Elevator pitch

Turning unemployment into self-employment is a suitable alternative to traditional active labor market policies in many developed countries. Start-up subsidies can assist unemployed workers in setting up their own business. This option can be especially interesting for people whose work is undervalued in paid employment or in situations where job offers are limited because of group-specific labor market constraints or structural changes. Furthermore, start-up subsidies are potentially associated with a “double dividend” if the subsidized businesses prosper, strengthen the economy, and create additional jobs in the future.

Key findings

Pros

Subsidized start-ups have high survival rates.

Subsidized start-ups may have large positive employment effects for participants and modest effects on income.

The positive effects of subsidized start-ups may be even higher for disadvantaged groups, such as women, youth, and low-educated workers.

Subsidized start-ups can induce some additional job creation.

Potential deadweight effects (if the same outcome could be achieved without the subsidy) are probably smaller than feared.

Cons

Subsidized start-ups lag behind regular start-ups in business growth and employment creation.

Subsidized start-ups are less innovative than regular start-ups.

By crowding out other, more efficient businesses, subsidized start-ups may have displacement effects, which can be hard to evaluate.

Subsidized start-ups require more commitment from participants in order to be fully successful.

Additional non-monetary support, such as coaching and mentoring, is required for subsidized start-ups in many circumstances.

Author's main message

Start-up subsidies are an effective policy for helping participants move out of unemployment and improve their prospects in the labor market. Subsidized start-ups can also increase human capital and expand labor market networks, making it easier to find paid employment if a business fails. Because the potential for successful start-ups from unemployment is limited, expansion of these schemes is not easy and requires voluntary participation. To succeed, programs should be of appropriate duration and require a business plan and other screening. Business growth should also be an objective, to increase returns for business owners and the economy.

Motivation

OECD countries spend considerable sums on active labor market policies (0.6% of GDP in 2011), mainly on such traditional measures as job creation schemes, training programs, and wage subsidies. The goal is to remove disadvantages in education, work experience, or productivity and re-integrate unemployed workers into the labor market. Although these traditional programs have had some positive impacts on income and employment prospects, the overall effects have been disappointing [1].

Start-up subsidies are a promising alternative. Instead of helping unemployed workers find paid employment, they provide financial assistance in setting up a business. This option may be especially attractive for people whose work is undervalued in paid employment (for example, if they have low formal skills) or who face discrimination. Start-up subsidies are also a way around the limited number of job offers arising from labor market constraints facing specific groups (such as a limited number of part-time jobs for women) or structural changes in specific regions or industries. Self-employment can help formerly unemployed workers increase their employability, human capital, and labor market networks, making it easier to find paid employment if their business fails. Start-up subsidies may also offer a “double dividend” if the subsidized businesses create new jobs or have a positive impact on structural change, innovation, and technology diffusion [2], [3], [4]. Empirical evidence on the effectiveness of such programs is scarce, in part because they are a relatively small component of active labor market policies but also because of the lack of data needed to test for long-term effects and differences in effects. One exception is Germany, which has used start-up subsidies on a large scale and evaluated them comprehensively. This paper summarizes the knowledge on the effectiveness of start-up subsidies in industrialized countries and highlights consequences for policy design.

Discussion of pros and cons

Start-up subsidies can help overcome multiple constraints

Providing start-up subsidies to unemployed workers is justified by the existence of constraints to unemployed workers starting a new enterprise [5]. Severe credit constraints are one problem. Unemployed workers have almost no access to formal loans because of default risks [6]. And they have lower personal and family financial means than people who start a “regular” business (starting from an employed position), which reduces the amount of personal equity for starting a business. Moreover, unemployed workers likely face disadvantages due to a depreciation of their start-up-specific human and social capital during unemployment, including lack of business experience. There are also stigma effects for unemployed workers, which may lead to discrimination. The lack of recent employment experience also weakens business and social networks, so unemployed workers have fewer contacts with potential customers, business partners, and knowledge spillovers from colleagues. In addition, imperfect information about self-employment options and failures in the labor market that can erode self-confidence make unemployed workers less likely to consider self-employment as an alternative to paid employment [7]. Finally, businesses started by unemployed workers are more likely to be “necessity start-ups” by people lacking employment alternatives. Such businesses are usually started at short notice, with little time invested in preparing business plans. Because unemployed workers have less access to information on business opportunities and have lower opportunity costs, they also have less valuable business ideas, introduce less innovation, and thus earn smaller profits.

