Elevator pitch

Public schemes for sickness benefits and disability insurance are often criticized for the lack of incentive they provide for preventive and reintegration activities by employers. To stimulate the interest of employers in engaging with these schemes, several modes of privatization could be considered, including the provision of sickness benefits by employers, “experience rating” of disability insurance costs, employer self-insurance, or insurance by private insurance providers. These types of employer incentives seem to lower sickness rates, but they also come at the risk of increased under-reporting and less employment opportunities for workers with disabilities or bad health conditions. Policymakers should be aware of this trade-off.

Key findings

Pros

Financial incentives may contribute to preventive activities of employers, causing less worker absence and, subsequently, less disability enrollment.

Financial incentives may trigger employers to increase reintegration activities for sick-listed workers and workers with disability insurance benefits, particularly at the start of benefit receipt.

Workers with bad health conditions can be better protected against layoffs if subsequent disability benefit costs are paid for by employers.

Cons

Employer incentives to curb sickness and disability enrollment may cause under-reporting of disability cases, particularly if employers decide to discourage claims by lawsuits.

Employer incentives of sick pay and disability benefits costs may decrease the number of hirings of new workers, particularly for vulnerable workers with health or disability issues.

The consequences of incentive systems such as “experience rating” may be difficult to grasp, particularly for smaller employers, while they are facing potentially large financial risks.

Author's main message

Employer incentives in disability insurance are limited in most countries, yet they can contribute positively to the prevention and reintegration of sick-listed workers and workers with disabilities. Employers do have opportunities to reduce the consequences of impairments, as they have the discretion to implement work adaptations such as flexible working hours, assistive technologies, or vocational rehabilitation. A key question for policymakers is how incentives to curb sickness and disability insurance enrollment should be targeted to decrease the risk of sickness and disability without transferring large financial risks to the employer. Employers should also be kept accurately informed, so as to increase their awareness and effectiveness of the incentives.

Motivation

Many countries currently face persistent increases in public disability insurance (DI) enrollment. The US, in particular, is a prime example of a country in which the Great Recession has resulted in the earnings capacity of workers with health impairments falling below the threshold of what is considered to be “substantial and gainful activity,” rendering them eligible for social security disability insurance (SSDI). At the same time, employers in the US have been inclined to use DI schemes as a substitute pathway into unemployment insurance (UI) schemes for their redundant workers [2]. However, unlike UI, where the costs of layoffs are typically imposed on employers, SSDI benefit costs are not transferred to individual employers. This makes the SSDI susceptible to “moral hazard” problems, whereby employers have an interest in diverting low-productivity workers from UI to DI.

This article focuses primarily on the benefits and disadvantages of the different modes of employer incentives. With DI risks that are transferred from public insurance to individual employers, consideration is given to the effects of a partial or full privatization of sickness pay and DI schemes. In this context, it should be stressed that evidence is not provided on the effects of a (full) privatization of DI schemes where public regulation—such as the setting of benefit conditions—is absent and benefit conditions are set by private insurers. The reason for this is that experiences with such reforms are scarce and, not surprisingly, empirical evidence from private insurers is virtually absent.

Discussion of pros and cons

The rationale for employer incentives

It could be argued that the actual presence of work-limiting impairments, such as mental disorders, cancers, and heart diseases, cannot be influenced by employers. This in turn calls for schemes where benefit costs of mandatory sick pay and DI schemes, in principle, are not imposed on individual employers. But there are also reasons to believe that employers do have opportunities to reduce the consequences of these impairments. Thus, employers have the discretion to implement work adaptations, such as flexible working hours, assistive technologies, or facilitate vocational rehabilitation. Such activities may also prevent a deterioration of health conditions once someone is sick. In addition, when taking a broader perspective, employers may reduce occupational risks, for example by adapting working environments and by monitoring sickness absence. Taken together, this creates a clear case for the use of employer incentives to reduce sick pay and DI costs.

