Elevator pitch

Labor market institutions that may weaken workers’ bargaining leverage have received increased scrutiny in recent years. One example is noncompete agreements, which prevent workers from freely moving across employers, potentially weakening earnings growth. New data sources and empirical evidence have led policymakers to consider sharp restrictions on their use, especially among lower-income workers. These restrictions take many different forms, each of which has unique tradeoffs between the desire to protect workers while allowing firms to use noncompetes in cases where they may create social value.

Key findings

Pros

Noncompete agreements can promote investments in intangible assets, such as research or worker training, that potentially benefit both employers and workers.

Empirical evidence supports the theory that noncompetes increase worker training and overall rates of corporate investment.

Noncompete agreements can help employers screen out job applicants who are more inclined to job-hop, reducing turnover and overall hiring costs.

Cons

By restricting workers’ ability to change employers, noncompete agreements can shift bargaining power away from workers and hinder wage growth.

Most empirical studies show that the use and enforceability of noncompetes decrease wages, on average, with exceptions in some occupations.

Noncompete agreements can create spillover effects on workers and firms that do not sign them, and potentially reduce the overall competitiveness of labor markets.

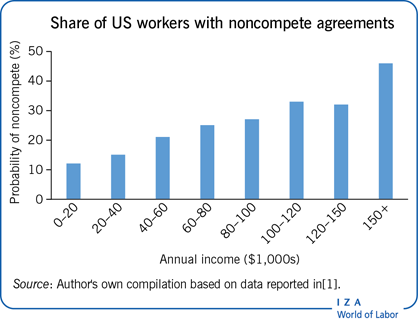

Evidence suggests the negative wage impacts of noncompete agreements are disproportionately concentrated on more vulnerable and lower-income workers, including minorities and women.

Author's main message

Economic theory suggests noncompete agreements have the potential to increase productive investments, but can also harm workers. Empirical evidence is similarly dichotomous, consistent with greater worker training and rates of corporate investment, but lower wages and job mobility on average. Though the harmful effects are often most salient, policymakers should aim to balance regulation that protects workers while still allowing the benefits of noncompetes in some contexts. Regulatory options include noncompete wage floors, transparent information requirements, and matching the timing of payments for noncompetes with the work restriction period.

Motivation

Noncompete agreements (NCAs) are clauses of employment contracts that prevent workers from exiting a job and moving to a rival firm. Traditionally, they have been used to prevent high-skilled workers from transferring trade secrets or research and development (R&D) knowledge to competitors. NCAs have been used and legally enforced for centuries, and exist broadly in many labor markets internationally. Only recently have systematic data been collected on the use and enforceability of NCAs, which has allowed researchers to begin to understand how pervasive they are in labor markets, to empirically assess their effects on wages and other labor market outcomes, and to understand the breadth of firms’ motivations for using them.

The growing body of empirical evidence on NCAs has led to a sharp increase in regulatory activity, particularly in the US, designed to mitigate the harmful effects of NCAs on workers and consumers. This protective regulation may impose tradeoffs that are difficult to observe and assess. Policymakers can protect the most vulnerable workers through regulation, while still permitting NCAs in some segments of labor markets, as empirical evidence on the effects of NCAs continues to develop.

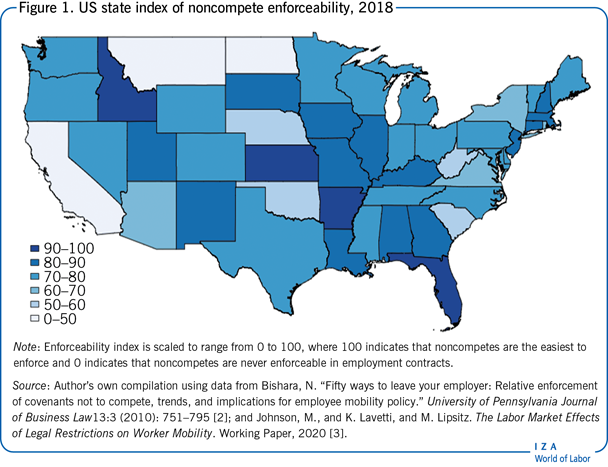

In the US there is no federal law governing the enforceability of NCAs among employees, so states set their own laws, which differ dramatically. Figure 1 shows a map of an NCA enforceability index in 2018 [2], [3]. California and North Dakota (light blue) do not allow NCAs to be enforced, while states like Florida (dark blue) permit them to be used and enforced in a broad set of contexts.

