Elevator pitch

Arguments for increasing gender diversity on boards of directors by gender quotas range from ensuring equal opportunity to improving firm performance. The introduction of gender quotas in a number of countries has increased female representation on boards. Current research does not justify gender quotas on grounds of economic efficiency. In many countries the number of women in top executive positions is limited, and it is not clear from the evidence that quotas lead to a larger pool of female top executives, who are the main pipeline for boards of directors. Thus, other supplementary policies may be necessary if politicians want to increase the number of women in senior management positions.

Key findings

Pros

Quotas increase the number of women on boards of directors.

The decision-making process improves with greater gender diversity on boards.

Having female board members seems to improve board attendance.

Having female top executives may have positive effects on the career development of women at lower levels of an organization.

Boards with more female members tend to be tougher monitors of company executives.

Cons

Boards with diverse members or members who differ from the company’s senior management may experience communication problems internally and with management.

Quotas imply that less experienced women will join boards because the supply of qualified women in senior executive positions is thin.

Quotas seem to have little positive effect on increasing the pool of women with senior executive experience.

Despite some positive outcomes, the short-term performance effects of female board members are insignificant or negative, and it is too soon to establish the long-term effects.

Author's main message

From an economic efficiency perspective, ensuring that there are good female candidates for board positions requires widening the pipeline of women progressing to senior management and top executive positions. Policymakers may have to change their focus from requiring quotas for the top of an organization to the much broader task of getting a more balanced gender division of careers within the family, for instance by encouraging more fathers to take advantage of parental leave schemes.

Motivation

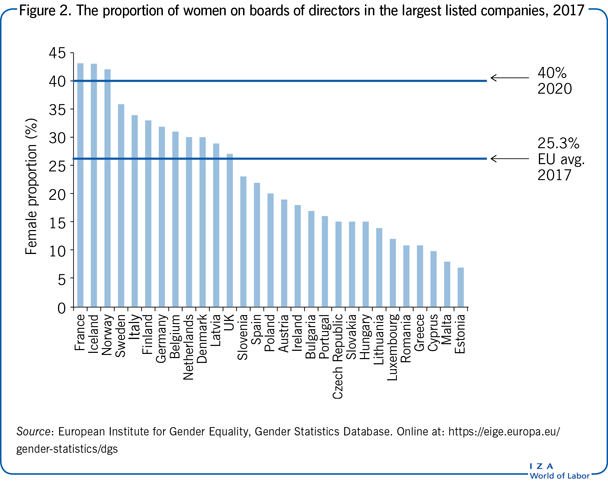

Many women have worked full-time for decades, and in 2015 close to 60% of all graduates of OECD universities were women. Nevertheless, women are still under-represented in executive suites and board rooms. In 2017, women made up 25% of board members of European publicly listed companies. There has been a sharp increase in this figure during the last ten years from only 11% in 2008 [1]. However, if women are as qualified for management as their male counterparts, the low female share of board members reflects a huge loss of talent and educational investment to both individual firms and the economy. Issues of fairness and equal opportunity also argue for political regulation and affirmative action policies.

Since 2005, several European countries have introduced radical gender quota regulations for their largest companies, and the European Commission has considered EU-level binding quotas for company boards. While the main political arguments for quotas are based on fairness and equality of opportunity, this article looks mainly at economic outcomes. It discusses the economic theory and empirical research on the potential effects of gender diversity at the board level and the relationship between gender diversity and firm performance. Norway, which was the first country to introduce binding quotas, receives special attention for its regulation, in force since 2008, requiring that the boards of publicly listed companies have at least 40% female representation. Norway’s experience can be viewed as a full-scale social experiment to guide politicians who want to increase the proportion of women in powerful positions. Though the quota has now been binding for ten years, it is still too early to evaluate all of the long-term effects of this policy.

