Elevator pitch

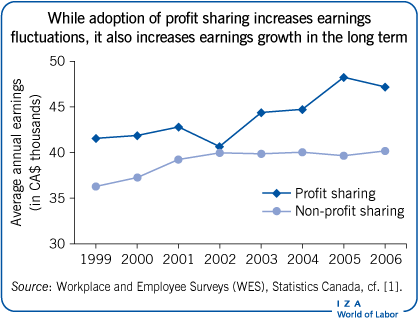

Profit sharing can lead to higher productivity and thus to higher firm profitability and employee wages. It may also enhance employment stability by enabling firms to adjust wages during downturns rather than lay off workers. While adoption of profit sharing increases earnings fluctuations, it also increases earnings growth in the longer term. As with any group incentive plan, profit sharing may result in some workers benefiting from the effort of others without themselves exerting greater effort (“free-rider problem”). However, there is evidence that in team-based production workplaces, profit sharing may reduce shirking and thus contribute to productivity growth.

Key findings

Pros

Profit sharing can lead to higher productivity and thus to higher firm profitability and employee wages.

By reducing shirking behavior, profit sharing may reduce supervision costs.

Profit sharing can lessen compensation risks for employers by allowing greater flexibility in wages.

Profit sharing may enhance employment stability by enabling firms to adjust wages during downturns rather than lay off workers.

The use of team-based production is important to the positive productivity growth effect of employee profit sharing.

Cons

As with any group incentive plan, profit sharing may result in some workers gaining from the effort of others with no greater effort on their part (“free rider problem”).

Workers cannot see strong links between their effort and their organization’s performance (profits).

Profit sharing may increase compensation risks for employees by making earnings more variable.

Profit sharing may incur high administrative costs.

There is a negative link between unionization and profit sharing as most unions oppose such organizational incentive programs.

Author's main message

There has been considerable debate in recent years about whether employees benefit financially from workplace practices such as employee profit sharing. Empirical studies show that profit sharing can deliver significant benefits to employees, through higher earnings and employment stability, and to employers, through higher workplace productivity, which again supports higher employee earnings. Labor unions may want to work collaboratively with management to enhance the mutual benefits of profit sharing. Governments may facilitate the adoption of the profit-sharing plans by offering incentives such as deferred tax benefits.

Motivation

There is no clear consensus on whether employees benefit financially from profit sharing, a formal employee bonus program based on firm profitability. While proponents argue that profit sharing increases employee earnings, others contend that the effect on employee earnings is neutral, and still others argue that profit sharing can even reduce employee earnings. Evidence is also mixed on whether profit sharing improves productivity. While the evidence is clear that it does so on average, it does not do so in all cases. One variable that has been much discussed but seldom tested is how team-based production in a firm affects the impacts of profit sharing.

This paper provides an overview of the impacts of profit-sharing plans on such worker outcomes as employee earnings and earnings growth, workplace productivity, employment, and employment stability. Such impacts may vary by national and organizational contexts and according to the motivations for adopting such compensation plans (wage substitution, work incentives, and human capital attraction and retention).

Discussion of pros and cons

Motives for profit sharing

Paying a profit-sharing bonus will increase net employee earnings only if employers refrain from reducing other pay components by more than the amount of the profit-sharing bonus. Whether employers reduce other pay components likely depends on their motives for adopting profit sharing. Theory suggests three main sets of motives, all aimed at enhancing firm performance but operating through different processes.

The first set of motives is based on substitution: firms use profit sharing to substitute for fixed pay components (wages and benefits) to better align the firm’s labor costs with fluctuations in its ability to pay [2]. When the firm’s financial capacity is high—in times of high profitability—employees receive higher earnings, but when financial capacity declines, so do employee earnings, which reduces labor costs. When there is no variable pay component (such as employee profit sharing), the main alternative for reducing labor costs is to lay off employees, which results in a variety of adjustment costs and risks the loss of valuable human capital. Making labor costs more variable also reduces the firm’s vulnerability to fluctuations in demand for its products or services and the attendant risks to firm survival.

The second set of motives centers on using profit sharing to increase total employee earnings, with the objective of attracting and retaining high quality human capital. In this case, employers may regard profit sharing as a less risky way to move to efficiency wages (above-market wages) than by increasing fixed wages and benefits. Efficiency wages may not only attract and retain higher quality labor but might also enhance worker effort since workers may be more motivated to keep a job that pays above-market wages. This human capital argument fits into the broader, high-road approach to employee relations in which firms pay high wages and benefits, invest heavily in worker training and development, create broad and meaningful jobs, and allow a high degree of worker participation in decision making. The opposite approach is termed a low-road strategy.