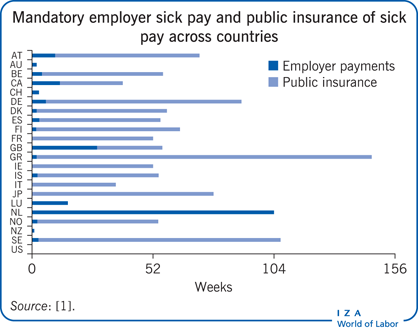

Employer incentives aimed at reducing sick pay and DI benefit costs can take several forms. To begin with, employers in many developed countries are obliged to continue full or partial wage payments from the start of a sickness period. In this context, private sickness pay by employers is mostly mandatory for benefit lengths of some weeks or some months; after this period, public insurance often takes over. In this respect, the Netherlands clearly stands out as a country with higher employer incentives—with private sick pay by employers lasting for a maximum of two years. This contrasts with the US, for example, where sick pay by employers is not mandatory at all.

Employer incentives in DI are more limited than for sick pay. If they are used, they typically involve the use of experience-rated premiums. Similar to experience rating for UI, the idea here is that employer premiums depend on the DI benefit costs from claims of their (former) employees. Experience-rating systems are used frequently in the context of workers’ compensation (WC) in the US and Canada, while limited only to public DI in the Netherlands and Finland. Premiums are related to DI costs but mostly capped at a maximum level, so as to avoid financial risks becoming too large for employers. As a result, the DI benefit costs of employees are not fully but incompletely experience-rated. Using a similar argument, DI benefit costs are experience-rated only for a time window with the most recent cohorts of new claims, which captures the idea that employers can only influence DI costs that occur in the first years of benefit receipt.

Consideration should also be given to privatization where there is no public insurance at all, but with regulatory standards that are set by public authorities. In the context of WC, employers in some US states may opt out and become self-insured. Essentially, self-insurance implies that employers become “fully experience-rated,” as they essentially bear all DI benefit costs. As an alternative to self-insurance, privatization may also entail a switch to a private insurer. Here, the idea also is that private insurers have a stronger interest in curbing DI enrollment than public insurers. This system of opting out has been implemented in the Netherlands since 1998.

The impact of private sick pay

It is widely understood in the literature that return-to-work interventions are most effective at the onset of sickness or disability [2]. Employers have the discretion to implement such interventions and, accordingly, influence sick pay costs, particularly by providing work adaptations or vocational training. This renders employers to be likely candidates to bear—at least to some extent—the financial responsibility of sick pay.

With this in mind, it may appear surprising that the length of private sick pay—if present—is limited in most countries to one or two months. The Netherlands, however, is unique in that it stipulates two years of mandatory private sick pay by employers. It could be considered that such a long period of mandatory sick pay is too much of a financial risk imposed on employers. However, another argument is that employers are facing the costs of a loss in production or as a result of the (temporary) replacement of sick workers. If these costs are substantial, and there are decreasing returns to prevention and reintegration efforts of the employer, the additional impact of sick pay costs on prevention and reintegration activities may be limited.

Empirical evidence on the impact of private sick pay is scarce. Cross-country comparisons mostly do not provide accurate measures of the effect of transferring sick pay to public insurance. It is likely that one or two outliers with lengthy private sick pay by employers—such as the Netherlands and the UK—will differ from other countries in many other institutional aspects as well. It is therefore more instructive to study the impact of changes in sick-pay systems within countries. In this respect, experiences with sick-pay reforms in Norway, Austria, and the Netherlands are helpful.

Evidence from Norway is derived from a natural experiment in which employers were exempted from short-term sick pay for pregnancy-related absences since 2002 [3]. Comparing the change of this type of absence after 2002 with the change of other types of absence for which employers remained liable, the removal of employer incentives increased the number of short-term absence spells. This suggests that employers are indeed able to lower the risk of sickness spells. At the same time, however, research findings indicate the existence of “sick pay traps” for workers, for which private sick pay was maintained. That is, employers had an incentive to maintain long-term absence if the private sick pay period had ended and public insurance had taken over. As such, they avoided work resumption that entailed the risk of costly short-term relapses for which employers are financially responsible.

