Elevator pitch

The main purpose of minimum pension benefit programs and old-age social assistance programs is to guarantee a minimum standard of living after retirement and thus to alleviate poverty in old age. In many developing and developed countries, the minimum pension program is a key welfare program and a major influence on the retirement decisions of low-income workers and workers with erratic work histories. The design of many minimum pension programs tends to create strong incentives for low-income workers to retire as soon as they become eligible for the program, which is often earlier than the normal retirement age.

Key findings

Pros

Minimum pensions help low-income workers achieve a minimum standard of living in old age and thus reduce poverty.

Minimum pensions transfer income from people with high incomes to those with low incomes.

The incentive effect of minimum pension programs at the normal retirement age is in general moderate.

Cons

Minimum pensions fundamentally alter the work incentives of low-wage earners.

The influence of minimum pension programs on labor supply peaks at the early retirement age, thus reducing the labor supply of eligible workers.

Noncontributory social assistance benefits in old age also lower the work incentives of older workers.

Minimum pensions lead to peaks in early retirement as well as in normal-age retirements.

Author's main message

Minimum pensions are useful for reducing poverty in old age, but they can cause substantial distortions in the incentives to work (and to contribute to the system) as individuals age. When benefits are available at the early retirement age, the incentive effects can be substantial. By encouraging early retirement, such programs reduce the labor supply of workers approaching retirement age. The size of the effect depends on both eligibility conditions and the generosity of the minimum pension compared with the average wage. However, when minimum pension benefits are not available until after normal retirement age, they tend to have little incentive effect on retirement decisions.

Motivation

The minimum pension, a vital part of the welfare program in many countries, is a key influence on the retirement decisions of low-income workers and workers with intermittent employment histories. While the main purpose of minimum pension benefits programs in developed countries is to guarantee a minimum standard of living after retirement, in many developing countries its main purpose is to alleviate poverty, as demonstrated by a simulation analysis of the introduction of a minimum pension in 18 Latin American countries [2].

However, a minimum pension can have undesirable indirect effects, mainly by reducing or removing incentives to keep working and to save, thereby reducing wealth accumulation. In general, contributory minimum pensions whose benefits are available only after the normal retirement age have little incentive effect on low-income workers [3]. But contributory minimum pension benefits that are available at early retirement age can have strong incentive effects on the transitions to retirement of both employed and unemployed workers [1], [4]. The strength of the effect depends on both the eligibility conditions and the generosity of the guaranteed minimum pension relative to the average wage. Recent research for Ukraine found large reductions in the labor supply following a tripling of the minimum pension benefit.

Discussion of pros and cons

Analysis of the effect of guaranteed minimum pensions on retirement incentives has taken two main approaches: studies of implicit incentives [5] and dynamic models of conditional consumer decisions in a given economic environment [6]. The first approach often involves the estimation of reduced-form models of retirement, which embed the minimum pension benefit in the calculus of implicit incentives to retire. The second approach involves simulations and estimations of structural models of retirement, typically in a life-cycle setting, in which an individual maximizes consumption and income subject to an intertemporal budget constraint. The optimal taxation literature provides a complementary perspective on this issue in studies focused on income taxes [7] and social security taxes [8].

Types of minimum pension benefits

There are basically two ways in which countries provide income to enable citizens to maintain a minimum standard of living after they retire from the workforce: noncontributory minimum pensions or social assistance minimum benefits, and contributory minimum pensions [4].

Two main factors affect noncontributory minimum pensions or social assistance minimum benefits: age, which together with an income threshold determines eligibility, and generosity relative to the average wage/average standard of living, usually related to a predefined poverty level and means tested. Many Organisation for Economic Co-operation and Development (OECD) countries provide only noncontributory minimum pension benefits, which are typically available beginning at the normal retirement age. Often, basic pensions are residency tested, as in the Netherlands and New Zealand. Canada, Denmark, and Iceland combine basic and means-tested benefits, while Austria, Finland, Germany, Italy, and the US (Supplemental Security Income) offer only means-tested schemes in this category of benefits, including social assistance.

Three factors affect contributory minimum pensions: age, generosity of benefits relative to the average wage, and number of years of contributions. Eligibility is generally determined by a worker’s age and years of contributions, while the level of benefits is typically a discretionary government decision, though the level often increases with age and with the number of years of contributions. In some cases, the minimum benefit is means tested.