The third set of motives relates to using profit sharing as an incentive to boost productivity by enhancing employee motivation and cooperation [3]. The idea is to increase firm performance by creating a work environment that motivates employees to work more diligently and effectively toward organizational goals. Profit sharing is viewed as providing both the incentive and the reward for employees who work harder or smarter [4]. Increasing employee earnings is not the direct motive for adopting profit sharing, although that should be an outcome if the profit-sharing plan succeeds in motivating more productive worker behaviors.

These three sets of motives are not mutually exclusive. For example, an employer might intend for profit sharing to substitute for fixed wages while also hoping that it will motivate more productive employee behavior as employees take on more of the risk of poor firm performance [5]. Even the wage substitution and human capital motives are not totally incompatible, as it may be possible for employers to reduce fixed wages while increasing total employee earnings, depending on how large the cuts in fixed wages are relative to the size of the profit-sharing bonuses.

Profit sharing and employee earnings

While proponents of employee profit sharing argue that it increases employee earnings [6], others contend that the effect of profit sharing on employee earnings will be neutral [7], and still others argue that profit sharing can reduce earnings [8]. Knowing which outcome generally prevails is important to scholars in unraveling the effects of profit sharing, to managers and employees in deciding whether to embrace profit sharing, and to public policymakers in assessing whether public support for profit sharing is warranted.

Why should employee profit sharing affect employee earnings? The answer seems obvious. If employees start receiving profit sharing payments in addition to their regular compensation, then their total earnings should increase. But this outcome is contingent on two key circumstances. First, total employee earnings will increase only when the employer is profitable subsequent to the adoption of profit sharing and actually pays a profit-sharing bonus to its employees. Second, total earnings will increase only when the bonus exceeds any reductions made to other pay components subsequent to the adoption of profit sharing.

Provided that the employer is profitable subsequent to adoption of profit sharing, profit sharing could increase employee earnings—even absent any profitability-enhancing effect of profit sharing—through a redistribution of profit from capital to labor. Therefore, whether total earnings rise is by and large an empirical question.

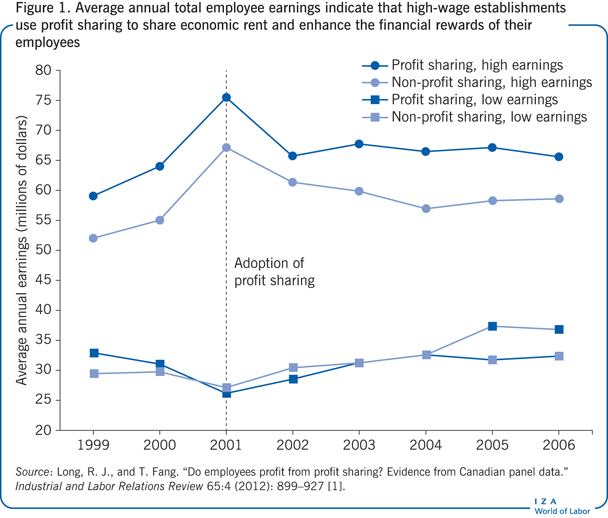

A study on whether adoption of profit sharing affects employee earnings growth used panel data from the nationally representative firm–worker linked Workplace and Employee Surveys conducted by Statistics Canada from 1999 (the first year of the survey) to 2006 (the last year of the survey) [1]. The adoption variable of all firms that were non-adopters in 1999 was measured in 2001. The study monitored the earnings growth effects for three years (2001–2004) and five years (2001–2006) after the adoption of profit sharing. The results are consistent with the notion that high-wage establishments with a high investment in human capital will use profit sharing as a means to share economic rent and thus enhance the financial rewards of their employees (Figure 1). This observation aligns with the human capital motive for adopting profit sharing. Attracting and retaining high-quality workers may translate into productivity improvements over time that, in turn, make it more feasible for firms to offer above-market compensation in the form of profit-sharing bonuses. This outcome may play into a high-road employment relations strategy (that is, one that utilizes higher pay and benefits, better working conditions, and more opportunities for employee participation in decision making to elicit greater effort and productivity enhancement, as opposed to a low-road strategy involving cost cutting and tight control and supervision) that some of these firms may practice [9].