Start-up subsidies aims to remove such barriers by providing financial assistance to cover living costs during the founding period. Because unemployed workers who want to start a business generally have fewer resources than regular entrepreneurs, they need to invest labor and capital during the founding period to elaborate underdeveloped business ideas, create networks, and acquire start-up-specific human capital. The subsidy is expected to compensate for these disadvantages and to provide insurance against the risk of low (or no) income during the start-up period.

Concerns: Low-ability entrepreneurs, deadweight effects, and moral hazard

Start-up subsidies can also have negative effects. The main concern is whether unemployed workers are qualified to start their own business [8]. The existence of the subsidy could encourage more low-ability individuals to start a business because the required returns from self-employment (needed to persuade someone to start a business) are lower than without the subsidy. This adverse selection is likely to be detrimental to the performance of subsidized businesses. Much of the entrepreneurship research considers start-ups from unemployment to be necessity start-ups that are doomed to fail or to generate only minimal income.

Second, the subsidy might induce moral hazard: individuals might reduce their effort while they are receiving the subsidy because subsidized businesses do not face the risk of low (or no) income during the subsidy period. However, as the subsidy is temporary, any moral hazard would be short-lived. In the longer term, the subsidy expires, so these business owners would also experience income loss or business failure if they reduce their effort.

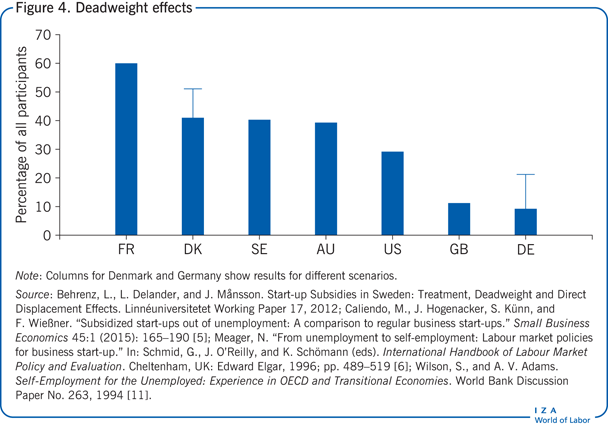

Third, deadweight losses could be a problem if subsidized individuals would have become self-employed even without the subsidy and if business success is uncorrelated with the subsidy [9]. The second possibility is not straightforward to analyze, so empirical evidence usually concentrates on the first dimension, which tends to overestimate deadweight effects.

A fourth concern is whether incumbent or non-subsidized firms may be displaced (crowded out) by subsidized start-ups. Subsidized start-ups could take advantage of the financial transfers they receive by offering their products at below-market prices. Both deadweight effects and crowding-out effects are hard to assess, but some countries try to prevent them through policy design measures.

Design of start-up subsidies

Subsidies differ in amount, duration, and eligibility criteria. They have been a major part of Germany’s active labor market policy for a decade [10]. During 2002–2011, some 120,000–250,000 participants received start-up subsidies per year—a substantial share of the 300,000–450,000 annual start-ups. The current program (Gründungszuschuss) provides financial support to unemployed workers (and those at risk of unemployment) to start their own business. Applicants must be eligible for unemployment insurance benefits for at least 150 days and present a business plan approved by a chamber of commerce or similar external institution. Since 2011, subsidies have been a discretionary entitlement requiring approval from the local labor office. For the first six months of self-employment, payments are the same as the unemployment benefits the individual would have received (which depend on previous labor earnings), with an additional payment of €300 to cover social security contributions. The average subsidy in this first phase is about €1,250 a month, or €7,500 for six months. The lump-sum payment of €300 can be extended for another nine months if self-employment is the main activity and the recipient can prove that the business is active.

In the UK, the duration of the start-up allowance is also six months, but the financial support is less generous, totaling about €1,450; however, the business founder can also apply for a loan of up to €1,150. Eligible applicants must be receiving some form of jobseeker support and have their business idea evaluated by a local mentoring organization. If the initial evaluation is positive, the applicant is assigned a mentor to help develop a business plan, which must be approved before support is awarded. In Finland, the average subsidy is about €590 a month for up to three six-month periods, with the extensions depending on whether recipients still need the subsidy to support their livelihood. Eligible applicants must be capable of managing a business, as evidenced by previous self-employment experience or participation in a training program. To avoid deadweight effects, the subsidy is paid only if the business would not have been established without it and if the subsidy will not distort competition. Unemployment is no longer a requirement. The French program is available to all unemployed workers who start or take over a business if the business does not generate sufficient revenue to secure a livelihood. If the revenue is above a certain level, participants can be exempted from paying social security contributions. Eligible applicants receive their full unemployment benefits for 15 months. In Sweden, the subsidy is available for registered unemployed workers (and those at risk of becoming unemployed) who are capable of starting and managing a new business that can secure their livelihood in the long term. The business may not distort competition and may not be in the agricultural or transport sector. The subsidy, paid for a maximum of six months, is based on eligible recipients’ unemployment benefits and declines from 80% of unemployment benefits in the first 200 days of unemployment, to 70% in days 201–300 and to 65% after more than 300 days. The subsidy averages €32–€82 a day and is taxable. In the US, self-employment assistance consists of unemployment benefit payments for at most six months and varies by state. Additionally, recipients participate in training in setting up a business. The program has a maximum number of participants. A profiling procedure assigns people to the program based on a low probability of being re-employed, which could lead to negative selection.

