Elevator pitch

The unequal distribution of refugees across countries could unravel the international refugee protection system or, in the case of the EU, hinder a common policy response to refugee crises. A way to distribute refugees efficiently, while respecting their rights, is to combine two market mechanisms. First, a market for tradable refugee admission quotas that allows refugees to be established wherever it is less costly to do so. Second, a matching system that links refugees to their preferred destinations, and host countries to their preferred types of refugees. The proposal is efficient but has yet to be tested in practice.

Key findings

Pros

A market for tradable quotas coordinates countries receiving refugees.

Tradable quotas minimize the total cost of hosting refugees, as “refugee-friendly” countries are paid by “refugee-unfriendly” ones for the numbers they host in excess of their quota.

A matching mechanism ensures that refugee rights are respected and that refugees can express their preferences.

The initial distribution of refugees becomes more flexible under this proposal.

The economic component, i.e. the tradable quotas market, is combined with the humanitarian one, i.e. matching, favoring political feasibility.

Cons

The proposal is theoretical and has not yet been implemented in practice.

Participating countries would face some uncertainty about the final allocation of refugees.

Allowing refugees to choose their destinations can be unpopular with some receiving countries’ constituencies.

The system minimizes total costs but some countries may lose if the initial distribution rules are not adjusted properly.

Political feasibility depends on making the system transparent both for refugees and host countries.

Author's main message

A market for tradable refugee admission quotas can be combined with a matching mechanism linking refugees and receiving countries, while taking the preferences of both into account. The system would distribute refugees to the countries where it is less costly to host them. This tradable quotas market is a more flexible system than one of binding quotas, and the matching mechanism minimizes implementation costs. This proposal focuses on international organizations (UNHCR, OECD, etc.). However, the EU would provide a more suitable context for reform, as there is already a common—though ineffective—asylum policy in place.

Motivation

The 1951 Refugee Convention enshrines the rights of those fleeing persecution in their home countries to look for a “safe haven” in any of the signatory countries, which totaled 145 in 2015. Hence, granting protection to refugees can be considered an international public good, in that most of the countries in the world agree that this protection must be provided somehow. However, this provision is often viewed as costly and there is disagreement as to which countries should bear the cost. An example is the Syrian civil war that began in 2011. Most of the refugees from this war were in neighboring Turkey, Jordan, and Lebanon, but an influx of asylum seekers in the summer of 2015 into Greece, Italy, and Hungary put the whole Common European Asylum System into question, with countries such as Hungary deciding to erect new border walls to prevent refugees from entering their territory.

This article combines two well-established market mechanisms—tradable quotas and matching—to propose how the current and future refugee crises could be more effectively addressed. The political feasibility of the proposal is also discussed.

Discussion of pros and cons

The use of market solutions, such as tradable quotas, to coordinate countries in providing common responses in the least costly way, has a long-established tradition in economics. A good example is the effort to combat global climate change. Combatting climate change is a global public good, as all countries in the world benefit from it. However, climate change mitigation measures are (or are perceived to be) costly for individual countries. This gives rise to a classical “free-rider” problem: countries agree that something must be done about climate change but they prefer that others do that “something.”

The same can be said about providing international refugee protection. Countries agree that refugees must be protected, which is why most countries have signed the 1951 Refugee Convention. However, they would prefer that other countries take care of the potential cost of hosting refugees. This cost need not be a purely economic one. Some authors have argued that refugees actually end up being an economic “plus” for the countries that receive them [1]. Still, public opinion may be hostile to the reception of asylum seekers, which means that governments in receiving countries still perceive them as a cost. For example, in 2002, 62% of respondents in the European Social Survey agreed that their country has more than its fair share of people applying for refugee status [2].

The solution of assigning property rights that can then be traded in a market can be applied both to “rights to pollute” and to “obligations to provide refugee protection” [3], [4]. In the first case, countries willing to pollute beyond their assigned quotas pay a price per emission to countries polluting below their assigned quota. In the refugee protection case, countries willing to provide more protection than their assigned quotas receive a “price per refugee hosted” that is paid by those countries willing to provide less protection than their assigned quotas.

“Refugees are not widgets”: The case for the matching mechanism

The analogy between the market for tradable emission permits and the market for tradable refugee admission quotas breaks down when the nature of the rights to be traded is considered. No one has expressed this more forcefully than Alvin Roth, who shared the 2012 Nobel Prize in Economics for his work on matching and market design: “refugees are not widgets to be distributed or warehoused. They are people trying to make choices in their best interest” [5]. No matter what the tradable quotas market allocation dictates, refugees must have a final say on where they want to reside and, in particular, under no circumstances should they be forced to relocate to an undesired destination.

