Elevator pitch

Corporate income taxation influences the quantity and type of entrepreneurship, which in turn affects economic development. Empirical evidence shows that higher corporate income tax rates reduce business density and entrepreneurship entry rates and increase the capital size of new firms. The progressivity of tax rates increases entrepreneurship entry rates, whereas highly complex tax codes reduce them. Policymakers should understand the effects and underlying mechanisms that determine how corporate income taxation influences entrepreneurship in order to provide a favorable business environment.

Key findings

Pros

Corporate income tax rates have a statistically and economically significant influence on entrepreneurship.

The relationship between corporate income taxes and entrepreneurship is stronger than the relationship between other taxes and entrepreneurship.

High effective corporate income tax rates increase the capital size of new firms, thereby enhancing their chances of survivability (“entry barrier effect”).

High levels of corporate income tax progressivity increase entrepreneurship entry rates (“tax progressivity effect”).

Cons

High statutory and high effective corporate income tax rates reduce business density and entrepreneurship entry rates (“tax level effect”), particularly for innovative and high-quality entrepreneurship (“prize reducing effect”).

Reductions in the corporate income tax rate may only affect entrepreneurship rates below a certain threshold tax level.

Corporate income tax rate reductions are more effective at promoting entrepreneurship in countries with higher-quality accounting standards.

Highly complex corporate income tax codes reduce entrepreneurship entry rates (“tax code complexity effect”).

High corporate income tax rates increase the size of the informal sector.

Author's main message

Empirical evidence shows that corporate income taxation has a significant, albeit small, influence on the quantity and type of entrepreneurship. In addition to the corporate income tax level, tax progressivity and tax code complexity exhibit effects on entrepreneurship. Policymakers must understand the nuances of how corporate income taxation affects entrepreneurship, and must consider contextual factors such as the quality of accounting systems and investors’ risk profiles before determining tax policy. For policymakers in countries with low-quality accounting standards, this suggests that lowering taxes to increase entrepreneurship rates should be accompanied with an effort to improve the quality of accounting standards.

Motivation

Taxes give governments the means to provide public goods for their citizens, and can be used to redistribute income from wealthy to poor citizens. Aside from these roles, taxes can have strong effects on economic behavior, in particular entrepreneurship, which is an important driver for innovation and economic development. Entrepreneurs and new firms turn research and development (R&D) and knowledge into innovation while also creating jobs [2] (see [3] for a summary of the value of entrepreneurship).

This article summarizes the empirical evidence on how corporate income taxation influences the type, quality, and quantity of entrepreneurship. Corporate income taxes refer to the taxes paid by corporations on their taxable income. This must be distinguished from personal income taxes (taxes to be paid on earned income by wage workers or the self-employed), capital income taxes (taxes to be paid on dividend or interest income), and capital gains taxes (taxes to be paid on profits that an investor realizes when he or she sells a capital asset for a price that is higher than the purchase price), which have also been the subjects of prior research regarding the relationship between taxation and entrepreneurship. (See [4] for the effect of personal income taxation on entrepreneurship and see [5] for a general overview of the literature on taxes and entrepreneurship.)

Despite several empirical studies on the relationship between entrepreneurship and corporate income taxation, a comprehensive overview for policymakers that summarizes the empirical evidence and explains how this type of taxation influences entrepreneurship is still lacking. This article is a step in this direction.

