Elevator pitch

Inheriting money can be a problem since the new wealth might sap the beneficiaries’ incentive to work. Or it could do the opposite, by facilitating entrepreneurship among those whose ambition to start a business had been stymied by a lack of cash. Recent evidence suggests inheritance-related work disincentives can be strong—unexpected inheritances can matter a lot for early retirement, for example. But where inheritances facilitate self-employment, as some evidence suggests, the labor supply might increase.

Key findings

Pros

Inheritances encourage entrepreneurship by easing the liquidity constraints on starting a business.

Labor supply could be stimulated by inheritances, since the self-employed tend to work more hours than wage and salary workers do.

The larger the inheritance, the more viable the enterprise.

Cons

Large inheritances discourage labor force participation among workers who are in the prime of their working life.

Inheritances lead older workers to retire earlier than planned.

If inheritances are unexpected, they increase the chances of retiring.

Inheritances are associated with reduced work hours, but the estimated effects show only a small reduction.

Author's main message

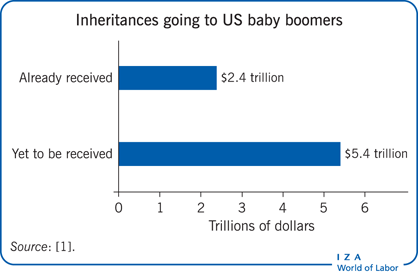

Baby boomers in the US are set to receive an enormous amount of wealth through bequests, totaling US$5.4 trillion in inheritances over their lifetimes. How such inheritances might affect the incentives to work has implications for tax policy. An estate tax could promote work among wage and salary workers. But these inheritances could also boost entrepreneurship and allow business start-ups by reducing liquidity constraints. An estate tax could discourage this entrepreneurship. Such prospects might point to differential estate tax treatment for wage workers and for the prospective self-employed.

Motivation

Industrialist Andrew Carnegie famously voiced misgivings about the effects of inheritances on work incentives (see The “Carnegie conjecture”) [2]. Prominent business magnates like Bill Gates and Warren Buffett have echoed his concerns. Was Carnegie right? Do inheritances discourage work? Are Carnegie’s concerns relevant for the broader reaches of the distribution of income and wealth? The connection between inheritance and labor supply is of interest to economists and policymakers for several reasons.

Knowing how inheritances affect labor supply can provide a window into the work incentives associated with other forms of windfall wealth, such as that accompanying some tax and pension reforms. Compared with, say, life-cycle wealth, which is likely confounded with attributes such as patience and risk aversion, an unanticipated inheritance likely does a better job of mimicking the exogenous wealth changes that policy can bring about [3]. Inheritances also increase inequality in income distribution, though by how much depends again on labor supply responses.

Estate tax policy

If there is a tax on labor income, inheritance-induced reductions of the labor supply can generate negative externalities [4]. The presence of an income tax implies an existing distortion in the form of depressed labor effort. Further reductions in labor supply from the receipt of inheritances entail revenue losses for the treasury. The private labor–leisure choices of inheritors are distorted since they do not account for these losses. The estate tax can redress this externality. The less beneficiaries get to keep, the stronger their work incentive. Much of the ongoing debate about the estate tax centers on this idea. Further, the tax itself has varied tremendously in the past decade or so. As recently as 2001 estates above US$675,000 were subject to a marginal tax rate of up to 55%. By 2010 the estate tax was gone—only to be reinstated the following year.

Inequality

Inheritances affect inequality, and how much they affect it depends in part on the extent to which inheritances reduce labor supply. The extent to which they increase the dispersion of lifetime resources is likely reduced by labor supply responses, which narrow the distribution of earnings.

The looming bequest boom

Even with post-financial-crisis adjustments, the baby-boom generation is expected to receive an enormous infusion of wealth through bequests. It is estimated that baby boomers have already inherited US$2.4 trillion, and they are projected to receive US$5.2 trillion more [1]. A lot of uncertainty surrounds prospective inheritances because of vagaries concerning parental lifespan, medical costs, asset value fluctuations, and the like. Uncertainty increases the fraction of inheritance dollars that are unanticipated, which likely magnifies any inheritance-related trends in labor supply.