Furthermore, matching mechanisms have a long and successful history of applications to problems, such as the assignment of doctors to hospitals, students to schools or colleges, or kidney exchanges [6]. A matching mechanism linking refugees to their preferred destinations and host countries to their preferred types of refugees could draw on the experience accumulated in these different setups.

The proposal: Combining the two market mechanisms

A full system of coordination of refugee acceptance policies should include three different stages in order to incorporate both the market for tradable quotas and the matching mechanism [7].

Stage 1: Initial allocation

In the first step, responsibilities must be divided. Some kind of distribution rule will determine which countries should provide international protection to a given number of refugees. This is not unique. For example, the allocation of quotas to member states of the EU was at the forefront of discussions to reform the Common European Asylum System in mid-2015 [8]. According to the European Agenda on Migration, these quotas would depend on the capacity of countries to absorb refugees, with this capacity defined by GDP, population, unemployment rate, and the number of refugees resettled and asylum applications received during the previous five years.

Stage 2: The market for refugee-admission quotas

The second step would be the opening of a market in which countries could trade the “obligations to provide protection” assigned in the first stage. This market for refugee-admission quotas would operate in the following way. Those countries that estimate the cost of hosting their assigned refugees as being too high would be willing to pay other countries to host them instead. Depending on the price, some other countries would be willing to host beyond their assigned quota as long as they were paid for it. Different auction mechanisms can be designed [7] to ensure that this tradable quotas market would be competitive, in that the final price would both clear the market—with extra refugees hosted in some countries equal to fewer refugees hosted in some others—and ensure that refugees would end up going to those countries where it is less costly to host them. This would serve to minimize the total cost of hosting refugees among participating countries. The reason this would be the “minimum” cost is that for those countries whose marginal cost (i.e. the extra cost incurred by hosting an additional refugee) would be below the market price, it would also be profitable to host an additional refugee through being paid for it. On the other hand, for countries whose marginal cost would be above the market price, it would make sense to pay the market price to get rid of the extra cost, which would be higher. As a result, the tradable quotas market would equate marginal costs across countries and there would be no scope for allocating any refugee in any participating country at a cost below the market price.

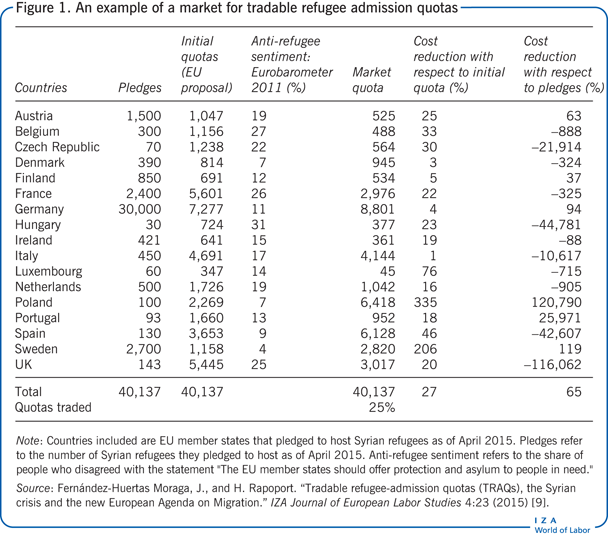

Figure 1 provides an example of a particular simulation on how the tradable quotas market would work [9]. It is based on the fact that many European countries had voluntarily pledged to host up to a total of 40,137 refugees from the Syrian war in April 2015, before the new European Agenda on Migration had even been announced the following month. Germany plays a dominant role, having pledged to host 30,000 Syrian refugees. However, the distribution of quotas according to the proposals of the European Commission for this selected group of countries, shown in the second data column, would be quite different [10]. In this scenario, Germany would still be the main country responsible for hosting refugees, but its number would go down to 7,277. Almost all other countries would have to host more refugees under the European Commission proposal than they had initially pledged.

In order to simulate the tradable quotas market, researchers need to make assumptions about the cost of refugees for hosting countries. In this example, the cost is determined by the share of people in each European country that in 2011 disagreed with the statement, “The EU Member States should offer protection and asylum to people in need” [9]. In this sense, the third data column shows the most refugee-friendly country would be Sweden, with 4%, while the country for which hosting refugees might have larger political costs would be Hungary, with 31% of the population disagreeing with the statement. In reality, the costs (and benefits) of hosting refugees are of course more complex, as they include economic, social, and political aspects, as well as the cost in terms of public opinion.