Discussion of pros and cons

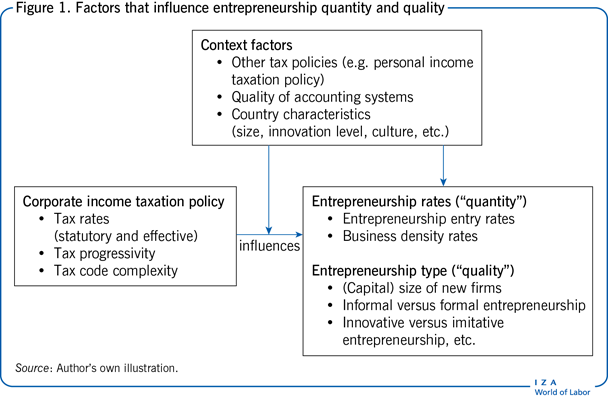

Determining the way in which corporate income taxes influence entrepreneurship is a complex and multi-faceted question (Figure 1) [6]. With regard to corporate income taxation, it is possible to distinguish between the level of corporate income taxes, the degree of progressivity, the difference between statutory and effective tax rates, the degree of symmetry in the treatment of profits and losses, the complexity of the tax code, and the treatment of holding companies. Moreover, corporate income taxation is not isolated from personal income or capital gains taxation. Income shifting between the different types of taxes occurs when their rates differ in a substantial way.

Entrepreneurship is also a multi-faceted concept. In addition to the quantity of entrepreneurship (often measured through “entrepreneurship rates”), there exist different types of entrepreneurship. Typical classifications are, for example, high- vs low-growth, innovative vs imitative, necessity vs opportunity, and formal vs informal entrepreneurship [7].

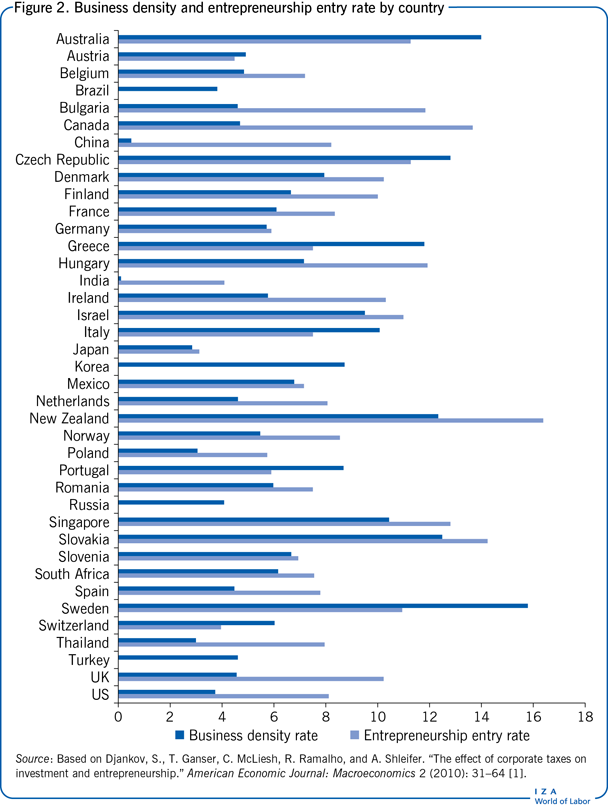

Figure 2 shows entrepreneurship entry (the number of newly registered corporations divided by the total number of corporations) and business density rates (the number of registered corporations divided by the number of employees) across selected countries. The countries with the lowest entrepreneurship entry rates are Japan, Switzerland, and India; the countries with the highest entrepreneurship entry rates are New Zealand, Slovakia, and Canada.

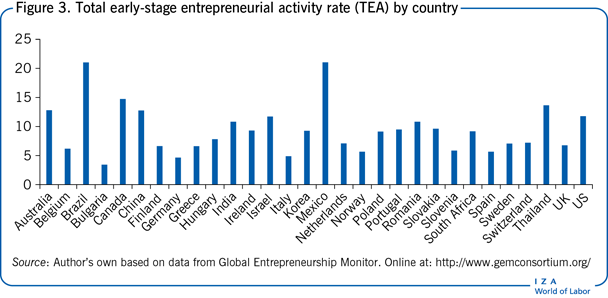

Figure 3 shows total early-stage entrepreneurial activity (TEA) rates across selected countries. The data are from the Global Entrepreneurship Monitor. The TEA rate is defined as the sum of the nascent entrepreneurship rate and the new business ownership rate.