Discussion of pros and cons

Large inheritances discourage labor force participation

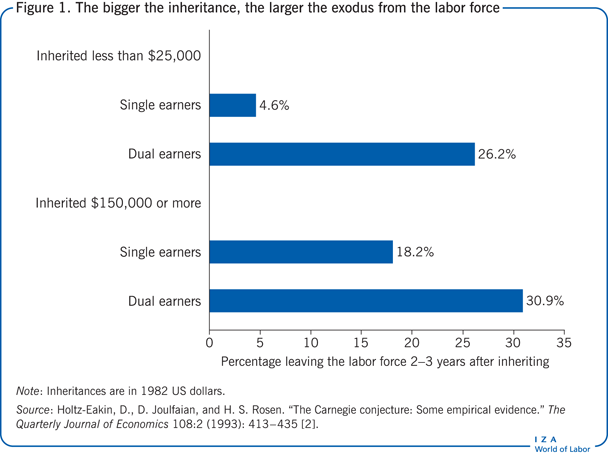

Among the beneficiaries of wealthy decedents in the US, receiving a substantial inheritance increases the chances that a worker will exit the labor force [2]. (Most of the discussion here pertains to the US, where the labor supply–bequest nexus has been studied the most.) Information from estate tax returns (required for estates exceeding US$300,000 in 1982) matched with income tax returns of decedents and their beneficiaries showed that 18.2% of single workers who inherited US$150,000 or more (in 1982 dollars) exited the labor force two to three years later. In contrast, just 4.6% of those inheriting US$25,000 or less did so.

Findings from these cross-tabulations are mirrored in calculations from joint returns. For example, among dual-earner households inheriting US$150,000 or more, 30.9% became single-earner households after two to three years. The equivalent figure for those inheriting US$25,000 or less is 26.2% (see Figure 1). (Controlling for characteristics such as age and pre-inheritance earnings produced similar results.)

Inheritances matter little for hours worked

The Panel Study of Income Dynamics provides evidence on the effect of inheritances on hours worked, showing only a small (but usually precisely measured) reduction [5]. A representative specification predicts that annual hours worked by men would fall just 14 hours from inheriting US$125,000 (2013 dollars). Much larger inheritances from estate tax data produced similar results.

In a life-cycle approach to labor supply, exactly when inheritances add to lifetime wealth, or whether they are anticipated or unexpected, matters little, since nearly all estimated effects are small [5].

Life-cycle labor supply

Although life-cycle considerations turn out not to be quite so crucial, they could play a part in labor supply adjustments immediately following an inheritance to infer labor supply effects. This might be problematic because the two need not closely coincide. Life-cycle effects could be downward biased if labor supply adjustments do not coincide with inheritances [2]. Inheriting mid-career could lead to subsequent early retirement with no effect on current work, for example. Conversely, the prospect of an inheritance later in life could prompt work reductions now. In either case, labor force participation just after inheriting would be unchanged despite the disincentive to work.

Indeed, pre-inheritance labor force participation is inversely related to the size of the inheritance, and this is consistent with the life-cycle labor supply idea [2].

Inheritance and retirement

The relationship between inheritances and retirement is strong, particularly if the inheritance is unexpected [3]. Inheritances tend to be concentrated at or near retirement age, so it is natural to ask how inheriting might affect retirement. One study restricts attention to workers younger than 62 [2]. Another considers retirement behavior, but the small sample sizes produce mixed results [5]. Filling that gap is a third study using the Health and Retirement Survey to investigate the connection between inheritances and retirement [3]. The survey is well suited for this kind of study:

The sample consists of respondents approaching or in their retirement years—aged 52–62 in 1994, followed at two-year intervals until 2002.

About 20% of the respondents inherited during this time. The median inheritance was US$37,500 in 2013 dollars.

The panel data make it possible to measure labor force exits over a long time interval.

In addition to actual inheritances, the Health and Retirement Survey contains sophisticated measures of expected inheritances.

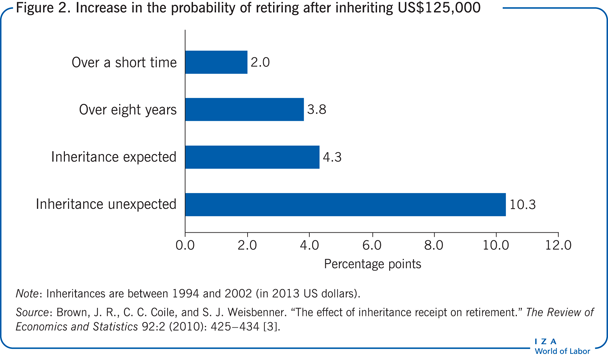

The baseline specification is comparable to that of the first study mentioned and produces similar results—an additional US$125,000 in inherited wealth (in 2013 dollars) is associated with about a 2 percentage point increase in the probability of retiring [3]. Addressing both the time frame of the labor supply adjustment and the expectations of an inheritance produces a stronger labor supply effect.

