Elevator pitch

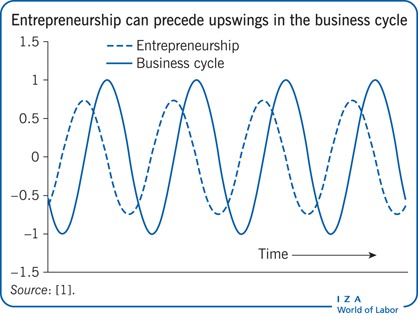

Entrepreneurship has a cyclical component, raising two questions. Is the entrepreneurship cycle related to the business cycle? And is there causality? A two-way relationship between entrepreneurship and the business cycle would be in line with the two faces of entrepreneurs: as agents of change creating upswings (opportunity entrepreneurship) and as rational actors escaping unemployment by setting up a business (necessity entrepreneurship). Nascent entrepreneurship can indeed be precyclical, implying that the two faces of entrepreneurship also show up in the business cycle, with promising policy implications.

Key findings

Pros

Opportunity nascent entrepreneurship is precyclical in the business cycle.

In recessions the innovations of start-ups can boost the economy.

Entrepreneurship can have some predictive power over the business cycle since owning a business signals trust in future economic conditions.

An upswing in opportunity nascent entrepreneurship may advance an upswing in the business cycle.

Policies aimed at stimulating entrepreneurship could influence the business cycle.

Cons

Unlike opportunity nascent entrepreneurship, necessity nascent entrepreneurship is not precyclical, nor is it correlated with fluctuations in the business cycle.

In the booming phase of the economy, entrepreneurs become hesitant.

There are no empirical studies examining causation.

The hypothesis of precyclicality does not imply causation, for entrepreneurs may merely foresee and react to the course of the business cycle rather than cause it.

Author's main message

The relationship between nascent entrepreneurship and the business cycle is complex. Nascent entrepreneurship is more volatile than incumbent entrepreneurship, creating more opportunities for interplay with the business cycle. Precyclicality—entrepreneurship preceding a business cycle upswing—seems plausible. Policy measures nurturing opportunity nascent entrepreneurship could thus have a beneficial influence on the business cycle in subsequent years. Necessity nascent entrepreneurship, in contrast, does not seem to have a cyclical component and therefore requires a different policy response.

Motivation

After the early 1980s, self-employment rates grew and entrepreneurship became associated with innovative, high-growth, high-tech industries. The emerging knowledge economies were accompanied by both thriving service sectors and a strong emphasis on intangible assets such as intellectual property and human capital. Entrepreneurship creates knowledge spillovers, which would explain its role in high-growth, high-tech industries and justify a central place for entrepreneurship in theoretical frameworks [2].

Economic policies cannot affect the business cycle directly but require intermediary targets, such as taxation and unemployment policies. In a sluggish labor market, regulations provide little leverage to combat unemployment or attract new businesses. The euro has deprived individual European central banks of monetary instruments to guide their business cycle. The high fiscal cost of Keynesian-style investments in infrastructure further ties the hands of politicians. This leaves entrepreneurship as one of the few remaining options for government intervention in a slow employment-growth economy. Government policies and regulations can create more favorable conditions for entrepreneurs, for instance through subsidies, tax exemptions, or lighter administrative burdens [3].

Empirical evidence suggests that (levels of or changes in) unemployment and entrepreneurship may be linked by push and pull effects. The push effect occurs if unemployed workers start a business because they lack other options—in other words, a choice induced by necessity. The pull effect implies that in a thriving economy, with a growing and differentiating demand for goods and services, there are more entrepreneurial opportunities, hence more entrepreneurs who require additional workers to sustain their growing businesses, resulting in less unemployment [4].

Discussion of pros and cons

The cyclical relationship between entrepreneurship and the economy remains unclear. This paper extends a study dealing with the interplay between incumbent entrepreneurship, unemployment, and the business cycle, with a specific focus on prospective entrepreneurship. Called nascent entrepreneurship, it is classified into opportunity, necessity, innovative, and imitative entrepreneurship [5]. That previous study also used prospective entrepreneurship but merely as a robustness check since the dataset is small.

