Elevator pitch

There are more informal workers than formal workers across the globe, and yet there remains confusion as to what makes workers or firms informal and how to measure the extent of it. Informal work and informal economic activities imply large efficiency and welfare losses, in terms of low productivity, low earnings, sub-standard working conditions, and lack of social insurance coverage. Rather than quibbling over definitions and measures of informality, it is crucial for policymakers to address these correlates of informality in order to mitigate the negative efficiency and welfare effects.

Key findings

Pros

The term “informal” raises awareness that many workers and firms are engaged in unproductive activities in low-quality working conditions.

Defining informality allows identification of those who are informal and therefore potentially vulnerable.

A flexible definition can exploit available data to measure the extent of informality.

The correlates of informality are widely known and can be addressed directly without necessarily formalizing workers or firms.

Cons

The term “informal” is too broad for targeting specific dimensions of informality, such as low productivity, low earnings, and job insecurity.

Different definitions can misrepresent the magnitude or severity of informality, and can muddy effective policy targeting.

Defining informality according to available data risks missing important aspects of being informal or different degrees of informality.

Author's main message

What is meant by “informal” varies widely and depends on a host of interrelated factors. Creating a single definition is challenging when the reality is complex; moreover, the very nature of informal activity—unregistered or underreported—makes accurate measurement difficult. If the definition of informality is shaped to fit the available data, policies may be poorly designed to address what matters most about informal work, namely low productivity, low earnings, poor working conditions, and vulnerability to income shocks. As such, policymakers should identify those who suffer from these effects, and address each set of challenges with specific, targeted actions.

Motivation

A majority of the world’s workers are engaged in tenuous employment, including self-employment in farming or low-productivity services such as retail trade, or perform work that is not registered with the government. Those in informal work lack protections with respect to working conditions and labor rights, and typically are not covered by social insurance, which provides protection against potential income shocks stemming from job loss, illness, or old age. Informal employment lacks the stability of an open-ended full-time formal job, due to variable work hours and income, and no guarantee of future earnings.

The high proportion of informal employment in total employment is a drag on productivity and living standards, and is a reflection of—and further undermines—weak institutions. The result is sub-optimal levels of efficiency and welfare. Informal work tends to be less productive, relies on less-skilled labor inputs and offers fewer opportunities for skill accumulation. This in turn constrains the growth rates of highly informal economies due to low value-added, and leads to low income per capita levels. Even though informal employment accounts for the majority of employment in the developing world, the contributions of informal workers and producers to national output fall in the range of 25–50% of GDP [1]. Informal work tends to pay less than formal work. Moreover, low informal earnings—especially for small farmers and subsistence entrepreneurs—limit disposable incomes and thus provide little support for aggregate demand through households’ consumption of local goods and services, slowing the pace of economic growth. Even non-subsistence informal workers are likely to make only limited contributions to aggregate demand given that informal earnings often average less than the national minimum wage [2]. Poverty incidence is much higher among those in informal work, and low informal earnings also lead to persistently low intergenerational human capital accumulation and therefore low labor productivity. With respect to firms, credit-constrained informal firms are less likely than formal firms to invest their limited profits in skills or technology upgrades that enhance productivity, revenues, and firm growth. Furthermore, tax and regulatory avoidance efforts are costly, diverting time and resources away from productive activities and limiting economic output and fiscal revenues. It is thus important for policymakers to understand the channels through which informality is a drag on growth and human development, and design policies to mitigate these negative consequences.