What about the relationship between having inherited between 1994 and 2002 and having retired over that eight-year period? The longer time frame is more consistent with the life-cycle model, in which labor supply reductions need not coincide with when an inheritance is received. An additional US$125,000 in inheritance is associated with a 3.8 percentage point increase in the probability of retiring [3].

Next we distinguish between expected and actual inheritances. Expected inheritances predict actual ones, but the relationship is far from perfect, and surprises are common. Of those who said they would never inherit, more than 10% eventually did. And of those who were certain they would inherit, 60% did not. Further, actual inheritances often diverged a great deal from what respondents expected [3].

Now consider the relationship between both expected and unexpected inheritances on the propensity to retire earlier than expected. An unexpected inheritance worth $125,000 was associated with a 10.3-percentage-point increase in the chances of early retirement. The comparable figure for an expected inheritance was only 4.3 percentage points (see Figure 2). So, inheritances can indeed hasten retirement.

Inheritance, liquidity constraints, and self-employment

The connection between inheritance and labor supply does not have to be negative. Inheriting could, in principle, stimulate labor supply by encouraging self-employment. Larger inheritances increase the chances of a recipient initiating self-employment. And there is evidence that transitions to self-employment entail increased work hours [6], [7].

Inherited money matters for starting a business if it helps circumvent liquidity constraints—that is, the barriers to conventional capital markets that would otherwise prevent someone from raising funds for starting a business.

How is the size of an inheritance received in 1982−1983 associated with the transition into self-employment between 1981 and 1985? Studies draw inheritance information from similar tax records [2]. Self-employment information is taken from beneficiary income tax returns, which are matched to estate tax returns.

The larger the inheritance, the more likely a beneficiary becomes self-employed between 1981 and 1985 [6]. A US$100,000 inheritance (in 1982 dollars) increases the probability of transition into self-employment by 3.3 percentage points. To put this figure into perspective: about one-fifth of wage and salary workers in the sample switched to self-employment between 1981 and 1985. So the estimated inheritance effect is more than one-sixth of the baseline transition rate.

Keep in mind that the sample comprises beneficiaries of wealthy decedents. The estate tax returns represent the uppermost 2.5% of the wealth distribution. Their beneficiaries likewise have higher-than-average income and wealth. Further, there are more self-employed in the sample than in the population at large—16% of the baseline sample versus 9% reported in 1980 census data.

Accordingly, it is less likely that liquidity constraints would matter as much for this sample as for an average household, which stacks the cards against the liquidity/entrepreneurship hypothesis and makes the inheritance results all the more striking. Further, the estimated inheritance effect is stronger for those who have little in liquid assets, which is consistent with the liquidity constraint hypothesis [6]. Despite this evidence, controversy remains over whether the inheritance–entrepreneurship connection is solely a matter of liquidity constraints. For instance, both past and future inheritances are positively predictive of starting a business, but future inheritances are unlikely to have much to do with liquidity constraints [8].

Self-employment and hours of work

Those for whom inheritance facilitated self-employment might indeed experience an increase in hours worked, considering recent evidence on transitions into self-employment. After controlling for standard determinants of labor supply, annual hours worked increase about 4% among those switching from wage-salary employment to self-employment [7]. The result is noteworthy for understanding the connection between inheritance and labor supply, because it implies that the results in the previous section—whereby inheritances encourage self-employment—could partially offset the negative labor supply effects of inheritances discussed at the outset.

The innovation is to pay attention to incorporation [7]. The self-employed who incorporate earn much more, and work more hours, than those who do not. (Indeed, it would be worthwhile to investigate—along the lines of [6]—the propensity for inheritance to facilitate incorporated self-employment.)

In light of these findings, it is reasonable to conclude that, to the extent inheritances encourage self-employment, they also boost labor supply.

Entrepreneurial survival

In addition to encouraging new sole proprietorships, inheritance money can help them survive. Indeed, inheriting a substantial amount is associated with an increase in the probability of remaining self-employed [9].

Consider the relationship between inheritances received in 1982–1983 and the probability for sole proprietors in 1981 to still be self-employed in 1985. The rate at which these enterprises went under is large—28% of the sole proprietorships sampled in 1981 no longer existed in 1985. But a substantial increase in the inheritance received (US$150,000 in 1985 dollars) is associated with a 1.3 percentage point increase in the probability of surviving as a sole proprietor from 1981 to 1985 [9].

Large inheritances also predict more profitable enterprises. Inheriting US$150,000 more is associated with 20% larger revenues (US$94,000 versus US$79,000) [9].

Limitations and gaps

More attention should be given to the labor supply implications of caregiving when considering the work incentives of inheritances. The emergence of innovative Health and Retirement Survey-style data sets for a variety of countries offers tremendous potential for learning more about inheritance and labor supply behavior. The existing literature suffers from a lack of studies across countries—much could be learned from exploiting international variation in tax treatment of inheritances and labor market conditions.