A similar natural experiment has been undertaken in Austria where, since 2000, employers have not been exempted for sick pay for the specific group of blue-collar workers [4]. This removal caused sickness incidence to drop by approximately 8% and sickness absences were almost 11% shorter in duration.

Sick pay reforms in the Netherlands have been more dramatic than in Norway and Austria. In 1996 the mandatory private sick-pay period was extended from four weeks to a period of one year, and in 2004 a further extension took place, increasing the period to two years. The overall evidence suggests that, amongst some other reforms, these changes have contributed substantially to the sharp decline in DI inflow in the Netherlands, amounting to about 60% [5], [6]. An additional lesson from this, however, is that in order for these employer incentives to have a considerable impact, they had to be complemented with another reform that took place in 2002: the “Gatekeeper Act.” This act specifies the legal responsibilities of both the employer and the sick-listed worker before the application to DI benefits takes place. While the employer incentives of private sick pay increased the economic urgency among employers to exert sickness and accident prevention and workforce reintegration activities, the Gatekeeper Act has alerted employers and guided them in their new role. Also, it has resulted in employers designing wage bonuses or wage penalties that are related to worker absence—thus transferring part of the sick pay risk to individual workers [7].

The use of employer sick pay has been criticized for its unintended side effects. First, employers may insure the risk of sick pay by private insurance contracts, thus effectively removing a substantial part of the incentive. Experiences in the Netherlands show that smaller firms, in particular, have indeed opted for private insurance of sick pay. But from the available evidence, it appears that reductions in absenteeism due to the extension of sick pay have also been realized for the group of employers who opted for private insurance [8]. Anecdotal evidence suggests that private insurers applied some form of incentives—such as co-payments or experience rating—or obligations to curb sick pay.

A further, and probably more important concern with private sick pay, is that it may decrease hirings, particularly of workers with bad health conditions. Similar to employment protection legislation measures, private sick pay may well lead to more employer commitment to workers, but also fewer hirings of new workers. Unfortunately, there is no compelling evidence to date on the net impact of both of these mechanisms. Still, the experiences in the Netherlands—with a very large increase in private sick pay—indicate that the employment rate of individuals with working limitations has not worsened following the reforms, compared to the employment rate of those without working limitations [5]. Thus, it may be that individuals with working limitations that were already employed benefitted from the increased employer commitment, whereas those without employment had fewer opportunities to resume work.

It could also be argued that employers in the Netherlands have responded to the financial incentives by an increased use of temporary or flexible contracts for workers who are considered to be “safety netters” by the social benefit administration. As employers were not financially responsible for the safety netters, they could avoid the risk of continued wage payments for workers with bad health conditions—at least starting from the moment the labor contracts ended. Although there are no formal empirical analyses that have addressed this issue, there is some suggestive evidence of this response from employers. Between 2007 and 2011, the share of DI benefits that were awarded to safety netters increased from 42% to 55%. This trend cannot be entirely explained by the (much smaller) decrease of five percentage points in the share of workers with permanent contracts; it rather suggests that vulnerable groups with bad health conditions have sorted into flexible jobs.

Overall, there are strong reasons to believe that employer sick pay has the potential to reduce the incidence and duration of worker absence. At the same time, however, the appropriate design of private sick-pay incentives poses complex challenges to policymakers, particularly regarding the optimal length and timing of payments. To address these issues, not only is information on the effectiveness of certain interventions required, but also the time period that is needed to internalize the savings on sick-pay costs and avoid the occurrence of sick-pay traps. If the impact of such sick-pay traps is substantial, an interesting policy alternative would be to reduce the financial responsibility for short-term absence, while increasing it for long-term absence.