Under these (simplifying) assumptions, the final distribution of refugees (the fourth data column) would indicate that countries with larger costs of hosting refugees, such as Hungary, would actually be willing to pay others to receive them. In this example, Hungary would only host 377 refugees of the 724 initially assigned by the European Commission, while countries with low costs of hosting refugees, such as Sweden, would be paid to host additional numbers: from 1,158 initially assigned, to 2,820 obtained through the tradable quotas market.

It should be emphasized that these are the results of one particular simulation under the assumption of a very particular cost structure [9]. This is used only for illustrative purposes on how the tradable quotas market allocation could actually change from the initial assignment decided by the European Commission. It is clear that the market gives greater flexibility to participating countries to decide how they want to contribute to hosting refugees, either by directly providing a safe haven, or else by paying other countries to provide it.

In all cases, the countries gain from trading in the market relative to the initial European Commission allocation. In the example, the market particularly favors Sweden and Poland, whose initial allocation is further from the relatively more pro-refugee stance of their populations. The market also generates cost reductions for countries more opposed to refugees, such as Hungary and Belgium. Overall, the total cost reduction achieved by the market with respect to the initial allocation amounts to 27%, thanks to the trading of 25% of the initially allocated quotas.

However, these cost reductions with respect to the European Commission allocation do not imply that all countries would be satisfied with participating in the overall mechanism to begin with. For example, if the cost reduction is measured with respect to the pledges made in April 2015, most countries are shown to actually have greater costs than what they would have if they just hosted the Syrian refugees pledged. Even though the market would still reduce the total cost overall, by 65%, some countries would perceive their costs as increasing too much with respect to a voluntary scheme.

Accordingly, only Austria, Finland, Germany, and Sweden would be better off after trading refugee quotas (starting from the initial allocation decided by the European Commission), than under their initial pledges. This does not question the appropriateness of the market, but simply reflects that the original assignment of responsibilities decided by the European Commission would not be politically feasible in this example.

The criteria used to initially allocate first-stage quotas should take into account the actual costs of hosting countries rather than some arbitrary measure of capacity like the one proposed by the EU. Unfortunately, these costs can be of a political, economic, or social nature and are very hard to quantify. In fact, only the tradable quotas market itself would be able to reveal information about these costs over time. This information could then be used to adjust the initial allocation [7].

However, such an adjustment would require careful consideration. On the one hand, if political costs are included in the calculation of the initial quotas, this would make more countries willing to participate in the mechanism. On the other hand, it would introduce an incentive for countries to signal that their political costs are very high, so as to obtain a more reduced initial quota. This manipulation would then result in a larger perception of costs and, probably, in a lower number of total refugees to be resettled.

Under the assumption that the chosen cost structure in Figure 1 evolve endogenously with public opinion (for example, hosting refugees may become more costly politically as public opinion becomes more negative), one might wonder how the tradable quotas market would behave over time. For example, if all participating countries become more refugee-friendly over time, total costs would go down, as would the equilibrium price. Hence, if some countries became more refugee-friendly than others, they would end up receiving more refugees while getting paid a lower price for their quotas. Of course, the opposite would happen if countries become less refugee-friendly.

Stage 3: Matching refugees to countries

After showing what the tradable quotas market could look like with a particular example, it is useful to return to Alvin Roth’s statement that “refugees are not widgets.” Suppose, as in Figure 1, that 377 Syrian refugees should be hosted by Hungary, but that some of them learn of the high anti-refugee sentiment in Hungary and refuse to move there. In order to accommodate this type of situation, the tradable quotas market must be combined with a matching mechanism that reconciles the preferences of refugees with those of host countries.

Allowing refugees to express their preference can reduce costs and misunderstandings in relocation processes, as has been documented in respect to the European relocation from Malta, undertaken by the EU in a pilot program in 2009–2011 [11]. During the program, many European member states reported serious communication problems with the refugees and asylum seekers, who were often unaware of their final destination.

As the European Parliament agreed in September 2015, it makes sense to gather information on refugee preferences before relocating them [12]. In this way, refugees could actually be moved to the places where they would have a higher probability of succeeding in their integration efforts. From the point of view of host countries, this would also increase the likelihood of fully incorporating the refugees into their societies. At the same time that refugee preferences are gathered and processed, they could be cross-checked with receiving countries’ preferences about the type of refugees they would like to host, in terms of education, occupation, country of origin, etc. This could increase the benefit to the host countries of participating.