An interesting finding is the eventual uptick in employee earnings in low-wage establishments (Figure 1). In these establishments, the human capital motive does not seem to apply; rather, these firms appear to use profit sharing to substitute for fixed wages, and many of the firms may be applying a low-road employee relations strategy. Even with profit sharing, low-wage adopters of profit sharing showed lower total employee earnings one year after adoption (2002) than did low-wage non-adopters and virtually identical earnings to non-adopters in 2003 and 2004. For employees in low-wage establishments, all that profit sharing apparently accomplished, at least in the first three years, was to put a higher proportion of their pay (the profit sharing portion) at risk with no offsetting financial gain. This may have made it more difficult to retain employees. It may be that as economic conditions improved mid-decade, low-wage adopters of profit sharing eventually found that they needed to be more competitive with the fixed component of their pay to attract and retain workers, thus accounting for the 2005–2006 uptick in employee earnings in these firms. An alternative explanation is that the benefits of pay flexibility provided by profit-sharing plans are greater in low-wage establishments, which have fewer resources available. Such benefits can eventually be translated into financial gains to workers.

Profit sharing and workplace productivity: The role of team work

Among the numerous motives for adopting profit sharing, an important one is the belief that profit sharing increases company productivity. However, while the evidence is clear that employee profit sharing boosts company productivity on average, the evidence is equally clear that it does not do so in all cases. A variable that has frequently been proposed to explain this difference is team-based production.

Profit sharing is thought to affect firm productivity in three main ways: by making wages more flexible in response to the financial conditions of the firm by substituting profit sharing payments for fixed wages; by attracting, developing, and retaining higher quality employees; and by serving as an incentive mechanism for aligning the interests of workers with those of the firm. Such alignment may prompt beneficial worker behaviors such as increased motivation and effort, enhanced cooperation with management, increased monitoring of workers’ own and others’ behavior, positive workgroup norms, and development of more efficient work methods [2]—in other words, profit sharing may cause workers to work harder and smarter.

The free-rider problem

However, while profit sharing may help align the interests of workers with those of shareholders, its effectiveness in motivating workers may be limited by the free-rider problem. All else being equal, the proportion of any profit increase produced by a given worker’s extra effort that the worker will receive—and therefore his or her incentive to provide extra effort—decreases with the number of workers participating in the profit-sharing scheme. Thus, the financial benefit that an individual worker will receive from increased effort is small in a collective reward system such as profit sharing, but the worker will still benefit from the efforts of other workers. Such collective reward systems are often thought to encourage shirking by workers. Obviously, if all workers under profit sharing react this way, profit sharing will not result in any increase in worker effort.

A recent analysis of shirking, using two major US databases, found that shirking is not confined to workplaces that have adopted “shared capitalism” (profit sharing, employee stock plans, and the like) but is also common in other workplaces [6]. The study posits that, contrary to the free-rider argument, workers in such arrangements may engage in “mutual monitoring” and may intervene with workers who are perceived to be putting forth insufficient effort. Where workers have no financial interest in the outcome, the costs of intervening with the shirker will almost inevitably outweigh any individual benefit to the intervener. The empirical results indicate that workers are most likely to intervene with shirkers in companies that have some form of employee profit sharing and where employees participate in decisions or work in teams [6].

Profit sharing, productivity growth, and team-based production

Working in a team setting may encourage anti-shirking behavior in a variety of ways. First, shirking is more apparent in a team context, compared to a context where employees perform their work in isolation. Second, in an interdependent context, shirking has the potential to impede the productivity of other workers, or to make their jobs harder, thus multiplying (in the eyes of workers) the detrimental effects of shirking. Third, these factors may cause teams to develop group norms that discourage shirking. Fourth, workers in a team context have an incentive to support an intervention by one of their members to deter shirking behavior, and potential interveners are far more likely to take anti-shirking action if they feel supported by the work group in so doing.

Thus, the extent to which a free-riding problem occurs with profit sharing will depend at least partly on the presence of team production in the workplace. Team production internalizes the costs of shirking for workers (at least to some extent), and therefore workers would be more prone to punish free riding. Consistent with this theory is the strong evidence of complementarity between group- and organization-based performance pay and work teams in their effect on worker productivity in a Finnish food-processing plant [10]. Also consistent with the argument that the free-rider problem can be overcome in a team context is a study that found no relationship between profit sharing and establishment size among German establishments using team production but found a significant negative relationship among establishments that did not use team production [11].

