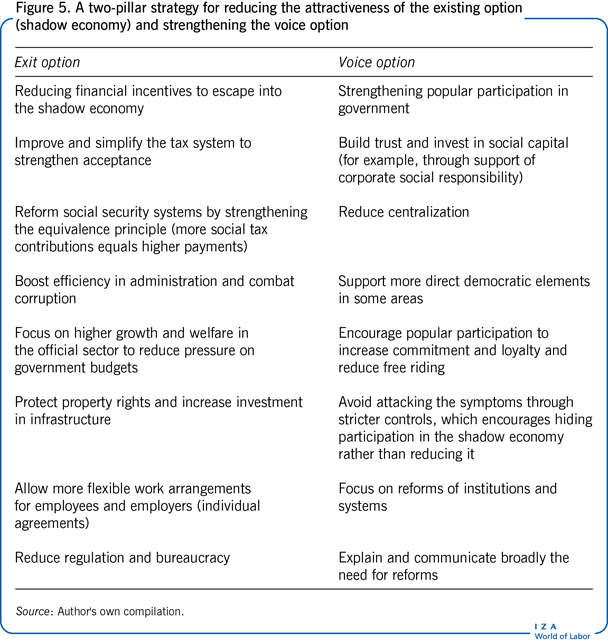

What does not work is to increase the costs of illicit work by intensifying controls and setting higher fines. Research has shown that people’s decisions to participate in the shadow economy are barely influenced by detection rates, but depend much more on perceived values, acceptance of the tax system, and the overall situation in the labor market, including the unemployment rate [12].

The shadow economy is caught up in a vicious circle. A heavy tax and regulatory burden results in higher growth of the shadow economy, which reduces government revenue and intensifies pressure on public finances, which in turn reduces the quality and quantity of publicly provided goods and services and public administration. Ultimately, this may lead to rising tax rates in the official sector, which creates even stronger incentives to participate in the shadow economy. As the shadow economy grows and state institutions weaken and lose popular support, democratic voting (voice) becomes less attractive than using the exit option of moving into the shadow economy.

And people will increasingly choose the exit option if the voice option is not strengthened by the introduction of more direct democratic elements. They will choose either to work illicitly or to search for an economic and social system that corresponds to their preferences [7]. In this context, the shadow economy can be viewed as part of an evolutionary process that is making economic and social development more dynamic. On the one hand, the societal pressure on deregulation and tax reduction is increased, and on the other hand, innovative forms of living together and working emerge outside the influence of government restrictions. In the long term, however, a society cannot accept the systematic flouting of the law, as this undermines acceptance of the legal authority of the state. One option for intervening in the vicious circle is to improve the quality of institutions and strengthen the institutional framework. Fighting corruption by increasing transparency will reduce the incentives to work in the shadow economy and strengthen loyalty toward the state in ways that intensifying controls and raising fines will never do.

Political implications—The two pillar strategy

The increasing resistance to existing norms and economic regulations that is reflected in the continuing importance of the shadow economy can be dealt with through a two-pillar strategy of reducing the attractiveness of the exit option (the shadow economy) while strengthening the voice option (voting and participation) [7] (Figure 5). Federal elements have to be strengthened, and instruments of direct democracy, such as referendums and legal initiatives, should be introduced to give citizens more opportunities to participate in rule making and the design of the tax system. Regional commitment and citizen initiatives could signal a wish to keep or regain control. Increased participation will diminish the perception of being subjected to unfair restrictions on personal freedom, thereby boosting tax morale and civic loyalty and reducing the attractiveness of the shadow economy. Acting in accordance with the subsidiarity principle (matters should be handled at the lowest competent level of administration) is economically advisable and more efficient. For the EU, that would mean that European-level benchmarking could be initiated for the exchange of good practice, but implementation of generalized norms should be kept to a minimum at that level.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Version 2 of the article updates the data in the Illustration and Figure 1, and adds a new Figure 3 and accompanying text.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Dominik H. Enste