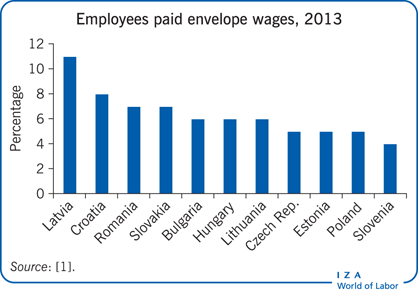

Elevator pitch

In transition economies, a significant number of companies reduce their tax and social contributions by paying their staff an official salary, described in a registered formal employment agreement, and an extra, undeclared “envelope wage,” via a verbal unwritten agreement. The consequences include a loss of government income and a lack of fair play for lawful companies. For employees, accepting under-reported wages reduces their access to credit and their social protections. Addressing this issue will help increase the quality of working conditions, strengthen trade unions, and reduce unfair competition.

Key findings

Pros

Paying envelope wages might preserve employment.

Employees can receive higher wages if tax and social insurance contributions are not fully deducted.

Envelope wages can contribute to company survival, functioning as a buffer that allows for downward wage mobility, thereby protecting the company and its employees against negative demand shocks.

Reducing institutional asymmetry between formal and informal mechanisms might reduce the salary under-reporting practice.

Cons

Envelope wages undermine the state’s ability to control the quality of working conditions; they weaken trade unions and collective bargaining power.

Such arrangements result in lost public revenues.

Under-reporting wages adds pressure on legitimate businesses to evade regulatory compliance due to unfair competition.

By accepting envelope wages, employees reduce their entitlement to credit, pensions, and social protection, and allow employers to impose additional conditions in the future.