Elevator pitch

Homeownership has important economic implications for society and individuals. At the social level is the greater civic engagement that homeowners tend to exhibit, while at the individual level an important outcome associated with housing tenure is better education outcomes, especially for children. The causal impact of tenure, in particular of homeownership, on education is mediated through a range of mechanisms. Evidence for the direct benefit of homeownership itself is less clear, though positive impacts associated with homeownership are stronger for low-income households.

Key findings

Pros

Homeownership is generally associated with benefits such as residential stability, better housing conditions, and civic engagement.

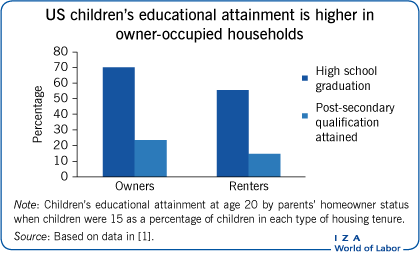

Children in owner-occupied dwellings achieve better education outcomes, including high school completion and college attendance, than children in rental households.

As a large and generally valuable household asset, homeownership provides a means to circumvent capital market imperfections and invest in education.

The benefits associated with homeownership are especially strong for low-income households.

Cons

Homeownership per se does not automatically lead to improved education outcomes; rather, the effects are mediated through mechanisms at the household and neighborhood levels.

The ways in which homeownership enhances education outcomes are not fully understood.

Households self-select into homeownership, so that children in home-owning households would on average achieve better education outcomes irrespective of housing tenure.

Policies to increase homeownership need to be targeted carefully if they are to have positive effects on education outcomes.

Policies that increase homeownership may reduce residential mobility and potentially increase unemployment, offsetting such benefits as those associated with education outcomes.

Author's main message

Studies commonly find that the children of homeowners achieve better education outcomes than children in rental households. The direct effect of homeownership on education outcomes is less clear, however. Recent analyses have used innovative techniques to identify the causal impact of ownership on education outcomes. The benefits of homeownership appear to be particularly strong for low-income homeowners. While a range of tax and transfer policies are designed to facilitate and encourage homeownership, targeting is needed to ensure that positive impacts on education are achieved.

Motivation

There is consensus among policymakers that homeownership provides benefits to individuals and to society. Indeed, in response to the large perceived benefits of homeownership, many governments provide a range of benefits, through tax and transfer systems, to encourage and facilitate homeownership [1].

For the individual, the benefits of homeownership include security of tenure, which has the potential to enhance labor market outcomes and the accumulation of wealth through house price appreciation over time. More broadly, it is generally hypothesized that homeowners have a greater investment in their local community and are more likely to add to the social capital in their neighborhood by engaging in civic activities.

One potential benefit of homeownership that has attracted increasing attention is its role in enhancing education outcomes, such as high school completion and college attendance, for children residing in such households. Homeowners, it is argued, may develop skills and attributes that enhance education and learning outcomes for children. Through this mechanism, homeownership may lead to better secondary and post-secondary education outcomes. Such benefits are over and above those associated with neighborhood effects, such as better schools in areas with a greater proportion of high-income homeowners, from which owner-occupiers disproportionately benefit. Homeownership can also improve education outcomes through its role as a large component of the household’s asset portfolio. Owner-occupiers have access to an important and increasingly liquid asset that can be used to support investment in human capital. Indeed, in launching the National Homeownership Strategy in 1995, US Secretary of Housing and Urban Development Henry Cisneros argued that homeownership is a commitment to personal financial security that provides families with an asset that can grow in value and provides homeowners with capital that can be used to finance a college education.

Other hypothesized benefits of homeownership include a lower likelihood of teenage parenthood among children in owner-occupied homes and greater participation in the labor market of children who grow up in owner-occupied housing [1], [2], [3], but these are not the focus of this article.

Discussion of pros and cons

In several countries, including Australia, the UK, and the US, there has been a longstanding belief in a policy of encouraging homeownership because of the benefits it provides to individual homeowners and to the community. For individuals, ownership provides security of tenure and an opportunity to accumulate wealth in an asset that has become increasingly liquid because of developments in financial markets. Ownership also provides specific incentives to invest in and maintain the housing asset, which has wider implications for the communities to which homeowners belong. Similarly, owner-occupiers are believed to have a greater stake in their neighborhoods and to be more likely to engage in formal and informal activities that enhance the civic environment.

