Elevator pitch

Although coverage of collective bargaining agreements has been declining for decades in most countries, it is still extensive, especially in non-Anglo-Saxon countries. Strong unions may influence firms’ incentives to invest in capital, particularly in sectors where capital investments are sunk (irreversible), as in research-intensive sectors. Whether unions affect firms’ investment in capital depends on the structure and coordination of bargaining, the preference of unions between wages and employment, the quality of labor-management relations, and the existence of social pacts, among other factors.

Key findings

Pros

By negotiating higher wages, unions may induce firms to reduce employment and substitute capital for labor.

In a strategic environment with bargaining over both wages and employment, greater union power may increase investment in research and development.

Where long-term labor contracts are common, unions may commit in advance not to appropriate rents from investment.

Positive labor relations and the existence of social pacts may boost investment.

If a union expects substantial gains from an innovation, it will bargain for high research and development expenditures when its power increases.

Cons

By raising wage demands after contract negotiation, unions may seize returns on capital and impede investment in capital.

The reduction in investment is larger when capital investment is sunk, as in research-intensive industries.

As long as the returns to capital are appropriable, firms react to union power by reducing both physical capital and research and development.

Unions have a negative effect on research and development investment in the US, but this effect is not found in other countries.

Cross-country evidence shows significant negative effects of unions on investment, especially in research-intensive sectors.

Author's main message

Powerful unions may slow investments in physical capital and in research and development, but the effect is influenced by the institutional context. Union effects on research and development are negative in the US but insignificant in EU countries. Cross-country evidence also shows negative effects, particularly for research-intensive industries with irreversible capital investments. However, industrial relations play a crucial mediating role. By routinely involving unions in government decisions on social and economic policy, policymakers may be able to shape incentives to sustain cooperation with employers and boost investment.

Motivation

While union density (the share of workers who belong to unions) is not very high in most developed countries, many more workers are covered by collective bargaining agreements, especially in continental EU countries. In France, the difference between coverage of collective bargaining agreements (76%) and union density (22.2%) was 53.8 percentage points in the mid-1970s and increased to 84.4 percentage points in 2008, as collective bargaining coverage increased to 92% and union density fell to 7.6%. Similarly, in Germany in 2011, approximately 18% of employees were union members, while collective bargaining contracts covered more than 60% of employees. The share of covered employees is lower in the UK and the US, where union density and coverage of collective bargaining agreements largely coincide. In the UK, 73% of workers were covered by collective bargaining contracts in 1970, but that share fell to 31% in 2011. And in the US, collective bargaining contracts covered 30% of workers in 1970 but just 13% in 2011. This paper discusses the effects of union power on investment in intangible capital, primarily research and development (R&D). It looks at the theoretical mechanisms at play and reviews the evidence on union effects for country case studies and cross-country studies.

Discussion of pros and cons

Key theoretical insights

Capital−labor substitution and the hold-up problem

Unions may affect investment in tangible (physical) capital and intangible capital (mainly R&D) in different ways. The effects can be analyzed using two theoretical frameworks, which broadly correspond to the different views of unions that have been proposed in the literature. According to the so-called “standard model” [2], unions focus on raising wages, and firms subsequently react by cutting employment. In this framework, there are two possible effects on capital investment: firms may reduce investment in capital in order to reduce costs (scale effect), or they may substitute capital for labor, thus increasing capital investment (substitution effect) [2], [3].

The second framework, the standard rent-seeking model, predicts that if firms invest in long-lived, irreversible (sunk) capital, union power will result in higher future wages, in effect levying a “tax” on returns to investment. By partially appropriating returns on investment, union power reduces the rate of return and ultimately reduces investment in both physical and R&D capital. This view lies behind many of the empirical studies on the impact of unions on innovation and investment [2]. This framework assumes that unions and firms cannot commit to long-term contracts and that capital investments are sunk. Thus, rent-seeking reduces incentives for firms to invest. This situation is known in the literature as the hold-up problem [4]. Theory also predicts that the negative effects on investment are larger in sunk-cost-intensive sectors [1].

The relevance of the hold-up problem is also associated with the capacity of firms to recover their capital costs before sharing their rents with employees. When wage bargaining occurs sequentially in two steps, the hold-up problem is likely to be lessened if the firm can credibly threaten to liquidate its capital, for example, by relocating their capital investments overseas [5].