Discussion of pros and cons

Investment incentives and firm productivity

NCAs have the potential to both create value and harm the competitiveness of labor markets, a dichotomy that has contributed to ongoing controversy over their use and regulation. Employers may benefit from using NCAs when they have the opportunity to make investments that can be protected by restricting employees from moving to rival firms. There are many common examples of such scenarios, including investments in research or other intellectual property that cannot be patented, or has not yet been patented; investments in employee training; or investments in intangible relationships with customers. By protecting the value of these investments, or allowing firms to choose how to allocate the benefits from the investment, NCAs can incentivize firms to make investments that would not otherwise be profitable. For example, firms may be unwilling to invest in intellectual property if workers could freely take the information learned from the investment and share it with a rival firm. NCAs can thus increase innovative investments by preventing knowledge transfers that occur through job flows.

Since NCAs are inherently restrictive to workers, it may seem at face value that their potential benefits are one-sided, favoring employers. However, this need not be the case universally. Consider a firm that has the opportunity to invest in training that will generate a positive rate of return for the firm if workers remain at the firm, but if workers exit the firm shortly after being trained the firm loses the cost of the training investment. The firm prefers to make the investment and impose an NCA, but workers prefer to not be bound by NCA restrictions. If the gains from the training investments are large enough, the firm can share some of the gains with the worker, providing a source of additional compensation to workers in exchange for accepting an NCA.

An important question for researchers is whether workers benefit from NCAs in practice. Empirical evidence on the impacts of NCAs, and of the many policies or regulations that affect their use, is mostly limited to the US context. In the US, states determine their own regulations in the absence of federal policy. Studies have broadly found that firms do provide more training to workers when NCAs are imposed [1]. Researchers have found that when states change their laws to allow NCAs to be more strictly enforced, the overall rate of investment by firms increases [4]. Similar evidence has been found showing that NCAs affect investments in or sharing of client lists in service sector employers, including financial advisory firms [5], and physicians [6]. This body of evidence is consistent with at least some sharing of the gains from NCAs with workers. Of course, this does not imply that all workers benefit from signing NCAs.

Worker earnings and bargaining leverage

Much of the controversy about NCAs relates to their impact on workers’ ability to bargain with employers. After signing an NCA, it may be more difficult for workers to negotiate salary increases, since employers know that the NCA reduces their ability to switch jobs. This effect on bargaining power is often cited in support of arguments to ban NCAs.

Of course, if workers anticipate this decline in bargaining power they can negotiate up-front for additional compensation in exchange for the NCA. While theoretically simple, the argument that workers can negotiate up-front has some practical limitations. First, many workers are inattentive or uninformed about NCAs [7], and may not be aware of the need to negotiate up-front. Second, negotiating long-term employment contracts, including provisions for future raises, can be difficult at the beginning of a job, when both sides have only limited information about the quality of the job match.

Empirical evidence broadly shows that when firms are permitted to use and enforce NCAs, wages are lower. Specifically, when US states made it easier for firms to enforce NCAs, an increase from the 10th percentile to the 90th percentile of an NCA enforceability index was associated with a decline in the average wages of all workers by about 3–4% [3]. A 2008 ban on NCAs in Oregon for low-wage workers was found to increase wages by 2.2–3.1% for the affected workers [8]. Moreover, when US states increased the enforceability of NCAs, the labor share of earnings as a proportion of total economic output declined significantly [3].

Evidence also suggests that the negative earnings effects of NCAs tend to exacerbate pre-existing disparities across demographic groups. Negative earnings effects are more than twice as large for women and black workers as they are for white men [3]. An implication of this finding is that regulations designed to protect workers from NCAs are likely to not only raise earnings on average, but to help narrow racial and gender wage gaps.

One of the few empirical studies from outside the US found that a ban on NCAs for lower-wage workers in Austria (earning below €2,100 per month) had approximately zero effect on rates of earnings growth for affected workers, despite about one-third of the labor force being bound by NCAs [9]. This finding suggests that it may be important to consider institutional factors related to the wage-setting process, rather than extrapolating US evidence to other contexts.

In some countries (and some US states), employers are permitted to compel workers to sign NCAs under threat of termination. This has the potential to tip the bargaining scales in favor of firms. For example, employers can demand that workers sign NCAs during recessions, when they may have limited alternative job opportunities. This allows employers to solidify better long-term bargaining leverage over workers even after labor market conditions improve. There is also some empirical evidence that NCAs can shift macroeconomic risks toward workers. In many labor markets worldwide there is compelling evidence that firms tend to provide implicit insurance that partially protects workers’ wages during economic downturns. Recent updates to this literature have shown that this evidence holds on average in the US, but in states that allow firms to aggressively enforce NCAs workers are less protected by their employers. During recessions, earnings fall by a greater amount in these states, and these relative earnings declines do not recover during subsequent expansionary years [3].

