Elevator pitch

A growing number of firms offer compensation packages that link pay to performance. The aim is to motivate workers to be more efficient while also increasing their attachment to the company, thereby reducing turnover and absenteeism. The effects of performance-related pay on productivity depend on the scheme type and design, with individual incentives showing the largest effect. Governments often offer tax breaks and financial incentives to promote performance-related pay, though their desirability has been questioned due to large deadweight losses involved. The diffusion of remote work will increase the relevance of performance-related pay.

Key findings

Pros

Linking pay to performance is expected to increase worker motivation, effort, and loyalty to the firm.

Pay incentives raise job satisfaction, lower absenteeism and turnover rates, and have a sizable effect on company performance.

Incentive schemes increase wage flexibility and the reallocation of high quality workers to high productivity firms.

The diffusion of remote work may involve a shift from input- to output-based compensation schemes such as performance-related pay.

Digital technologies may improve performance measurement, thus improving the targeting of performance-related pay.

Cons

The effects of performance-related pay schemes differ significantly according to their design and the type of firms.

When pay incentives are ill-designed, the effects can be perverse and counterproductive.

More risk averse workers may be reluctant to accept jobs with performance-related pay.

When performance is difficult to measure, or when employees’ intrinsic motivation is relevant, performance-related pay may generate distorted incentives and have unintended consequences on worker morale.

Linking pay to performance may generate excessive stress and be detrimental to long-term performance.

Author's main message

Performance-related pay can effectively increase firm performance if the type and design of schemes is appropriate. Individual schemes linked to performance have been shown to be associated with higher firm productivity, while group performance-related pay and financial participation generally exhibit smaller effects on performance. Performance-related pay is a relevant policy to improve firm performance and competitiveness, although the adverse effects on work intensification and employees’ physical strain and psychological stress should not be overlooked. Looking forward, new patterns of work-from-home and remote work will increase the relevance of performance-related pay.

Motivation

The principle of linking pay to performance is as old as the practice of sharecropping dating back to the 19th century. Likewise, remunerating workers “by the piece” has long been the rule in the manufacturing industry. Every employer is interested in improving the efficiency and productivity of its workers. Providing an appropriate compensation package which combines a fix-pay component with a variable-pay element, linked to a measure of a firm's performance, can prove effective to motivate workers and increase their attachment to the firm, thereby reducing turnover and absenteeism. Policymakers often encourage the introduction of performance-related pay schemes (also in the public sector) to enhance productivity, increase wage flexibility, and improve companies’ resilience to economic shocks. The effect of incentive pay schemes on productivity has always been a core question in the economic analysis of company performance.

Discussion of pros and cons

The central issue with performance-related pay is whether linking some components of employees’ pay to their individual performance or to the company's performance has a (causal) effect on productivity. Most firms introduce pay for performance systems as part of other changes in management practices and usually after a substantial re-organization of work tasks and procedures. This complicates identification of the effects of pay incentives on labor productivity as compared to other workplace innovations that involve new work organization practices (such as teamwork, employee involvement committees, and total quality management). The introduction of pecuniary rewards can have undesirable effects, crowding out employees’ intrinsic motivation. Most existing studies support the view that performance-related pay is associated with higher employee productivity and better worker–firm match. However, there is considerable variation in the type and design of incentive schemes, as well as the type of firms adopting such schemes. Moreover, the effects of performance-related pay schemes tend to be quite different in the private and public sectors.

Performance pay schemes

Firms often rely on different types of pay incentives, such as individual performance pay, group performance pay, as well as financial participation (e.g. profit-sharing and employee stock ownership).

Individual performance-related pay often takes the form of a bonus, paid when an individual's output meets a given target (e.g. number of pieces or a share of sales), on top of a fixed wage or salary. As a special case, in pure piece-rate systems the entire payment depends on the number of goods produced or with a commission on the number of contracts sold. In other cases, individual performance is based on a performance appraisal scheme or via a subjective assessment of performance by a supervisor. Since subjective measures of performance are often affected by prejudice or favoritism, many firms use a mix of objective and subjective elements.

