Elevator pitch

Liberalization of foreign trade and investment raises the domestic ratio of skilled to unskilled wages (skill premium) if the country has a sufficiently well-educated workforce, but lowers it otherwise. Wide wage inequality is undesirable on equity grounds, especially in poor countries where the bottom wage is close to the breadline; but it gives parents an incentive to invest in their children’s education. The incentive will be ineffective, however, if parents cannot borrow for their child’s education because of underdeveloped credit markets or because they are too poor to finance the investment from their own income and savings.

Key findings

Pros

In developing countries with a sufficient stock of skilled labor, liberalization boosts the skill premium and increases the incentive for parents to invest in their children’s education, provided that liquidity constraints can be addressed.

A fall in the skill premium redistributes income from the rich to the poor.

Regardless of the initial stock of skilled labor or the effect on the skill premium, liberalization raises average income and reduces child labor (encourages investment in education).

Cons

In developing countries with a sufficient stock of skilled labor, liberalization redistributes income from the (unskilled) poor to the (skilled) rich, making it harder for parents who are poor to invest in their children’s education.

If a country lacks enough educated people when it liberalizes, wage inequality will fall, but the incentive to invest in children’s education will weaken.

Foreign investment reduces the demand for skilled labor in countries where the supply is low.

Author's main message

Although liberalization raises average income and reduces child labor, developing countries ought to delay opening to foreign trade and investment until they have accumulated a stock of educated workers large enough for foreign trade and investment to raise the skill premium. Countries that liberalized prematurely because of outside pressures prolonged their condition as low-skill producers, while development advanced in countries that waited. Even if the stock of educated workers is sufficiently large, government intervention may still be needed to counter the adverse consequences of trade-induced wage disparities on income distribution.

Motivation

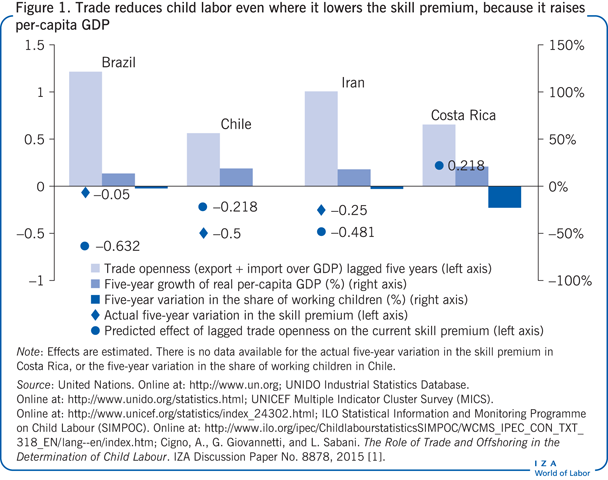

Economic inequality has increased to an unprecedented level since the 1970s. Many popular commentators and some research economists attribute this rise in inequality to the lowering of barriers to cross-border trade and investment (trade and investment liberalization). While inequality can refer to either wealth inequality (the concentration of assets in very few hands) or wage inequality, the focus here is on wage inequality in developing countries, where it has implications not only for income distribution, but also for educational attainment and child labor (see Figure 1).

This paper examines the case for a connection between trade and foreign investment liberalization and wage inequality. While foreign investment can refer to either portfolio investment (the acquisition of foreign private or public debt instruments, such as stocks) or foreign direct investment (the relocation of production activities from one country to another, or offshoring), offshoring is what matters most in connection with wage inequality.

Discussion of pros and cons

Is there a connection between trade and investment liberalization and wage inequality?

From a developing country perspective, wage inequality has two somewhat contrasting features.

On the one hand, wage disparities are more worrisome in developing countries than in developed countries because the wage earners at the bottom of the wage distribution are closer to the subsistence level, and governments are less well equipped to shelter the weaker members of society through fiscal and welfare safety net measures.

On the other hand, to the extent that wage disparities reflect differences in acquired skills, wage inequality constitutes an incentive to invest in children’s education. While the same incentive is at work in developed countries, the urgency may be greater in developing countries because the alternative to study is often child labor rather than leisure. The discussion in this section reviews the theoretical arguments and empirical evidence to the effect that trade liberalization raises wage inequality under certain initial conditions and lowers it under others.