The simplest type of contributory pension is the flat minimum pension, which provides a basic benefit amount irrespectively of the number of years of contribution, provided the minimum retirement age criterion is met. In some countries, the minimum benefit is related to the flat-rate pension. Other cases are more complex. For example, in Belgium people are eligible for the minimum pension after 45 years of contributions regardless of their age. In France, people are eligible for the full benefit after 41 years of contributions or when they reach the retirement age of 65. In Luxembourg, people need to contribute for 40 years to receive the full minimum pension. Both France and Luxembourg reduce the benefit amount proportionally for fewer years of contributions. Chile introduced a funded minimum pension system, the Garantia Estatal, in 2008 to complement the private pension system. Benefits in the minimum pension program are determined by gender, age, and years of contributions. In Spain, people are eligible for the minimum pension when they reach the early retirement age of 61 and have contributed for at least 15 years; the benefit level increases at the normal retirement age of 65.

Among developing countries, China and Peru also require 15 years of contributions. Mexico links eligibility to the number of weeks of contributions. A worker must contribute to the program for 900 weeks to be eligible for 50% of the minimum pension. There is a 7% increment for each additional 50 weeks of contributions until full eligibility is reached (1,250 weeks of contributions). In Brazil, a very generous country for the (poor) elderly, all pensions must exceed the minimum wage. In Argentina, the minimum contributory pension has three components: the basic old-age pension, unrelated to contributions; a contributory pension; and additional public and private pensions. In Bolivia, everyone who has contributed is eligible for the solidarity pension, which is calculated as the difference between a benefit formula (contributions plus accrued interest) and a legally defined threshold corresponding to the individual’s number of years of contributions. The benefit increases incrementally from 10 years to 35 years of contributions, up to a maximum. Key issues in developing countries are the relationship between contributory and noncontributory pensions and the incentives to contribute to the system. Brazil is an extreme case in which contributory and noncontributory pensions are identical.

The average minimum pension standard in OECD countries is 25% of the average wage, but it varies considerably across countries. The minimum pension benefit is as low as 3% of average earnings in Korea and as high as almost 39% in New Zealand. Coverage also varies considerably. While average coverage of the retired population is 30%, coverage ranges from less than 2% in the Czech Republic, Germany, and Slovakia to more than 75% in Australia, Greece, and Portugal.

The effect of minimum pensions in a life-cycle model

To explore the effect of a minimum pension program on an individual’s labor market decisions, consider an example (an extension of [9]) in which an individual’s lifespan takes random values between an initial planning age (typically 20) and a maximum lifespan. The precise age at death is unknown. Life-cycle analysis presents two clearly defined stages separated by age at retirement. Before retirement, gross labor income depends on the individual’s hours worked and the wage rate. After retirement, the individual stops working and earns no wages.

Now consider an institutional environment that includes a basic pension system: individuals contribute a fixed proportion of their wages while they are economically active, which entitles them to a gross pension, b, throughout the retirement stage of the life-cycle. The pension is a defined-benefit system, and b is assumed to be positively related to the pension age (the benefit level is subject to age penalties and to wages earned before retirement). In addition to mandated contribution to the public pension system (social security savings), individuals can voluntarily save part of their income by accumulating a financial asset. For simplicity, the analysis considers this a riskless asset, paying an instantaneous return, r. (Portfolio choices are discussed later in the paper.)