Tax rates, business density, and entrepreneurship entry rates (“tax level effect”)

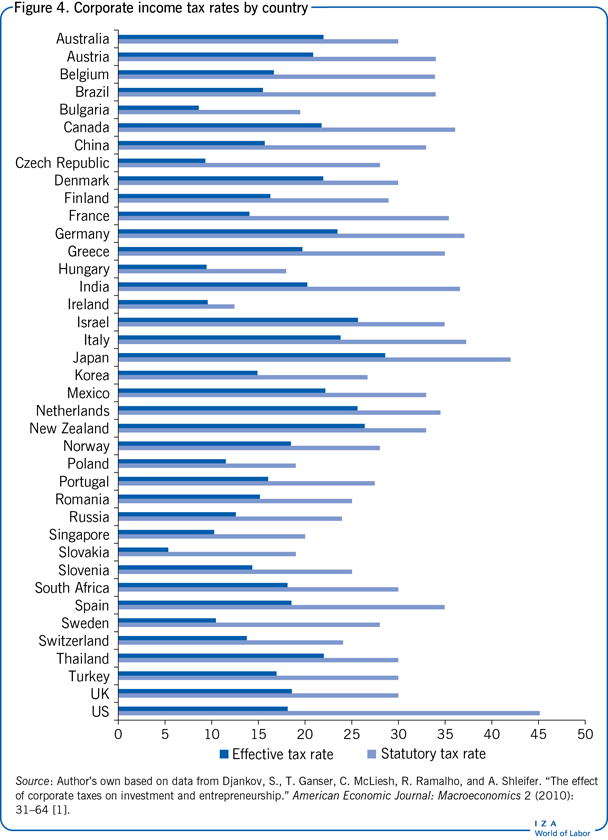

Prior research distinguishes between statutory and effective corporate income tax rates. The former describes the tax rate imposed on a corporation's taxable income, whereas the latter refers to the taxes a corporation pays as a percentage of its economic profit. The two tax rates can differ strongly as a result of generous rules regarding tax credits, asset write-offs, income that is exempt from taxation, and so on (Figure 4).

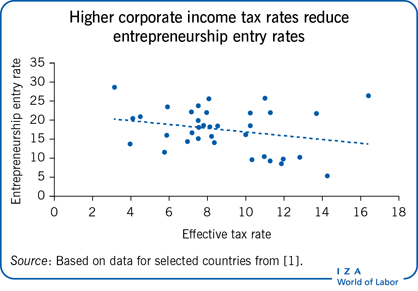

Higher effective corporate income tax rates increase the tax burden for incorporated firms, thus reducing the gains from entrepreneurship. Hence, higher corporate income tax rates should have a negative effect on entrepreneurial activity. A worldwide cross-sectional data set of 80 countries shows that high statutory and high effective corporate income tax rates reduce business density and entrepreneurship entry rates [1]. A study from Portugal exploits a quasi-natural experiment where the corporate tax rate for start-ups was reduced in some regions and not in others [8]. The authors find that a reduced corporate tax rate increased firm entry and new firm job creation. The results from the worldwide and Portuguese studies support the argument that high corporate income tax rates reduce profits for incorporated businesses, thus reducing incentives for individuals to become entrepreneurs [1], [8]. Moreover, income shifting may occur. That is, entrepreneurs may decide not to incorporate their business, instead choosing other forms of entrepreneurship such as entrepreneurship through non-incorporated firms or informal entrepreneurship. The literature provides some tentative evidence about the latter: the size of the informal sector as a percentage of economic activity is shown to depend on the effective corporate income tax level [1]. Thus, corporate taxes not only affect entrepreneurship activity but also influence the allocation of resources between the formal and the informal sectors.

Further findings show that the effects of statutory and effective corporate income tax levels on entrepreneurship entry rates are of similar magnitude [1]. This is important for policymakers, as entrepreneurs do not seem to distinguish between the two corporate tax rates when making their occupational choice or deciding on their incorporation.