Taking the skill premium as the ratio of non-production wages (supervisory and managerial) to production wages, a study finds that this form of inequality increased in about half the low- and middle-income developing countries during the 1980s and 1990s (countries with an annual per capita GDP below $14,000 in 1980) [2]. Other studies specify that the increase especially affected middle-income Latin American countries, but it also affected some low-income countries [3], [4], [5], [6]. Yet another study detects a positive correlation across developing countries between growth in wage inequality and an increase in the share of skill-intensive goods in those countries’ exports [7].

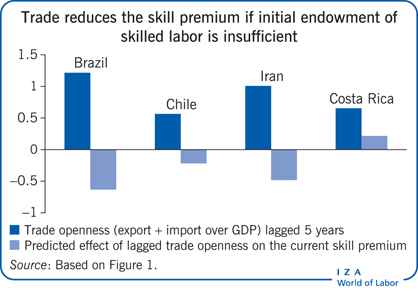

The relationship between wage inequality, skill endowments, and exposure to international trade is investigated in a very recent study using merged and matched data from the World Bank, the United Nations Industrial Development Organization, and the United Nations Educational, Scientific, and Cultural Organization [1]. The study used as a measure of the skill premium the ratio of the average wage rate in high or medium-high technology industries to the average wage in low technology industries. Trade exposure is measured by the ratio of exports plus imports to GDP. Skill endowments are measured by the share of the adult population with a primary education only and the share of the adult population with a secondary or higher education. The study finds that the effect of trade depends on the size of a country’s skill endowments. If these endowments are small, trade will reduce the skill premium (the ratio of skilled to unskilled wage rates). If they are sufficiently large, trade will raise the skill premium. For countries with very few adults educated to secondary school level (or higher), it is estimated that trade will raise the skill premium only if at least three quarters of the adult population have completed primary education.

What explains the connection between foreign trade and investment liberalization and wage inequality?

How should these statistical regularities be understood? According to economic theory, in an economy with no international trade (a closed economy), the larger the endowment of a particular factor of production, such as labor and capital, the lower the return to that factor relative to others. That may change if the country opens itself up to trade.

According to traditional (Heckscher–Ohlin) theory, countries specialize in the production of goods that make more intensive use of their comparatively more abundant non-tradable factors, and the returns to these factors are higher with international trade than without it. If the non-tradable factors are labor and capital, then in the standard model of trade between developed and developing countries, trade liberalization will induce labor-abundant developing countries to specialize in the production of goods requiring relatively more labor (labor-intensive goods) and induce the capital-abundant developed countries to specialize in the production of capital-intensive goods. Consequently, with trade, the wage rate will rise in developing countries and fall in developed countries (Stolper–Samuelson theorem).

If the non-tradable factors are skilled (more educated) and unskilled (less educated) labor, trade liberalization will induce the skill-abundant developed countries to specialize in the production of goods with a high level of skilled-labor inputs, and induce the skill-poor developing countries to specialize further in the production of goods with a low level of skilled-labor inputs. If countries then open up to trade, the skilled wage rate will rise relative to the unskilled wage rate in developed countries and fall in developing countries.

Technology and trade in intermediate goods

That is what traditional theory says. But, as reported above, this is not what happened in practice. Why? The theoretical framework (Hecksher–Ohlin) assumes that all countries have access to the same technology and envisages only trade in final goods. In reality, developed countries (or, rather, imperfectly competitive firms in those countries) have exclusive knowledge of and patent rights over production processes they have recently discovered. Furthermore, international trade includes trade in intermediate goods as well as final goods. Trade in intermediate goods has risen sharply in recent decades since the relaxation of legal constraints on foreign ownership has facilitated the relocation of the factories producing intermediate goods from developed to developing countries. Since developed countries have a relative abundance of skilled workers, the recently discovered production processes used exclusively in those countries will be more skill-intensive than the production processes they replace. This skill-intensiveness has two important implications:

it compounds developed countries’ comparative advantage in the production of skill-intensive goods; and

it encourages the relocation of older and less skill-intensive production processes from developed countries to developing countries, where labor costs are lower.