Empirical evidence

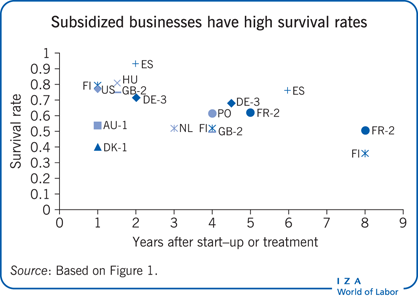

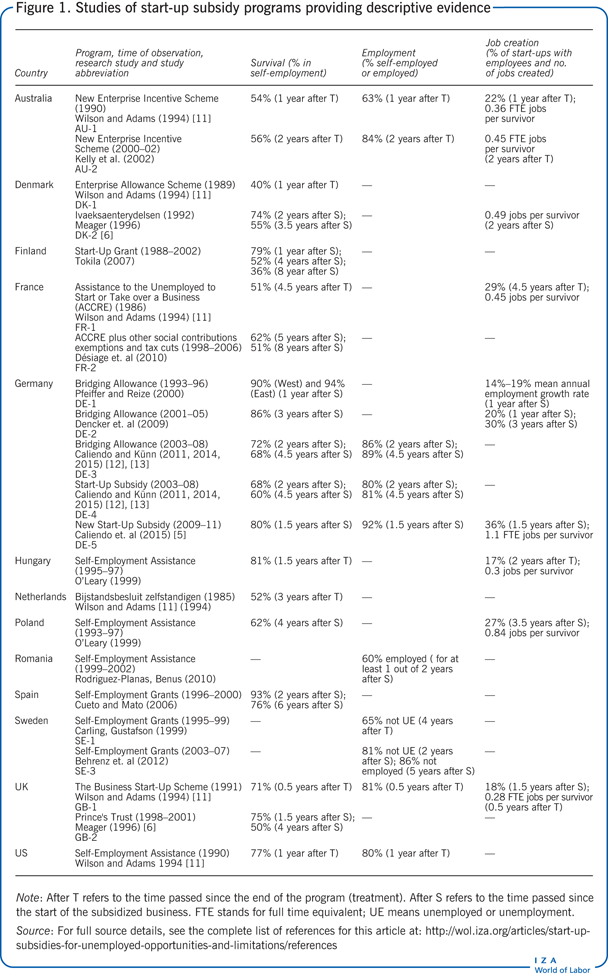

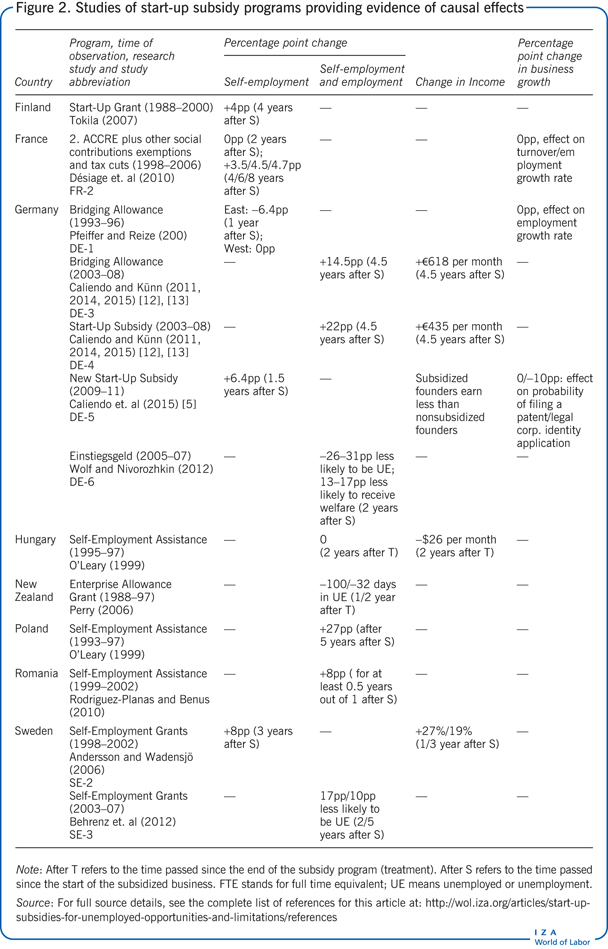

The success of start-up subsidies can be measured along several dimensions. The most common is the survival rate. Others include re-integration of unemployed workers into the labor market, income, the double dividend (contribution to growth and job creation), and deadweight effects (would the business have been started without the subsidy?). Most studies focus on only a few dimensions, and most are descriptive studies (Figure 1) rather than causal studies (Figure 2).

Survival rates and effects for disadvantaged groups

A key measure for assessing the success of start-ups is their survival rate at different stages. Survival rates vary from 40% in Denmark (one year after the subsidy has ended) to 93% in Spain (two years after start-up) [11]. While it is difficult to assess these numbers without a proper comparison group, for most countries survival rates appear to be remarkably high and comparable to (or even higher than) those for all businesses. In the short term (one to two years after start-up) they are in the 70–90% range in most countries. In the few cases where long-term effects (four years and more) can be observed, survival rates are 50% in the UK and 62% in Poland (after four years), 60–70% in Germany (depending on the sub-group, after 4.5 years), 76% in Spain (after six years), and 36% in Finland and 51% in France (after eight years). Thus, a preliminary conclusion is that the subsidized start-ups have high survival rates.

A study finds that start-up subsidies successfully integrate unemployed women into the labor market and that the impact on childbearing is less detrimental than for traditional active labor market programs [12]. Subsidized start-up programs seem to be particularly effective for disadvantaged groups, e.g. low-educated workers or young people [13]. Thus, start-up subsidies may augment traditional active programs by providing an alternative for disadvantaged subgroups and in regions with low labor market demand.

Business closure, job creation, and potential deadweight effects