The way to combine these preferences would be to employ matching mechanisms that have been suggested to, for example, allocate students to colleges using the “college-proposing” (or in the case of refugees, “country-proposing”) deferred acceptance algorithm [7]. Countries with unfilled market quotas would propose to host refugees, who would have the option of accepting or rejecting these proposals, for as long as there would be refugees left to resettle. In practice, rather than going through the rounds of offers, acceptances, refusals, and new offers, an agency could just run the algorithm in a centralized way after collecting the preferences of both the host countries and refugees.

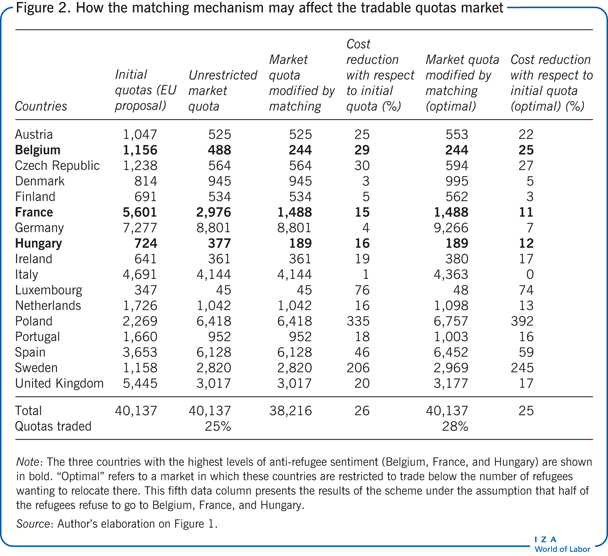

The matching mechanism would improve the final allocation of countries and refugees, but it would not change it unless some refugees refused to go to a particular location. An example could be the case of the Syrian refugees to be distributed across Europe discussed earlier (Figure 1). If half of them refused to relocate to the three countries that had a higher share of people opposed to receiving refugees (Hungary, Belgium, and France), then rather than receiving 377, 488, and 2,976 refugees respectively, those countries would each receive only a half of that number. This situation is presented in Figure 2, which reproduces the initial allocation according to the European Commission proposal and the market result from Figure 1.

If some refugees refused to go to Hungary, Belgium, and France, a total of 1,921 refugees could not be resettled. All the countries that were not refused by the refugees would still receive what they bid for in the market, while Hungary, Belgium, and France would only receive the refugees that accepted to go there. The non-resettled refugees would remain in their original location: either the refugee camp they were drawn from, or their reception country.

If such a situation persisted, some countries would have an incentive to become unattractive for refugees in order to bid for quotas in the market, secure the price, and then not have to bear any cost because refugees would not go there anyway. To prevent this from happening, and also to compensate the original location of the refugees (the reception country or refugee camp), one research paper proposes a penalty for the unfulfilled part of the quota [7]. Eventually, countries would not pay or receive the prices they bid in the market but the price determined by the matching mechanism. In the example in Figure 2, France, Belgium, and Hungary would have to pay to the final destination country the market price multiplied by the number of refugees refusing to move there.

These penalties provide the appropriate incentives for countries to become attractive locations. Nevertheless, if refugees continued to refuse to move to some of them, it would make sense to incorporate this information into the tradable quotas market, so that countries could not be allowed to bid beyond the number of people who would actually be willing to move there. The fifth data column in Figure 2 presents the results of this scheme, under the assumption that half of the refugees refuse to go to Belgium, France, and Hungary.

Incorporating this information into the market would result in a larger overall cost of allocating the refugees. In contrast, it has the advantage of relocating all of them. The quota price would go up by 5.3% and the total cost would increase for those receiving fewer refugees than their initial quotas, whereas it would decrease for those receiving more refugees than their initial quota.

Political feasibility

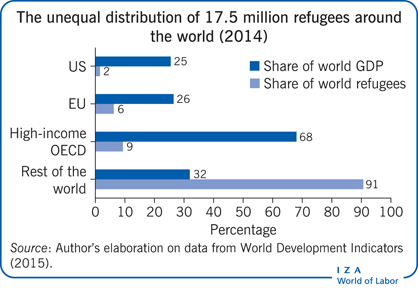

Every year, the United Nations High Commissioner for Refugees (UNHCR) hosts countries and NGOs in Geneva during the so-called “Annual Tripartite Consultations” to resettle refugees around the world. Countries (or groups of countries, such as the EU) decide how many refugees to resettle on a voluntary basis, with some having internal rules on how to distribute refugees within their borders. Apart from this, countries may receive refugees when asylum seekers arrive “at their door” and ask to be recognized as such. Typically, neighbors of countries in conflict tend to receive the bulk of these refugee flows, leading to the distribution of refugees reflected in the Illustration.

