Elevator pitch

In transition economies, a significant number of companies reduce their tax and social contributions by paying their staff an official salary, described in a registered formal employment agreement, and an extra, undeclared “envelope wage,” via a verbal unwritten agreement. The consequences include a loss of government income and a lack of fair play for lawful companies. For employees, accepting under-reported wages reduces their access to credit and their social protections. Addressing this issue will help increase the quality of working conditions, strengthen trade unions, and reduce unfair competition.

Key findings

Pros

Paying envelope wages might preserve employment.

Employees can receive higher wages if tax and social insurance contributions are not fully deducted.

Envelope wages can contribute to company survival, functioning as a buffer that allows for downward wage mobility, thereby protecting the company and its employees against negative demand shocks.

Reducing institutional asymmetry between formal and informal mechanisms might reduce the salary under-reporting practice.

Cons

Envelope wages undermine the state’s ability to control the quality of working conditions; they weaken trade unions and collective bargaining power.

Such arrangements result in lost public revenues.

Under-reporting wages adds pressure on legitimate businesses to evade regulatory compliance due to unfair competition.

By accepting envelope wages, employees reduce their entitlement to credit, pensions, and social protection, and allow employers to impose additional conditions in the future.

Author's main message

The phenomenon of salary under-reporting is a result of an illegal verbal arrangement between employers and employees. This agreement nullifies the formal written contract regarding the conditions of employment. A common feature is the payment of illegal cash, or “envelope” wages, which are not recorded by formal institutions (i.e. tax, pension, or credit authorities). Policymakers can address this problem in a number of ways, including educational or punitive measures, or by modernizing government processes; however, the bringing of formal and informal institutions into closer alignment—though no simple task—may represent the most effective method to reduce salary under-reporting.

Motivation

Envelope wages occur when an employee receives an official declared salary based on a formal written contract and an additional undeclared (“envelope”) wage. This envelope wage is based on an unwritten verbal contract, which supersedes the formal written contract [2], [3], [4], [5]. At first glance, it might be expected that employees would welcome such an arrangement with their employer, because otherwise they might not have a job, or their salaries would probably be lower if the employer was forced to pay the full social contributions due. However, empirical studies point out that employers largely impose this wage practice onto employees as a condition for obtaining the job. Employees often complain about this arrangement, mainly because their ability to access credit is reduced, as are their pensions and social protections, which are lower in systems where those entitlements are linked to one’s official wage. For governments, such arrangements result in lost public revenues as well as a reduced ability to monitor the actual quality of working conditions [1], [3], [6]. Governments therefore oppose these arrangements.

Discussion of pros and cons

Formal/informal employment nuances

Envelope wages can be seen as a kind of (semi-)informal employment. In order to define informal employment and to distinguish it from formal employment, three types of descriptions have been used, namely enterprise-, activity-, and job-based. The International Labour Organization offers the standard definition, which has changed focus over time from an enterprise level to a job level description, considering informal employment within formal enterprises [1]. However, in OECD countries, the widespread view is that an activity-based definition is more suitable.

The vast majority of literature recognizes that an enterprise can have both formal and informal employment, and that a worker may engage in both formal and informal jobs. Yet, a job remains classified as either wholly formal or wholly informal, under no circumstances is it referred to simultaneously or partially as both [1].

However, recent studies recognize the existence of envelope wage arrangements, which brings into question the typical depiction of jobs as either formal or informal. These studies show that, in some cases, formal employees receive from their formal employers wages that are divided in two fractions, one declared wage and an additional undeclared envelope wage.

How envelope wages operate

Envelope wages can be explained as follows: when people become employed, a formal agreement is signed between the employer and the employees; this includes remuneration with an officially declared wage, to which a supplementary, undeclared salary is added. This additional undeclared wage is based on a mutual understanding between both parties that the verbal agreement supersedes any formal written agreement [2], [3], [4]. Verbal agreements per se are definitely not illegal, and they are afforded the same legal effects as written agreements in several countries. However, as both parties mutually agreed to circumvent the complete payment of the full tax and social security dues owed to the state through the illegal underreporting of earned salary, this particular type of verbal agreement is illegitimate [5]. Yet, this practice is used as a coping strategy by some firms who otherwise might not declare the jobs at all, since they do not have sufficient resources to cover the full tax contribution due. Furthermore, envelope wages can function as a financial buffer, allowing for downward wage mobility that protects the firm (and the employee’s job) against negative demand shocks. In other words, firms have additional flexibility to quickly reduce their wage expenditures, which may prevent wholesale layoffs when times get tough.

