Elevator pitch

Firms regularly use incentives to motivate their employees to be more productive. However, often little attention is paid to the language used in employment contracts to describe these incentives. It may be more effective to present incentives as entitlements that can be lost by failing to reach a performance target, rather than as additional rewards that can be gained by reaching that target. However, emphasizing the potential losses incurred as a result of failure may entail hidden costs for the employer, as it may damage the trust relationship between a firm and its employees.

Key findings

Pros

Employees work harder when incentives are described as entitlements that can be lost by failing to reach a performance target than when they are presented as extra rewards to be gained by reaching that target.

Modifying the description of incentives has virtually zero financial costs for firms.

The way incentives are described does not seem to matter for the types of employees attracted by a firm.

Emphasizing losses incurred as a result of failure does not seem to discourage employees from signing employment contracts.

Cons

Penalty contracts are perceived as more unfair and controlling than bonus contracts.

There is some evidence that contracts that emphasize losses lead to more cheating and corrupt behavior among employees.

When contracts do not regulate all possible aspects of performance, penalty contracts may lead to a reduction of effort in the tasks that are not directly regulated by the contract.

Penalty contracts are rarely used by firms, suggesting that employers may be particularly wary of their cons.

Author's main message

Linking pay to performance can be an effective instrument for increasing employees’ productivity. However, extra attention should be paid to how incentives are described. Experiments show that employees can be motivated to work harder under “penalty” contracts than under “bonus” contracts. This suggests that firms can reap productivity gains by simply adjusting the language of their employment contracts, at no extra financial cost to the firms. However, employers must be mindful of ensuring that penalty contracts do not induce counterproductive behavior by employees that would have negative consequence for the firm.

Motivation

Evidence shows that people evaluate outcomes not in absolute terms but in relative terms, assessing them as either gains or losses relative to a reference point. Moreover, a consistent finding is that individuals are loss averse, i.e., they are typically more sensitive to the pain of losing something that they already have, than to the joy of gaining something they do not have.

In the context of employment contracts and remuneration, the concept of loss aversion can yield surprising insights into how performance incentives, such as bonuses, commissions, and perks, can be used to affect workers’ productivity. Usually these rewards are given once an employee has achieved a specified performance target and evidence shows that such incentives are indeed very effective in raising performance. However, if employees are loss averse, it may be even more effective to modify the language used in employment contracts to describe incentives to employees: from presenting rewards as an extra incentive that can be gained by reaching a performance target, to an entitlement that could be lost if the employee fails to reach that target. Under loss aversion, the fear of losing a reward acts as a greater motivator than the attraction of gaining it, even if the economic value of the reward is exactly the same.

This emphasizes the importance of paying more attention to the way incentives are described to employees, rather than simply stating their economic value. As The Economist rather nicely phrases in a 2010 article, “economists have always been advocates of using carrots and sticks. But they may not have emphasized appearances enough. Carrots...may work better if they can somehow be made to look like sticks.” In other words, firms could reap productivity gains by simple, and virtually costless, modifications of the language they use in their employment contracts. Thus instead of emphasizing the positive consequences of success, contracts could highlight the negative consequences of performance failure, while keeping constant the economic value of the incentives.

Discussion of pros and cons

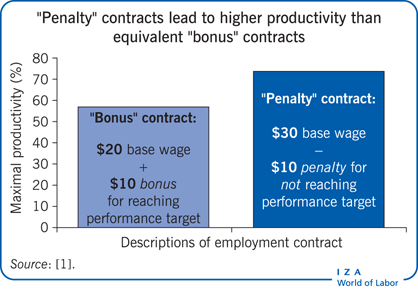

The productivity gains of “carrots that look like sticks”

Can firms actually boost productivity by using “carrots that look like sticks”? In one of the first studies to address this question, 68 MBA students were invited to take part in a paid research experiment where they were asked to act as employees of a fictional company [1]. Students received a monetary compensation on the basis of their choices in the experiment. They had to choose a number representing how hard they wanted to work for the company. Higher numbers (i.e. higher effort) made it more likely that the firm could meet a desired production target. However, higher effort was also more costly for the employee (i.e. a larger monetary sum would be subtracted from their final compensation). Students were randomly assigned to one of two payment conditions. In the “bonus” condition, students were paid a base salary of $20 plus a bonus of $10 if the firm met the desired production target. In the “penalty” condition, students were paid a base salary of $30 minus a $10 penalty if the firm did not meet the target. The two conditions are objectively equivalent: in either case, the employee receives $30 if the target is met and $20 if it is not. However, the language used in the contracts differs: incentives are presented as “carrots” in the bonus condition and as “sticks” in the penalty condition.