If the relocated production processes, while less skill-intensive than the last-generation processes recently introduced in developed countries, are nonetheless more skill-intensive than those originally carried out in the destination countries, demand for skilled labor will shift upward in the destination country and the ratio of skilled to unskilled wages will rise accordingly. An example is the sharp rise in foreign direct investment into Mexico that followed the liberalization of trade and the easing of restrictions on foreign ownership during the 1980s [3]. Between 1983 and 1989, foreign direct investment into Mexico rose ninefold in absolute terms, and sevenfold (from 1.4% to 9.7%) as a share of total investment. Between 1984 and 1990, the ratio of skilled wages to unskilled wages rose from 1.93 to 2.55.

Technology transfer and technological progress in developing countries

Technology transfer to developing countries through foreign direct investment from developed countries, as well as autonomous technological progress in developing countries tends to narrow the technology gap between developed and developing countries in all sectors (not only those affected by foreign direct investment). This narrowing may eventually cause some developing countries to become developed countries [7]. The combined effect of these two forms of technical change is to raise the skill content of the goods exported by developing countries. Wage inequality increased in countries where this foreign investment-related effect prevailed over the wage-equalizing effect associated with international specialization according to initial comparative advantage (specialization in capital-intensive goods in developed countries and labor-intensive goods in developing countries). Where the reverse occurred, wage inequality decreased.

But why did the foreign investment-related effect (increasing wage inequality) prevail over the effect associated with international specialization by initial comparative advantage (wage-equalizing) in some developing countries, while the reverse happened in others?

One study argues that the skill content of the foreign direct investment attracted by a developing country rises with the share of skilled workers in that country’s total workforce at the time foreign trade and investment barriers are lowered [1]. According to this argument, developing countries that entered the globalized economy with a very low share of skilled workers (and, consequently, a very high ratio of skilled wages to unskilled wages) attracted production processes that made more intensive use of low-skilled workers than the production processes already in use. In these countries, trade liberalization raised the demand for low-skilled workers relative to the demand for higher skilled workers and thus lowered the skilled wage to unskilled wage ratio. The opposite happened in developing countries that started off with a share of skilled workers large enough (and thus a lower ratio of skilled wages to unskilled wages) to attract production processes that make more intensive use of skilled workers than the processes already in use. In these countries, trade liberalization raised the demand for high-skilled workers relative the demand for low-skilled workers, and thus raised the skilled to unskilled wage ratio. This explanation is consistent with the estimates reported above. Is that good or bad?

Is trade liberalization good or bad for developing countries?

To the extent that skill comes from formal education rather than work experience, an increase in the skilled to unskilled wage ratio raises the incentive to invest in children’s education, while a decrease in the ratio lowers the incentive. An adequate return to education, however, is not all that is needed for children to go to school rather than work. Parents must also be able to afford the investment (even if the tuition is paid for by the government, the family will still need to pay the cost of rearing the child and buying books and other school materials and will need to make up for the loss of the child’s income). Because of underdeveloped credit markets (liquidity constraints) in developing countries, this means that parents must be rich enough to finance their children’s educational investment out of their own resources.

In addition, while an increase in the ratio of skilled to unskilled wages raises the incentive to invest in education, it also redistributes income from less to more educated working parents and thus (assuming that the less educated parents are on average poorer and consequently more likely to be liquidity constrained than the more educated) makes it more difficult for the poor to finance their children’s education. Conversely, a fall in the skill premium reduces the incentive for parents to invest in their children’s education, but it also redistributes income from more to less educated parents. Therefore, theory cannot tell us in advance whether child labor will rise or fall in aggregate when the skill premium rises.

There is a further complication. By widening the range of production possibilities, and reducing the economic distortions generated by trade barriers, liberalization of foreign trade and investment reduces inefficiency and raises average income. Other things being equal, therefore, liberalization reduces the number of families that are too poor to invest in their children’s education and consequently the number of children who work instead of going to school.

