Elevator pitch

Economic theory has many predictions regarding how workers should be paid and how workplaces should be organized. However, economists’ attempts to test these in the real world have been hampered by a lack of consistent information about workers’ productivity levels. Professional sports offer a potential solution, since the performance of individual sportspeople is easily observed and yet many of the same problems faced by managers in workplaces still apply. In many ways, sportspeople may be less atypical of the modern workforce than farm laborers, doctors, or other groups of workers that are often scrutinized by economists.

Key findings

Pros

Unlike most other skilled workers, it is possible to easily measure the productivity of many sportspeople.

Since the rules of sports are known, the production function of the sports team—the “firm”—is clear.

It is clear what information players have—and what incentives they face—when choosing how much effort to put in to their tasks.

In team sports, it is clear which players play together at any point in time and how they interact.

Cons

Professional sportspeople may not be representative of workers in the wider labor market.

Sportspeople and referees are scrutinized more than normal employees, which might change the way they behave.

The organization of labor markets in some professional sports is idiosyncratic and differs from the labor markets for other occupations.

Extreme levels of pay inequality exist in many professional sports compared to other occupations, due to the presence of superstars.

Author's main message

Decision makers in governments and firms may learn from the findings economists have uncovered using data on sportspeople's decisions. Professional sportspeople are arguably unique in that they are highly skilled and sometimes highly paid but also have easily measured productivity. As a consequence, it is possible to find answers to many important questions that are currently impossible to answer using data from conventional workplaces, such as how productivity is rewarded over the life cycle and the extent to which discrimination can reduce productivity.

Motivation

Sports data allow researchers to measure factors that are typically unobserved, from a worker's productivity and contract details to a firm's production function. Furthermore, phenomena that have long been features of sports labor markets—extreme earnings inequality across workers doing the same job, performance-related pay, monitoring of effort—often emerge in the wider labor market decades later, so that an analysis of sports data today affords a glimpse of the future labor market. The advent of wearable technology means that many workers may soon find that their productivity is as easily observed as today's baseball players and footballers. And while the “gig economy” is seen as a recent phenomenon, it encapsulates the way thousands of journeyman tennis players and boxers have always sought to make a living. Moreover, although sports are unrepresentative of the labor market as a whole, sportspeople are still motivated by the same factors all workers are and are subject to the same behavioral biases and constraints, such as prejudice and a temptation to cheat.

Discussion of pros and cons

How does productivity affect pay?

The relationship between a worker's pay and productivity level depends on the nature of competition in the labor market. In a perfectly competitive labor market, economic theory predicts that the equilibrium wage should equal the workers’ marginal revenue product, that is, the value of what is produced by the last worker hired during a given time period. However, when there is a single buyer of labor in a market—or a “monopsony”—the wage that workers receive will be less than their marginal revenue product.

Economists have examined whether these predictions are borne out by studying the labor market in Major League Baseball. Among sports, baseball has proven an ideal setting for comparing pay and productivity for two reasons. First, it is easy to measure an individual baseball player's contribution to team output—and hence the player's marginal revenue product—since each hitter and pitcher performs his or her tasks essentially in isolation. Second, there have been major changes in the organization of the labor market in US Major League Baseball over time, which allows researchers to test the importance of bargaining power on the pay-productivity relationship.