Experience rating

The use of experience-rating systems in DI is not widespread. As stated earlier, most evidence on the effects of experience rating focuses on WC schemes in the US and Canada [9]. More recently, studies have assessed experience rating for public DI in the Netherlands and Finland [10], [11], [12].

Studies on experience rating in WC typically focus on outcome measures, such as fatality and injury rates and return-to-work rates of injured workers. Generally, the empirical findings in this literature lend credence to the idea that experience rating reduces disability claims costs. However, experience rating is also found to lead to an increase in the number of lawsuits, which can be viewed as an unintended side effect. Employers may put strong pressure on workers not to report injuries, which means that part of the gains of reduced disability claims can be attributed to this. So employer incentives work, but for better and worse.

The Netherlands is one of the few countries where experience rating is used for public DI. Recent evidence suggests that experience rating can be effective in both lowering DI inflow and increasing the outflow from DI by increased prevention and reintegration activities. At the same time, these results stress that the impact of experience rating largely depends on contextual factors. Most importantly in this respect, the extension of the employer sick-pay period from one to two years is likely to have lowered the potential for experience-rating incentives to work in the DI benefit period that starts thereafter [11]. In addition, there is evidence—also from experiences in Finland—that smaller firms, in particular, are not always aware of the presence of experience-rating incentives. This may be due to the complexity of the calculation of experience-rated premiums.

DI experience rating thus has the potential to reduce benefits costs—just as employer incentives in the period of sick pay do. Nevertheless, financial incentives for employers are probably more effective in the period of sick pay that precedes entitlement to DI benefits. Employer interventions are more effective at the onset of absenteeism, with employers that can still take responsibility and act accordingly. When DI benefits have been awarded and experience rating applies, however, the employment contract has typically ended and the employer will lose sight of their (former) workers. In addition, the actual implementation of incentives is more complex in the case of experience rating than for sick pay, thus also limiting its behavioral impact.

Self-insurance and private insurance

In many US states, employers can opt out from standard WC schemes and become “non-subscribers.” As self-insurance implies that all DI benefit costs are paid by the employer, employers essentially switch to full experience rating. In the context of WC, Texas is the only US state where a large fraction of employers has opted for self-insurance. In addition, the Netherlands is the only country where employers may opt out from public DI. Distinct from WC schemes, however, almost all employers that opt out from public insurance in the Netherlands do not bear DI costs themselves but switch to private insurance providers. This has led to a “mixed market” of one public provider and many private providers of disability insurance.

Empirical findings on the behavioral impact of self-insurance in WC in the US seem reasonably well in line with those for experience rating. Accordingly, self-insurance comes with fewer DI claims but also more efforts to increase the non-reporting of injuries. Experiences with opting out in the Netherlands, however, do not provide evidence of lower DI enrollment [13]. This suggests that private insurers are not very effective in increasing return-to-work rates of sick-listed workers and DI benefit recipients. In a way, this is not surprising, as private insurers in the Netherlands typically provide partial re-insurance of the incentives that come with the experience-rating system under the public program. Thus, the added value of private insurance is limited, given that premiums are experience rated in the public scheme.

The greatest concern with opting-out systems is that they may give rise to adverse selection effects. Within the Dutch context, such adverse selection is associated with private insurers attracting employers with low DI risks, thus raising the average DI benefit costs of employers that remain in the public system. This process may harm the sustainability of the mixed system. Thus far, however, the evidence suggests that although adverse selection occurs, the effective impact is small.

Employer incentives: Key lessons from the Netherlands

As discussed earlier, the Netherlands is the only country where all possible modes of privatization of sick pay and DI have been implemented. As such, experiences in the Netherlands, as an extreme case, may help in obtaining a broader, integrative view on the use and usefulness of employer incentives. Keeping in mind the pros and cons of the privatization modes discussed above, at least three key lessons can be drawn from the Dutch experience [5].