Some envelope wages may simply deviate from the formal contract by stipulating that the employee will be paid more for their regular employment than is listed in the formal written contract. However, more commonly, this verbal agreement attaches additional conditions to the employee. These may include: that the employee does not take their full entitlement to annual leave, that they work more hours per week than is stipulated in the formal written contract (which might cause them to work more hours than is considered legal, or result in them being paid below the minimum hourly wage), or it may specify different job responsibilities to those stated in the formal contract [2], [5], [7]. In general, if employees do not agree to these additional conditions, they will not be offered the job. Moreover, this verbal agreement replaces the formal agreement and represents a verbal “psychological contract” between the two parties [7].

At first glance, one might assume that employees would prefer to under-report their wages, especially considering that they could receive a higher income if their employer does not have to pay their full tax and social insurance contributions [8]. Nevertheless, at EU level, evidence shows that only one out of three employees who receive envelope wages is happy with this type of arrangement. The others would rather declare their complete wages, were undecided, or refused to provide an answer. Importantly, their preferences differ according to the type of activity for which the employee receives the under-reported wage: for regular work; for overtime/extra work; or for both, respectively. This practice is more widely accepted by employees’ who only under-report payments for overtime/extra work. Those paid with envelope wages for their regular duties or for regular and overtime/extra duties would rather have a full statement of their actual income. The reason for this is that under-reporting salaries for regular duties might reduce employees’ access to social protections (e.g. social security or pension funds), and may restrict their ability to secure bank loans or mortgages [3]. Similar insights were revealed by previous qualitative studies conducted in two transition economies, Ukraine and Russia [6], [9].

The prevalence of envelope wages

Analysis of the literature reveals that most studies do not provide much useful information about the prevalence of envelope wages. This is largely due to the fact that existing studies have been relatively small-scale, and primarily involved specific countries from Central and Eastern Europe. However, some hints about the spread of this illegal arrangement can be extracted. For instance, the proportion of employed persons that are believed to receive an under-reported salary is 9.6% in Estonia, 22.5% in Latvia, 11.7% in Lithuania [10], 30% in Ukraine [6], and 60% in Moscow [9].

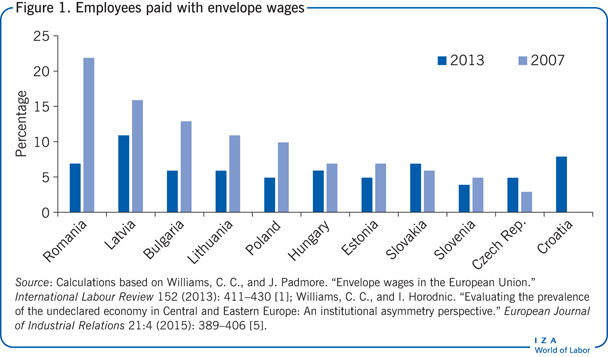

Insightful studies, based on data from the 2007 and 2013 Eurobarometer surveys show that the countries with the largest percentage of employed persons paid with envelope wages in their formal jobs are those classified as transition economies. In 2007, across transition economies, Romania had the highest share of employees receiving envelope wages (22%), while the Czech Republic had the smallest share (3%). In 2013, the share diminished in all transition economies, except for Slovakia and the Czech Republic. The largest share of employed persons paid with envelope wages at their formal job is in Latvia (11%) (Figure 1). Yet, these results should be cautiously interpreted considering potential biases related to whether respondents answer honestly given that the subject matter is related to illegal work practices. Thus, the percentages reported might be underestimated.

Indeed, a recent study reveals that envelope wages represent a large share of the shadow economies in each of the Baltic countries. Considering three components of the shadow economy, namely unreported business income, unreported employees, and envelope wages, the study shows that envelope wages represent 52.3% of the shadow economy in Estonia, 42.9% in Lithuania, and 39.2% in Latvia [11].

Which employee groups receive envelope wages and which businesses are more likely to pay them?

The practice of under-reporting salaries is more common among certain sectors as well as certain groups of employees. In particular, employees and employers working in smaller businesses and the construction sector are more likely to use this practice [1]. Smaller businesses are more likely to pay envelope wages due to a lack of human resource management (HRM) personnel and the absence of formal HRM procedures within the company. This creates a background for implementing verbal agreements, thus infringing upon or wholly supplanting formal written employee agreements.