An additional benefit of homeownership that is receiving increasing attention is the education gains that accrue to the children of homeowners, an outcome that has important policy implications. In the US, for example, policies have sought to move households away from disadvantaged neighborhoods in which education opportunities for children may be poor or limited. Housing assistance measures have been reoriented toward “tenant-based” assistance, which can be used to offset the cost of rent in the private rental market in neighborhoods with lower poverty rates. If homeownership provides benefits over and above those associated with positive neighborhoods effects, such a mechanism would provide an additional rationale for policies that promote homeownership and that focus attention on the goals of housing policy more generally.

How might owner-occupation enhance education outcomes?

A range of reasons are hypothesized for why homeownership might affect education outcomes. Broadly speaking, these can be associated with direct and indirect effects [1]. Direct effects include positive impacts on parental behavior, the enhanced physical environment enjoyed by owner-occupiers, the stability of tenure that accompanies owner-occupation, and the wealth that accrues to ownership. It is hypothesized, for example, that owners are likely to develop a set of skills as they respond to the challenges associated with ownership, such as general maintenance duties, management responsibilities, and negotiation with contractors. Home-owning parents develop a range of interpersonal skills that have positive impacts on the home environment and children. Moreover, home-owning parents tend to be more satisfied with life, which may provide a more supportive environment for children. Similarly, because of a direct financial investment in the housing asset, the physical environment in owner-occupied homes is generally better than it is in other forms of housing tenure. In general, owner-occupied dwellings tend to be of a higher quality and more spacious. There is evidence, for example, of a lower prevalence of lead-based paints in owner-occupied housing.

Especially important, ownership provides a stability of tenure that exceeds that of most other tenures, especially private rental. This residential stability represents a key mechanism through which education benefits are realized. Disruptions associated with changes in schooling are a key cause of poor outcomes during secondary school education. Moreover, residential mobility has the potential to affect social networks that provide continuity and thereby may enhance children’s learning and development during critical junctures in their education. Moreover, recent developments in financial markets over the past few decades that have enabled homeowners to withdraw accumulated equity also point to an important mechanism through which ownership can enhance education outcomes, for example, by making money available to pay for a college education [4]. While studies generally identify positive financial implications of owner-occupation, it is also important to recognize the potential negative impacts of the financial commitment that this form of tenure may create if it leads to stress and a less advantageous home environment for children.

Some indirect positive effects of homeownership arise from the advantages associated with the neighborhoods in which owner-occupation is more likely. Communities in which a higher proportion of homes are owner-occupied tend to have higher average levels of income and wealth. Owner-occupiers tend to have higher levels of civic engagement and to contribute more to social capital (the network of connections between people that can be socially and economically valuable), in part because of the greater financial interest of such households in the quality of the neighborhood. These neighborhood characteristics provide a positive external benefit to homeowners and their children independent of the direct benefits of ownership.

A final source of benefits associated with homeownership over other forms of tenure arises from the interaction between ownership and neighborhood effects. Homeownership provides the opportunity to counter some of the deleterious effects of a poor quality neighborhood and to enhance the benefits associated with an advantaged neighborhood.

It is generally acknowledged that the benefits of homeownership are moderated through the mechanisms described above rather than arising from ownership per se. Understanding the mechanisms by which housing tenure affects outcomes such as education has critical policy implications. Housing policies often confer tax benefits on homeownership and emphasize facilitating choice of housing tenure for those assisted and mitigating the deleterious effects of social or public housing. For example, housing assistance may provide vouchers or other subsidies that are readily transferable across housing markets. It should be acknowledged, however, that some of the advantages of homeownership may be replicable through other forms of housing tenure. For example, social or public housing can provide security of tenure despite the negative neighborhood implications typically associated with such programs.

Correlation or causation? The challenge of isolating the effect of tenure on education outcomes

Identifying the causal impact of owner-occupation on outcomes such as education is challenging. Ideally, the effect of homeownership would be assessed through an experiment in which parents and children are randomly assigned to different housing tenures, with homeowners being the treatment group and other forms of tenure the control group. In such a setting, the outcomes of treatment and control groups, such as children’s educational achievement, could be readily compared. Subject to some regularity conditions, including that the treatment applied to one household does not affect the outcome for other households, the differences in outcomes between treatment and control groups can be interpreted as a causal effect of the treatment—homeownership. An experiment like that would be nearly impossible to arrange, however.