One potential interpretation of the body of empirical evidence is that NCAs may benefit firms at the expense of workers. However, understanding whether workers are harmed more broadly by the reduction in bargaining power caused by NCAs depends in part on whether workers are well-informed about NCAs and can anticipate these bargaining effects prior to agreeing to the employment contract.

Hiring: Selection and turnover

Some firms highly value long-term relationships with workers, while others adjust more easily to worker turnover. A challenge for the former is that when hiring new workers it may be difficult to select applicants who intend to remain at the company for a long time, while avoiding workers who expect to job-hop. NCAs can provide a valuable form of screening for these firms. Since the cost imposed upon workers by NCAs only occurs if the worker exits the job, workers who intend to remain at a company can identify themselves through their willingness to sign NCAs. Of course, NCAs may also directly reduce turnover by increasing the cost to workers of changing jobs. NCAs can decrease aggregate hiring costs through this direct effect or by facilitating the self-selection of workers.

Empirical evidence consistently shows a negative relationship between NCA use (or enforceability) and turnover rates. After NCAs were banned in Oregon in the US job transition rates increased by 12–18% among low-income workers [8]. This case study evidence is consistent with broader correlations in many states [3], [6], [10].

Labor market fluidity and competitiveness

In addition to considering the perspectives of individual workers or firms, policymakers must also consider the aggregate impacts of NCAs on labor markets more broadly. If a large share of workers are bound by NCAs, potential new employers may find it more costly to enter the market since the pool of recruitable workers is smaller. By deterring firm entry, NCAs may affect labor market demand and the degree of competition in product markets for goods and services [10]. One of the few empirical studies that has taken a macroeconomic perspective on NCAs highlights the importance of this effect on the ability of new firms to enter and hire workers. Though the study focuses on high-skilled managers, it demonstrates how a reduction in labor market fluidity could potentially be harmful enough to offset benefits associated with NCAs. The study concludes, in this context, that forbidding the use of NCAs is likely to improve social welfare [11].

NCAs may also cause other impacts on labor market fluidity. If employers cannot easily observe which workers have signed NCAs, it may become more costly to search for new workers. This deterrent effect could decrease the hiring rate of incumbent firms, in addition to the entry of new firms, both of which would tend to reduce the demand for labor. Workers may also end up in jobs that match their skills or preferences more poorly. However, given the lack of relevant large-scale data, to date there has been limited empirical evidence on how rates of NCA use in markets might impact labor outcomes or product market prices.

Similar arguments have been made in the literature on urban economics and agglomeration. The ability to job-hop between geographically clustered firms can allow resources to quickly shift toward the most innovative ideas. The knowledge flows associated with job-hopping can also reduce the cost of human capital increases, leading to higher rates of earnings growth. Researchers have hypothesized that the lack of enforceable NCAs in California in the US was a key factor behind the clustering of highly innovative IT firms in Silicon Valley.

Information and the freedom to contract

A central point of contention among scholars studying NCAs is whether evidence that NCAs shift bargaining leverage in firms’ favor should be interpreted as undesirable. Some scholars argue that workers and firms should have the freedom to agree to contracts as they see fit, and if NCAs make workers worse off then workers are free to simply decline those job offers. This “freedom to contract” argument assumes that workers are well-informed about NCAs, and agree to them voluntarily. The freedom to contract argument also requires that there are no harmful spillover effects (also known as negative externalities) of NCAs onto other workers in the labor market.

If workers are not well-informed, or if firms tend to have more experience with NCAs than workers do, it is possible that firms can benefit at the expense of workers by using NCAs to increase bargaining leverage. However, this argument requires that workers lack information, or behave in short-sighted ways. Empirical evidence on this point is again limited to the US context. Accordingly, only about 61% of workers who signed NCAs in the US were aware of the NCA before accepting the job, and only 10% of workers negotiated over the terms of the NCA [1].

There is also evidence that increasing NCA enforceability has negative wage spillovers on nearby workers employed across state borders, who are not directly impacted. This suggests NCAs may have broader impacts on the overall functioning of labor markets [3]. When applying the freedom to contract argument to NCAs, policymakers should carefully consider how informed workers are about NCAs, and the potential for NCAs to impact the overall competitiveness of markets.

Regulatory options for noncompete agreements

In the US, judges and legislators seeking to balance the incentives to promote firm investments while protecting workers have made increasingly frequent changes to the enforceability of NCAs. The majority of the legislative changes have been in the direction of protecting workers, while judicial changes have moved enforceability in both directions.

Internationally, there is a broad range of policies governing the use of NCAs. Many countries (e.g. Russia, India, Mexico, Malaysia) forbid them in nearly all cases. However, the vast majority of developed countries allow NCAs in at least some restricted form. Typically, regulation aims to balance the benefits of NCAs to firms with the harm caused by NCAs to either workers or to the public at large.