Envelope wages prevail among the following groups: men, youth, manual workers, and lower-paid staff [1]. According to a study on transition economies in Eastern and Central Europe, people at retirement age, those with fewer years in formal education, and those with lower incomes, who often have difficulty paying their bills, are more likely to adopt this type of informal payment and thus under-report a larger share of their income. Thus, weaker and more vulnerable employee groups are more likely to be taken advantage of by employers, often by means of unfavorable conditions attached to envelope wage agreements [5]. Although this practice might, in some cases, be the only way to get a job, and might have positive effects for some individuals (i.e. higher salaries when their employer does not have to pay their full tax and social insurance contributions), at a societal level, the practice has widespread negative effects. Due to the direct link between the contribution amount and the level of social protection, governments lose out on revenues, which could be used for assuring better social protection for their citizens [12]. Governments also lose some measure of control over the quality of working conditions since they are unable to monitor the actual situation imposed on employees via their unwritten verbal contract (e.g. if the firms meet legal standards regarding minimum wages, maximum hours, safety, or health standards; or if the employee is required to perform different activities to those specified in their formal contract). Furthermore, this creates a situation in which unfair competition exists for legitimate businesses, adding pressure on them to evade regulatory standards in order to keep pace with those that already do.

Explaining the practice of paying envelope wages

Typically, three theories pertaining to the wider undeclared economy are used to understand the practice of salary under-reporting. The most common is the “modernization” thesis, which argues that undeclared work is most established in less developed economies, where government modernization is not particularly robust. Therefore, economies with low gross national product (GNP) per capita and countries without a modernized state bureaucracy are more prone to envelope wages [5]. A second explanation is provided by the “neoliberal” school of thought, which claims that high tax rates and increased interference in the free market by the state lead to a higher frequency of salary under-reporting [5], [8]. This perspective believes envelope wages prevail in countries that levy higher taxes and experience greater levels of state interference in the work and welfare systems. Third and finally, a “political economy” explanation emphasizes the opposite: that lower state intervention in work and welfare fails to protect workers properly, resulting in the envelope wage practice. From this point of view, a possible solution is to provide greater security to vulnerable groups by putting financial emphasis on social protections, by reducing inequality, and by promoting social transfers. Inherently, this perspective believes that envelope wages will be more predominant in countries with relatively low levels of state intervention. The evidence from Eastern and Central Europe tends to validate the modernization and political economy theses. Thus, the neoliberal thesis fails to explain the prevalence of envelope wages in those regions [5]. However, approaches that attribute the practice of envelope wages to country-level structural issues fail to explain why some citizens in a country accept this arrangement, while others do not. In other words, they do not consider differences between individuals in their explanations [7].

In response to these traditional theories’ inadequacies, a new theory for depicting and approaching envelope wage practices and the undeclared economy has been developed based on an institutional perspective. This theory purports that misalignment between a society’s formal written rules (as would be enforced via an official employment contract) and the informal unwritten rules (represented by the additional verbal contract that supersedes the official version) results in the under-reporting of salaries.