A closed business does not necessarily mean that the start-up subsidies failed, at least when the goal is to re-integrate unemployed workers into the labor market. There is evidence for some countries that some unemployed workers who started a subsidized business returned to regular employment, and only a small fraction returned to unemployment. For example, in Australia, 56% of subsidized start-ups were still in operation two years after the end of the subsidy, while 84% of participants were in paid employment or self-employment, meaning that 28% of subsidy recipients found a paid job. A similar pattern can be observed in Germany and the UK, while for Sweden, a large share of participants did not move into registered unemployment [13]. Though mostly descriptive, the evidence does suggest that the programs integrate participants into the labor market at a high rate.

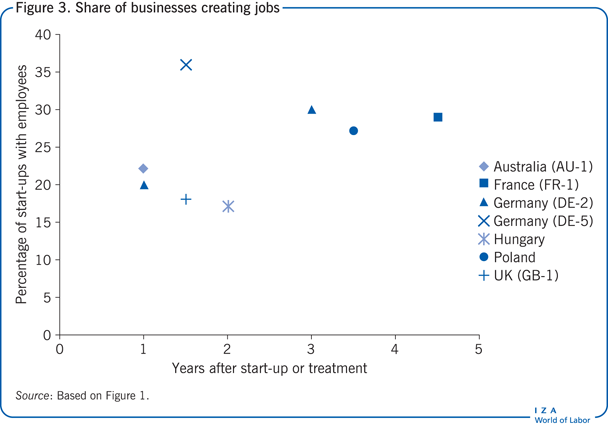

Besides creating a job for the new business founder, some 17–36% of subsidized businesses have hired at least one employee (see Figure 3). The variation in the average number of new jobs created is also large, ranging from an average of 1.1 full-time equivalent jobs per survivor in Germany to less than 0.5 in France [5], [11]. The average number of jobs created by those firms who hired at least one employee is between 1.6 and 3.1 full-time equivalents. While in Germany the direct employment effects are about the same for new businesses supported by the start-up subsidy and for regular new businesses, that is not the case in all countries. Thus, although there is some additional job creation from subsidized start-ups, this effect should not be overstated.

Finally, calculating the deadweight effects related to start-up subsidies requires counting any subsidy paid to recipients who would have started a new business even without the subsidy and determining that the subsidy had no impact on subsequent business success. Often studies contain information only on the first criterion; for example, the share of subsidy recipients who would have started a new business even in the absence of the subsidy was 40% in Sweden, 56% in Denmark, and 60% in France (see Figure 4) [11]. However, it is crucial to also consider the second criterion. One study that does consider the impact on business survival during the first six months finds that the share of subsidized firms that are potentially affected by deadweight effects drops from 49% to 21% and from 23% to 9% (for a narrower definition of people who registered as unemployed to get the subsidy). Overall, it seems that potential deadweight effects are probably smaller than feared.