The rent-seeking theoretical framework predicts that union power reduces both long-lived physical capital and innovative R&D capital. As long as the returns to physical capital and R&D are both appropriable, firms react to union power by reducing both types of investments. Because the stock of knowledge deriving from R&D is likely to be long-lived and firm specific, and R&D expenditures often anticipate investment in physical capital, firms that reduce investment in physical capital are also likely to reduce investment in R&D and related innovative activities [2].

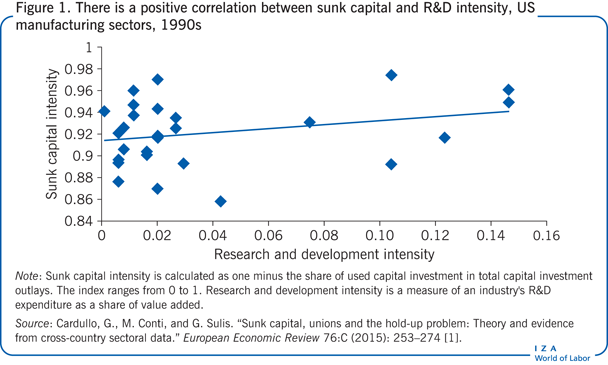

Although some analysts express concern about extending the hold-up model from investment in physical capital to investment in R&D capital [6], R&D expenditures are treated in much of the literature as indicators of the specificity (or irreversibility) of an investment [1], [3]. For example, Figure 1 reports a positive empirical correlation between the extent of sunk capital and R&D intensity across manufacturing sectors in the US. R&D-intensive industries are defined as industries with a larger expenditure of R&D as a share of value added, while sunk capital intensity is calculated as one minus the share of used capital investment in total capital investment outlays. This is not surprising, as R&D expenditure is largely sunk capital and, therefore, to a certain extent, industry R&D intensity might be considered an alternative measure of industry sunk capital intensity.

Extensions of the theoretical framework

Contrary to the rent-seeking theoretical framework described above, extensions of the theory have posited that it is not the strength of unions itself that reduces investment but rather the type of bargaining in which they are able to engage [7]. The basic hold-up problem emerges in a context in which a firm makes the investment decision before bargaining over wages (and employment). As long as wages and employment are bargained after the investment decision, the investment will be irreversible, so firms have no incentive to invest because workers can subsequently expropriate some of the rents. However, when risk-neutral unions bargain in long-term labor contracts over wages, employment, and capital (or R&D), the union has no incentive to deviate from the efficient level of investment. In this context, the level of investment (in physical capital or R&D) will be independent of the bargaining power of the union, which will, however, have an effect on wages, or the share of rents the union will receive. When bargaining occurs after investment decisions, unions have more power to increase wages, thus reducing employment opportunities and inducing less investment and ultimately making workers worse off.

A second possible criticism of the theoretical framework concerns the dynamic strategy of unions and firms in collective bargaining. In the real world, unions and firms interact continuously: agreements are not the outcome of a single bargaining game; rather, the bargaining is repeated over time. As long as opportunistic behavior in the form of appropriating rents can be punished, both unions and firms have incentives to cooperate and maintain favorable relations. Some studies have explicitly cited differences in time discount rates between firms and unions as potential explanations for opportunistic behavior. If union members do not have property rights in the union, they will discount the future at a higher rate than will the firm’s shareholders. As a consequence, union members will be rationally myopic, supporting short-term defensive strategies in negotiations [3].

A related point concerns the role of unions as a commitment device. In countries in which long-term labor contracts are common, unions may commit in advance not to appropriate rents from investment. For example, labor contracts are longer in Japan than they are in Anglo-Saxon countries. However, commitments are difficult to maintain in an environment with considerable uncertainty and information asymmetries between unions and firms [8].

Finally, recent empirical work on the effect of unions on innovation has noted possible differential effects of union power on product and process innovation [3]. Product innovation constitutes a very large share of R&D investment, and it allows a firm to increase its market share, while process innovation is essentially labor saving. The two effects may have very different implications for employment and R&D investment, as is discussed below in the sections on the empirical evidence.