Interplay between entrepreneurship and the business cycle

It is possible that nascent entrepreneurship (through new and young start-ups) rather than incumbent entrepreneurship (through existing firms) interlinks more closely with the business cycle. Business cycle movements may have a significant influence on nascent entrepreneurial ventures, and nascent entrepreneurial ventures may in turn influence the business cycle. Nascent entrepreneurship is a more volatile measure than incumbent entrepreneurship, and this volatility creates more opportunities for interplay with the business cycle. Different kinds of nascent entrepreneurship may vary in the way they influence the business cycle or are influenced by it—and each kind may require different economic policies. In other words, some kinds of nascent entrepreneurship may anticipate the movements of the business cycle or be useful as indicators of business cycle movements; others may lag behind the business cycle.

Thus the research question here is whether nascent entrepreneurship is an early indicator of the business cycle and whether this differs for booms and recessions. While there may be a large difference between entrepreneurship and business ownership for individuals [6], the business ownership rate and the nascent entrepreneurship rate are accepted measures of entrepreneurship at the aggregate level [7].

Until recently, there was little scholarly attention to the interplay between entrepreneurship and the business cycle, in part because of differences in definitions of entrepreneurship (see Research on entrepreneurship and the business cycle: Data and methods). One study explores the involvement of entrepreneurs in economies entering or emerging from recessions [7]. Another study identifies three strands of theories on the interplay between entrepreneurs and their innovation and the business cycle [8]. A third study provides a policymaker’s perspective on the links between entrepreneurship and the business cycle [9]. Yet another study proposes a procyclical model [10].

Nascent entrepreneurship

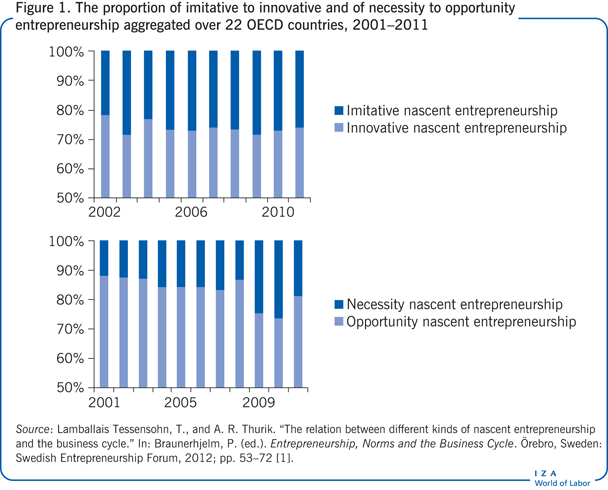

Nascent entrepreneurship can be divided into innovative and imitative entrepreneurship and into opportunity and necessity entrepreneurship. Figure 1, using aggregate data for 22 Organisation for Economic Co-operation and Development (OECD) countries, shows that the proportions for each type remain relatively stable over time (2001–2011) at the aggregate level (22 OECD countries). Innovative entrepreneurship contributes about 75% to nascent entrepreneurship and opportunity entrepreneurship about 80%, except in 2008 and 2009 when necessity entrepreneurship took a larger share than otherwise. This means that at the aggregate level of the 22 OECD countries, between 60% and 75% of all nascent entrepreneurs can be labelled as innovative, opportunity entrepreneurs.