These results are partially confirmed by an alternative study [9]. Using a panel dataset of 39 industries in 17 Western European countries, a high effective average tax rate is shown to reduce the number of entrants per industry (calculated as the number of newly registered firms in a particular industry divided by the number of active incumbents in that industry). The negative effect of corporate income tax rates on industry entry rates is concave, suggesting that tax reductions only have an effect on entrepreneurship entry rates below a certain threshold tax level. That is important for policymakers who are considering cutting corporate income tax rates in order to promote entrepreneurship activity.

Reducing corporate income tax rates is found to be more effective in countries with higher-quality accounting standards [9]. Higher accounting standards make it more difficult for companies to hide profits, thereby increasing the effectiveness of corporate taxation as a policy instrument. Thus, to increase entrepreneurship in countries with low-quality accounting standards it is necessary to combine lowering taxes with efforts to improve the quality of the accounting standards.

Figure 4 shows statutory and effective corporate income tax rates across selected countries. Large discrepancies between the two tax rates exist. In the US, for example, the statutory corporate income tax rate is 45.2%, whereas its effective corporate income tax rate is only 18.2%.

Progressivity and entrepreneurship entry rates (“tax progressivity effect”)

Tax systems can differ in their progressivity, that is, the degree to which the tax rates increase with taxable income. A progressive tax system is shown to encourage entry into entrepreneurship [10]. By controlling for the overall expected tax burden, data from Switzerland reveal that regions (“canton” is the exact unit of observation in the study) with a higher progressivity in corporate income taxation have higher regional firm birth rates than those with a flat corporate income taxation system. With progressive rather than proportional income taxation, firm owners retain a smaller fraction of large profits, but a larger fraction of small profits. Some scholars argue that such a situation encourages risk-taking by risk-averse individuals, thus leading to higher entrepreneurship entry rates [11]. It should be noted, however, that this argument only holds true if the expected tax burden is held constant. A higher tax burden decreases entrepreneurship entry rates (see the section on the “tax level effect”).

Complexity of tax code and entrepreneurship entry rates (“tax code complexity effect”)

Entrepreneurship entry rates may also be negatively affected by tax-related administrative burdens and the complexity of the corporate income tax system. For example, Swiss cantons with more complex corporate income tax codes (measured as the number of words in the cantonal corporate tax codes) have lower municipal firm birth rates relative to other cantons [10]. This finding is in line with the results from another study that uses country-level data obtained from the World Bank Doing Business project [12]. This study finds that higher levels of the overall administrative tax burden have a negative effect on entrepreneurship entry rates. Tax administrative burdens and the complexity of the tax system can be interpreted as indirect effects of the tax system. In a simple form, they constitute fixed operating costs that do not depend on the level of the firm's or the entrepreneur's profits. The entry of new firms will occur as long as firms or entrepreneurs expect profits to be greater than their fixed operating costs.

The size of new firms (“entry barrier effect”)

In addition to entrepreneurship rates, corporate income taxation also influences the types of new firms entering established markets. As such, corporate income taxation has an effect on both the quality and quantity of entrepreneurship. Using information on newly incorporated firms in 17 European countries between 1997 and 2004, it is shown that decreasing effective corporate income tax rates by one unit leads to a decrease in the capital size of new firms by between 2.7% and 14.4% (the results regarding labor size are mixed and vary in magnitude and sign) [13]. For policymakers, this implies that increasing corporate tax rates is not exclusively associated with negative effects on entrepreneurship activity (see “tax level effect” above). Rather, an increase in corporate income taxes can also lead to the development of “healthier” firms with larger capital sizes and therefore higher chances of survival and higher growth potential. This finding is in line with predictions from [10], and can be interpreted as an indication of taxation being an entry barrier that only firms of a certain capital size can overcome. As the labor size of new firms is not equally affected by corporate income taxation [13], raising corporate tax levels not only increases the capital size of firms, but also the capital to labor ratio.