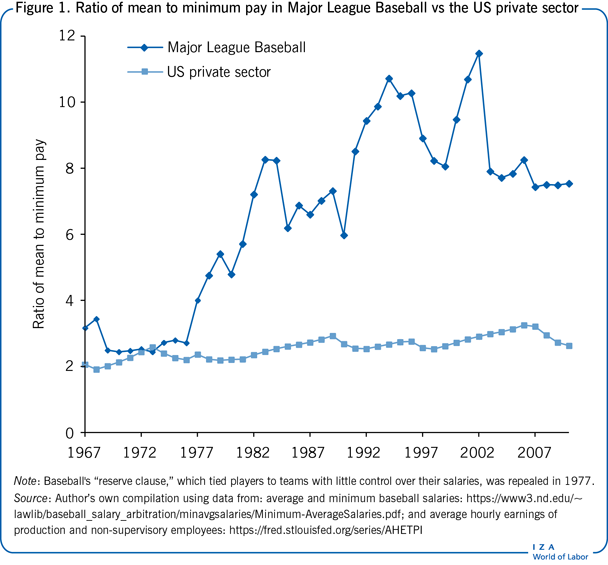

For almost a century, until the 1970s, baseball teams were essentially monopsonists. Players were signed to one-year contracts and every player had a clause in his contract stating that he could not sign with another team. This so-called reserve clause meant that teams could make take-it-or-leave-it pay offers to their players. However, after a series of industrial disputes and legal challenges, the reserve clause system was dismantled progressively between 1973 and 1977. Since 1977, players have been bound to their original teams for their first six years in the major leagues, as under the reserve clause. However, after they have accumulated six years of service, players may now become “free agents,” allowing them to sign with any team. In addition, players who have accrued more than three years of major league service are eligible for salary arbitration. Under this, when a player and team cannot agree on a contract, either party may take the dispute to an independent arbitrator, who chooses between the offers made by the player and team and whose decision is binding. The introduction of salary arbitration and free agency has led to an enormous rise in major league salaries—the average salary grew more than tenfold between 1977 and 2010.

Because both individual and team success can be observed in baseball, researchers have estimated players’ marginal revenue products in two stages. First, they calculate how much each player contributes to a team's win rate, then they calculate how much a team's win rate affects its revenue. A study of major league salaries in 1968–1969 found that players were only paid about a third of their marginal revenue product [1]. However, among the first group of free agents in 1977, salaries were substantially closer to marginal revenue product, especially for pitchers.

As Figure 1 indicates, the repeal of the reserve clause in 1977 also sharply increased pay inequality between players. There is a minimum salary that teams are allowed to pay under the terms of their agreement with the players’ association. This is regularly paid to players who have not attained eligibility for salary arbitration. Until 1976, the ratio of mean to minimum salary was roughly similar to the ratio of the mean US private sector hourly pay to the federal minimum wage. However, although baseball's minimum salary has been raised regularly in recent decades, it has not kept pace with the average salary. In comparison, the ratio of average US private sector hourly pay to the federal minimum wage has grown much more slowly over the past five decades.

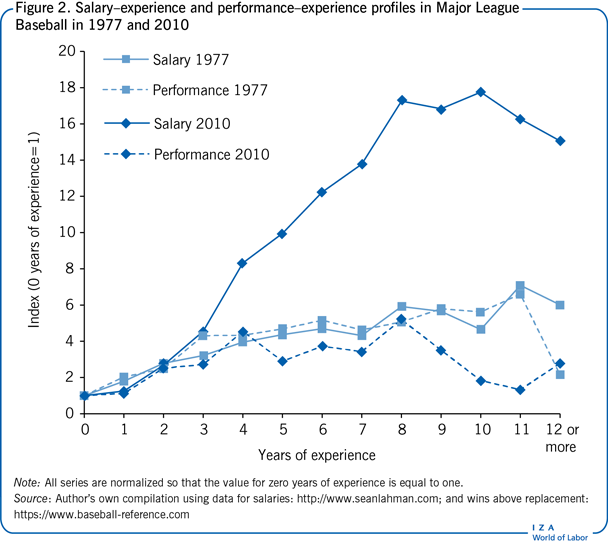

Although the persistence of an element of monopsonistic power makes baseball unusual within the US labor market, the hybrid system gives researchers an opportunity to test how bargaining power affects earnings. For instance, evidence suggests that players receive pay gains over their careers that are independent of productivity gains [2]. Figure 2 shows how average pay varies with years of experience in the major leagues and compares this with “wins above replacement”—a statistic that captures a player's value to his team. Although the observed increases in pay are exaggerated because only the best players are retained each year, this permits a comparison of pay and productivity among players at each stage of their career. Before the reserve clause was repealed, pay and productivity matched each other closely, but by 2010 pay rose much faster with experience than productivity. This is not consistent with a market in which players are paid “spot wages” equal to their marginal revenue product in each period. Rather, it is reminiscent of implicit contract models, wherein older players are relatively overpaid in order to motivate players to put in effort earlier in their careers. The timing of salary increases coincides with increases in a player's bargaining power. Players receive significantly higher salaries once they become eligible for salary arbitration (after three years), with no change in their performance statistics. Furthermore, they are given significantly longer contracts once they become eligible for free agency (after six years). In comparison to the relationship between pay and experience seen in Figure 2, the average worker in the US labor market receives a much smaller increase in pay with each year spent in the workforce.

Overall, the evidence from over half a century of research on the baseball labor market indicates that when workers have a high degree of bargaining power, firms prefer to offer their best employees longer contracts and to structure these so that pay increases faster over time than does productivity.

How does pay affect productivity?