With so many factors at play (trade-induced changes in skill premium, average income, and income distribution), it is an empirical question whether liberalization will result in more or less child labor. The study mentioned above in relation to the effect of trade on the skill premium also looks at the effect of trade on child labor. This study estimates that trade reduces child labor no matter whether it raises or lowers the skill premium [1]. An earlier study shows that not only actual trade, but also trade openness (measured by an index that rates a country as either open or closed according to whether it does or does not clear a number of obstacles to foreign trade and investment) reduces child labor [8].

It would thus seem that the income-enhancing effect of trade is strong enough to more than compensate for any adverse incentive effect (reduction in the skill premium) or distributional effect (redistribution from the poor to the rich).

An implication of these findings is that trade liberalization is good for developing countries because it raises average income and reduces child labor. But what does it do for these countries’ role in the international economy? While liberalization will raise the skill premium where the initial supply of qualified workers is sufficiently large and reduce it elsewhere, it will boost educational investment and thus, eventually, the supply of qualified workers everywhere. However, in the countries where the initial supply of skilled labor is sufficiently large, trade will attract production activities with high skill requirements from developed countries, so that the domestic skill premium will rise even as the supply of skilled workers rises. Elsewhere, by contrast, liberalization attracts production activities with low skill requirements, so that the domestic skill premium falls. Countries in the first group will gradually increase the share of skill-intensive goods in their output mix. Countries in the second group will specialize even further in the production of goods with a low skill content.

A different perspective on trade and development

The theoretical argument is made that liberalization of trade and investment lead not to an integrated world economy but to the emergence of a number of vertically integrated production systems consisting of countries that cooperate with each other because the education level of their workforces are not too dissimilar [9]. According to this theory, trade integration among such countries will lead, first, to greater wage disparities between more developed and less developed countries in the same integrated production system (and thus to a deterioration in the labor market position of the unskilled) and then to wage convergence between the countries and divergence within them. Developing countries that are unable to integrate with developed countries will be condemned to no international trade or to trading only among themselves.

On the face of it, this vision of the development process is somewhat reminiscent of Myrdal’s description in the 1950s of development as a virtuous circle triggered by a historical accident. However, empirical studies find that the developing countries that succeeded in integrating with developed countries had a sufficiently well-educated workforce when trade and investment was liberalized [1], [9]. Thus, because the number of educated workers is an outcome of earlier private or public education investments, and liberalization is the outcome of a political decision, the fact that the virtuous circle started in one place rather than in another is not a historical accident, but the result of deliberate action.

The economies referred to as the “Asian tigers” (Hong Kong, Singapore, South Korea, and Taiwan) are a good example of countries that took this kind of deliberate action. In the 1960s and 1970s, they invested massively in education (among other ways, by sending their brightest young people to study for higher degrees in Western Europe and North America) before liberalizing in both the economic and the political sense. That allowed Hong Kong and Singapore to become major exporters of financial services, and South Korea and Taiwan to become major exporters of information technology goods. Their example was followed, with a lag, by the “tiger cub” economies (Indonesia, Malaysia, Philippines, and Thailand). The Asian tigers and their cubs are now classified as emerging market economies or newly industrialized countries.

In contrast with the view that developing countries that are unable to integrate with developed countries in vertically integrated production systems are doomed to fall back into autarchy or to trade only with other countries in a similar position [9], the estimates reported above suggest that this is not necessarily the outcome for countries caught wrong-footed by trade liberalization [1]. These countries may still trade with and attract investment from developed countries, but this trade and investment will only accentuate their specialization in low-skill production activities and narrow (instead of amplifying) the domestic gap between skilled and unskilled wage rates, with all the positive and negative consequences this entails. African countries are a case in point. After waiting on the sidelines of the globalization process for several decades, these countries have recently started to engage in important regional trade agreements and to attract foreign investments.

During the 2000s, world trade fell as a share of global GDP. A recent International Monetary Fund paper attributes this decline to the exhaustion of the wave of information and communication technology innovations that led to a rapid expansion of global supply chains and consequent increase in back-and-forth trade in components during the 1990s. The participants in that boom are today’s emerging market economies and newly industrialized countries. The paper concludes that, although the first wave of vertical integrations across national borders has lost momentum, “there is still considerable scope to enhance the international division of labor by drawing in regions that have been at the margin of global supply chains, such as South Asia, Africa, and South America” [10]. In other words, the time may soon come for the participation of countries that were excluded from the first wave of vertical integration because their labor forces were not sufficiently well-educated.