Work organization in modern production systems often requires workers’ cooperation in achieving output targets. Working in teams is also common, making it difficult to measure individual performance. In such cases, performance-related pay schemes are designed to reward group performance (e.g. a team's success in completing a project, or a department hitting a sales target). Measurement of group performance is likely to be based on a number of indicators, such as output, rejects, and customer satisfaction.

Under financial participation schemes employees have a residual claim over part of the firm's surplus, in the form of profit-sharing (and) or employee share ownership. Profit-sharing schemes link pay to the firm's profit, (and) or other indicators of performance, such as quality or productivity indicators. Performance bonuses are usually paid in cash, though they may also be deferred into savings accounts, or offered in the form of company shares (or share options). Most profit-sharing schemes link bonuses to company or establishment-level profits, while some combine these with other indicators of collective performance such as sales, absenteeism, and quality. Firms often offer free or discounted shares to employees, especially in managerial positions, thereby linking employees’ incomes to the firm's performance in the form of dividends, and in part on the share price. In this way employee share ownership is used to reward employees’ long-term performance and loyalty. Unlike profit-sharing, employee share ownership may involve losses, as well as gains, thus introducing an additional element of risk sharing.

Facts on performance-related pay: Diffusion, incidence, and determinants

In recent decades, the incidence and diffusion of performance-related pay schemes and financial participation has grown both in Europe and the US.

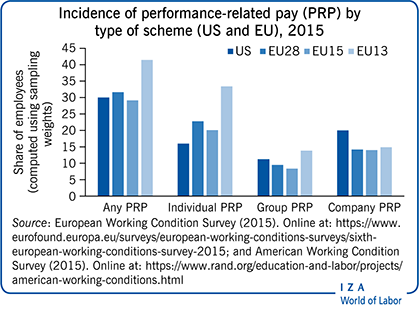

Cross-country patterns show that the incidence and diffusion of performance-related pay can be related to country differences in terms of company size (e.g. often there are mandatory provisions for large firms), regulations in the labor and product markets (e.g. regulation reduces competitive pressures to introduce performance-related pay) and the existence of fiscal incentives (e.g. reduced taxation for variable components of pay). The coverage of different types of performance-related pay schemes in the US and Europe is shown in the Illustration.

Over the past decades, a number of studies for the US have reported that mostly 5–10% of employees had some form of performance-related pay, with wide differences by industry (ranging from 2% in the chemical industry, to 26% in the service sector) and occupation (from 2% in low-skilled blue-collar occupations up to 21% in sales occupations). In the late 2000s, the figures reported in most studies showed a significant increase in the number of firms with some form of performance bonuses, with one in two companies reporting having more than 20% of employees covered by incentive pay and or sharing schemes. Comparable figures for employee coverage, however, show lower incidences of 10–12% for sharing schemes and 2% for ownership schemes, reflecting the fact that in most firms only a small minority of workers receives incentive pay [1].

In Europe, data from the European Working Conditions Survey show that the share of employees whose earnings partly depend on some form of performance-related pay slightly increased between 2005 and 2015 (from 19% to 23%), with a different pattern across incentive schemes, registering the largest increase for group incentives (from 4% to 10%) and company performance schemes (from 9% to 14%). The diffusion of incentive pay is greater in high-skilled jobs, in the private sector, in manufacturing and financial services and, finally, in larger firms; incentive pay is less common in hotels and restaurants and other services industries. Capital market development is also associated with the diffusion of performance-related pay: sharing and ownership schemes are more likely when a larger proportion of companies within a country are listed on the stock exchange or capital markets are more developed. The diffusion of performance-related pay also depends on the structure of collective bargaining, with incentive pay more widespread under company and multilevel collective bargaining, whereas its implementation is limited under national-level collective bargaining [2].