Strategic R&D competition

The discussion so far is based on a single firm and single union framework in which strategic competition across firms is ruled out by assumption. A series of studies has emphasized the possibility of interaction effects in a two-firm–two-union environment [7]. In that setting, firms compete to discover a new technology that allows them to save on labor inputs and thus increase profits. Because R&D investment influences the probability of discovering the new technology, investment in R&D is driven by a competitive threat: the difference in profits between discovering and not discovering the technology. When labor is not unionized, the resulting outcome is overinvestment in R&D by both firms [7].

The results change substantially when labor is unionized. In that case, no general result emerges, and several results are possible, depending on the attitude of unions toward risk and the characteristics of the bargaining mechanism. With long-term bargaining, firms and unions bargain over the level of wages, employment, and R&D expenditures. Wages and employment depend on whether the firm wins the R&D race. When unions are risk neutral (they do not care about employment levels), the results are the same as before: R&D and employment will be at their competitive level, and thus union power does not affect R&D. When unions are risk-averse (they care about employment levels), the results depend on the relative gains of unions and firms from innovation. If the union expects substantial gains from an innovation, it will bargain for high R&D expenditures when its power increases. Because wages are the same whether the firm wins the R&D race or not, the union’s gains in utility depend on the change in employment after the innovation and the relative weight the unions place on employment [7].

When there is short-term bargaining, the firm alone chooses the level of R&D expenditures, and two different bargaining mechanisms over wages and employment are possible. In the case of right-to-manage bargaining, unions negotiate wages conditional on technology. Thus, when there is an innovation, stronger union bargaining power implies higher wages and a lower competitive threat—the difference in profits between winning and losing the R&D race. By reducing the competitive threat, stronger union bargaining power may have negative effects on R&D and innovation [7].

In the case of short-term efficient bargaining, unions negotiate wages and employment conditional on technology. With risk-neutral unions, unions care only about wages and not about employment levels. Thus, union power leads to higher wages and lower profits, competitive threat, and ultimately R&D. When unions are risk-averse, the results change depending on the initial level of union power and the degree of risk aversion: if unions are weak, an increase in union power leads to an increase in profits, competitive threats, and ultimately R&D expenditures. The mechanism is the following: if the union is very risk-averse, greater bargaining power will have an effect on employment and not on wages, which are approximately at the competitive level. As long as unions are very weak, employment will also be at its competitive level; thus, an increase in employment will have no direct effect on profits. However, an increase in employment will have important effects for the competing firm, which will cut back on employment. As a result, higher employment implies a higher market share, higher output, and higher profits. Thus, even with short-term bargaining, greater union power may lead to an increase in R&D expenditures [7].

Bargaining structure and wage centralization

Firms’ investment incentives for R&D, and the hold-up problem associated with unionization in the context of strategic interaction, are also determined by the degree of centralization of wage bargaining [9]. When wages are bargained at the industry level (centralization), firms have the greatest incentives to invest. In this setting, wages are equal to average industry productivity, so innovation increases productivity (and wages) for the entire industry. For the innovating firm, the increase in productivity will be higher than the increase in wages, thus limiting the hold-up problem. Under decentralization, with wages set independently at the firm level, strategic competition between firms limits the hold-up problem. In this setting, the non-innovating firm grants wage increases to its workers to increase its competitiveness [2]. Finally, under coordination, the union separately bargains wages at different firms. In this setting, the firm will be particularly vulnerable to a potential hold-up problem because wages increase directly with productivity, thus making investment less attractive. Thus, the incentives for firms to invest are highest under centralization and smallest under coordination, with decentralization being an intermediate case [9].

The empirical evidence

Single-country studies

For the US, the first generation of studies finds significant negative effects of unions on R&D intensity, whether at the firm or the industry level [8]. One important result is that unions reduce R&D directly by reducing firm profitability and indirectly by inhibiting investment. Similar evidence is found for Canada. The negative effect of unions in this case is usually interpreted in terms of the hold-up problem, such that firms do not invest before wage negotiations take place. In the US studies, the size of the negative effect of unions on R&D is often very large [8].