Using panel data for a large sample of Canadian establishments, another study examined whether adoption of profit sharing affects workplace productivity growth in the period subsequent to adoption relative to workplaces that do not adopt profit sharing, and whether adoption affects productivity more in workplaces that use more team-based production [12]. The study employed a before-and-after within-firm analysis of panel data to assess the effects of profit sharing adoption on an objective measure of productivity within a carefully constructed sample of Canadian establishments, while controlling for numerous variables that could affect the results. Because the effects of profit sharing adoption may take time to appear, that analysis looked at both three- and five-year periods after adoption of profit sharing. The study also examined whether three other firm-level variables influenced the relationship between profit sharing and workplace productivity: firm size, union status, and pre-existing employee earnings level.

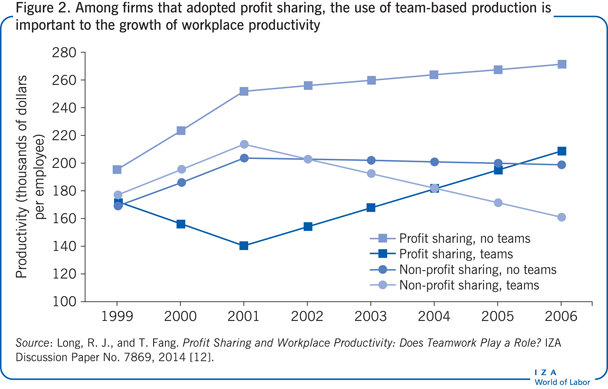

As Figure 2 shows, the results suggest that team-based production is important to the success of employee profit sharing—at least for workplace productivity growth [12]. A change in the slope of each line after 2001 (compared to 1999–2001) indicates a change in the productivity growth rate. For example, establishments that did not adopt profit sharing—regardless of whether they had work teams—showed substantial productivity growth between 1999 and 2001. This is not surprising, since the economy was strong during this period, and demand for goods and services was high, allowing firms to show increased productivity simply as a result of increased prices for their goods and services, also due to economies of scale in production.

But between 2001 and 2006, non-adopters without work teams showed no productivity growth, while non-adopters with work teams showed a significant drop in productivity. That productivity would stagnate or decline after 2001 is not surprising, as economic conditions worsened in the wake of the high-tech meltdown and the September 11 attacks, and most firms faced sagging demand and prices. However, why non-adopters with work teams showed such substantial productivity decreases is not clear. Perhaps firms with work teams make a larger investment in recruitment, selection, and training to develop employees with both task-related and team skills and are loath to disrupt their teams through layoffs. Failure to make layoffs commensurate with declining demand will reduce reported productivity, since in the absence of some mechanism like profit sharing, layoffs are the only way to reduce labor costs.

Of establishments that adopted profit sharing, those with team-based production showed a substantial and highly significant increase in workplace productivity over both the three-year and five-year periods subsequent to adoption, while establishments without team-based production showed no significant growth in productivity over either period. Figure 2 shows some interesting results for profit sharing adopters. Those who did not have team work showed rapidly increasing productivity before 2001 (as did non-adopters). However, during 2001–2006, the adopters continued to show productivity growth (though at a lower rate than before 2001), while non-adopters showed no productivity growth. Non-adopters with team work actually showed a productivity decline, which more than wiped out productivity gains that occurred before 2001. Thus, it seems that adoption of profit sharing mitigated—to some extent, at least—the effects of a declining economy on productivity. These findings are in line with the notion that work teams prevent some shirking behavior in profit sharing firms and are an effective mechanism for transforming the purported motivational and other benefits of profit sharing into tangible productivity gains [11].

If shirking was a problem—and was worse in large workplaces—a significant negative effect on productivity growth would be expected for the interaction between profit-sharing adoption and workplace size. However, the study found no significant interaction effect, which suggests either that shirking is not a problem for profit-sharing firms or that use of work teams reduces the negative effect of a firm’s large size for profit-sharing adopters [12]. Indeed, the results show that establishments with work teams were significantly larger than those without them and were also significantly more likely to adopt profit sharing. This finding is consistent with other research in this area [11].

The study also found a significant negative effect on productivity growth for the interaction between adoption of profit sharing and union density in the five years after adoption of profit sharing [12]. That suggests that unions may constrain workers’ anti-shirking behavior—and possibly also constrain increases in productive worker behaviors—that might otherwise flow from adoption of profit sharing. One can easily surmise that unions would oppose anti-shirking action by union members against fellow members. The finding that profit sharing will be of little or no benefit to establishments with high union density is consistent with the reality that firms with high union density are significantly less likely to adopt employee profit sharing, as is commonly discovered in the empirical literature.