Performance related pay in the public sector

The diffusion of incentive schemes in the public sector is reported to be much lower as compared to the private sector, although growing rapidly in recent years. One explanation may be that incentives in the public sector could simply be “optimally” low, since high-powered incentives (e.g. individual performance-related pay) may induce excessive competition, whereas public services require employees’ cooperation. Another reason is that it is more difficult to measure output in the public sector: teamwork, multiple objectives, multiple principals, and variation in objectives are among the main features that reduce the benefits of performance-related pay. Finally, it is generally argued that public sector employees have higher “intrinsic” motivation and are relatively more risk averse, such that pecuniary incentive and variable pay may even be counter-productive. In 2015 in both the EU and US, around 20% of public sector employees had incentive pay, compared with 35% in the private sector [3].

The economic effects of incentive pay: Theoretical implications

The traditional model of incentive pay is framed as a so-called principal–agent problem, where output depends on costly individual effort [4]. Effort is typically not observable, while output can be observed. Hence, the use of a contingent contract linking pay to output can solve (or mitigate) the agency problem. Under a fixed wage scheme, since effort is costly, the worker would theoretically exert no effort at all. Conversely, if pay is linked to individual performance, such as in a piece-rate contract, the worker will choose effort up to the point where the additional costs associated with a slight increase in effort equal the additional value of greater output and will receive compensation that is proportional to the product of output and unit price. However, when output is only imperfectly measured or when there is an element of noise (e.g. output is only partially correlated with effort), contracts based on output are not likely to produce an optimal incentive pay scheme. In such circumstances, relative performance measures are often used—for example, where output is compared to the average in the firm or past observations.

When performance is measured at a higher level of aggregation (e.g. team or firm level), the contribution of co-workers and their effort also becomes relevant in the design of incentive pay schemes. As the number of workers in a group increases, the relative contribution of each individual to aggregate output decreases (e.g. what economists often call the “1/N problem,” where N is the number of team members). In such cases, a genuine free-riding problem is likely to arise. The empirical evidence shows, however, that group pay incentives are often associated with team workers co-monitoring, suggesting that firms have developed mechanisms to reduce free-riding. Such mechanisms are based on behavioral responses of workers who care about their co-workers (e.g. peer pressure, guilt and shame, and social norms).

Empirical evidence on the impact of incentive pay

Earlier studies on the effects of incentive pay on productivity and profitability primarily used a production function approach and reported a modest positive association. However, since firms that change pay policies often do so for reasons that may be associated with other changes in work organization that may also affect performance, a number of endogeneity and selectivity issues are likely to arise. For example, firms that adopt performance-related pay schemes may do so because they are doing well, or because they have “good management” that might improve results with any type of innovation. The problem in interpreting the results of many existing studies is related to the validity of extrapolating evidence from the firms that have chosen to change their mode of compensation to firms that have not chosen to do so. A new wave of studies has adopted quasi-experimental empirical strategies, where firms’ performance is compared before and after a change in pay regimes, such as a shift from fixed pay to performance-related pay. The literature has distinguished between “individual incentive schemes” (e.g. piece-rates), and “group incentive schemes” (e.g. teamwork, profit-sharing, gain-sharing, and share-ownership).