Also challenging is ensuring that other factors that may affect the outcome of interest, other than the treatment, are held constant. For example, owner-occupation is usually associated with significantly higher household wealth levels, which also have an effect on the education outcomes of children. Moreover, if neighborhood effects are important, any impact is likely to be affected by which households are allocated to the treatment and control groups and by which neighborhood they are in.

In the absence of well-defined experiments, researchers have turned to non-experimental and quasi-experimental approaches to identify the impact of tenure on education and the causal mechanisms through which it occurs. While it is tempting to simply regress the outcome of interest, such as high school graduation or entry into college, on a set of characteristics that include housing tenure, that approach can generate spurious results.

One problem is selectivity bias. It is likely that education outcomes are at least partly determined by the same set of factors that are associated with the choice of homeownership over other forms of tenure, including parental skills and family stability factors. That is, housing tenure is chosen endogenously and is not simply an exogenously determined characteristic of households. Failing to take account of this endogeneity will likely lead to biased estimates of the impact of homeownership on the outcomes of interest. Effectively, the unobserved attributes of homeowners that affect education outcomes may be incorrectly attributed to tenure status. An alternative way to think about the problem is to note that homeowners select a particular tenure status, the neighborhood where they reside, and how often they move. In short, homeowners do not represent a group of households that have been randomly assigned to a particular tenure status.

Empirical analyses that sought to take account of the possible selection bias by using a measure of the cost of homeownership relative to renting have found mixed results [2], [5]. While there is little evidence that type of housing tenure and children’s school completion are affected by unobservable factors, analysis of cognitive and behavioral outcomes indicates a positive correlation between determinants of homeownership, such as wealth and education, and investment in children [2], [5]. Thus, there is sound—albeit somewhat limited—evidence that selection of households’ tenure status is not random. In turn, empirical estimates that fail to take account of this may provide biased estimates of the impact of housing on education and related outcomes.

Furthermore, notwithstanding the availability of increasingly rich data sets, it is generally not possible to control for the entire set of determinants of education outcomes. Factors such as housing stability, neighborhood quality, school characteristics, and parental inputs are all likely to affect education outcomes. Analyses that fail to control for the set of factors that determine education outcomes due to data limitations are likely to overestimate the impacts of housing tenure on children’s education outcomes.

An additional challenge for researchers relates to the nature of the tenure choice and outcome of interest. In general, any impact of housing tenure will manifest itself sometime in the future. That makes it necessary to use data sets that capture retrospective information on the housing status of individuals at critical points in their life when they resided with parents, such as data sets of a fairly long panel nature.

In the absence of random assignment to particular tenures, researchers have adopted a number of empirical strategies to deal with these challenges. These include estimating models that use instrumental variables (variables that are correlated with both the outcome and the explanatory variables that can be used to estimate the model without bias), modeling the tenure choice decision and education outcomes jointly, or exploiting what can be characterized as exogenous variation in housing circumstances, such as large increases in wealth experienced by homeowners during unanticipated housing booms. Analyses have been repeated across data sets to determine the robustness of the estimated impacts.

In most cases, empirical analysis suggests that homeownership has a positive impact on education outcomes such as high school completion. However, while the effect is statistically significant, it is substantially mitigated as additional factors are incorporated into the analysis. Moreover, the effect of homeownership is mediated through a range of other mechanisms, such as stability and security of tenure. While statistical techniques to identify the direct effect of a treatment such as homeownership net of the indirect effect through mediators are available, they require controlling for the endogeneity of the treatment and mediating variables. And that generally means that additional assumptions are needed about the independence of the potential outcomes and treatment and the independence of potential outcomes and mediators [6].

Cognitive skills and secondary education

It might be expected that the home environment, including tenure status, is a significant determinant of outcomes during formative years in early to mid childhood. Residing in an owner-occupied house is associated with significantly higher measured mathematics and reading skills for young children aged five to eight [5]. These associations are also observed to carry over to schooling outcomes, with children in owner-occupied housing more likely to graduate from high school, have better jobs, and have fewer teenage pregnancies [2], [7]. The positive impact of homeownership has been shown to be robust in a range of studies that have jointly modeled education outcomes and tenure choice or that have included a large set of parental and neighborhood variables to control for confounding factors that might affect education outcomes [2], [5]. The relationship between parents’ housing tenure status and children’s outcomes is also robust across a range of data sets and countries [2].