The results of the experiment are striking. Despite the economic equivalence of the two contracts, employees in the penalty condition worked harder than those in the bonus condition, and the size of the effect was large. In the bonus condition students, on average, worked at 57% of maximum possible productivity. In the penalty condition they worked at 74% of maximum possible productivity. Therefore, productivity improved by 17 percentage points under the penalty contract (see the Illustration).

However, one could be skeptical about whether findings from such an artificial experimental study, conducted with students and relatively low monetary stakes, can be trusted to represent what motivates employees in actual labor markets. Do these results transfer to real-world workplaces, where actual employees work for substantial amounts of money? A recent study shows that this is indeed the case [2].

The study was conducted in a natural workplace in collaboration with the managers of a Chinese electronics company who wished to investigate the effectiveness of various incentive schemes for increasing productivity in their firm. For a period of four weeks, workers were offered a monetary bonus for achieving a pre-determined productivity target. The weekly bonus was sizeable and amounted to more than 20% of the weekly salary of the highest-paid worker in the company. The incentive scheme was announced to workers by the company in a letter, and workers were unaware that they were taking part in a research study.

About half of the workers were told that they would earn RMB 80 for each week in which they had met the weekly productivity target. The other half of the workers were instead told that they had been provisionally assigned a bonus of RMB 320. However, for each week in which their performance failed to meet the target, the bonus would be reduced by RMB 80. Both groups were paid the corresponding bonuses at the end of the fourth week of the scheme. The economic incentives offered to the two groups were identical: under both schemes a worker meeting the productivity target in all four weeks earned a final bonus of RMB 320. A worker meeting the target in only three weeks earned a bonus of RMB 240, and so on. But the incentives were described differently, either as bonuses or penalties, depending on the wording of the letter announcing the scheme.

The average productivity of workers assigned to the penalty condition was roughly 1% higher than the productivity of workers assigned to the bonus condition. Moreover, workers were between 2% and 9% more likely to reach the target under the penalty condition. While the overall effects on productivity were fairly small (and were only found for assembly-line workers and not for workers who had the task of inspecting products), it should also be noted that the manipulation was indeed minimal (e.g., workers in the penalty condition were not actually paid the lump sum bonus at the beginning of the period, but only told that they were assigned the bonus provisionally). Moreover, and perhaps most importantly, the productivity boost came virtually free of cost, since it only involved a minimal re-wording of the letter that the company sent to employees to introduce the new incentive scheme.

Overall, these two studies highlight how the language used in contracts can have powerful effects on productivity. Sizeable performance boosts can be obtained at virtually no financial cost for the firm, by simply changing the presentation of the contract describing the incentives to employees. Several other studies have confirmed these findings, both in the laboratory and in field settings. The following section reviews this additional corroborating evidence in detail.

Further evidence for why penalties are better than bonuses

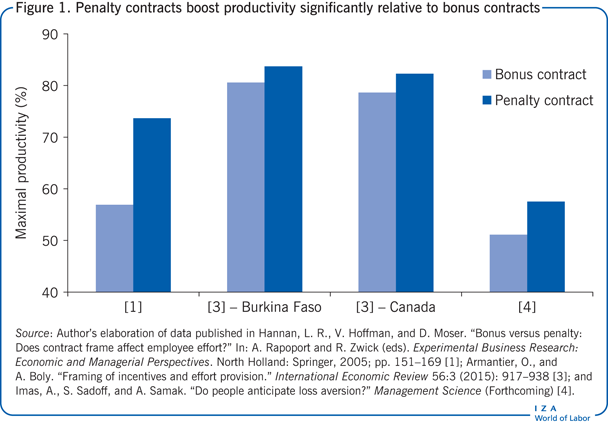

In a study conducted in Burkina Faso, 131 participants were recruited to spell check a set of ten typed exam papers [3]. They were paid a fixed base salary (independent of performance) and a variable salary that depended on the quality of their spell checking. While the economic value of the variable salary was the same for all participants, in one condition it was presented as a bonus payment for reaching specific performance targets, while in the other condition it was described in terms of a penalty for not reaching the targets.