A more recent study provides evidence of causal union effects on innovation in the US [10]. The study uses patent quantity (total number of patents granted) and patent quality (number of citations received by each patent) as innovation outcomes. Innovation outcomes are compared for firms in which unions win election by a small margin with firms in which unions lose election by a small margin. Under the hypothesis that union victory is approximately a random event under such circumstances and that this event is not correlated with the firms’ characteristics, the study finds that the presence of unions implies a reduction in innovation output of 8.7% for patent quantity and 12.5% for patent quality after victory in the election [10].

For Europe, most of the studies are for the UK and Germany. In the UK case, the negative correlation between R&D expenditures and union power disappears when additional controls are included in the analysis. Two separate studies conclude that the negative correlation between unionization and R&D intensity seems to be spurious and occurs because unions are less prevalent in new companies and in companies that operate in high-tech industries, that is, firms that tend to have higher R&D intensities [11].

The studies find a positive association between unions and investment in R&D at low levels of union density. However, the effect of unions on investment is negative at high union density levels, suggesting possible non-linearities in the union effect. The studies argue that this evidence is consistent with the short-term efficient bargaining model discussed above. In that setting, when unions are not very strong and when there is bargaining over wages and employment, an increase in union power may result in higher R&D expenditures. Still, the effect depends strictly on the preference of unions for employment and on union attitude toward risk. In contrast, when bargaining is over wages only, the correlation between union power and R&D expenditures is negative.

When the same analysis is conducted after dividing the sample of firms by the presence or absence of additional non-wage-related bargaining, a negative relation emerges in firms where bargaining is over wages only. In contrast, an inverse U-shaped relationship emerges when there is also bargaining over employment (hiring and firing and other issues related to the workforce). Finally, when the same regression analyses are conducted using US data, there is a clear and significant relationship between union power and investment [11]. The study concludes that differences in the institutional context and in the preferences of unions over wages and employment in the the UK and the US may explain their results.

Further evidence of the role of institutional factors is provided by a series of studies that analyze the German case [3]. Germany has a peculiar structure of cooperative industrial relations, and previous studies have found no significant effect of works councils and union density on investment in physical capital [6]. One study uses longitudinal observations at the firm level to investigate the causal effect of works councils and sectoral agreements on measures of innovation in the manufacturing and service sectors [3].

First, probability models estimated for the actual (or successful) introduction of some product or process innovation at the firm level conclude that it is the joint presence of works councils and sectoral agreements that is likely to be associated with a higher probability of innovation. Second, the longitudinal dimension of the data set is employed to conduct a difference-in-differences analysis that exploits differences in behavior between collective bargaining (and works councils) switching and non-switching firms. The results confirm previous findings on the interdependence of works councils and collective bargaining at the sectoral level. Moreover, sectoral agreements seem to have a direct, negative effect on product innovation, but an ambiguous effect on process innovation. Overall, the evidence suggests that the dual bargaining structure in Germany may represent a more favorable environment for innovation than the highly decentralized structure in the US [3].

Cross-country evidence

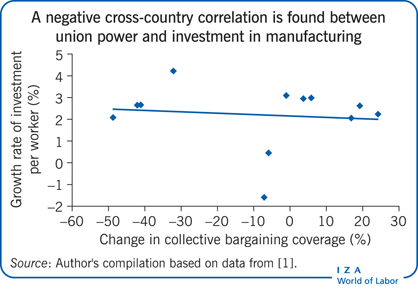

A recent empirical study using cross-country manufacturing sector data for a sample of 11 OECD countries during 1980–2000 offers additional evidence on the relevance of the hold-up problem [1]. The study finds a negative effect of greater union power (proxied by coverage of collective bargaining agreements) on levels and growth rates of physical capital investment, with stronger effects for more sunk-capital-intensive industries. Using R&D expenditures as a proxy for sunk investments, the study finds that the negative effect of unions on investment levels (and growth rates) is higher in more R&D-intensive industries (industries with a larger share of R&D expenditures on value added).

A series of further checks confirm the main findings. Because theory predicts that it is the sunk nature of capital investments that generates the hold-up problem, not the physical capital intensity itself, industry physical capital intensity was also included in the analysis. The results confirm this prediction. The study also considers the role of the threat of liquidation and the possibility that firms would relocate overseas, using the degree of vertical integration (measured by the ratio of sectoral value added to gross output) as a proxy for this threat [5]. In sectors where production tends to be vertically integrated, the scope for outsourcing and overseas relocation might be lower, all else remaining equal. Again, the main result on the relevance of the hold-up problem is confirmed [1].