The pay structure within a firm can influence a worker's productivity by altering incentives to put in effort. “Tournaments” are often used to determine promotions to senior positions in large organizations. These may be overt, such as the US federal government's “competitive service,” or the consequence of relatively few promotion possibilities, such as the election of partners at large law firms. The principle is that if the gap in rewards for finishing first versus second in a tournament is particularly large, all competitors will have an incentive to work as hard as possible. Here too, sports allow the analyst to examine what effect pay structure has on performance by examining the outcomes of the (actual) tournaments that are common in many individual sports.

Golf is an ideal sport in which to examine effort effects because it does not involve direct competition between pairs of players, as in tennis or most other individual sports, where the outcome of a match is determined by the relative performance of the two competitors. Instead, each golfer's score reflects his/her performance alone. Most golf tournaments distribute prize money in more or less the same way, with a similar fraction of the total “pot” going to the winner, runner-up, and so on. However, the total size of the pot varies markedly across tournaments. This suggests that a larger pot should elicit more effort, but that this should be particularly pronounced among those who are near the top of the leaderboard. A study of tournament scores in the Professional Golf Association (PGA) Tour in 1984 found exactly this pattern, with a US$100,000 increase in a tournament's pot leading to an average improvement of 1.1 strokes in a player's score [3]. This effect is concentrated in the last round of a tournament and depends on how much is at stake for a given player, given his performance earlier in the tournament. Similar evidence has been found for tennis, where top players do better at the most lucrative tournaments and on points within a match when there is most at stake. Conversely, there is some evidence from football that players “choke” under pressure and perform worse when the stakes are highest.

Does productivity depend on who a person works with?

Economists have also used performance data from professional sports to examine whether a person's productivity is influenced by the quality of that person's co-workers. Such spillovers could exist because teammates learn valuable skills from each other, are pressured or encouraged to work harder when they work alongside high-productivity peers, or face a financial incentive to put in more effort when their teammates are performing well.

In PGA Tour golf tournaments, players are randomly assigned a playing partner, unlike in most workplace settings that economists have studied. Since playing partners can observe each other during a tournament, they have the opportunity to learn from or be motivated by one another. However, evidence suggests that the quality of a given player's partner makes no difference to their overall score. However, the presence of a superstar—namely Tiger Woods—has been shown to reduce other players’ performances during tournaments.

Of course, golf is an individual sport, meaning that spillovers cannot be driven by the nature of the production function. Other studies have focused on baseball and basketball, where players must interact successfully in order for their teams to succeed. These allow a test of whether spillovers are generated by income maximization on the part of individuals, rather than behavioral factors. Theory implies that the direction of such spillovers depends on whether individuals are complements or substitutes in the production function. If individuals are complements, positive spillovers may arise, because individuals face a greater pay-off to their performance when their teammates are successful. However, if individuals are substitutes, negative spillovers will predominate, because individuals have an incentive to free ride when they have more able colleagues.

Baseball players are divided into hitters, whose job is to score runs, and pitchers, whose job is to prevent runs being scored. Within a game, pitchers and hitters can be viewed as substitutes for one another, because a team can win the game either by scoring a lot of runs or preventing the opposing team from scoring a lot of runs. However, hitters are complements for other hitters and pitchers are complements for other pitchers, because they must work together to score or prevent runs, respectively. Results suggest that hitters perform better in seasons when they play alongside better hitters but worse pitchers, while pitchers perform better when they play alongside better pitchers, but are unaffected by their hitting counterparts. In reality, hitters can be both substitutes and complements for one another to different degrees, depending on the order in which they bat and the nature of a particular game. Data on individual hitting events within baseball games indicate that hitters are more likely to succeed in their task of getting on base if doing so will raise their team's chances of successfully making the end-of-season play-offs by a lot, but are less likely to get on base if the team already has a high probability of making the play-offs [4]. One hitter can influence his teammates through either of these channels, but they offset each other on average, so that the overall size of the spillover is very small.

In general, the productivity of individual players is more difficult to measure in sports like basketball and football, where players interact in an unstructured way. However, data on every occasion a player handles the ball during basketball games in the National Basketball Association (NBA) indicate that spillovers are an important component of team production [5]. Despite this, players tend to be paid salaries that are determined mostly by their own productivity levels, without accounting for the influence they have on other players’ performance levels.