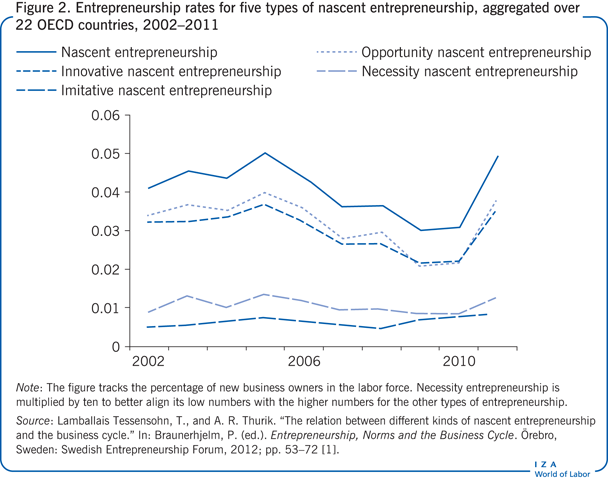

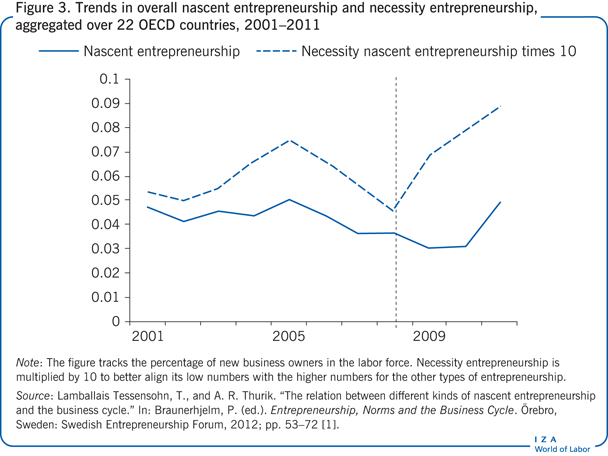

Despite some differences in levels, the similarities in the movements in overall nascent, opportunity nascent, innovative nascent, and imitative nascent entrepreneurship at the aggregate level for the 22 OECD countries are remarkable (Figure 2). Opportunity and innovative entrepreneurship rates are clearly much higher than those of necessity and imitative entrepreneurship, but they move in synch with the overall nascent entrepreneurship rate. The imitative entrepreneurship rate also behaves similarly to the nascent entrepreneurship rate, though the peaks and troughs are less pronounced. The necessity entrepreneurship rate, which also moved in synch with the overall nascent entrepreneurship rate before the recent economic crisis, began to deviate from it as the recession worsened, suggesting that necessity entrepreneurship follows unemployment with a delay (Figure 3).

New evidence on the relationship between entrepreneurship and the business cycle

Some new empirical regularities found between incumbent entrepreneurship (self-employment) and the business cycle come from average national data for 22 OECD countries for 1972–2007 [5]. The results support the hypothesis that entrepreneurship is precyclical and has some predictive power over the business cycle, at least at an aggregate level. This seems plausible because entrepreneurs commit their livelihoods and their substantial time and effort to a prospective business that is prone to failure, especially during a recession. Also, setting up a business may benefit from cheaper productive resources during a recession. Engaging in business ownership would therefore be a sign of trust in future economic conditions.

Incumbent as well as nascent entrepreneurs must judge the business cycle in the long term since months or even years of investment and preparation may pass before sales begin to take off. Incumbent and nascent entrepreneurship rates—the shares of business owners in the labor force—summarize the joint judgment of all (potential) entrepreneurs as the business cycle progresses. Because start-ups generally serve local, regional, or national markets rather than an international one, this paper deals with the national business cycle.

One possibility is that nascent entrepreneurship rates are procyclical—rising in an upswing in the business cycle, falling in a downswing. Another is that entrepreneurship rates are precyclical—with nascent entrepreneurship rates rising before upswings and falling before downswings. Note that this relationship does not imply causation. There are ways that entrepreneurs may influence the course of the business cycle (and be influenced by it in turn), but there is no decisive empirical evidence to confirm such influence. The attempt here is simply to establish whether precyclicality is plausible, not to demonstrate causality.

Data for 19 OECD countries over 1998–2007 show that, in the short term (after one quarter), a country’s entrepreneurial activity (measured by the incumbent self-employment rate) is stimulated if the country’s business cycle lags the world’s business cycle [11]. But in the medium term (after one to two years), entrepreneurial activity is stimulated if the country’s business cycle leads the world’s business cycle. These results apply only to fairly open economies, suggesting that economic openness plays a role for entrepreneurial opportunities related to a country’s cyclical performance.

Three mechanisms of precyclical entrepreneurship

Precyclical entrepreneurship may reflect three mechanisms of interplay with the business cycle.

First, an upswing of entrepreneurship leads to higher levels of economic growth caused by any of its positive mediating effects, such as introducing novel products, increasing imitative competition, reducing unemployment, or creating knowledge spillovers.

Second, in the booming phase of the economy, entrepreneurs become hesitant—for two possible reasons. They intuitively feel that “what is high must come down.” And they put a greater weight on the opportunity costs of entrepreneurship (caused by incumbent firms offering well-paid jobs) than on the opportunities offered by a generous labor market in the boom.