Discussion of pros and cons

Theoretical arguments on gender diversity and firm performance

There are several theoretical arguments for gender diversity and a more balanced composition of executive and supervisory boards. Diversity could improve the quality of the decision-making process compared with a more homogeneous board. Women directors might add new perspectives to board discussions or have a better understanding of the market than men do. A more gender-diverse board might also improve a company’s image and legitimacy, with positive effects on firm performance and shareholder value.

Women in top management positions can act as role models and mentors, with a positive impact on the career development of women at lower levels. Boards with a more balanced gender distribution may also act more independently than all-male boards, particularly when a board is closely allied to the executive through an “old boys’ network” [2].

Finally, there is the talent pool argument for economic efficiency. If only men are viewed as potential candidates for the board, but men and women are equally qualified, boards will be of lower quality than if the best men and women were selected. Board quality is taken to be reflected in the organization's efficiency and productivity, so a larger pool of potential candidates for top positions will have a positive economic effect.

However, there may also be negative effects of gender diversity. A more gender-diverse board might experience more disagreement and conflict, resulting in long, drawn-out discussions—a serious problem when a company needs to react quickly to market shocks. There could also be communication problems if the executives of the company are reluctant to share key information with demographically dissimilar directors, which could compromise board efficiency [2].

The theoretical arguments on costs and benefits take on an extra dimension when quotas are binding. If a company already has an optimal board composition, imposing a binding quota for a larger share of women will alter the board composition to one that is no longer optimal. Another argument against quotas is that in many countries the proportion of women in top executive positions is low—though growing—so there is a limited pool of female candidates. Until the pipeline widens, companies will either overburden the small number of qualified women or accept less experienced candidates.

Soft and binding quota regulations

In many countries gender diversity is encouraged but not required. Gender diversity sometimes has the status of “soft law,” featuring in the guidelines on good corporate governance, for example. Since such guidelines are not always followed, the effect is weaker than with mandatory regulation with sanctions for non-compliers [3].

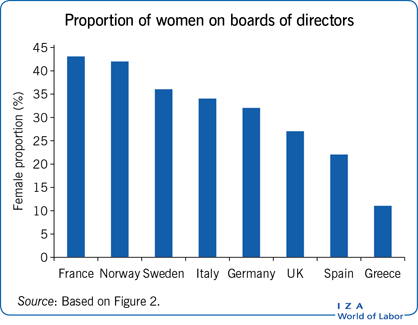

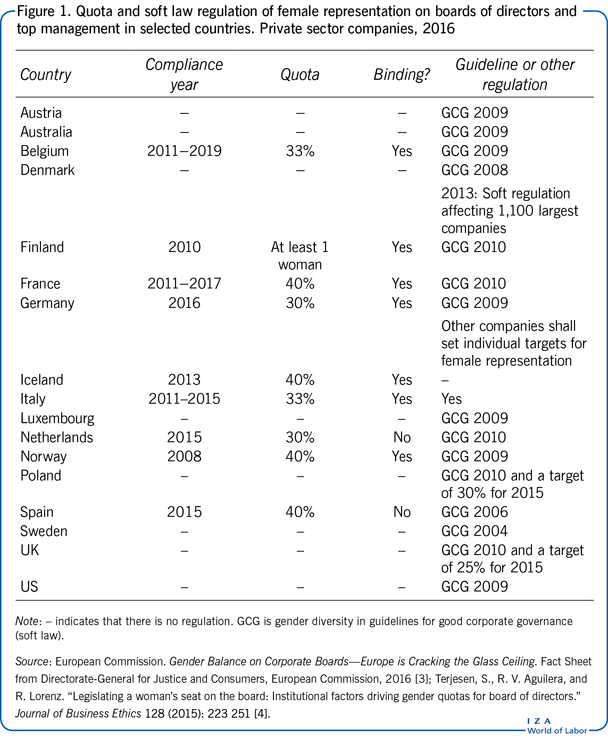

The European Commission has considered a binding minimum quota for female board members of 30% by 2015 and 40% by 2020, and some EU countries have implemented similar quotas (Figure 1). The proportion of women on major corporate boards is currently much lower in many EU countries (Figure 2), so these quotas, if met, would have a large impact on gender composition [4].