The innovativeness of new firms (“prize reducing effect”)

Empirical research shows that corporate income taxes not only influence the size of new firms but also the innovativeness of new firms. One study that analyzes a data set of 632,116 individuals, including 43,223 entrepreneurs from 53 countries, shows that high levels of corporate income taxes reveal a negative relationship with innovative entrepreneurship. Corporate income taxes represent recurring costs [14]. They reduce the gains or “prize” from successful innovation (“prize reducing effect”) and hence can have a deterrent and discouraging effect, particularly for risk-taking entrepreneurs with innovative ideas. This finding leads to a trade-off situation for policymakers. While high levels of corporate income taxes can have a positive effect on the size and “healthiness” of the new firms, a negative effect seems to exist with regard to the innovativeness of such firms. The results from Portugal exploiting a quasi-natural experiment go in the same direction showing that high corporate tax rates are a constraint in particular for high-quality entrepreneurship [8].

Effect magnitude due to changes in corporate income taxation

While the impacts on entrepreneurship discussed above are observed in the literature, the size of the described effects has not proven to be particularly large. It is found that most changes in tax rates have statistically significant but only small economic effects on entrepreneurship rates. Time series regressions with US data from 1950 to 2000 show that overall tax rate changes have only had small economic effects on entrepreneurship activity [15]. An exception seems to be the top corporate income tax rates and the payroll tax rates, which appear to have the largest impact on entrepreneurship among the different tax types investigated. Still, one study concludes that taxes are “likely ineffective tools for generating meaningful changes in entrepreneurial activity” [15]. The authors do not offer an explanation though for why this effect is seen in relation to corporate income taxation but not with other types of taxes.

Limitations and gaps

Most existing research investigates the relationship between entrepreneurship and corporate income taxes only on an isolated basis. However, tax cuts or increases are often part of larger policy packages. Future empirical research could investigate how corporate income tax policy interacts with other types of taxes (e.g. personal income or capital gains tax) or other policy measures (e.g. subsidies for new ventures, reductions of administrative burdens, or entrepreneurship education). Contextual influences should also be considered: it is conceivable that the effect of corporate income tax policy on entrepreneurship is different for large vs small countries, and for industrial vs emerging countries. Empirical results support this assertion; they find that the effects of corporate taxation on entrepreneurship activity depend on the quality of the accounting system [9].

A third area of further research concerns the effects of tax policy on different types of entrepreneurship. It can be argued, for example, that high taxes and a progressive tax system have stronger effects on innovative vs imitative entrepreneurship, necessity vs opportunity entrepreneurship or on low- vs high-growth entrepreneurship. Empirical results about the effects of corporate taxation on the capital size and innovativeness of new ventures [13], [14] and the size of the informal sector [1] support this idea.

Fourth, most existing research focuses either on tax level or tax progressivity effects. Several other aspects of corporate income taxation exist however, which can also have meaningful effects on entrepreneurship, such as the degree of symmetry in the tax treatment of profits and losses and the treatment of holding companies [6].

Fifth, there is not much empirical research that investigates how tax enforcement and control influence entrepreneurship. Entrepreneurs may, for example, evade or avoid taxes through income underreporting, among other tactics. The latter is facilitated if the quality of accounting standards is low.

Finally, the empirical evidence is based on only a few studies from a few countries. For example, the evidence regarding the effect of tax progressivity on entrepreneurship activity is entirely based on a study using data from Switzerland. More research from a wider range of countries is needed to obtain more generalizable and more robust results.

Summary and policy advice

Entrepreneurship is important for innovation and economic development. Entrepreneurs and new firms provide new job opportunities and foster innovation by turning R&D and knowledge into new products and services [2], [3]. Through corporate income taxation, governments can exert a significant, albeit small influence on entrepreneurship activity. Reducing corporate income tax rates or increasing tax progressivity increases entrepreneurship rates. Conversely, the (high) complexity of a tax code can reduce entrepreneurship rates. Corporate income taxation is also shown to impact the quality or type of entrepreneurship, in addition to quantity. For example, empirical evidence shows that high corporate income tax rates increase the capital size of incorporated firms as well as the size of the informal sector. Policymakers should thus use corporate tax policy with great caution when they want to stimulate entrepreneurship.