In addition, the study found no significant interaction between profit sharing and employee earnings, suggesting that workplaces with high employee earnings derive no particular productivity advantage from adopting profit sharing [12]. Either profit sharing has no particular utility in extracting additional productivity from employees with high human capital or these workers are able to appropriate in their earnings any productivity gains that ensue from profit sharing (rent sharing). However, it may be that profit sharing is beneficial to establishments with costly human capital in ways that do not affect worker productivity growth, such as by allowing firms to maintain high employee earnings while gaining a greater degree of pay flexibility.

Finally, an intriguing finding is that establishments with team-based production that did not adopt profit sharing saw a substantial decline in productivity over the study period. This decline contrasts sharply with the substantial increase for team-based establishments that did adopt profit sharing and with the lack of significant change in productivity for establishments without teams that did not adopt profit sharing [12]. This finding is consistent with the argument that team-based work needs to be combined with some type of group or organizational performance pay to ensure that teams work toward organizational goals [13]. The significant positive relationship between profit sharing adoption and teamwork is also in line with this argument. However, the study was not designed to establish causality (unlike the analysis of the adoption of profit sharing), and thus it cannot be concluded that teamwork reduced productivity in establishments that did not adopt profit sharing.

Limitations and gaps

All empirical studies are bounded by their temporal, national, and institutional contexts. It is important to note that the period covered by some of the larger studies reported here ([1], [9], and [12]) was characterized by good economic conditions in 1999 and 2000, an economic meltdown in 2001, and then gradually improving economic conditions until the end of the study period in 2006. The main studies reported here used firm-level panel data for Canada, considered a liberal economy rather than a coordinated market economy, and in which cash-based profit-sharing plans are the norm. In other countries, such as the US, deferred profit-sharing plans are more common. Any of these factors may have influenced the results.

On the issue of the effects of team-based production on productivity in firms that adopt profit sharing, the study based on Canadian survey data included many firms across different industries with different structures and was thus unable to control for all possible relevant variables [12]. The study did not identify the specific drivers of the productivity increases observed in profit sharing adopters that use work teams. It may be, for example, that teams provide a better context for restraining shirking behavior (thus resulting in employees working harder), or it may be that teams provide a context for more cooperative and more innovative work behavior (thus resulting in employees working smarter). It could be some of each.

In terms of effects of profit-sharing plans on employee attitudes and behaviors, there is a small body of research pointing to positive effects on employee absenteeism, quits, and organizational citizenship behavior. More work is needed though on these issues and on the effects of profit sharing on job satisfaction.

Summary and policy advice

Adopting employee profit sharing has effects on important dimensions of worker outcomes, notably employee earnings and earnings growth, workplace productivity, employment, and employment stability. The impacts may vary by national and organizational contexts and the motivations for adopting such compensation plans. Analysis of a large firm-level panel data set finds that employees appear to benefit financially from the adoption of profit-sharing plans through earnings growth, especially in high-wage firms [1]. These findings align with the human capital argument for adopting profit sharing plans and, to some extent, with the incentive argument.

The extensive empirical studies on the productivity effects of profit-sharing plans support an incentive–productivity link. Although the evidence is quite clear that employee profit sharing increases firm productivity on average, the evidence is equally clear that it does not always do so, highlighting the importance of the national context and organizational conditions that influence this relationship. One condition that has been identified in the literature is participatory workplace practices, especially team work [12]. The research on the relationship between profit sharing and employment stability has generated mixed results. Recent studies using large national data sets for Canada [1] and the US revealed consistent patterns of increased earnings fluctuations along with enhanced employment stability among firms with profit sharing or other group incentive plans during dramatic economic cycles, including the economic recession in the early 2000s and following the global financial crisis of 2008/2009.

There has been considerable debate about how much employees actually benefit financially from a variety of “high-performance” or “high-involvement” workplace practices. The empirical studies reviewed here contribute to this debate by providing substantial evidence that one of these practices—employee profit sharing—can deliver significant benefits to employees, through higher earnings and employment stability, and to employers, through higher workplace productivity, which in turn supports higher employee earnings. At the same time, by making employee earnings more responsive to financial circumstances, employers may be able to better manage costs during poor economic times, making employee profit sharing a win–win proposition for employees and employers. As such, it would be in the long-term interest of firms to adopt profit-sharing plans. Workers and their representatives—labor unions—may want to work collaboratively with management to enhance the mutual benefits of profit sharing, for example, through teamwork. Government, in light of the mutual benefits of profit sharing to workers and firms, could facilitate the adoption of profit-sharing plans through positive incentives, such as deferred tax benefits for such schemes.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. This paper draws extensively on previous work by the author with Richard Long, in particular [9] and [12].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Tony Fang