Empirical findings on diversity and firm performance

In the sometimes heated debate on affirmative action and gender quotas, claims are often made that gender diversity has a positive effect on the bottom line. Studies showing this positive result have had a large impact in the media [5]. However, a number of these studies have shortcomings. They point to correlations between the proportion of women on the board and firm performance but do not prove causation and they typically ignore even the most obvious background characteristics.

The results of empirical research on the economic efficiency impact of gender diversity on corporate boards are also unclear. Some studies show a large positive effect, whereas others find negative outcomes. The reasons suggested for this ambiguous picture include:

Variations between countries and between types of firms could mean that having more women on the board is advantageous in some circumstances but not in others. For instance, institutional differences between companies can affect the role of the board. Some studies have focused on large publicly listed companies, while others have included small and medium-size companies, which are often family owned.

It is difficult to design research that reflects all relevant variables. Many studies show a positive correlation between the proportion of women on a board and firm performance, but correlation does not prove causation or provide evidence of its direction. It might not be the presence of women that improves performance but rather that better performing companies choose to appoint more women. Or the companies might have another shared characteristic (either observable or unobservable) that both leads to better performance and prompts them to improve gender diversity. When researchers allow for other observed characteristics, the positive relation found in the simple models often disappears.

Outcome measures differ. Some studies focus on economic performance measures, while newer studies also consider whether gender diversity affects board decisions and processes.

The impact of gender diversity in a country with no quota regulations and a low proportion of women on boards is likely to be very different from the impact in countries with a binding quota. Boards in countries with a binding quota of 40% for example may have to recruit women with a much broader and potentially less qualified background compared with boards in countries with no regulations.

Gender diversity and board processes

Two recent studies focus on work processes and decision-making on corporate boards, looking at whether boards operate efficiently rather than at how boards affect an organization’s efficiency.

Board members and chief executive officers (CEOs) of Norway’s largest listed companies and private firms were surveyed in 2006, before the 40% quota was fully implemented [6]. The survey tested a number of hypotheses about the impact of women on decisionmaking. Women with nontraditional professional experience (those who have not held senior management roles in commercial companies) were found to have a weak impact on board decisions. Women with strong ethical and moral values were found to have a strong impact. In cases where a male majority on the board considered the female appointees to be less qualified, the women had significantly less impact in the boardroom. Finally, more women on boards increased the involvement of the board of directors in the strategic decisions of the company.

A 2009 study of US corporate boards found that boards with a larger percentage of female members had better attendance rates: having women on a board improved the attendance of men. Gender-diverse boards were found to be tougher in monitoring management and more prepared to fire the CEO when company performance was poor. Firms with diverse boards often included incentive schemes in management compensation packages. Overall, the researchers concluded “that diverse boards add value in firms with otherwise weak governance” and that female board members might be too tough (and over-monitor) in firms with otherwise strong governance [2].

The impact of the 40% quota in Norway

Norway was the first country to introduce binding gender quotas for the largest Norwegian companies. Over the last ten years other OECD countries have followed Norway's example (Figure 1). Italy introduced a gender quota of 20% in 2011, which was gradually increased to 33% in 2015. The short-term effects on firm performance of this Italian quota seem to be minor or insignificant [7]. The following focuses on the Norwegian quota since the potential full impact of a quota on firm performance, company structure, and the position of women in general, takes time. Norway is the only case for which there is some empirical evidence on these broader and longer-term effects.

In 2002, less than 10% of board members in the largest publicly listed Norwegian companies (known in Norway as Allmennaksjeselskap, or ASA companies) were women. Regulations introduced that year gave those companies five years to raise the proportion of women on their boards to 40%. By January 2008, women made up more than 40% of the board members of ASA companies. In that sense, the law was a clear success. But research studies reached different results, some finding a negative impact, and some finding no significant impact, except in the poorest-performing companies.