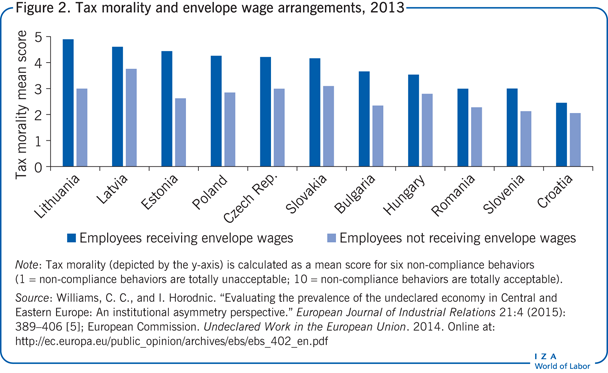

When formal institutions (codified laws and regulations) and informal institutions (values, beliefs, and norms of society) are not aligned, either at an individual or societal level, the result is the emergence of practices based on unwritten socially shared rules, which are “illegal” in comparison to the formal, written ones. The tax morale of a person or population represents their intrinsic motivation to pay the taxes owed, and can be used to measure the level of misalignment between formal and informal institutions with respect to tax compliance [12], [13]. If there is a high level of symmetry between formal and informal institutions, then individuals and societies will display a high level of tax morality. Conversely, when there is greater asymmetry (i.e. a more significant gap between people’s willingness to follow formal rules versus the socially accepted informal ones), the level of tax morality will be lower. Indeed, studies using attitudinal questions about the adherence of populations to the codified laws and regulations of formal institutions with regard to tax compliance reveal a close relationship between salary under-reporting and institutional asymmetry. Not only is the likelihood of salary under-reporting greater amongst those whose beliefs regarding tax compliance are more at odds with the formal rules (Figure 2), but also in countries or regions where the level of institutional asymmetry (i.e. how far apart a population’s informal views are from the formal laws that exists) is higher [5]. This has important implications as it suggests that when there is asymmetry between these formal and informal institutions, practices based on unwritten socially shared rules emerge, which are “illegal” in comparison to the formal, written regulations. Thus, the probability of using envelope wages, is higher when institutional misalignment is greater [5], [12].

Policy approaches toward envelope wages

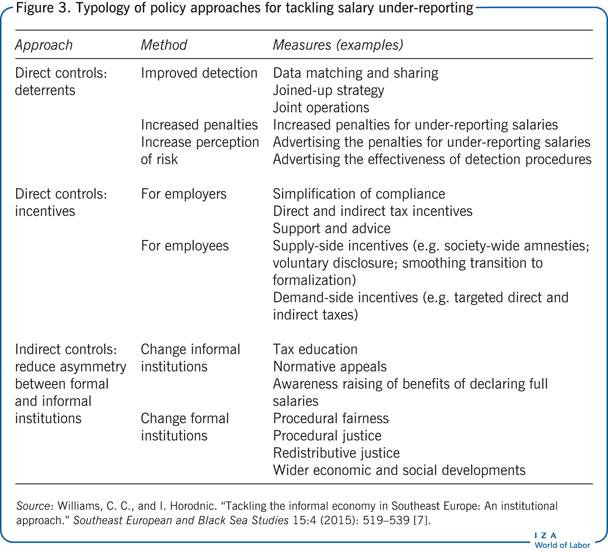

Conventionally, public authorities have tried to tackle wage under-reporting by using direct controls to ensure that the cost of being caught and punished is greater than the pay-off from acting illegitimately. Most governments have pursued this tactic by making their citizens perceive a greater risk and a higher cost related to participation in such practices. Punishments and fines have been raised and/or the probability of being caught has increased. To achieve this, governments use strategies to improve the collection, distribution, and matching of data to identify discrepancies in wages, in particular between companies in comparison to the sector average. Also, the number of workplace inspections has increased. Conversely, little attention has been paid to giving employees and employers more attractive incentives to follow the formal law. Findings from recent studies suggest that the status quo of punishing wage under-reporting is perhaps not the best way forward [5], [7].

As the extent of institutional asymmetry increases, the probability of wage under-reporting at both the individual and country level also increases. Therefore, decreasing the level of institutional asymmetry should be a priority for affected societies. Toward this goal, a shift from direct to indirect controls is necessary [5], [7]. Organizations that have undergone a change of focus from “hard” to “soft” provide a useful example for how this can be achieved; they have transitioned from bureaucratic management to a post-bureaucratic style through the use of internalized rather than externalized controls by combining the individual aspirations of the employees with the organization’s strategic goals rather than a “following the rules” approach. An equivalent approach is recommended at the societal level in order to curb salary under-reporting. Instead of aiming for obedience through high-level centralized supervision and monitoring, strict rules, and preset procedures, the goal should be to foster internal control, thereby encouraging a more highly committed society that more willingly complies with formal institutions [7] (Figure 3).

To change informal institutions to better align them with formal institutions, three policy initiatives can be pursued. First, employers and employees can be educated about the importance of paying taxes. As an example, information could be provided about the public goods and services that are paid for by employees’ taxes, which should enhance the internal motivation to pay those taxes. Second, governments could use advertising campaigns to present the advantages of a complete declaration of salaries. And third, governments could use normative appeals; for example, letters sent by the tax office which remind employers and employees how their taxes fund public goods and services such as schools and hospitals. As an example, in 2008, a large share of Estonian companies (46%) willingly recalculated their wage levels and ended up paying an increased amount of taxes after such a campaign [5]. For this to work, a broader change is needed concerning both formal and informal institutions in order to improve this psychological (or social) agreement involving the state, the employers, and employees. If there is still distrust in the government and suspicions of public sector corruption, then employers and employees’ tax morality will not change.