Empirical research suggests that corporate tax policy requires high-quality accounting standards in order to have meaningful effects on entrepreneurship activity. In addition, tax reductions seem to have an effect only below a certain threshold tax level. Thus, it is important for policymakers to determine the most appropriate combination of policies within their contextual situation, and to further determine the threshold tax level beyond which tax policies lose their power to stimulate the desired quantity and quality of entrepreneurship activity. An interdisciplinary approach involving experts from taxation, accounting, and entrepreneurship is needed in order to develop effective policies for stimulating entrepreneurship.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Version 2 of the article introduces the “prize reducing effect” and adds new “Key references” [3], [5], [8], [14].

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Jörn Block

Corporate income tax terms

Corporate income tax: Tax to be paid on corporate income. The tax is of concern for entrepreneurs who incorporate their business and thus create a legal entity for their entrepreneurship activities.

Deductibility of business expenses: A higher deductibility of business expenses reduces the taxable corporate income of a firm, thus reducing the amount of corporate income taxes to be paid.

Effective average tax rate (EATR): Proportional decrease in the rate of return of a hypothetical investment following taxation of the income stream generated by the investment.

Progressive tax: A tax rate that increases along with the payer's taxable income.

Statutory and effective corporate income tax rate: The statutory corporate income tax rate refers to the rate imposed on the taxable income of corporations; the effective corporate income tax rate refers to the taxes a corporation pays as a percentage of the corporation's economic profit. The effective corporate income tax rate is lower than the statutory income tax rate when the corporation's taxable income is lower than its economic profit (e.g. due to tax credits, high write-offs, non-taxable income).

Source: Henrekson, M., D. Johannson, and M. Stenkula. “Taxation, labor market policy and high-impact entrepreneurship.” Journal of Industry, Competition, and Trade 10 (2010): 275–296; Da Rin, M., M. Di Giacomo, and A. Sembenelli. “Entrepreneurship, firm entry, and the taxation of corporate income: Evidence from Europe.” Journal of Public Economics 95:9–10 (2011): 1048–1066.

Measures and types of entrepreneurship

Entrepreneurship rates: The number of entrepreneurs as a percentage of total employment; the number of entrepreneurs is often proxied by the number of self-employed persons (see below).

Entrepreneurship entry rates: The number of new firms or ventures that enter a particular industry or market.

Total early-stage entrepreneurial activity (TEA) rate: The Global Entrepreneurship Monitor (GEM) surveys adults between 18 and 64 and defines the TEA rate as the sum of the nascent entrepreneurship rate and the new business ownership rate. Nascent entrepreneurs are individuals involved in setting up a business; new business owners are owner-managers of firms that are younger than 3.5 years.

Self-employment refers to a situation where an individual works for him- or herself instead of working for an employer. In labor market research, self-employment is often used as a proxy for entrepreneurship. This approximation may be considered justified or not depending on the definition and type of entrepreneurship considered (see below). Critics argue that entrepreneurship is not only about working for oneself, but also about pursuing a profitable business opportunity and taking high personal and financial risks.

Types of entrepreneurship: several established entrepreneurship typologies exist, including:

Opportunity vs necessity entrepreneurs (entrepreneurs who start their business because they see a profitable business opportunity vs entrepreneurs who start their business out of necessity)

Innovative vs imitative entrepreneurs (entrepreneurs with goods or services that are new to customers vs entrepreneurs with goods or services that are identical or very similar to what is already available in the market)

Low- vs high-growth entrepreneurs (entrepreneurs with low growth potential/ambitions vs entrepreneurs with high growth potential/ambitions)

Formal vs informal entrepreneurship (entrepreneurs who have registered a business vs entrepreneurs who have not registered a business)

Low-technology vs high-technology entrepreneurship (entrepreneurship in low-technology sectors vs entrepreneurs in high-technology sectors)

Social vs for-profit entrepreneurship (entrepreneurs who are primarily motivated by solving social problems vs entrepreneurs who are primarily motivated by earning profit).