Despite the largely positive impact of housing identified across studies, it is the case that the measured impact of homeownership is reduced or in some cases eliminated when additional control variables are incorporated in the analysis, especially those related to neighborhood characteristics [3], [8]. Controlling for residential stability also reduces the impact of ownership on outcomes such as high school graduation, as does the inclusion of variables that account for child- or household-specific characteristics [5], [7], [8].

Empirical analyses indicate that the impact of homeownership is particularly large for low-income households. If ownership requires devoting substantial resources in the form of time and money to attaining and maintaining this form of housing tenure, that suggests that the financial discipline associated with ownership does not result in household resources being diverted away from investment in the human capital of children [3].

Post-secondary education outcomes

A positive association has also been identified between the homeownership status of parents and the post-secondary education attainments of their children, such as college attendance and completion. The fact that housing is a significant asset in a household’s wealth portfolio has focused attention on causal mechanisms through which tenure can affect children’s education. In the US, where college tuition can be high, the role of housing equity in facilitating a college education was first identified following changes in a student aid program that excluded this form of wealth in means testing [4]. The role of homeownership as an important asset has been strengthened by developments in the housing market, particularly the large increase in house prices in the early 2000s in the US, coupled with the increased ease of borrowing against accumulated housing equity [4], [9]. Rising housing wealth may affect education choices and outcomes directly by increasing household wealth and indirectly by relaxing credit constraints facing homeowners.

These developments in the housing market can arguably be characterized as creating exogenous variation in wealth holdings that is tenure specific. While rising housing prices may have positive implications for homeowners, who can draw on enhanced wealth holdings, the same is not true for renters, who need to accumulate additional savings if they wish to become homeowners in the future.

Research that exploits this change in housing wealth indicates that homeownership and the increased wealth that accompanies the growth in housing equity lead to increases in college enrollment [4]. The effect is fairly large, with a $10,000 increase in housing wealth raising college enrollment by 0.7 percentage points. As might be expected, the effect on college enrollment is confined largely to lower- and middle-income households, which might otherwise have faced borrowing constraints associated with the college participation decision. Analysis using the same variation in housing equity indicates that rising housing equity wealth also enhanced post-secondary education outcomes in other dimensions. Increased housing wealth is associated, on average, with a greater number of college applications, higher enrollment in more prestigious universities, and lower enrollment in community colleges by the children of homeowners [9]. Again, the evidence suggests that the impact is driven largely by the behavior of low-income households. Moreover, renters appear to be negatively affected by such developments in the housing market, as shown by evidence of lower educational attainment and earnings of their children when growth in house prices occurs at the critical juncture around college enrollment.

Beyond homeownership: Other forms of tenure and education outcomes

While homeownership has clear benefits, so do alternative forms of housing tenure. Forms of tenure may be broadly classified as owner-occupation, rental tenure in the private market, and some form of social or public housing. Owner-occupation is perceived to offer security of tenure that is not available in private rental markets. Further, on average, there are positive neighborhood impacts such as higher-quality schools that can benefit owners but that do not on average accrue to renters in public or social housing tenures. Social or public housing, in particular, has been associated with entrenched pockets of poverty and is increasingly being replaced by direct assistance that enables low-income households to select their own housing in private rental markets.

However, evidence suggests that concerns about the deleterious effects of social or public housing may be overstated. Analysis of tenure in public housing projects exploiting exogenous variation in the size of public housing allocated as a result of the gender composition of the household indicates that children in public housing exhibit better school outcomes, at least in being less likely to be held back during early years of primary school, than children in other rental tenures [10]. This outcome is important because of the correlation between the likelihood of being held back during early years of primary school and future education attainment. Despite potentially positive neighborhood effects, private rental accommodation may be of lower quality than that afforded by public or social housing. One caveat, however: The analysis suggests that the benefits of public housing tenure are confined to men, although it is unclear why this may be the case. More recent analysis of evidence exploiting a natural experiment provided by the demolition of public housing projects also suggests that the alleged deleterious impact of this form of tenure on education outcomes is overstated.

Limitations and gaps

Several dimensions of the tenure–education nexus remain unknown. One is the lack of evidence about the exact causal mechanisms through which homeownership enhances educational outcomes. While it is hypothesized that the beneficial effects occur through a number of mediating factors, evidence remains limited on exactly which factors are quantitatively important. For example, homeownership likely provides security of tenure that is not available to individuals in the private rental market, who face the risk of displacement if the property is sold. The importance of the residential stability associated with homeownership is highlighted by the fact that the impact of homeownership on secondary schooling outcomes is much reduced after residential stability is controlled for.