Third, new entrepreneurship in the recession phase may contribute to productivity shocks because it is the new entrepreneurs who absorb inventions. In the trough of the cycle, the willingness of incumbents to take risks may be lower, while new entrepreneurs have nothing to lose and so are more likely to bring inventions to the market. New firms innovate more during recessions, unlike incumbent firms, which face the costs of making new production technologies compatible with installed technologies. New firms do not have to deal with incompatibilities because they start from scratch [5].

Testing the precyclical hypothesis

The precyclical hypothesis states that an increase in entrepreneurship is associated with a lagged upturn in the business cycle and that a decrease in entrepreneurship is associated with a lagged downturn in the business cycle [1]. This hypothesis does not necessarily imply causation, however. Entrepreneurs may merely foresee and react to the course of the business cycle rather than cause the changes.

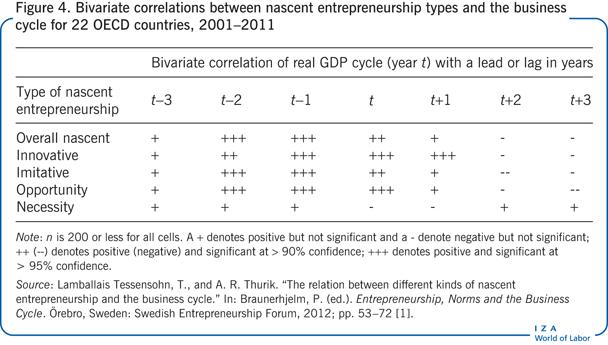

To test the precyclical hypothesis, bivariate correlations were calculated between the five different kinds of nascent entrepreneurship and the business cycle using data for 22 OECD countries for 2001–2011 (Figure 4). The analysis checks for contemporaneous correlation (t) and whether the business cycle in period t is correlated with entrepreneurship in earlier years (t–3, t–2, t–1) or subsequent years (t+1, t+2, t+3). That makes it possible to establish whether entrepreneurship is procyclical or countercyclical, whether it is precisely cyclical or precyclical, or whether these behaviors are combined.

Necessity nascent entrepreneurship, whose behavior consistently differed from that of the other types of entrepreneurship during the recent economic crisis, deviates from the other four nascent entrepreneurship types both in the magnitude and the sign of the coefficients. For none of the seven lags, t–3 through t+3, is the correlation significant between necessity entrepreneurship and the business cycle. But many significant correlations are observed for the other four nascent entrepreneurship types (see Figure 4).

The four seem to follow a pattern: at t–2 and t–1 the correlations are significantly positive, and at t+2 and t+3 they are negative, though not significantly so. This means that overall nascent, innovative nascent, imitative nascent, and opportunity nascent entrepreneurship are correlated with fluctuations in the business cycle but in a lagged fashion, supporting the precyclicality hypothesis. In short, the correlations are not at odds with the interplay in the Illustration. Contemporaneous correlations (t) between the business cycle and entrepreneurship are positive and significant, and while correlations are positive at t+1, only for innovative entrepreneurship is the correlation significant, emphasizing the cyclical effect.

Results from two other studies do not reject the hypothesis that entrepreneurship can precede the business cycle, as also represented in the Illustration, and the effects of entrepreneurship on the business cycle seem to be stronger than those of the cycle on entrepreneurship [5], [11]. Looking at the interplay between entrepreneurship and the business cycle reveals a new aspect of cycle dynamics that is not captured by existing theories about entrepreneurship in the economy or the causes and consequences of the cycle. All three studies and their analyses are data-driven: all three contributions make a point of letting the data speak rather than deriving equations from earlier or new theory. In sum, there is some evidence supporting the central hypothesis of the present study: entrepreneurship is precyclical—that is, entrepreneurship precedes upswings in the business cycle.

Limitations and gaps

The relationship between entrepreneurship and the business cycle, with its many direct and indirect links, is inevitably complicated. That is why this paper makes no attempt to prove the existence of a causal precyclical relationship between entrepreneurship and the business cycle, something that can be done only in the framework of a theoretical model. But the findings appear to conform to the three mechanisms at work in the section on precyclical entrepreneurship.

The hypothesis here does not imply causation, for entrepreneurs may merely foresee and react to the course of the business cycle rather than cause it. Causation is notoriously difficult to prove or reject. Only Granger causality is investigated in [4] and [5]. The next scholarly step will be to integrate entrepreneurship in existing theoretical models of cycle dynamics. The current generation of macroeconomists should take up this challenge.