There are many reasons to doubt that inheritances can be treated as exogenous

The case for exogeneity of inheritances is far from airtight. A central premise of most leading models of private giving is that donors respond to the characteristics of recipients, including their income. One might imagine, for example, endogenously determined bequests that compensate for recipients’ labor market-related shortfalls. Alternatively, strategic considerations might motivate adult children to work less in order to give more care and attention to their parents. In either case—and others too—the bequest will depend on the potential recipients’ characteristics, including labor supply.

The case for liquidity constraints is also far from settled

The suggestion that inheritances provide needed liquidity for fledgling businesses could be premature [8]. If it turns out that liquidity matters little for self-employment, the case for increased labor supply through inheritance and self-employment is weakened.

Indeed, wealth appears to matter little for entrepreneurship—there is little relation between wealth and self-employment, except for the wealthiest 5% of households. And the timing of inheritances appears irrelevant for entry into self-employment [8]. Future inheritances are superfluous for the liquidity story, since tomorrow’s wealth does little to alleviate today’s liquidity constraints. At minimum, there must be more to the inheritance−self-employment connection than liquidity alone. Imagine, for example, that parents who bequeath are more likely to inculcate preferences for entrepreneurship in their children. Any number of confounding forces could be at work, such as skills or even the effects of wealth [8].

Little attention to caregiving

Caregiving provided by adult children to disabled elderly parents can affect both labor supply and inheritances. It is not unreasonable to imagine that caregiving might prompt reductions in labor supply that occur around the time an inheritance is received. Patterns of labor supply and inheritance might suggest that the Carnegie conjecture is at work when in truth the story could be far more complex.

Indeed, since caregivers tend to be women, it would be useful to address gender effects in the connection between labor supply and inheritance. As a minimum, we would want to know how much labor supply is affected by caregiving before making a connection between inheritance and market labor.

A lack of international evidence

The literature on inheritance and labor supply is small, and there are few studies for countries other than the US. One exception uses data from the Swedish Tax Register and finds that five years after an inheritance, labor income is reduced by about 7% of the value of the inheritance—suggesting a significant and long-lasting association between inheritance and labor supply [10]. Much more evidence is needed from around the world.

Taking the longer view

The foregoing discussion is motivated by the experience of the baby boom in the US and draws from comparatively recent evidence. Yet the time period covered may well be anomalous. Inheritances were a larger source of wealth, and likely a more influential force in economic and social life, before the 20th century. And economists who study inheritances across the broad sweep of history have argued that they may regain their earlier prominence.

The argument is simple. In times of fast productivity growth, lifetime resources of children tend to outpace those of parents, so that inherited wealth matters comparatively less than self-made wealth. When growth is slow—such as with traditional agriculture, say—inherited wealth matters much more, as when the family farm is passed from one generation to the next. The same argument would apply to an industrialized economy. By increasing the resources of older relative to younger generations, slow growth raises the importance of inheritances.

If we have entered an era of slow productivity growth for the long term, inheritances could well take on heightened influence for all sorts of economic behavior, including labor supply.

Summary and policy advice

Baby boomers are set to inherit US$5.4 trillion over their lifetimes. Inheritance-related work reductions can add to existing distortions from taxes on labor income by generating losses in tax revenue. By contrast, an increase in the estate tax could generate welfare gains by discouraging these work reductions. The issue is nuanced, however, because inheritances might stimulate labor supply by increasing the liquidity and facilitating the self-employment of inheritors.

Large inheritances can reduce the labor force participation of prime-aged workers and encourage older workers to retire early. And if those inheritances are unexpected, they increase the chances of retiring even more.

Inheritances can also encourage entrepreneurship by easing the liquidity constraints on starting a business. That could stimulate the supply of labor since the self-employed tend to work longer hours than wage and salary workers. It could also provide more work opportunities as the new enterprises hire workers on salary or contract. And the larger the inheritance, the more likely the enterprise is to survive. But whether inheritances and liquidity indeed matter for self-employment is an unsettled issue in need of further study.

Given the possible prospects of the boom in inheritances for baby boomers, policymakers might consider differential treatment for wage workers and for prospective self-employed entrepreneurs. At the very least, they should understand better how the inheritance might affect the supply of labor.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Donald Cox

The “Carnegie conjecture”

Holtz-Eakin, D., D. Joulfaian, and H. S. Rosen. “The Carnegie conjecture: Some empirical evidence.” The Quarterly Journal of Economics 108:2 (1993): 413–435.