Regardless of why they arise, the existence of spillovers between teammates has implications for managers when choosing teams. If top players teach, motivate, or pressure more modest players, spending a large portion of a fixed wage budget on one star player might pay off with the best results for the team. However, the reverse could also be true, if playing alongside weak teammates demotivates star players. Overall, there is evidence of an “optimal” level of inequality in ability within a team. Analyzing the performance of Major League Baseball teams over eight decades, evidence suggests that teams win the most games when the standard deviation in performance across hitters (as measured by on-base plus slugging) is 6.2% of the mean of hitters’ performances [6]. Most teams were found to have levels of dispersion that were higher than this optimum, suggesting that they could benefit from selecting a slightly more homogenous set of teammates.

What makes a successful manager?

People may not just be influenced by their peers, but also by their bosses. What makes a good manager is usually considered a highly subjective matter. However, sports data have allowed economists to analyze systematically the determinants of managerial success. In baseball, managers with more experience and higher past winning percentages win more games, holding constant the quality of the players on the team. Furthermore, players tend to outperform their previous levels when they have a higher quality manager.

It is also possible to use professional sports to examine whether high-ability workers make good managers. In many organizations, managers are promoted from within, based on how well they have performed on the “factory floor.” Using NBA data, a study finds a correlation between a person's ability as a player and his success as a manager later in life [7]. These effects seem to be quite large; for example, having a manager with five years of playing experience (rather than no experience) moves a team six places up the league table.

What is the extent of discrimination between workers?

Gary Becker's seminal work on the economics of discrimination suggests that discrimination on the part of firms should be eliminated over time, as the entry of less-prejudiced employers drives prejudiced employers out of the market. Sports data provide an ideal setting in which to study the extent of discrimination in the labor market, since researchers can test whether equally productive players of different races are less likely to be hired or, if hired, receive different salaries. They can also look at the more subtle question of whether discrimination on the part of those who enforce the rules may make players from certain ethnic groups less productive than they would otherwise be.

In 1945, Jackie Robinson signed with the Brooklyn Dodgers, breaking Major League Baseball's “color line.” However, the process of desegregation was gradual—the final team to sign a black player was the Boston Red Sox in 1959. Black players were considerably cheaper than white players: in 1947, black players able to transfer directly to the major leagues from the Negro leagues were mostly paid between $1,000 and $5,000, whereas the total cost of developing a white player was probably in excess of $100,000. Furthermore, the black players who were hired had higher average performance levels than white players. Each additional black player who was hired was estimated to have resulted in a team winning two extra games (out of 154) per year. Given the clear competitive advantages of signing black players, the fact that it took 14 years to fully desegregate the major leagues casts doubt on Becker's theory of employer discrimination. This conclusion is reinforced by evidence that it was the teams who were already successful who integrated their playing rosters first [8]. The fact that clubs had monopsonistic power may explain why they were able to continue their discriminatory practices for so long.

The curtailment of baseball teams’ monopsonistic powers in the 1970s appeared to reduce the extent of salary discrimination. In 1969, non-white players earned significantly less than white players with comparable past performance and experience [1]. However, by 1978–1980, there was no significant difference in salaries between whites and non-whites of equal ability, while salary differences remained among those who were not eligible for free agency. In contrast to the evidence regarding desegregation, these findings are consistent with Becker's theoretical predictions and suggest that competition in the labor market can aid disadvantaged groups.

Indirect evidence has also been found that discrimination exists in English league football, since clubs with an above-average proportion of black players systematically outperform clubs with a below-average proportion of black players, after controlling for their total wage bills [9].

Discrimination can also manifest itself in the form of unequal treatment of members of a given race within the workplace. The rules of different sports have allowed economists to consistently test whether this is the case. In the NBA, referees are responsible for calling fouls on players who break the rules of the sport. Despite being watched by millions of fans, referees appear to treat players unequally, depending on the player's race. A study of all fouls called in games between 1991 and 2004 found that black referees were significantly more likely to call fouls against white players and white referees were significantly more likely to call fouls against black players [10]. After these findings received significant media attention, a follow-up study found that the prevalence of such behavior had reduced. Similar patterns have also been uncovered in baseball, where an umpire exercises a degree of subjectivity in calling a “strike,” which is a favorable outcome for a pitcher. Fewer strikes are called when the umpire and pitcher are of a different race or ethnicity [11]. The baseball data also suggest that players anticipate such discrimination by throwing pitches that are more clearly strikes and allow umpires less subjective judgment. Since such strikes are relatively easy for hitters to hit, this compounds the reduction in productivity that minority pitchers face in the presence of an overwhelmingly (almost 90%) white group of umpires.

What causes unethical behavior in the workplace?