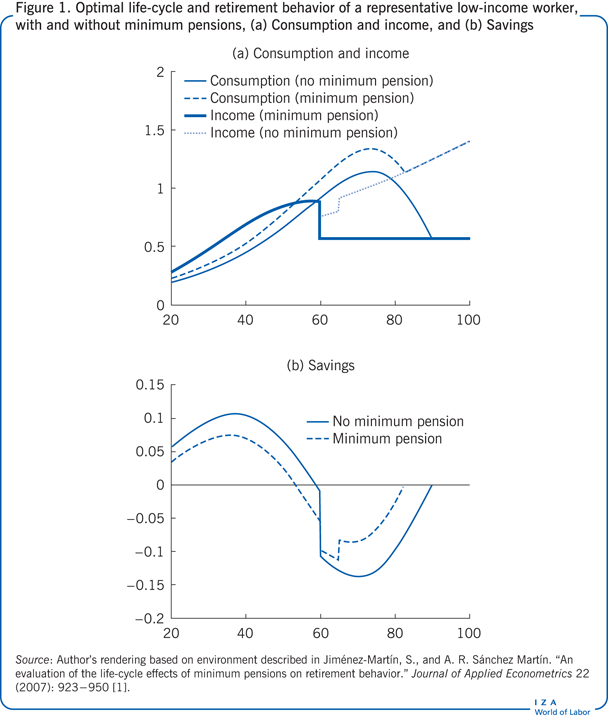

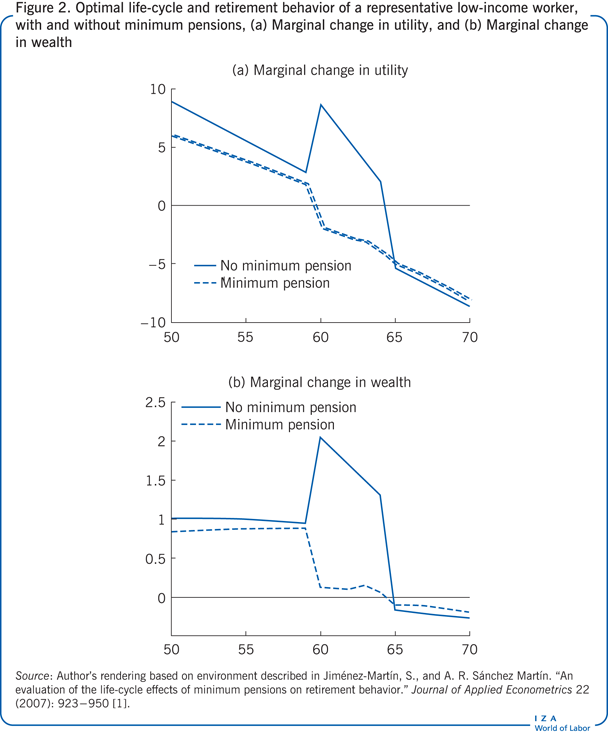

Individual choices (consumption, savings, working hours, and retirement age) are obtained from the maximization of a standard, time-separable, life-cycle utility function. For simplicity, the utility function is additively separable in consumption and leisure. A visual interpretation of the solution of the individual choice problem for a representative low-income earner, in the institutional environment described in [1], is shown in Figure 1 and Figure 2. The figures show optimal life-cycle behavior and the key determinants of optimal retirement with and without a minimum pension.

Without a minimum pension, the following choices prevail. Real labor income (net of payroll taxes) increases until the representative wage earner reaches their mid-50s, drops moderately until retirement age, and then falls to about 70% of the wages at retirement age. After retirement, the flow of pensions keeps income constant in real terms. Consumption is smoother than income, showing a moderately increasing pattern with age until the mid-70s. Savings are positive before retirement, negative after retirement, and equal to zero during the last part of the life-cycle, assuming constraints on borrowing. Retirement depends critically on the change in life-cycle income with age.

Introducing a minimum pension changes these patterns in fundamental ways. First, a minimum pension redistributes income from high- to low-income workers. This is achieved by topping up pension benefits for individuals whose pension is below the guaranteed minimum (thick blue line in Figure 1). In this way, the pension system generates a more egalitarian distribution of income across society. Although somewhat less visibly, the program also reduces the welfare of individuals whose taxes finance this extra generosity (typically through mandated social security system contributions that are larger than needed for their own pensions).

Redistribution is the most visible consequence of a minimum pension program, but there are other, more subtle ones. A minimum pension program changes the economic behavior of those who anticipate participating in it. Most of the changes derive from the increase in total life-cycle wealth. That increase boosts consumption, while a reduction in the marginal value of lifetime wealth and the severed link between current work and future pensions encourage fewer working hours. As a result, savings can fall substantially before retirement (Figure 1), appreciably reducing the accumulation of private assets. Depending on the program’s coverage, this behavior can affect asset prices and financial markets. Working in the other direction is the increase in income after retirement that leads to slower dissaving.