Causal effects on employment, income and business growth, and potential displacement effects

Only a few causal studies (Figure 2) have compared the results for unemployed workers who received start-up subsidies with the results for a control group. And most of the studies compare unemployed workers who started a subsidized business with unemployed workers who did not—but not with people who started a business without subsidies. The effects on employment outcomes are usually strongly positive. For Germany, for example, unemployed workers who receive start-up subsidies have a 14.5–22 percentage point higher probability of being employed 4.5 years after start-up than unemployed workers who did not start a business. Findings for another program indicate that unemployed workers who receive start-up subsidies are 26–31 percentage points less likely to be unemployed or to receive welfare. The evidence is similar for other countries with causal studies. Germany and Sweden also show some modest positive effects on income. But when unemployed workers who receive start-up subsidies are compared with workers who start a regular business, the evidence is mixed. An earlier German study shows some negative effects on survival, but a later German study, and studies for Sweden and France, show positive survival effects.

While start-up subsides help participants escape unemployment and improve their labor market prospects compared with other unemployed workers, much less in known about start-up subsidies from a business perspective. A study comparing subsidized start-ups by unemployed workers with regular start-ups after 19 months finds higher survival rates for the subsidized businesses but lower income, slower growth, and less innovation [5]. A study for France finds no significant effect on turnover or employment growth rates.

Furthermore, it is possible that recipients of start-up programs displace other businesses. While hard empirical evidence is lacking, displacement effects cannot be ruled out. However, since most programs guarantee subsidies for only a short time period and provide only small amounts (to secure the livelihood in the initial starting phase), overall distortion effects seem manageable.

Limitations and gaps

In contrast to the case for many other active labor market programs, the empirical evidence is still scarce for the effectiveness of start-up subsidies. More causal evaluation studies are needed, especially comparing start-ups by unemployed workers with regular start-ups (to assess the business component of the programs). Better data are also required to assess effects across subgroups and under different economic conditions as well as to analyze long-term effects. Policy-oriented research should examine the optimal design of start-up subsidies (amount of money, duration, entry requirements, and so on). Deadweight and displacement effects are hard to assess but clearly important determinants for policy decisions.

Summary and policy advice

Start-up subsidies are an effective active labor market policy that can help participants move out of unemployment and to improve their labor market prospects compared with other unemployed workers. However, subsidies also induce (some) negative biases, resulting in weaker business performance because they spur less business growth and innovation than other start-ups. Whether the weaker business performance is cause for concern depends on the objective. If the main aim is to reintegrate unemployed workers back into the labor market, then the weaker performance is less important. From that perspective, unemployed workers who start a subsidized business should be compared with unemployed workers who do not rather than with other business start-ups. In that case, the causal evidence indicates that the overall performance is better for unemployed workers who start a business. In contrast, if the primary goal is to establish strong new businesses with good growth and job-creation potential, policymakers should be concerned if subsidized businesses are proven to persistently lag behind.

Policy is also constrained by the fact that the potential for unemployed workers to establish successful start-ups is limited. So, program expansion is difficult. To succeed, the program must be voluntary. Requiring unemployed workers with weaker job prospects in paid employment to start their own business is not a sensible strategy. Research identifies several program elements that contribute to success: The time horizon of the subsidy should be neither too short, in order to allow time to overcome initial problems, nor too long, to avoid moral hazard. To help participants survive the initial stage of self-employment, when the business might not yield an adequate income, the financial component should cover basic living costs and social security contributions.

Not everyone is cut out to be an entrepreneur. Initial screening, including preparing a credible business plan that is approved by an objective third party, has to be sufficiently stringent to prevent windfall gains and to ensure selection only of people who are truly interested in starting a business. Participants need to commit to the program. One way to ensure this is to require that participants give up ordinary unemployment benefits. Training unemployed individuals with no initial interest in becoming an entrepreneur (as in the US) does not seem promising. Finally, business growth should also be an objective, since a business that is too small and underperforms will have fewer returns for the business owner and for the economy. To spur growth and to support ambitious entrepreneurs who want to create a larger business, subsidies may be accompanied by support services, such as coaching and mentoring.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author is indebted to co-authors on previous joint research projects on the topic, especially Alexander Kritikos and Steffen Künn, and also Stefan Tübbicke for his research assistance. Previous work of the author contains a large number of background references for the material presented here and has been used intensively in all major parts of this article [5], [9], [13].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Marco Caliendo