The results confirmed the superior performance of the penalty contract. Under the bonus contract, participants correctly identified 81% of the spelling mistakes contained in the exam papers. Under the penalty contract they identified 84% of mistakes (Figure 1). While this difference in performance is not as large as the one found in the laboratory study discussed earlier [1], it is nevertheless statistically significant. Moreover, this effect is robust to different cultural and geographical characteristics. The experiment was replicated with 228 students in Canada, where, again, the penalty contract significantly outperformed the bonus contract, yielding a three-percentage-point gain in performance (Figure 1).

Similar results have been observed even in settings where the rewards for reaching productivity targets were non-monetary. In one study, 83 students were recruited to perform a task and were rewarded with a custom made T-shirt for reaching a productivity target [4]. In the bonus condition, the T-shirt was only given to the students who had reached the target after they had finished the task. In the penalty condition, all students were initially given the T-shirt, but only those who had reached the target could keep it, while the other students had to return the T-shirt at the end of the task. Productivity was on average seven percentage points higher under the penalty contract than the bonus contract (Figure 1).

Importantly, these effects have also been replicated in the field, using actual employees in real-world labor markets. For example, a study conducted in collaboration with nine schools in the US implemented a teacher incentive program in order to increase students’ test score performance [5]. Teachers were rewarded with additional bonus payments depending on how highly their students ranked relative to their peers. Some teachers were paid this additional reward at the end of the school year once test results became available (bonus condition). Another group of teachers were paid a lump sum of $4,000 (the expected value of the reward, equivalent to about 8% of the average teacher salary) at the beginning of the school year. They were told that they would have to return some or all of the $4,000 if their students’ performance failed to meet the required targets (penalty condition). Thus, in both groups, teachers with the same student performance received the same final monetary reward. When the pay-for-performance scheme was implemented in the bonus condition, the incentives did not produce any significant improvement in students’ test scores relative to a control group that was not offered any reward scheme. In contrast, when the scheme was implemented that paid the reward upfront and demanded repayment for low performance, this generated a significant increase in test scores.

Another study tested whether the superiority of penalty contracts over bonus contracts is sensitive to the type of monetary incentives a firm uses [6]. The study was conducted in China, in collaboration with the same firm at which the earlier study was conducted [2]. The conditions of the study were similar to the earlier one, except that the performance incentives were not assigned on the basis of a predetermined productivity target, but on the basis of relative performance. Workers were grouped in teams that competed against each other for a weekly bonus awarded to the team with the higher productivity. As in the earlier study, the incentives were described to workers using either a penalty or reward contract frame. Absolute productivity was slightly higher in the penalty condition, although the effect was not statistically significant. However, teams in the penalty condition were about 35% more likely to win the contest than teams in the bonus condition, showing that the frame of the contract also affects performance when the incentives are based on relative, rather than absolute performance.

The hidden costs of penalty contracts

The evidence reviewed so far shows that simple differences in the presentation of a contract can significantly affect workers’ behavior and produce considerable increases in productivity, at virtually no extra financial cost for the firm. However, redrafting incentive contracts to emphasize losses instead of gains may entail “hidden” costs, which firms should take into account when designing incentive contracts. In fact, most firms tend to use bonus rather than penalty contracts, which may suggest that the use of penalty contracts could involve substantial drawbacks that employers are particularly wary of.

Employees may dislike penalty contracts

One potential drawback of penalty contracts is that employees may dislike them. For example, if the superior effectiveness of penalty contracts is indeed due to loss aversion, then penalty contracts may be inherently less attractive for employees, in that failure to reach performance targets is more painful (and success less rewarding) than under economically equivalent bonus contracts [7]. Hence, employees may demand higher payments from firms to accept an employment contract that is framed in terms of losses than an equivalent contract framed in terms of gains. Additionally, the differences in contract frames may trigger differences in the characteristics of employees who self-select into employment. These potential “hidden” costs may offset any gains obtained by firms through productivity increases.

