Elevator pitch

Private charitable contributions play an essential role in most economies. Despite the existence of welfare states, people contribute money and supply volunteer labor to charity. From a policy perspective, there is concern that comprehensive government spending might crowd out these private charitable donations. If perfect crowding out occurs, then every dollar spent by the government will lead to a one-for-one decrease in private spending, leaving the total level of welfare unaltered. Understanding the magnitude and causes of crowding out is crucial, as it represents a hidden cost to public spending and can thus have significant impacts on public welfare.

Key findings

Pros

If people are only concerned with the total level of welfare provided, they will treat government spending as a perfect substitute for their own donations.

Crowding-out behavior is observed in laboratory experiments, which show that tax-financed contributions largely crowd out individuals’ charitable contributions.

Even if crowding out is small, potential negative consequences of a reduction in private philanthropy have to be considered.

Cons

The decision to contribute privately is determined by many other factors beyond the total level of welfare, such as the individual’s desire for earning respect or social prestige, or the utility derived from the act of giving itself.

Apart from the laboratory setting, there is hardly any empirical evidence to suggest that government spending largely crowds out individual charitable behavior.

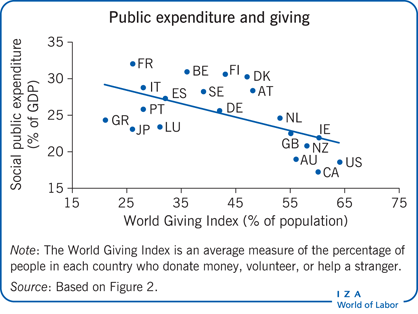

Studies based on micro-level data from charities as well as studies using regional or cross-country variation in private and public spending usually find small or incomplete crowding-out effects, or even some evidence of a crowding-in effect.