This current situation seems very far from the theoretical proposal of a creation of a market for tradable refugee admission quotas combined with a matching mechanism. However, there are many elements of this three-stage proposal that have been introduced in different forms over the past few years, particularly in Europe.

First, the European Commission’s effort to assign refugee quotas to member states on the basis of some capacity criteria clearly shows that the initial allocation of responsibility must be a starting point in any coordination system [8]. Second, the suggestion to incorporate a matching mechanism or, more precisely, the collection and consideration of refugee preferences, already appeared in the European legislation in September 2015: “While applicants do not have a right to choose the Member State of their relocation, their needs, preferences and specific qualification should be taken into account to the extent possible” [12]. Finally, while the tradable quotas market is not currently on the political table, there are many historical instances in which countries have compensated others for the admission of refugees that they would not take. One example of this involved the Comprehensive Plan of Action, originally signed in 1979 by 65 governments, which agreed to resettle refugees from Indochina in up to 38 countries [4]. The polar examples there were the US and Japan. The US resettled around one million refugees between 1979 and 1989 at an estimated cost of $7,000 per refugee. Japan resettled fewer than 8,000 refugees, while contributing significant financial assistance to the overall program. In the case of Europe, the historical European Refugee Fund, substituted by the Asylum and Migration Fund in 2014, typically paid some fixed amount of between €6,000 and €10,000 per refugee resettled in the EU to the countries charged with the responsibility. In the context of the European Agenda on Migration, the European Commission even proposed that countries unwilling to fulfill their quotas could opt out of them by paying a fixed penalty of 0.002% of the country’s GDP [13]. This sets an implicit price per refugee.

All in all, none of the historical examples features an explicit market, but they can all be interpreted as an implicit one, with implicit prices paid to those countries willing to receive refugees by other countries less willing to receive refugees. Of course, none of these implicit markets is as transparent and as efficient as an agreed tradable quotas market mechanism could be.

Limitations and gaps

While every new refugee crisis leads to calls for greater responsibility sharing and a fairer distribution of refugees across the globe, proposals such as the one outlined in this paper, are still far from implementation, with the exception of the EU context.

While the proposal is very solid theoretically it has yet to be tested in the “real world.” Will refugees be provided with the necessary information to make their choices? Will these informed choices really lead to better outcomes for them and their hosts?

For participating countries, the combination of the tradable quotas market and the matching mechanism would create some uncertainty. They could be allowed to choose their preferred type of refugees, say by nationality, but then it would be up to the matching procedure to determine whether they would get what they chose or even whether refugees would be willing to come at all. This uncertainty could possibly hinder the participation of some countries, but again this needs to be empirically tested.

Summary and policy advice

A market for tradable refugee admission quotas can be combined with a matching mechanism linking refugees and receiving countries, while taking their preferences into account. The system would distribute refugees to the countries where it is less costly to host them, while ensuring that refugee rights are respected, in the sense that no refugee would be forced to relocate to an undesired destination.

This would address one of the main deficiencies of the international system of refugee protection, which is that most of the responsibility for protecting refugees falls on a few selected countries (typically the neighbors of conflict countries), while the benefit from this protection extends to the whole world. Economic theory tells us that there is no need for this to be the case. Frontline countries could be compensated by involving more far-away or unwilling countries, either on financing costs or on hosting refugees themselves.

The proposal works well in theory and should be given a chance of testing “on the ground,” in order to understand whether it deserves to be considered as a policy reform of the international refugee protection system. Existing resettlement programs, such as the EU proposal, do not cover the total population of refugees and asylum seekers arriving in the member states, but only a limited fraction of them. Nevertheless, the EU would provide a particularly good context for reform, as there is already a common—albeit ineffective—asylum policy in place.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for their suggestions on the initial draft proposal, and two anonymous referees for their suggestions on the initial manuscript. Previous work of the author, co-authored with Hillel Rapoport, contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [7], [9], and [11]. Support from the Ministerio de Economía y Competitividad (Spain), grant MDM 2014-0431, and Comunidad de Madrid, grant MadEco-CM (S2015/HUM-3444), is gratefully acknowledged.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Jesús Fernández-Huertas Moraga