Minimum pensions have a particularly strong impact on the retirement decision, as mentioned, because of the lower marginal value of lifetime wealth and the severed link between current contributions and future pensions. The key to understanding this mechanism is that the minimum pension eliminates the incentive to work in order to ensure a future pension, making it optimal for most low-income workers to retire at the earliest age possible. The magnitude of this substitution effect is evident in Figure 2. Minimum pensions also have an income effect, as they effectively increase an individual’s life-cycle wealth and so reduce the marginal value of wealth. Figure 2 shows the overall impact on the marginal value of wealth of a representative low-income worker.

These effects help explain the likely impact of recent reforms in developing countries aimed at reducing the generosity of contributory pensions while maintaining the generosity of the guaranteed minimum pension. Jointly, these two policies imply a substantial increase in the incentive to retire as soon as the minimum pension becomes available, thereby reducing the labor supply of older workers and likely reducing the implicit fiscal savings.

Minimum pensions and risk taking

Minimum pensions can also influence portfolio choices—and more broadly, any risk-taking behavior. It is intuitive that, by reducing the downside of risky bets, the retirement income guarantee fosters riskier behavior. In this way, minimum pensions can have an additional impact on financial prices and saving behavior. Minimum pension programs also extend their behavioral consequences to defined contribution pension systems that guarantee a set portfolio return or pension income.

Some examples of the minimum benefit and the effect on incentives

This section reviews the incentives embedded in alternative configurations of the minimum benefit in Chile, Spain, and the US. Chile is an interesting case because its pension program combines an unfunded minimum benefit with a funded component. Spain is another interesting case because the minimum benefit is particularly attractive to low earners at the early retirement age. Finally, the US case is included because it shows that social assistance benefits may have important incentive effects on the labor supply decisions of older workers.

Chile

Chile’s pension system has three pillars: social assistance, contributory, and voluntary. Before the 2008 reform, the social assistance pillar consisted of a means-tested assistance pension and the minimum pension guarantee for individuals who contributed to the individual capitalization scheme for at least 20 years but were not able to finance a minimum pension amount for their retirement. This configuration led to reduced contribution densities (evenness of contributions over the working life) and provided incentives for informal rather than formal sector work.

In 2008, Chile reformed its pension system, aiming to both boost living standards and increase the coverage of the contributory part of the pension system. The reform introduced two minimum pension components: a basic solidarity pension for individuals with no contributions and a supplemental income-tested pension for those who satisfy a minimum contribution requirement. The supplement, a decreasing function of the contributory pension amount, is available to all individuals whose defined contribution pension is less than the maximum welfare pension threshold—the maximum minimum pension available to eligible workers. Since the supplement is not fully taxed away as the contributory pension rises, the disincentives generated by the supplement are expected to be lower than they otherwise might be (see the Spanish case below). However, the disincentives remain substantial. Recent work shows that the income effect may dominate other potential effects of the reform. A study using administrative and self-reported panel data to estimate a dynamic household labor supply and saving decision model with a formal and an informal sector finds that minimum pension benefits, by encouraging nonparticipation in the labor force, can significantly reduce pension coverage for women regardless of program design [10].

Spain

Spain’s public pension system (old-age, survivorship, disability) has two components. The first component is a compulsory pension system, universal and financed by taxes, that guarantees a minimum pension income to all Spaniards. The second component is a defined benefit plan financed by contributions on a pay-as-you-go basis. The crucial element for redistribution and solidarity is the minimum pension. During the late 1970s and early 1980s, close to 70% of Spanish pensioners received the minimum pension. By 2001, the share had fallen but it was still substantial, at 32% of all pensioners, with about 25% of new pensioners accessing the minimum pension. Finally, the amount of the minimum pension benefit has been growing faster than the minimum wage, and in 2000 the minimum pension benefit surpassed the minimum wage.

In a life-cycle model estimated using Social Security data, the minimum pension increases the opportunity cost of forgone pension income and removes the incentive to work arising from early retirement penalties [1]. These two effects make it optimal for most low-income workers to retire at the earliest age allowed. This substitution effect is accompanied by an income effect as the minimum pension increases life-cycle wealth. This income effect also weakens the incentive to keep working in the years before normal retirement age.