Sports data have also been a testbed for examining what causes unfair or corrupt practices among employees. The economic model of crime developed by Gary Becker and others posits that individuals are more likely to engage in illegal activities when the gains from doing so are large, the probability of being caught is low, and the punishment if caught is low. However, this assumes a level of rationality that could be unrealistic in many cases. The testing of Becker's model has been hampered by the difficulty of calculating the expected costs and benefits from a criminal act. Once again, sports offer measurement advantages: compared to almost all other settings, it is possible to more accurately measure what a specific person stands to gain from an “illegal” act, what he/she knows at the time, and what the probability of detection is.

College basketball in the US provides a useful setting for examining whether the incidence of fouls committed during a game changes in response to the probability of this behavior being detected. In 1978, the number of officials in the Atlantic Coast Conference was increased from two to three per game. This resulted in a 34% reduction in the number of fouls per game.

Using information on the results of sumo wrestling tournaments, a study has examined whether corruption is more likely to occur when the benefits from being corrupt are highest [12]. Sumo wrestlers receive the largest boost to their ranking once they win their eighth match at a tournament. They are found to win an eighth match more often than would be expected. Of course, this might be because they put more effort in, given the high stakes. But the following time the two wrestlers meet, the opponent has an unexpectedly high probability of winning, suggestive of collusion. Match rigging is also lower when media attention is heavier. Finally, those wrestlers claimed not to be corrupt by two whistle-blowers did no better in their eighth game than would be expected. Evidence consistent with match fixing has also been found in college basketball, where the benefits may be derived from gambling, among soccer teams in danger of relegation in countries with high levels of corruption, and in professional tennis.

The use of performance-enhancing drugs in professional baseball has also made it a useful setting to examine whether information about unethical activities is learned from one's co-workers. One study attempted to examine whether Jose Canseco, a star baseball player who subsequently confessed to using steroids, affected the performance of his teammates by introducing them to steroids [13]. Players’ performances were found to increase significantly in the seasons after they played with Canseco. The “Canseco effect” disappeared after 2003, the year that drug testing was implemented, suggesting that deterrence also influences behavior among baseball players.

Limitations and gaps

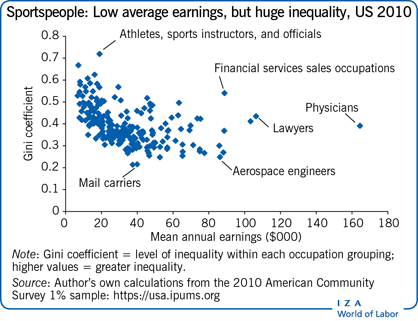

Professional sportspeople are clearly different from other workers in the labor market, in terms of competitiveness, dedication, and natural ability. Most of the sportspeople that have been studied by economists also earn substantially more than average workers. This may limit the extent to which the findings discussed in this article apply to other workplaces. In fact, average earnings among professional sports as a whole are relatively low, at least in the US, as shown in the Illustration. Most sportspeople earn relatively little, such as tennis players on the Challenger Tour and Minor League Baseball players. For many of these people, the sports labor market resembles the so-called “gig economy,” in which the amount of income available—and the chances of making ends meet—can vary from week to week. In addition to these semi-professionals, there are millions of amateur sportspeople around the world, running marathons or cycling. Productivity data are available in all these cases and deserve more attention from economists.

While average earnings among athletes are unexceptional, professional sports does exhibit the highest inequality of any occupation. However, there are many occupations with levels of inequality that are almost as high and inequality has been growing in the majority of occupations over recent decades. Economists need to understand better the implications of having a few superstars on the behavior of the many who earn far less.

Summary and policy advice

Sports allow researchers to examine relationships that are impossible to test in more conventional workplaces, mainly because the productivity of individual sportspeople is easily observable. Professional sport stands out from other occupations in that it has very high pay inequality; however, in many other ways sportspeople are no different from other workers, and evidence from sports data has a lot to teach managers in the wider labor market.

Studies on sportspeople have found that older workers tend to be paid more than their value to their employer; people work harder when the rewards from doing so are high; workers may either perform better or worse when they have good colleagues, depending on the nature of the production function; experts make good managers; non-whites are less likely to be hired, earn less, and are treated unequally in the workplace; and workers cheat when the benefits from doing so are high and the penalties are low. Carefully designed pay and promotion systems that accommodate these insights, for example offering performance bonuses for workers who are required to interact extensively, may therefore boost productivity and provide a fairer workplace for all employees.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work by the author contains more background references for the material presented here and has been used throughout this article [4], [6].

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Kerry L. Papps