One of the studies found a negative impact of the higher proportion of female board members on several economic performance variables [8]. These effects were most pronounced in the companies with the fewest women on their boards before the law came into effect. The crucial point in the estimation strategy in this study is that the pre-announcement gender composition was already reflecting an expectation about a future binding gender quota. Whether this was actually the case has been criticized [9]. Another study that found a negative impact used a slightly different sample of Norwegian firms and compared their performance with that of large companies in other Nordic countries [10]. This study also found significant negative effects: companies were slower to adjust employment to cyclical upturns and downturns. However, the study has been critized for not being able to tackle potential statistical problems in a convincing way [9].

A potentially negative effect of the quota law is that it could prompt ASA companies to delist from the Norwegian stock exchange to avoid the quota obligation [11]. This effect is not easily assessed because companies delist for multiple reasons. The research findings differ, partly because some studies include the financial sector while others do not. Some financial companies delisted because of other institutional changes during the period when the gender quota was introduced.

A positive effect found in the literature is that a much larger proportion of the female board members in Norway after the quota were found to be independent, i.e. they are not affiliated with the executive board or business dealings of the company [11]. Average independence increased from 46% in 2003 to 67% in 2008.

Other studies have found insignificant or slightly positive effects of the Norwegian quota. Thus, research results do not agree and there has been a heated discussion between researchers on methodological issues and results [9]. A recent survey of the impact of the Norwegian quota on firm performance concludes that “…There are too many problems with the ‘causal’ evidence on the effect of quotas on performance. It is fair to say that we don't really know whether and how quotas affect the financial performance of firms” [9].

However, all these findings concern only the short-term effects, since the law has been in effect for only ten years. The effect might well be different over the longer term, perhaps because firms may be able to make board appointments differently or will have a larger pool of qualified women to select from.

The Norwegian minister who sponsored the law made it clear that the longer-term objective is to have a better gender balance in senior management, achieved through a diffusion effect rather than through quotas, as more women assume positions of executive responsibility. The law achieved its short-term objectives—increasing the number of women on boards and reducing the power of the “old boys’ network.” However, so far, the diffusion effect has been weak. The proportion of female CEOs and chairs of boards more than doubled over 2001–2009, but from a very low base: from 2% to about 5% [8].

The longer-term effects of the Norwegian quota are analyzed in a recent study [12]. The results are not that optimistic, in the sense that, besides having an effect on female representation on boards which were subject to the quota, there have been no observed trickle-down effects of the quota on the Norwegian labor market. The quota regulation has not yet reduced the gender gap in management positions in any significant way. Further, the quota does not seem to have affected the career aspirations, career plans, and behavior of young Norwegian women, which may have consequences for the future pool of potential directors on Norwegian boards and top executives. The study concludes that “Overall, seven years after the board quota policy fully came into effect, we conclude that it had very little discernible impact on women in business beyond its direct effect on the women who made it into boardrooms” [12].

Which competencies are relevant?

An important and related policy question concerns which competencies are important for a member of a corporate board. Is a good level of education and solid work experience sufficient, or should board members have senior management experience? The answer affects the size of the pool of potential board members. Many women have a high level of formal education and substantial work experience, but far fewer have direct senior executive experience [13].

The main tasks of the board of directors determine which competencies are important. Both management theory and economic theory suggest that boards have a dual role as monitors and advisors of management. Powerful board members with senior executive experience (or the equivalent) will be better able to match the competencies of the CEO and senior management and might therefore function more ably as both monitors and advisors.

Of course, changing the number of women in the boardroom will not have an effect on decisions of the board and the operation of the company unless the female directors actually have influence. “For gender diversity to have an impact on board governance, it is not sufficient that female directors behave differently than male directors. Their behavior should also affect the working of the board” [2].

The same conclusion can be drawn from a 2010 study that found a correlation between how well-regarded a board member was by the other members and that member's ability to add value and affect the board's decisions [6]. Both the board's predisposition to value women and women's ability to make a valuable contribution might be affected if they lack experience as a top executive. From this perspective, those without senior executive experience might be less effective board members.