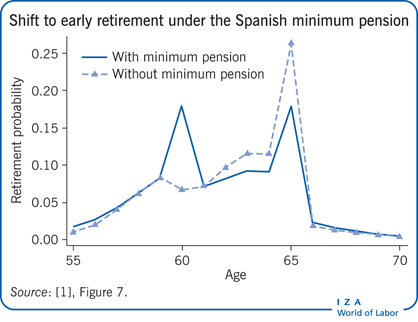

The net effect is a fundamental change in the shape of the retirement probability distribution. A remarkable spike emerges at age 60 as the probability of retiring exactly at the early retirement age almost triples, from 6.6% to 18%, and retirement at the normal retirement age drops by 30%. Thus, the minimum pension moves the retirement age of large groups of individuals from 65 to 60, and the retirement probability distribution changes from a single peak at age 65 to dual peaks at ages 60 and 65 (see the Illustration). Overall, introducing a minimum pension implies a 10% increase in early retirement and pre-retirement and a four-month lowering of the average retirement age.

The model also shows that the minimum pension influences people’s saving behavior and welfare [1]. For example, the minimum pension benefits low-income workers, but at the cost of higher contribution rates for the overall population. Finally, analysis shows that a reform postponing eligibility for the minimum pension to the normal retirement age would significantly increase labor force participation of older workers in the pre-retirement period.

United States

The US provides a means-tested benefit for the elderly, known as Supplemental Social Security income. Eligible individuals receive a benefit that represents 18% of the national average wage (28% when a spouse is also eligible). The benefit is indexed to price increases. The asset tests are strict (with some minor exclusions). The analysis is complicated by the fact that states can supplement the federally determined minimum, and the generosity of these supplements can differ markedly.

A study used Social Security Administration data linked to multiple panels of the Survey of Income and Program Participation to infer the likelihood of participation in the Supplemental Social Security program [3] and to analyze its effect on the labor supply incentives of eligible older workers, taking variations in payments across states into account. States can supplement federal payments at different levels.

The empirical evidence shows that the program generates labor supply disincentives. Among workers likely to be eligible for the program, labor supply falls off more as workers approach the age of eligibility in states that generously supplement program benefits. The results for the preferred case indicate that likely participants aged 60–64 are 10–25 percentage points less likely to be employed in a more generous state. These are huge impacts, suggesting that the Supplemental Social Security program, in combination with supplemental state benefits, may exert a powerful influence on the labor supply of possibly eligible older workers as they near eligibility age.

Limitations and gaps

More data-based analyses of the incentive effects of minimum pensions are needed, especially for countries that have a social assistance-type pension (as the US and many Latin American countries have) rather than a strict minimum pension program. More studies are also needed on the effects of potential reforms of minimum pension programs that are intended to minimize their disincentive effects on labor supply while preserving their redistributive function.

Summary and policy advice

The main purpose of minimum pension and social assistance benefits of all kinds is to alleviate poverty by supporting a minimum standard of living after retirement. Most programs achieve this goal, as many studies have demonstrated (see [2] for a recent analysis). However, the design of many minimum pension programs tends to create employment disincentives for low-income workers who become eligible for the program. By this measure, Chile’s reformed pension supplement program is expected to perform much better than Spain’s minimum pension program, because it includes (some) incentives to keep working for a longer time.

The evidence indicates that introducing a minimum pension or increasing its generosity (as observed in recent reforms of the pension system in many European countries) reduces the employment incentives of workers as they approach eligibility for the pension benefit. Consequently, to increase the labor supply of older, low-income workers, countries experiencing increasing labor shortages should design minimum pension benefit programs that minimize the potential employment disincentives for low-income workers. One way to do that is to delay eligibility to the normal retirement age. Another approach is to make the accumulation of minimum pension rights after the early retirement age compatible with continuing employment, which could incentivize some low-income workers (those who are more productive and healthy) to work longer. Specifically, for developing countries a clear distinction between noncontributory (social assistance) and contributory minimum pensions is needed in order to incentivize contributions (and thus work in the formal sector).

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts, as well as Alfonso Sánchez Martín for help with the Spanish case. The author is also grateful to the Spanish Ministry of Science and Innovation for financial assistance under project ECO2011-30323-C03-02. A preliminary, extended version of this paper can be found in [11].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Sergi Jiménez-Martín