This issue was examined in a recent experiment [8] which was conducted on Amazon Mechanical Turk, a large online marketplace where employers can hire contracted “workers” to perform simple computerized tasks, such as data entry, categorization of images, and proof-reading. The experiment consisted of two phases. In both phases the researcher acted as an employer seeking workers to transcribe several text strings. In the first phase workers were paid a flat fee to complete the task. In the second phase, taking place a week later, workers were sent a second job offer asking them to perform the task again. However, this time pay depended on performance: workers were told that they would be rewarded based on the accuracy of their work. Workers were offered two types of contracts: half of the workers received a contract framed in terms of losses, while the other half was offered an equivalent contract framed in terms of gains. The key question was whether the contract acceptance rates differed across the two conditions and, in particular, whether penalty contracts were less likely to be accepted than the bonus contracts.

The findings of the experiments were surprising: penalty contracts were actually more likely to be accepted than bonus contracts. The acceptance rate of penalty contracts was 25% higher than that of bonus contracts. Moreover, there was no evidence that the differences in the language used in the contracts triggered differences in workers’ selection: the workers who accepted the two contracts were similar in terms of ability (measured in the first phase of the experiment) and loss aversion (measured using a standard experimental protocol). These results were corroborated by another laboratory experiment, which measured subjects’ demanded compensation for working under penalty or bonus contracts [4]. It found that subjects on average demanded a lower compensation for working under a penalty contract, although this difference is not statistically significant.

These results were not anticipated, as one would expect loss-averse workers to avoid penalty contracts. One study has suggested that a possible explanation for the puzzling result is that workers may anticipate the fact that they are loss averse and may therefore intentionally select the penalty contract as a commitment device that forces them to work harder and thus increase their chances of being successful [4]. While the mechanisms underlying these findings are not yet well understood, the available evidence indicates that selection of employees away from penalty contracts does not seem to represent a substantial cost that may stop firms from using the loss frame when designing their employment contracts [8].

Penalty contracts may be perceived as too controlling

However, a number of studies have emphasized another potential drawback of using penalty contracts: that they may be perceived as being unfair and controlling, which may in turn make workers feel distrusted and insulted. There is now ample evidence, from a vast array of experimental studies, that feelings of distrust and unfairness can trigger strong negative reactions from individuals, who are often prepared to incur monetary costs in order to retaliate against those who have mistreated them. If workers feel they are treated unfairly under penalty contracts, they may retaliate against their employers by modifying aspects of their work behavior that may not be directly related to performance and productivity, but may still be of importance for the firms. Workplace theft, embezzlement, absenteeism, and sabotage are all examples of counterproductive workplace behaviors that can have harmful consequences and severe costs for organizations.

This leads to the question of whether the use of penalty contracts can trigger more negative and counterproductive responses from employees relative to bonus contracts. There is some evidence that this may indeed be an issue of concern. First, there is evidence that penalty contracts are, in fact, perceived as less fair than bonus contracts by workers. For example, workers who participated in one of the laboratory experiments reviewed earlier were also asked to rate the fairness of the employment contract they had faced in the experiment, on a scale ranging from “extremely fair” to “not fair at all” [1]. Workers who faced the bonus contract, on average, rated the employment contract as being fairer than those who faced the penalty contract. A similar finding is reported in another study [7].

Second, there is some evidence that exposure to penalty contracts may trigger more counterproductive workplace behaviors than exposure to equivalent bonus contracts. One study examines the impact of contract framing on the propensity for workers to engage in corrupt behavior [9]. The setup of the experiment is similar to the study conducted in Burkina Faso, which was discussed earlier [3]. Participants were recruited to spell check a set of exam papers, either under a bonus contract, a penalty contract, or a contract that offered both penalties and bonuses depending on the targets reached by the participant. In one of the papers, the experimenters had placed a monetary bribe and the message: “Please find few mistakes in my exam paper.” The study found that participants who were offered the contract combining penalties and bonuses were significantly more likely to accept the bribe and found, on average, fewer spelling mistakes than participants who faced the other contracts. There were no differences between bribe acceptance rates and grading quality of the participants in the pure bonus and penalty conditions.