Discussion of pros and cons

Informality is a global phenomenon

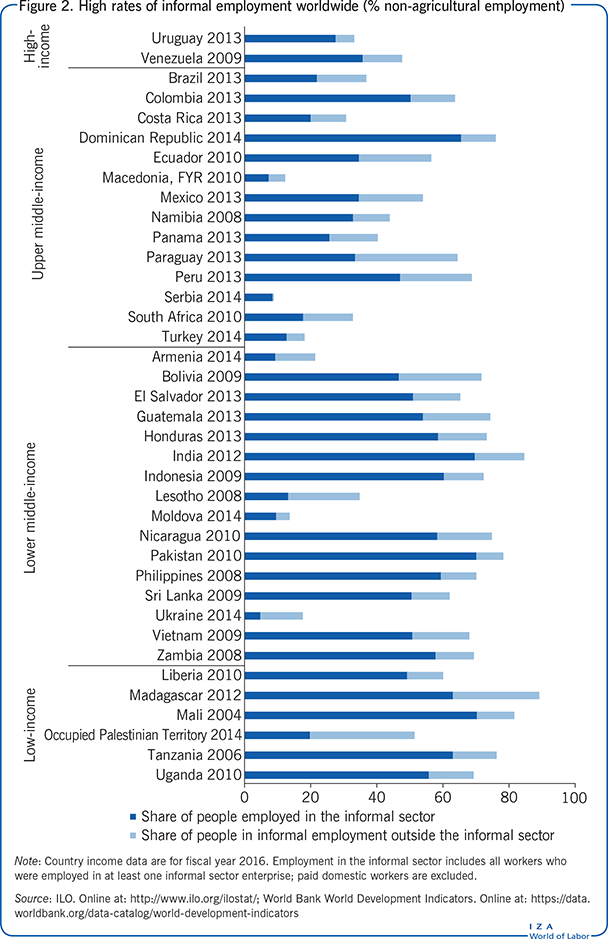

Worldwide, the share of informal employment in total employment varies from very low rates in rich countries such as the US and much of Western Europe, to moderate rates of around 20% in transition economies such as Macedonia, Serbia, and Mongolia, to 70–80% in many countries in Latin America, and exceeds 90% in countries such as India and Madagascar.

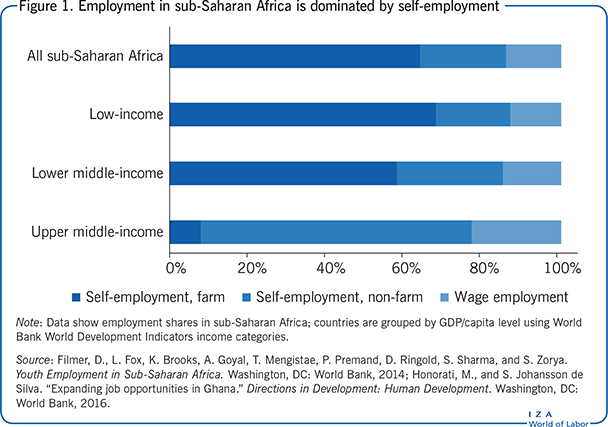

Informal employment is the dominant work status in most developing countries, partly due to the fact that a high proportion of economic activity is concentrated in primary production (e.g. agriculture) using traditional or low-tech methods and performed by self-employed farmers on small plots of land. Figure 1 illustrates the very high rates of self-employment across sub-Saharan Africa, especially in poorer countries.

Even developing economies that are transitioning from traditional agriculture toward modern production in manufacturing and a diverse services sector have high shares of informal employment, precisely because many services are low value and tend to be delivered by low-productivity microenterprises or self-employed workers. When the agriculture sector is excluded from employment measures, informality rates are still high throughout the world’s developing economies, especially among the low-income and lower middle-income countries (Figure 2). Moreover, most countries show a significant degree of evasion, reflected by the large portion of informal employment outside the informal sector, including undeclared workers in a registered firm, for example.

Structural transformation within the world’s most advanced economies was initially characterized by a shift from primary sectors into urban-based, capital-intensive manufacturing activities in medium and large firms and a subsequent diversification into services. This economic development was accompanied by the emergence of institutions associated with formality, such as modern tax regimes, business and consumer safety regulations, worker protections, and social insurance, among other things. Despite this historical context, informal contracts and informal activity are again becoming increasingly prevalent in advanced economies, as evidenced by the rise of temporary contracts, sub-contracting relationships that lack worker protections, and the relatively under-regulated internet economy [3].

Competing definitions confound the side effects that really matter

The term “informal” is used to refer to various types of work with characteristics ranging from home-based work to poor working conditions, lack of benefits, and small firm size—all factors implying a degree of vulnerability. Informality can also refer to unregistered or underreported economic activity. Because of the wide range of definitions used, cross-country comparisons of informality rates are difficult to get right. Informality has been extensively debated, defined, and measured in the literature (for some recent examples, see [4], [5]). The term is so familiar that its meaning is often taken for granted.