Recent analyses that have exploited unexpected and arguably exogenous changes in housing wealth suggest that wealth has a positive impact on the education outcomes of children residing in owner-occupied housing. What remains an open question is whether and how the contraction in housing wealth that coincided with the global financial crisis may have diminished educational attainment.

A key limitation of current research is that, with a few exceptions [11], [12], [13], it is confined largely to analyses of US data. This limitation is meaningful for two reasons. First, because the social institution of homeownership differs across countries, it is likely that any benefits of homeownership are country-specific and would likely depend on what alternative forms of tenure exist and what their characteristics are. For example, evidence for Switzerland shows no enhanced education outcomes for children residing in owner-occupied housing compared with children residing in housing with other forms of tenure [13]. Notably, the homeownership rate in Switzerland is approximately half that in the US, and people residing in rental housing generally experience relatively secure tenure. Rather than tenure itself, then, it appears that overcrowding is a more important determinant of children’s education outcomes.

Second, education outcomes are likely to be driven in part by the determinants of access to education facilities and funding at both the secondary and post-secondary levels. For example, in the US, concern about school outcomes for children in disadvantaged neighborhoods has motivated policies to enable children to attend better performing and better funded schools outside their neighborhood. There is some evidence, however, that the potential benefits from such a policy may be offset by the disruptive effects associated with residential or school mobility, especially during adolescence [7]. It is also possible that the benefits of homeownership are more limited in countries where post-secondary institutions are more homogeneous. In some countries, such as Australia and New Zealand, financing higher education does not require large upfront payments but rather can be achieved through loans that are contingent on student’s future income, potentially severing the nexus between parental housing tenure and children’s higher education. Despite these limitations, it is notable that evidence for Sweden and Taiwan is consistent with the positive impacts of homeownership identified in US studies at both secondary and post-secondary levels [11], [12].

Summary and policy advice

The consensus finding from a range of studies of the relationship between housing tenure and education points to positive educational outcomes such as high school completion and college attendance for children who reside in owner-occupied housing. This positive association is stronger for low- and middle-income households, where homeownership may offset other negative neighborhood impacts by providing stable housing tenure, as well as a source of wealth to draw on to pay for post-secondary education.

For enhanced secondary education outcomes, a key challenge is to identify the causal mechanism through which housing tenure affects education, which is critical to developing appropriate policy responses. The statistical tools and techniques required to establish such inferences are available and can be used in developing robust housing policies [6]. Some evidence indicates that important mediators through which housing tenure affects education include stability of tenure and extent of crowding within a household. Effective policies for improving education outcomes would thus need to focus on improving the stability of tenure and reducing crowding. While homeownership provides a potential mechanism for enhancing the impact of housing tenure on education outcomes, alternatives are also available. It is feasible, for example, to enhance stability of tenure and reduce overcrowding through appropriately designed housing policies for private and social rental markets.

Many different countries have considered homeownership to be a worthwhile policy goal. But most of the evidence on the impact of ownership on children’s education is confined largely to the specific institutional setting and experience of the US. Housing markets, institutional arrangements, and education policies differ across countries. Moreover, the causal mechanisms through which ownership, or other forms of housing tenure, affect secondary schooling outcomes are not fully understood. And while the evidence points to largely positive impacts associated with owner-occupation, there are caveats. Evidence suggests that high rates of homeownership may limit mobility and the adjustment of labor markets more generally. If this is confirmed by additional studies, then other mechanisms, such as reduced residential mobility, may be offsetting the potential gains associated with the education benefits of homeownership.

The findings reported here have implications for policymakers. Policies to support home buying could be misguided if they are motivated mainly by a desire to enhance educational outcomes. The evidence base on the benefits of homeownership for children’s education does not appear to support policies that are focused on increasing homeownership itself. Policies to encourage homeownership must be weighed against the challenges of making homeownership sustainable, as became sharply evident during the global financial crisis of 2008–2009. While homeownership can support investments in human capital, experience during the financial crisis and its aftermath cautions against relying on rising housing prices to sustain such investments. Finally, because evidence suggests that education-related benefits from homeownership are largest for low- and middle-income households, to the extent that policies to encourage homeownership benefit wealthier homeowners, they are unlikely to have the desired impact. More targeted policies directed to low-income households and first-time homeownership may provide greater education-related benefits than policies supporting homeownership in itself.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Stephen Whelan