The quality of employment relations and labor regulations

As mentioned briefly above, the bargaining system and the attitude of unions toward management may also influence the quality of employment relations. The rent-seeking activities of unions may be associated with high levels of conflict and may provoke anti-union behavior by management. Conversely, unions may improve employee–management relations by facilitating communication between workers and management, thereby increasing productivity and investment [12].

While it is difficult to measure the quality of a labor relations system, one study used information for each country on whether both unions and employers had been routinely involved in government decisions on social and economic policy issues (social pacts) as an admittedly raw proxy for the degree of cooperation between unions and management [1]. The idea is that by involving unions and employers in at least some economic policy decisions, the government creates a more cooperative framework that favors the sustainability of a cooperative equilibrium in which unions refrain from exploiting their bargaining power. The empirical results provide some favorable evidence for this hypothesis [1].

An important determinant of union power is related to the characteristics of the industrial relations system in which the unions operate. Does the magnitude of the union effect vary with regulations in the labor relations systems across countries? For instance, in some countries, the government has the power to impose compulsory arbitration in a labor dispute or at least mandatory conciliation procedures before workers can call a strike. In other countries, unions are not allowed to strike if there is a collective bargaining agreement in place, or if notification is required before a strike can take place. In other countries, the law forbids strikes once a collective agreement has been signed. Such regulations are important because they can be expected to significantly alleviate the hold-up problem by greatly reducing the ability of unions to behave opportunistically. Indeed, the evidence shows that the effect of union power is greatly diminished in countries that forbid strikes when a collective agreement is in place or that mandate arbitration procedures [1].

Limitations and gaps

The empirical results discussed here rely on different methodological approaches. Although most of the studies provide consistent evidence that goes well beyond simple correlations, the relationship between unions and investment in capital may still be confounded by several factors. First, the empirical correlation may suffer from omitted variable bias if variables that are correlated with union power are not included in the analysis. Moreover, it could also be the case that countries that specialize in industries with low levels of R&D are more likely to have stronger unions and higher coverage of collective bargaining, thus reversing the direction of causality. Future research should take these confounding factors into account to provide more robust causal evidence.

Most of the studies in the literature refer to Anglo-Saxon countries and Germany. Because these countries have very peculiar bargaining systems, it is difficult to generalize the results to countries with different bargaining arrangements. Future research should extend the analysis to different countries by exploiting both the cross-country and the temporal variations in the data.

Another limitation of these studies is that they refer mainly to the manufacturing sector. Few studies consider the public service sector.

Finally, there are issues about how to measure union power. Although various proxies have been used, they do not necessarily reflect the true capacity of unions to influence investment. More work in this direction is needed.

Summary and policy advice

Unions may have potentially important effects on investment in physical capital and R&D. Positive effects of unions on investment may derive from the substitution of capital for labor. However, when workers and firms cannot commit to long-term contracts and capital investments are sunk, union power reduces incentives to invest in both physical and R&D capital.

The evidence suggests that unions have negative effects on investment in physical capital and R&D intensity in the US, while the results for other countries are less clear-cut. The relationship disappears when considering other factors, such as the characteristics of the sectors in which unions operate, as in the UK and Germany. Recent cross-country evidence from OECD economies indicates negative effects of unions on physical capital investment, especially in sunk-capital-intensive industries, such as R&D-intensive sectors. Still, these results depend partially on the structure of wage bargaining, on the quality of the industrial relations systems, and other institutional factors.

The goal of policy is to improve the quality of the labor relations system. In this setting, the regulation of strikes and other institutional arrangements such as the introduction of arbitration and conciliation procedures may have favorable effects on union behavior and ultimately on investment.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author also thanks Gabriele Cardullo and Maurizio Conti for comments and suggestions. This paper draws on findings contained in [1], including previous versions of the article.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Giovanni Sulis

Sunk-capital-intensive sectors and the hold-up problem

Source: Cardullo, G., M. Conti, and G. Sulis. “Sunk capital, unions and the hold-up problem: Theory and evidence from cross-country sectoral data.” European Economic Review 76:C (2015): 253–274 .