Individual effort and performance-related pay

A seminal study in the literature examines what happened to the productivity of a US company operating in the car repair industry when fixed hourly rates were replaced by a piece-rate pay regime based on the number of windscreens fitted [5]. The change to a piece-rate pay regime led to a large increase in productivity (44%), half of which was attributable to the “incentive effect” (i.e. workers being more motivated and putting in more effort) and half to the workers’ “sorting effect” (e.g. more productive workers stayed with the firm or joined it while the less productive left). Another important study investigates a reversal in an individual incentive pay scheme, considering a US company operating in the shoe industry that shifted from piece-rate pay to time-rate pay [6]. Productivity measured by monthly average shoes produced per day fell by about 6%. However, since piece-rates required costly monitoring of output, profits increased when moving to time-rate pay despite the decline in labor productivity. The above studies, however, are likely to suffer from confounding factors (unobservable to the analyst) that may affect both the choice of pay system and productivity. A number of studies have tried to overcome this problem by introducing experimental variation in the mode of compensation, that is, by randomly allocating workers to different pay-setting regimes and recording the effect on a number of economic outcomes (effort, productivity, wages, profits, and so on). These studies confirm that productivity is significantly higher under piece-rates compared to other performance-related pay schemes, such as in the case of relative incentives that make workers’ pay negatively related to the average productivity of co-workers. Given their experimental nature, these studies investigated very specific labor markets, such as tree planting, cherry picking, and harvesting, which limits their external validity.

Company performance and financial participation

The early literature on the effects of profit-sharing schemes on productivity and company performance is mainly based on cross-sectional studies highlighting the potential interactions of company incentive schemes (e.g. profit- or gain-sharing) with other practices. However, when group performance schemes are introduced at the same time as a company makes a switch to team-based production, or enacts other organizational or managerial changes, it is difficult to isolate the productivity enhancing effect of company incentive schemes. More recent studies provide more convincing evidence in support of the positive effect that profit-sharing schemes may have on productivity. These studies generally use firm-level panel data or personnel data from case studies using a quasi-experimental methodology to compare the effects of the change in pay schemes. One example is the case of a garment plant in the US, which shifted from individual piece-rate for specific tasks to group incentive pay for each entire garment, introducing at the same time autonomous team working. Group performance pay resulted in an increase in productivity of about 18%, part of which was due to high-ability workers sorting into team production, and the rest due to greater effort induced by group performance pay. Another example is that of a multinational distributor of heating and plumbing products that introduced group performance pay in one division prior to extending it to other divisions in the firm. Initially, the company provided a bonus based on branch-level profits that was allocated to staff at the branch manager's discretion. The new bonus system was based on multiple targets, was non-discretionary, and provided managers with a range of performance indicators. The new system only succeeded when it was implemented by branch managers with at least ten years’ experience, suggesting that implementation can be as important as design for pay incentive schemes. While firm-wide schemes in large companies are more likely to suffer from a low-powered incentive problem, there is evidence that peer effects can reduce free-riding. Finally, one study examines the productivity effects associated with the introduction of an incentive scheme in a large US airline. The pay scheme was based on a bonus linked to firm-wide targets. The main findings suggest that the bonus scheme raised performance (e.g. improvements in on-time departures) mainly through co-worker monitoring within each team.

A study on Italy investigates the causal effect of a switch from fixed wages to group performance-related pay on firm productivity, using panel data from an entire industry and exploiting a reform in the structure of collective bargaining triggered by a so-called Social Pact, that is, a policy contract between the government, national employers’ associations, and trade unions [7]. The main results show that an increase in firms’ probability of adoption of collective performance-related pay led to productivity gains up to 5%. The effect on productivity is shown to vary substantially by firm size, industry, and union density. Both the size of the performance-related bonus and the design of the scheme—in terms of number and type of parameters used—are also found to be important features for firm productivity.

In general, evidence from most of the above studies confirms that the design of bonuses is key, especially in the case of group performance-related pay schemes. Group incentive schemes may actually be more effective in boosting firm productivity when profitability is used as a performance measure. Conversely, marginal changes to existing incentive schemes (such as adding a quality improvement metric to an existing bonus) yield no additional productivity gain [8]. Furthermore, few studies highlight the risks of lower product quality, longer hours, and less equipment maintenance associated with group incentives based only on quantity targets [9], [10].