First, the effectiveness of incentives crucially depends on awareness among employers [10]. Employers have difficulty understanding the way the risk of DI enrollment affects their premium rates, as experience-rating formulas may be complex. As long as there is no DI enrollment, employers may even be completely unaware of experience rating. This calls for the implementation of systems that inform employers of the financial risks they are facing. Likewise, the experiences with the Gatekeeper Act show that employers need guidance during absenteeism of employees; they need to be alerted as to their responsibilities. The implementation of procedural rules and the provision of information may complement and strengthen incentives.

Second, employer incentives are not necessarily to the detriment of the employment of vulnerable groups with health problems. Although there may be an interest for employers in screening workers on their health, they also have an interest in continuing labor contracts with workers with bad health who are already employed. In this respect, there is no strong evidence that employers’ incentives that have been implemented in the Netherlands have worsened the labor market position of individuals with bad health. At the same time, however, it seems that the employer incentives have led to an increased use of temporary and flexible contracts for workers with bad health. In this way, employers have avoided the potential costs associated with (long-term) sick pay and DI experience rating.

Finally, private employer incentives can be implemented successfully in a public DI system [13]. With experience-rated DI premiums, employers increased preventative and reintegration activities to reduce new DI inflow. That said, it seems that the added value of insurance by private insurance providers, from which employers could opt out, has been limited. Private insurance may even have led to a reduction of employer incentives if they provide higher insurance coverage than under public insurance.

Limitations and gaps

Experiences with employer incentives are typically scarce and contextual. This underlines the general need for more analyses in this field of research, which takes into account the specifics of countries and states where private sick pay, experience rating, and private insurance are implemented. However, there are still some gaps in the literature that are more pressing than others. First, many of the unintended side effects of employer incentives have not been touched upon empirically. There are, for instance, no studies on changes in hiring policies of employers stemming from financial incentives, particularly with respect to workers with health conditions. This is important from a policy perspective, as adverse hiring policies are often put forward as a major argument against employer incentives. Related to this issue, it would be interesting to consider the impact of financial risks on employer bankruptcies—which may also be seen by some people as an unintended effect of employer incentives.

Second, a better understanding of the optimal design of incentive systems is needed. To target employer incentives in the right way, the specific injury risks that can be influenced by employers and the length of time interventions are effective for must be known. Thus far, however, the empirical literature does not provide much guidance on these decisions; rather, it provides effect estimates of crude measures of experience rating that include all injury types. In addition, the appropriate design of sick-pay incentives requires more knowledge on sick-pay traps: are these important, and do they justify the use of employer incentives for long-term absence?

Third, the most imminent limitation is the unavailability of data from private insurers. To study the determinants of private insurance would ideally require access to all relevant aspects of the insurance policies that are offered by private insurance providers, including premium rates, deductibles, or experience rating specifics. In practice, however, sick pay and DI insurance contracts with employers are often considered to be private information and thus out of reach for researchers.

Summary and policy advice

The experiences in various developed countries and various contexts show that employer incentives can make a difference in curbing sickness absenteeism and DI enrollment. It seems that employers have room to implement work adaptations and vocational rehabilitation and that they are more likely to make use of this room if they have financial incentives to do so. Thus, the privatization of (a part of) the sick pay and DI benefit costs may contribute toward slowing down, or even reversing, the rise of expenditures on sick pay and DI enrollment, which has been observed in many countries.

That said, however, the key question that remains for policymakers is how employer incentives can be targeted to generate a substantial effort to decrease the risk of sickness and disability, but without transferring large financial risks that are exogenous to the employer. The available evidence suggests that employers’ incentives should, in principle, be directed to the starting period of sickness, but probably stretch out over a period that is longer than some weeks or a few months—as is the case in most countries with mandatory private sick-pay systems.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Also, Nynke de Groot and Wolter Hassink are gratefully acknowledged for suggestions and comments on earlier drafts of this paper. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [10], [13].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Pierre Koning