Summary and policy advice

Entrepreneurs have not only a reason but also an inclination to judge the course of the business cycle in the long run, and precyclicality would imply that they are able to do so.

Nascent entrepreneurship could influence the business cycle in three ways. First, an upswing in nascent entrepreneurship contributes to an upswing of economic growth. This mechanism is supported by the correlations in Figure 4 and is not refuted by anything in the analyses of [1], [5], and [11]. Second, in the booming phase, nascent entrepreneurs may become hesitant, which means that nascent entrepreneurship rates decline before the business cycle enters a declining phase. This mechanism is also supported by the correlations in Figure 4. Third, in a recession, it is innovative start-ups rather than incumbent firms that innovate and thus produce positive productivity shocks for the economy. Some support for this mechanism is in Figure 2, where a sharp rise in innovative and opportunity nascent entrepreneurship is shown from 2010 onward, in the midst of the recent economic crisis.

Necessity nascent entrepreneurship shows behavior different from that of the other entrepreneurship types. Unlike the others, it does not appear to be precyclical: it does not even seem to have any cyclical element at all. This makes sense because necessity entrepreneurs do not start a firm from a position of choice. Rather than judging the course of the business cycle and waiting for the right moment, they are likely to start a business soon after losing their job irrespective of the typical cycle phase. Moreover, because unemployment is countercyclical, necessity entrepreneurship is unlikely to be procyclical in the first place.

Whether the different types of entrepreneurship actually cause fluctuations in the business cycle remains speculative. But if they do, policies targeted specifically at entrepreneurship could be beneficial to the economy as a whole. Assuming that a causal relationship exists for nascent entrepreneurship to be responsible for some of the fluctuations in the business cycle, policy measures nurturing nascent entrepreneurship would have a beneficial influence on the business cycle in subsequent years. During the recent crisis, with its ban on higher public spending, policymakers have had few options to influence the business cycle. The correlations here and in [1] and [5] show that entrepreneurship rates predate fluctuations in the business cycle. So it is possible that policies to stimulate entrepreneurship could influence the business cycle.

Three policy options spring to mind. First, the level of unemployment benefits may influence the effect of unemployment on entrepreneurship [12]. Given the results of the analysis here, governments should be very careful about supporting ailing economies by increasing employment benefits. Second, the call for more regulation in the wake of the banking crisis should not spill over from banking to other sectors and thus increase the administrative burden for other genuinely entrepreneurial sectors. The perception of administrative burden, rather than the uncertainty over acquiring enough financial capital, may frustrate entrepreneurial activities. Third, during a persisting crisis, big and incumbent firms will most likely apply for financial and other support in the near future. Governments are well-advised to evaluate whether they should support existing sectors or new ones that may blossom from nascent entrepreneurial energy. They may instead consider participating in venture capital activities so that taxpayers benefit twice—from an earlier recovery and from venture capital gains.

Acknowledgments

The paper is based on [1], inspired by [5]. The author thanks his co-authors for their comments and for letting him use some of their joint ideas. The author also thanks Pontus Braunerhjelm and the Swedish Entrepreneurship Forum for the opportunity to use parts of [1]. Two anonymous referees and the IZA World of Labor editors provided many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Roy Thurik

Nascent entrepreneurship

Opportunity—Sees a profitable business opportunity and wants to become independent or have more income.

Necessity—Is out of work or has just lost a job and has little choice but to start a business venture.

Innovative— Produces goods or services that are new to customers and does not expect strong competition.

Imitative—Produces goods or services that are identical or very similar to what is already available in the market and expects strong competition.

Source: Reynolds, P., N. Bosma, E. Autio, S. Hunt, N. de Bono, I. Servais, P. Lopez-Garcia, and N. Chin. ‘‘Global entrepreneurship monitor: Data collection design and implementation 1998–2003.’’ Small Business Economics 24:3 (2005): 205–231.

Research on entrepreneurship and the business cycle: Data and methods

Source: Koellinger, P. D., and A. R. Thurik. “Entrepreneurship and the business cycle.” Review of Economics and Statistics 94:4 (2012): 1143–1156.

van Stel, A. J. “COMPENDIA: Harmonizing business ownership data across countries and over time.” International Entrepreneurship and Management Journal 1:1 (2005): 105–123.