The impact of share ownership schemes and employee stock options on performance is more difficult to assess. Evidence on the operation of share schemes and their impact on firm performance mainly comes from studies based on firms that run share schemes in the US (the so-called “shared capitalism” firms) [11]. Results show that shared capitalism is associated with better firm performance, partly because share schemes complemented other high-involvement human resources policies, and partly because the diffusion of teamwork facilitated workers’ co-monitoring, thereby reducing free-riding behavior. Furthermore, firms that use shared capitalism modes of compensation allow greater employee involvement in decisions and greater information sharing than other firms [12]. A recent study on a multinational firm that adopts Employee Share Purchase Plans as a core component of its compensation policy shows that workers joining these plans have lower turnover intentions and respond to the group incentive of ownership with greater work effort, longer hours, and lower absence rates [13].

The unintended effects of performance-related pay

Intrinsic versus extrinsic motivation

Some organizational psychologists contest the efficacy of extrinsic incentives, such as pay for performance, as in some settings it may displace workers’ intrinsic motivation. While extrinsic motivation refers to motivation that comes from explicit incentives (e.g. pecuniary or future promotions), intrinsic motivation is a personal trait characterizing individual preferences. In other words, providing incentives based on extrinsic motivation may offset an inner willingness to work or perform certain tasks and actually reduce output. The usual example brought forward to highlight some of the unintended effects of performance-related pay is that of public sector workers and non-profit-oriented firms, where intrinsic motivation is expected to be highest.

Pay variability and risk aversion

An often neglected feature of performance-related pay schemes is the risk component that is embedded in a contract with variable pay. Assuming that firms are risk neutral while workers are risk averse, the introduction of a performance-related pay scheme involves a trade-off between efficiency and insurance. In a standard fixed-wage scheme, workers are fully insured and exert low effort, thus reducing efficiency. In a performance-related pay scheme, workers elicit higher effort but also bear part of the risk associated with output variability, for the level of insurance now depends on the ratio of variable to fix pay (e.g. under piece-rate schemes there is no insurance). In share ownership schemes employees own shares of the firm in which they work, hence their income is affected by firm performance (as dividends), and their wealth depends on the share price. The risk involved in share fluctuations is added to the employment risk, which may expose employees to an excessive level of risk, with adverse effects on their morale.

Performance measurement and competition versus cooperation

When output or performance are difficult to measure, performance-related pay schemes may have unintended consequences for worker morale. When output is difficult to measure due to teamwork, multitasking, or multiple objectives, the benefits of incentive pay may be diminished and employers (and unions) may become quite conservative in defining pay schemes. Also, in contexts where teamwork and employee cooperation are important, the introduction of high-powered incentives (such as individual performance-related pay) may induce excessive competition and reduce employee willingness to cooperate. In general, social connections between co-workers within the firm significantly influence productivity effects of different performance-related pay schemes.

Performance-related pay, work intensification, and job stress

While much attention has been paid to the positive effects of incentive pay schemes on employee effort, motivation, and turnover, researchers have only recently investigated the possibility that performance-related pay may lead to work intensification and induce employees to over-exert themselves with excessive strain and psychological stress. Thus, while increased work pressure may or may not improve performance in the short term, it may also have detrimental effects on employees’ long-term performance through its effects on health. If health and safety at work are merit goods, the productivity gains associated with incentive schemes might not be unambiguously welfare-improving when associated with higher psychological stress and poorer health.