Women with senior executive experience are rare in most countries. The female share among CEOs in the largest listed companies in all EU countries was 5.5% in 2017 [1]. If the boards of major companies are required to add more women, either the few experienced female top executives will be overextended across a large number of boards, or younger, more inexperienced women will take some of the positions. There are clear disadvantages to both approaches.

Increasing the pool of potential female board members

The Norwegian approach seems to be intended to make it possible for women to learn on the job. This could well be a valid policy approach, though there is a potential short-term cost to accepting less experienced board members.

Another approach is to focus on increasing women's representation in senior management positions, not only their representation on boards. That could establish a pipeline of women with qualifications more directly comparable to those of male candidates. The Norwegian quota law has so far had only a limited diffusion effect: there are still very few female CEOs in Norway. The same holds for other Nordic countries and, to varying degrees, for other countries around the world. A recent study from Denmark shows a significantly positive relationship between the pipeline of female top executives in a given industry and female representation on the boards of directors for companies in the given industry. The study concludes that “Our empirical evidence suggests that an important way to increase the female proportion of non-employee-elected board members is that more women reach top executive positions” [13].

Family-friendly employment regulations are often said to help women advance their careers. The Scandinavian countries have a long tradition of such laws, but the laws have not substantially increased the number of women in senior executive positions.

For example, long periods of maternity leave are intended to enable women to continue their careers after having children, and virtually all mothers take such leave. These provisions seem to have had an unintended boomerang effect, however. Studies show that children are an important explanatory factor for the divergence in men's and women's careers, even when controlling for level of education. Besides the direct negative effects on experience and human capital of taking long parental leave, there may be more subtle effects on gender norms and stereotyping, especially when women avail themselves of parental leave more frequently than men do. These indirect discrimination effects could then disadvantage highly skilled women who aspire to a top executive career.

One solution might be to introduce quotas for fathers in the take-up of parental leave. This could be as important as the introduction of quotas for women on boards of directors if the aim is to get more women into powerful positions in private companies.

Limitations and gaps

The empirical research is still young, and there is as yet no consensus on the best methods for analyzing the impact of gender diversity on firm performance. The conclusions outlined here are based on an evaluation of the most statistically robust studies and results. Most of the results are based on the Norwegian experience.

Furthermore, most of the results reflect only the short-term effects of female quotas. In the longer term, there may be more positive effects as the quota regulation brings about deeper-rooted changes. However, the limited existing experience from Norway is not that promising in this direction.

Summary and policy advice

Research offers no clear answer on whether gender diversity on boards of directors positively affects economic efficiency and firm performance. The empirical results are sensitive to statistical specification and need to be weighted by their statistical validity. When the results are weighted, positive economic efficiency effects of gender diversity on corporate boards generally cannot be documented. Only for badly performing companies does there seem to be a positive result from having more women on the board. One explanation may be that women tend to be tougher monitors of company executives and to improve board decision-making processes. The empirical evidence concerning the economic effects of gender quotas for boards of directors is likewise very mixed and inconclusive.

However, whether there is a business case for quotas may not be the most important question to pose. In a long-term policy perspective it may be much more important to ask the question: how can the gender gap and lack of women in management positions be alleviated? Women are equal or even superior to men in their level of formal education, but even countries with a long history of strong equal opportunity and female-friendly policies, as in the Nordic countries, have a large gender gap when it comes to top management positions. The lesson from these countries seems to be that family-friendly policies do not help women move into top management positions or onto boards of directors unless they are gender-neutral in operation.

If the main policy objective is to get more women into powerful positions in private companies, politicians might have to change the focus from quotas at the top of the organization to the much broader task of getting a more equal gender division of careers within the family. This might be achieved through gender-neutral family policies and quotas for fathers in parental leave schemes.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Version 2 of the article takes a look at the Norwegian gender quota ten years since it was first introduced, updates the figures, and completely revises the reference lists.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Nina Smith