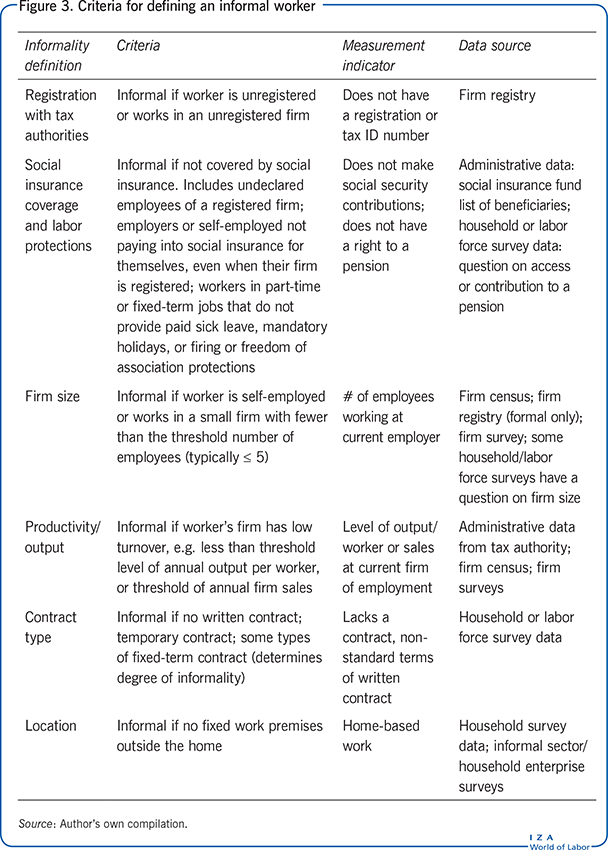

In practice, informality is defined according to a range of different criteria (Figure 3). Workers can be categorized as informal if they are unregistered or work in an unregistered firm. This definition is based on regulatory requirements that employers register with tax authorities and meet rules for providing their employees access to social insurance (e.g. unemployment and health insurance and old-age pensions), and comply with worker safety protections and workers’ rights (e.g. minimum wages and dismissal restrictions). Informal workers do not have access to these workplace protections or social insurance. This definition aligns closely with the work status categories commonly used in labor force and household surveys: unregistered own-account or self-employed workers, subsistence farmers, and unpaid family workers are informal; public sector wage employees are formal; private sector wage employees and employers can be either formal or informal.

An alternative definition of informality considers only the worker’s welfare in terms of access to social insurance and other labor protections [6]. In this case, even employers or high-income self-employed workers whose firms are registered but do not make social security contributions on their own behalf are exposed to income shocks; but this subset of workers does not need government-sponsored social insurance, given they have the means to privately insure themselves. The social insurance-based definition of informality could also include wage workers in temporary, part-time, on-call, or sub-contracted employment, or those on fixed-term contracts who do not meet eligibility criteria such as minimum hours, minimum earnings, job tenure, or contract type to be covered by social security or other benefits or protections (e.g. mandatory holidays, sick leave, firing restrictions). Workers in these categories are defined by the ILO as being in “non-standard employment” [3]. In countries with less stringent regulations for service sector employment with respect to, for example, limits on working hours, mandatory holidays, or sick leave, or where social insurance has important coverage gaps due to high eligibility thresholds, workers in non-standard employment might be registered and in full compliance with the tax and regulatory requirements, but still be vulnerable to income shocks or other work-based risks.

Informality can alternatively be defined on the basis of firm size, since small firms are excluded from many of the above-mentioned regulations in some countries and tend to have low productivity, low turnover, or very small profit margins. For example, firms with five or fewer employees may not be subject to labor rules such as social security, firing restrictions, or workplace safety provisions, or may be exempt from profit taxes. One shortcoming of this definition is that it cannot distinguish between two groups with vast differences in job quality: (i) small producers with very high skills and high earnings (e.g. self-employed accountants), and (ii) unskilled, low-earning producers of low-tech goods and services. The size cut off also varies; in many countries, workers are categorized as informal if they work in or are the employer of a firm with five or fewer employees, even if the workers are registered (consistent with the ILO definition).

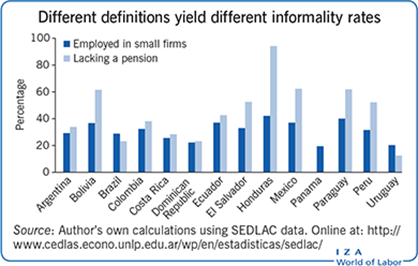

Comparing informality rates using different definitions yields quite different results. In Paraguay, for example, the share of workers lacking social security coverage or employed in an unregistered firm was 71% in 2014, but using the firm-size definition indicates that only 58% of workers were informal [2]. Repeating this comparative exercise for a sample of Latin American and Caribbean countries reveals large gaps between the two definitions, with informality rates differing by 20 percentage points on average, and as much as 52 percentage points in the case of Honduras.

Informality can alternatively be defined using a productivity threshold, or based on output levels. Many low-paid workers hold one or more jobs in addition to a main occupation. These secondary labor activities may involve fewer working hours, evening or weekend work, and generate output/income below a certain threshold. On the other hand, even small firms can have high output or productivity levels, such as an import supplier to large formal firms or a government agency. This can also arise for importers of high-value retail goods, or high-end service providers. In Peru, for example, the production-based cut off for classifying normally micro or small firms (based on number of employees) as “medium” is annual sales over US$2 million (2016 threshold).