New challenges: Incentive pay in the era of remote work arrangements

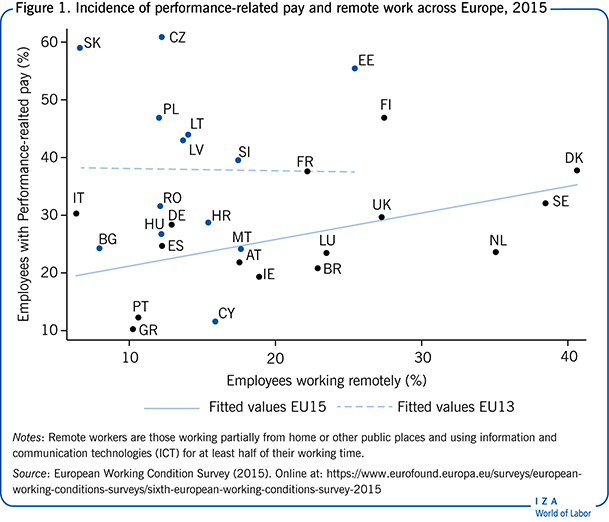

In recent years, and particularly during the Covid-19 pandemic, workplace organization for many people has changed significantly, allowing individuals to split time between the workplace, home, and other non-traditional settings. This flexibility has affected not only the modes of work, both in terms of autonomy and involvement, but also compensation policies, with a shift from an input-based compensation system (e.g. skills, hours of work, overtime) to a performance-based reward system (e.g. productivity, profitability, output target, overall performance). Figure 1 shows that, even before the Covid-19 pandemic, in the EU15 the share of employees who used to work remotely was positively associated with the diffusion of performance-related pay. On the contrary, there is not a clear-cut pattern across eastern member states of the EU (EU13), although they register an average higher share of workers receiving performance-related pay as part of their compensation compared with EU15 member states. Progressive increases in remote work are thus expected to foster the diffusion of management by objectives and of performance-related pay, while also raising concerns about work intensification and mental health problems. The current debate on the so-called “right to disconnect” (i.e. the right for workers to switch off their digital tools outside their working time) is an indication of the relevance of these threats.

Limitations and gaps

A major drawback with existing empirical studies is the uncertainty regarding the external validity and generalizability of findings to other firms, industries, or countries. For example, several studies use data on small (and selected) samples of firms or from inside a specific firm. While results from such studies are important to shed light on the mechanisms through which pay incentives influence employee behavior and firm performance, care should be taken in drawing general conclusions or expecting the same effects to occur across time, place, and different environments. The additional spillover effects on employee health add further complexity to the overall picture, as the “healthy worker effect” is likely to confound evidence from empirical studies. Moreover, firms that change their mode of pay generally do it because the firm is not efficient in terms of performance or profitability, such that other changes in work organization or management style are often introduced along with performance-related pay, thereby confounding the identification of a “clean” effect on firm performance.

Summary and policy advice

Performance-related pay schemes represent an effective way to increase firm performance, provided that the type and design of schemes are appropriate. Compensation packages with a performance-related pay component are associated, at the company level, with higher motivation and reduced turnover and absenteeism. Moreover, the diffusion of incentive pay schemes is associated with better performance, higher wage flexibility, and enhanced resilience to economic shocks. In particular, individual pay schemes generally exhibit large increases in productivity, while the effects of financial participation are often smaller due to the low power of group incentives.

The empirical evidence from recent studies shows that companies with performance-related pay schemes have better (or no worse) economic outcomes than other firms. Given this evidence, it is somewhat puzzling that performance-related pay is not more widely diffused across firms. Part of the explanation may lie in the variation of the effects, as what works in one setting may not work in another. Such uncertainty may increase governments’ reluctance to intervene by subsidizing or mandating the introduction of performance-related pay or financial participation. Thus, the case for government intervention, in terms of what type of performance-related schemes are desirable and whether these should be subsidized, is to be evaluated with care, as large deadweight losses (due, for example, to firms getting public subsidies to adopt performance-related pay schemes that they would have adopted anyway) may be involved. Progressive increases in remote work and the shift from an input-based to a performance-based compensation system opens new challenges and opportunities for companies’ pay policies. Finally, the possibility that performance-related pay may lead to work intensification and induce excessive strain and psychological stress should not be underestimated.

Acknowledgments

The authors thank an anonymous referee and the IZA World of Labor editors for comments and helpful suggestions. Previous work of the authors contains a number of references used in this article [3], [7]. Version 2 of the article significantly updates the text and references, includes new figures, and adds a discussion on remote work since the Covid-19 pandemic.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Claudio Lucifora and Federica Origo