Another study examined the effect of contract framing on cheating [10]. A total of 259 students were invited to take part in a laboratory experiment where they had to complete a task. Participants were given a sheet of paper with 20 pairs of matrices, each containing nine non-integer numbers. They were asked to find, in each of the pairs, two numbers that added up to ten. Their pay depended on the number of matrices solved correctly within five minutes. Some participants were paid at the end of the experiment, at a rate of €1.50 per matrix solved. Other participants were given a lump sum payment of €30 upfront, and they were told that they would have to give back any excess amount based on the number of matrices that they had failed to solve. Participants’ performance under the penalty and bonus contracts was measured in two conditions. In one condition payments were based on the self-reported number of matrices solved: at the end of the experiment participants counted the number of correct answers on their own and reported it to the experimenters. They then put their work sheets through a paper shredder so that no one could verify their actual number of correct answers. In the other condition the actual number of matrices solved was instead verified by the experimenters. Therefore, in the former condition participants had the opportunity to cheat by over reporting the number of matrices they had solved correctly. However, cheating was not possible in the latter condition because performance was monitored by the experimenters.

Productivity was higher under the penalty contract, both in the monitored and unmonitored condition. However, when performance was monitored, the productivity gain was small (about 2%) and statistically insignificant . In contrast, when performance was unmonitored, participants under the penalty contract reported to have solved, on average, 76% more matrices than participants under the bonus contract. The large increase in matrices solved in the unmonitored condition relative to the monitored condition strongly suggests that the productivity gain was by and large achieved by cheating.

Penalty contracts and performance on tasks not regulated by the contract

There is also evidence that penalty contracts can have counterproductive effects on aspects of performance that are not directly regulated by the contract. In one experiment, participants were asked to perform two tasks [11]. In both tasks they were matched in pairs and were assigned either the role of “employer” or “worker.” In one task, workers had to select a portfolio of risky investments for their employer and were paid using either a bonus or a penalty contract based on the ex-post profitability of the investments. In the other task workers had to choose how many shares of a riskless investment to purchase for their employer. This second task was not regulated by a performance contract, but workers were paid a discretionary amount chosen by the employer. Workers were found to purchase fewer shares in the unincentivized task when the incentivized task had been remunerated using a penalty contract than a bonus contract. Post-experimental questionnaires reveal that the negative influence of penalty contracts on workers’ performance can be attributed to the damaging effect that those contracts had on the trust relationship between employers and workers.

Limitations and gaps

The literature paints a mixed picture of the relative effectiveness of penalty and bonus contracts in encouraging workers’ productivity. While there is growing consensus about the beneficial effects of penalty contracts relative to bonus contracts, with corroborating evidence collected in laboratory experiments as well as in the field, there is a more limited understanding of the potential drawbacks of penalty contracts.

A few laboratory experiments offer some evidence that penalty contracts may impair workers’ feelings of trust and fairness towards their employer, and that this can have counterproductive effects on workplace behavior. Future research should complement these findings with evidence from the field to examine the extent to which these potential drawbacks play a role in actual labor markets.

It also seems important to examine the long-term effects of penalty contracts. All the studies discussed focus on relatively short-term increases in performance, but more research is needed to understand whether the beneficial effects of penalty contracts can be sustained in the longer term.

The existence of potential drawbacks and the lack of understanding about the long-term effects of penalty contracts may explain why employers may be averse to the use of such contracts and hence why penalty contracts are rarely used by firms.

Summary and policy advice

A large empirical literature supports the view that linking pay to performance is highly effective in raising productivity. However, often little attention is paid to how these pay-for-performance incentives are described to employees. A number of laboratory and field experiments have shown that employees can be motivated to work harder when pay-for-performance contracts emphasize the negative consequences of performance failure (“penalty contracts”), rather than the positive consequences of performance success (“bonus contracts”). This evidence suggests that firms can reap productivity gains by simple language adjustments of their employment contracts at virtually no extra financial cost.

However, there is also evidence that there may be hidden costs in the use of penalty contracts, as they may damage the trust environment of an organization, which may induce employees to engage in counterproductive workplace behaviors that can have harmful consequences for the firm. However, more evidence is needed on these potential drawbacks of penalty contracts to improve our understanding of their costs.

The long-term effects of penalty contracts are also not yet well understood. Overall, this suggests that penalty contracts should be used with caution and that firms should closely monitor employees’ levels of satisfaction and perceptions of fairness when using this type of contract, in order to promptly identify any impairments of the trust environment that may potentially offset any productivity advantage of the penalty contract.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author would also like to thank Hanna Fromell and Simone Quercia.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Daniele Nosenzo