Contract type can also be used to define informality. Workers lacking a formal, written—and therefore enforceable—contract typically include self-employed subsistence or smallholder farmers, own-account workers, and unpaid family workers. They might also include other potentially vulnerable workers such as casual day laborers, domestic employees, or informal wage workers in unregistered firms or undeclared wage workers in registered firms. On the other hand, this definition of informality would also include owners of highly productive and profitable firms as well as highly skilled IT entrepreneurs or business services consultants with high earnings that may go untaxed, which are examples of workers who are not particularly vulnerable or in need of subsidized social insurance or other support to raise productivity.

Finally, informal employment status can be defined using physical location criteria. For example, workers lacking a fixed place of work outside their home would be defined as informal. This would include those engaged in household production of vegetables or handicrafts that are sold casually, or those engaged in “walking employment,” such as mobile street vendors, but would exclude non-contract wage employees in manufacturing firms and small farmers or traders with regular market stalls.

Limitations and gaps

Data availability and coverage are serious concerns when measuring or comparing informality

The data available to determine formality status and measure the extent of informality in an economy tend to be inadequate, creating serious measurement challenges. On the positive side, the wide range of options for defining informality raises the prospects for finding the necessary data to measure informality. The data sets typically available include household-level data on the working-age population, administrative data, and firm-level data. Household-level data tend to be collected through periodic household censuses or voluntary household surveys, living standards measurement surveys, or labor force surveys. Each survey type is based on questionnaires that use largely standardized ILO definitions of employment and unemployment, capture data on individual and household characteristics as well as individuals’ employment and earnings, and cover all types of workers (formal, informal, registered, unpaid, and illegal immigrants). Another data source is government administrative records. For example, tax records can provide information on a firm’s revenue and cost structure, including the wage bill, while social security records provide information on workers’ wages and places of work; but, administrative data sources exclude unregistered workers, unregistered firms, or those that fail to meet minimum income thresholds. Firm-level data is available in many countries, though with less frequency. Instruments include occasional firm censuses (typically formal firms only), annual administrative data such as tax records for formal firms, periodic firm surveys that may or may not cover small firms or rural firms, and specialized informal sector surveys that capture microenterprises and household production.

In countries lacking good survey data, or where data sets have only limited coverage (e.g. urban rather than national coverage), administrative records provide a second-best alternative. The inherent difficulty of collecting comprehensive and representative data has implications for accurately measuring total employment activities and for estimating GDP, due to the exclusion or underreporting of informal activity. Moreover, poor quality national accounts data in turn limits the ability to derive credible labor productivity measures comparing informal and formal workers, or workers in different sectors and their relative contributions to economic growth.

In data-poor countries, informality may be defined using more readily observable characteristics such as firm size, whereas in data-rich countries, information on tax registration and annual sales may be available. The increasingly standardized household and labor force survey instruments allow a nuanced definition such as the regulatory definition combining firm registration and social insurance access. But even in data-rich countries, variations in regulatory requirements and therefore formality status together with incentives for evasion or underreporting mean that measurement is imperfect. For example, when tax and social security obligations are linked to firm size, firms have an incentive to underreport the number of their employees or the level of sales or profits, or a single employer may create numerous firms, each falling below the threshold for reporting or taxation. Applying the legal or firm-size definitions would identify these firms as informal, but in reality they act more like large firms in terms of their resources, investment decisions, and management [7].

Whereas it may be useful to have a simple definition using the lowest common denominator—such as number of employees—to compare informality rates and characteristics across countries, even this measure is difficult to obtain accurately, particularly in countries with weak tax institutions, low statistical capacity, or governance challenges such as mistrust of the state. Moreover, these various aspects of weak institutionality directly contribute to higher rates of informality, creating a vicious cycle of mismeasurement and evasion. It is therefore useful to have complementary definitions that capture different aspects of informality.

Measurement challenges can be acute in the least developed countries, but arise even in countries where statistical capacity has increased significantly over the past decade. Across the Latin America and Caribbean region, for example, household surveys are regularly conducted, most of which are nationally representative; on the other hand, not all surveys collect information on the registration status of firms. As a result, it is impossible to use the regulatory definition of informality for all countries. Similar problems emerge in the Africa region, where data tend to be collected infrequently, survey quality and coverage are inadequate, and consistency of questionnaires is lacking, all of which undermine international comparisons, and may partly explain the wide variations in informality rates across regions [8].