An alternative solution is to modernize governance. This entails at least three steps. First, procedural justice must be improved in the society. This relates to employers’ and employees’ beliefs that they will be treated with respect and impartiality by the tax authorities. Second, procedural impartiality must be fostered, referring to the degree to which employers and employees consider that they each pay equal tax shares, in comparison to each other. Third, redistributive justice has to be amended, so that employers and employees believe that they receive the appropriate goods and services consistent with the level of taxes that they pay [5]. Moreover, governments should pursue wider economic and social developments. Existing studies on transition economies in Central and Eastern Europe clearly show how countries with more equality, more effective redistribution via social transfers, and greater state intervention in the labor market to ensure the protection of vulnerable groups, have a lower propensity to under-report salaries [5].

In order to avoid increasing asymmetry with informal institutions when altering formal ones, a dialogue between policymakers, citizens, and trade union representatives should be encouraged. As such, public consultations before implementing new rules and regulations might present a short-term measure for avoiding substantial asymmetries between formal and informal institutions. Indeed, trade unions can play an active role in this process, given the positive effects resulting from the strength of trade unions on the informal sector as they fight on behalf of vulnerable groups and for improvements in the quality of working conditions [8].

Limitations and gaps

Most empirical studies are based on surveys with employees and/or employers. Considering the sensitiveness of admitting illegal behavior, the extensiveness of the phenomenon might be underestimated, especially amongst employers. Also, the analyses are generally based on cross-section data. Thus, causality effects could not be inferred.

Another limitation concerns the generalizability of the findings regarding the link between envelope wage arrangements and institutional asymmetry. It seems likely that these findings apply for transition economies in Europe; yet, some results might not be externally valid for other countries and contexts other than those directly analyzed.

Summary and policy advice

Envelope wage arrangements, which are widespread in transition economies, are an outcome of employees and employers not adhering to the written codified laws and regulations and instead adopting unwritten verbal agreements that violate the formal written ones. The latest studies show that, alongside country-level structural conditions, this arrangement is related to the asymmetry between formal and informal institutions. To substantially tackle salary under-reporting, it appears necessary to improve the psychological (or social) contract between the state, employers, and employees. This implies that both informal and formal institutions must change. In order to alter informal institutions, governments can use three policy approaches: education campaigns about the importance of paying taxes, advertising campaigns about the advantages of a complete declaration of salaries, and normative appeals for both employees and employers. In terms of formal institutions, governance modernization is needed; this should include more equitable and transparent approaches to procedural and redistributive justice, as well as procedural impartiality.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author also thanks Colin Williams for many helpful comments. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [5].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Ioana Alexandra Horodnic

Informal employment definitions

Enterprise-based definition: “Informal employment ... refers to those jobs that generally lack basic social or legal protections or employment benefits and may be found in the formal sector, informal sector or households.”

Activity-based definition: “All legal production activities that are deliberately concealed from public authorities for the following kinds of reasons: to avoid payment of income, value added or other taxes; to avoid payment of social security contributions; to avoid having to meet certain legal standards such as minimum wages, maximum hours, safety or health standards.”

Job-based definition: “Employees are considered to have informal jobs if their employment relationship is, in law or in practice, not subject to national labor legislation, income taxation, social protection or entitlement to certain employment benefits (e.g., advance notice of dismissal, severance pay, paid annual or sick leave, etc.).”

Source: ILO, Statistical Update on Employment in the Informal Economy. Geneva: ILO Department of Statistics, 2011; p. 12; OECD, Measuring the Non-Observed Economy. Paris: OECD Publications Service, 2002; p. 139.

Formal and informal institutions

Formal institutions: Laws, rules, and procedures outline the legal guidelines that they have to obey.

Informal institutions: Rules shared at a social level, usually based on a verbal agreement, which are generated, communicated, and applied aside from formal channels.

Source: North, D. C. Institutions, Institutional Change and Economic Performance. Cambridge: Cambridge University Press, 1990; Helmke, G., and S. Levitsky. “Informal institutions and comparative politics: A research agenda.” Perspectives on Politics 2 (2004): 725–740; Williams, C. C., and I. Horodnic, “Evaluating the prevalence of the undeclared economy in Central and Eastern Europe: An institutional asymmetry perspective.” European Journal of Industrial Relations 21:4 (2015): 389–406.