Limitations and gaps

Existing explanations of the way trade and investment liberalization affects the ratio of skilled wages to unskilled wages imply that foreign investment raises the demand for skilled labor where the supply is high and reduces it where the supply is low. The evidence is consistent with theory, but does not actually tell us that the more skill-rich a developing country is, the more skill-intensive will be the production activities that relocate to that country. The reason is simple: there is no country-level information on the skill content of these foreign direct investment flows. There is information on the size of these flows, but that is not the right explanatory variable.

The same applies if an index of a country’s openness to foreign investment is used instead of actual foreign investment. Some firm- or sector-level studies (not reviewed here) are available, but the information they provide cannot be readily combined with country-level data on trade, wages, child labor, and skill endowments. Until country-level information on all the relevant variables is available, we cannot be fully confident that liberalization has the effects hypothesized in the literature reviewed here.

Summary and policy advice

The paper examines the argument that reducing obstacles to foreign trade and investment will widen the gap between skilled and unskilled wages if a country has a sufficiently large stock of educated people in its workforce when the liberalization takes place, because it will attract foreign investment with relatively high skill requirements. A large wage gap is undesirable from an income distribution point of view, especially in poor countries where the bottom wage is close to starvation level, but it constitutes an incentive for parents to invest in their children’s education instead of cashing-in on their children’s earning capacity by sending them to work prematurely. A high return to education is of no use, however, if parents cannot finance the investment on credit or are not rich enough to finance it out of their own pockets. As uneducated parents are, on average, poorer than educated parents, trade-induced redistribution from the uneducated to the educated will counter the incentive effect of a higher skill premium, and liberalization could thus fail to yield a higher investment in education. Conversely, if a country does not have a sufficiently large stock of educated people in its workforce when liberalization takes place, wage inequality will be reduced because the incoming foreign investment will have relatively low skill requirements, and the incentive for parents to invest in their children’s education will become weaker. Consequently, liberalization will not necessarily result in higher educational investment and less child labor.

Such empirical evidence as there is confirms that liberalization increases wage inequality in countries where the share of educated adults is above a certain threshold and reduces it elsewhere. But it also shows that educational investment will rise and child labor will fall everywhere, because liberalization raises average income enough to more than offset any adverse incentive or distributional effects. In conclusion, therefore, liberalization appears to make all developing countries richer and less reliant on child labor, but it also divides these countries into two groups: those that will become developed countries and those that will continue to be underdeveloped. Subject to the caveat that the relevant evidence is still limited and not absolutely firm, one policy implication is that developing countries wishing to become developed should follow the example of the Asian tigers and their cubs in not opening their frontiers to foreign trade and investment until they have accumulated a sufficiently large stock of educated workers. Developing countries that had liberalization prematurely imposed on them by international agencies or, in earlier times, colonial powers, suffered a perpetuation of their underdeveloped condition.

Getting ready by accumulating a large stock of educated workers before lowering trade and investment barriers has the undesirable side-effect of perversely redistributing wage income from the poor to the rich. Even though the poor become fewer as the children of today’s uneducated workers become educated, the gap between rich and poor may still increase. Indeed, according to one of the models reviewed here, within-country wage inequality will increase in all countries, developing and developed, that become part of an integrated production system [9].

Large wage inequality is undesirable not only on equity grounds, but also because, where credit markets are underdeveloped, it limits the ability of uneducated parents to finance their children’s education. Wage and wealth disparities across countries have been touched on only lightly here because they are tangential to the topic. One study advocates transfers between countries and an establishment of an international organization to coordinate equitable development; that seems a tall order [11]. If another of the studies discussed here is right in predicting that closer economic integration between developed and developing countries will gradually turn inequality between countries into inequalities within countries [9], the ball is firmly in the national governments’ courts.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Alessandro Cigno