There are additional challenges involved in reconciling various informality definitions to the available data. For example, whereas household or labor force surveys may solicit information on all productive activities in a household, aggregating these various activities is complicated. As a result, researchers may simplify by using data on the main occupation only, thereby forgoing information on secondary and tertiary—often informal—productive activities.

Defining informality is a flawed process and should not be the ultimate goal

A key shortcoming of the preceding definitions is their binary nature, implying workers and firms are either formal or informal. Much of the early literature addressing informality presented dualistic models of, for example, modern capitalist production versus non-capitalist production, or the informal rural sector versus the formal urban sector [9], [10]. In reality, a more mixed picture prevails. Firms or workers in transition from informal to formal status may move along a formality spectrum, or “continuum” [11]. Workers can manifest varying degrees of formality, reflected in their contract type and benefits such as social security coverage, and in the enforcement of workers’ rights, including workplace safety, work hours, holidays, and sick leave provisions, among other things. Furthermore, a single worker can be simultaneously employed in formal and informal work. On the firm side, firms may be formal because they are registered and report business activities that are taxed, but may underreport some activities and therefore pay less tax and lower social security contributions for undeclared employees. More nuanced definitions have been proposed that establish gradations of enterprise formality using a combination of criteria, such as firm size, registration, tax status, honest accounting, mobility of workplace, and access to bank credit [12]. The many variables used to derive the different definitions of informality reflect the high degree of heterogeneity among the workers and firms that are considered informal [13].

There is no simple definition that can perfectly determine who is informal. It is better to shift the focus from identifying who is informal, to how to mitigate the costs of being informal. The definitions discussed above do not capture nuances in the gradations of informality related to productivity and efficiency gaps, or to job quality gaps. Instead, it would be more useful to focus on the correlates of informality, namely, low productivity and earnings, poor or unfair working conditions, and limited access to social insurance. To do so, it will be necessary to identify the factors that make certain entrepreneurs or firms unproductive, or the factors that inhibit them from expanding or upgrading their product quality and accessing new markets. With respect to workers, it is important to identify the dimensions in which workers are suffering from poor job quality. Do they relate to dangerous or harmful working conditions? Excessive or unpredictable work hours? Unstable earnings? Low wages? Exposure to income shocks? Addressing the binding constraints facing informal workers and informal firms can more directly improve productivity and welfare, regardless of formality status.

Summary and policy advice

Informality affects a majority of workers around the world, especially in developing economies. Awareness of the negative effects of informality is rising, and policymakers are devoting increased attention to understanding and addressing the implications. However, the lack of coherence in defining informality and the measurement challenges associated with data availability and data quality may be getting in the way. For example, misstating the extent of informal employment may bias conclusions about households’ income earning opportunities or income security. Likewise, relying on firm-size criteria alone may lead to poor targeting of resources to highly skilled, high-earning micro-entrepreneurs who more closely resemble formal firms. Focusing on getting the definition and data and measurements right does not help with designing policy interventions to reduce the negative implications of informality.

Mitigating the impact of informality can be approached from different angles by separately addressing the various drivers of informality. Whereas the drivers may be similar for workers and for firms, the transmission channels are likely different. Burdensome regulations and/or poor enforcement may drive employers or workers into the shadows; understanding the reasons for lack of enforcement and enhancing incentives for compliance and enforcement will lead to better outcomes.

It will be important to target interventions to the specific channels through which informality is individually or collectively costly:

For unproductive firms that cannot access the right mix of inputs, government incentives and specifically targeted interventions can foster a more efficient allocation of capital, labor, and human capital in order to enhance firms’ productivity. Self-employed workers may require more capacity and start-up support compared to small firms, for example, but even small and medium firms may need support—whether regulatory, strategic, or relating to infrastructure or input quality—to reach globally competitive productivity levels.

For workers lacking workplace or contract protections, government policies could help foster worker coordination or representative mechanisms to increase workers’ collective rights in the face of unequal bargaining power. Where government enforcement capacity is weak, partnering with civil society organizations to strengthen oversight of worker protections can be an effective approach.

For workers suffering from low incomes and/or limited human capital, income support policies can be targeted to families that fail to meet their basic consumption needs. Means-targeted programs for education, training, and labor market insertion can also assist needy workers to compete for better quality jobs that pay higher wages.

For workers exposed to income shocks, extending social insurance to informal workers can reduce their vulnerability and mitigate negative income fluctuations that can deplete household savings and undermine human capital accumulation.

Because the main correlates of informality are known—low productivity and earnings, poor working conditions, and limited access to social insurance—policies should be designed to address these outcomes directly.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The analysis and conclusions expressed in this article are those of the author and not necessarily those of the World Bank.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Elizabeth Ruppert Bulmer