Much of the regulation focuses on the duration and scope of NCAs. In countries that allow NCAs, they are typically permitted to last at least 6 to 12 months, though some countries like Switzerland, Italy, and Argentina may allow durations beyond two years. In China, NCAs are permitted only for certain occupations, including senior managers and senior technical employees.

In recent years policymakers have actively debated whether to increase regulation of NCAs, or potentially ban them outright. This is perhaps unsurprising, because in many cases the drawbacks are highly salient, while the potential benefits may be harder to directly attribute to NCAs. The following discussion addresses this point by examining potential regulatory options, with a focus on how these options may enhance the economic benefits of NCAs for both workers and firms while attenuating any potential harm.

Minimum wage for jobs with NCAs

Much of the recent derision of NCAs has centered on their use in low-skilled, low-wage jobs, in which it is difficult to imagine how NCAs may generate meaningful value to society. For example, a sandwich chain in the US was widely scorned for imposing NCAs on low-wage workers to prevent them from making sandwiches at other restaurants.

Eight US states have recently responded by banning NCAs for low-wage workers (six enacted bans in 2019–2020). Similar federal legislation has also been introduced in the US Senate. These regulations tend to impose minimum wage or salary levels for workers that sign NCAs, effectively forbidding their use at the low end of the earnings distribution, and in some cases the middle of the earnings distribution. On the low end, Illinois set a minimum wage for workers with NCAs to $13.50 per hour, and New Hampshire set it to $14.50, with automatic adjustment to twice the federal minimum wage. Many states also set annual salary limits, ranging from $31,200 in Maryland to $100,000 in Washington. Rhode Island and Maine both tie the minimum salary to the federal poverty line, which implies that the minimum salary for workers with NCAs depends in part on the size of the worker's household (the minimum is about $103,000 annually in Maine for a worker with a family of four).

The economic motivation behind regulating wage floors for jobs with NCAs is that it allows them to be used where they are likely to generate very large economic benefits, as they may for scientists, high-skilled professionals, or executives, while outlawing them in jobs where their benefits are less clear. This protects low earners, who may be more vulnerable to the type of harm that NCAs can cause, such as declines in bargaining leverage during economic downturns.

Any minimum wage-based NCA policy has the potential to affect labor market equilibria broadly. If firms derive some value from imposing NCAs on low-wage workers, then firms may be harmed by this regulatory restriction. For example, evidence from cosmetologists is consistent with firms using NCAs to extract additional value from workers in settings where wages cannot be reduced because of minimum wage restrictions [12]. Firms may also benefit from NCAs if a large share of workers are inattentive or uninformed about them. For example, less educated workers in US states with unenforceable NCAs were less likely to be aware that NCAs were unenforceable [7]. Regulators must weigh the tradeoff between eliminating this source of value for firms or protecting uninformed workers.

Information regulation

One regulatory option that faces little resistance on its economic merits is the requirement that workers must be explicitly informed about the use of NCAs. A survey of engineers found that 69% of workers who signed NCAs were asked to do so after receiving the initial offer letter, and 24% were asked to sign on the first day of work [13]. Allowing firms to impose NCAs on new workers after they have already accepted a new job, and potentially declined alternative offers, can shift bargaining power toward employers at the expense of workers. There is no clear source of social benefit from this shift of bargaining power. Nonetheless, regulating transparent disclosure of NCAs may not be devoid of harm. The question for regulators is whether mandating transparency, ensuring both sides are aware and informed about an agreement, is desirable even if opacity could have benefited one side of the agreement.

Regulatory restrictions on NCA disclosure should be careful to distinguish new jobs from existing jobs. In many cases there are valid economic rationales for imposing NCAs after a job has begun, for example, if a worker is promoted and has a substantively different role in the company, or is entrusted with knowledge that is valuable to the company. On the other hand, if firms are free to demand that workers sign NCAs under duress, such as during an economic downturn, this could oppose the spirit of regulating open information about NCA policies. For this reason, it may be more effective to combine information regulations with a policy requiring that workers receive explicit compensation in exchange for signing NCAs.

Another form of information transparency policy is to require firms to publicly disclose to a regulatory agency whether they use NCAs. This information could be used by workers to improve job search efficiency when they have strong preferences about NCAs.

Explicit compensation and timing

Requiring explicit line-item compensation for NCAs can help ensure that workers capture some direct benefits. In some US states, NCAs must be accompanied by up-front one-time payments at the time of signing. In contrast, many other countries do not require higher compensation for NCAs during the job, but do require employers to continue paying workers a share of their salary after the job ends, during the restricted period. This type of regulation forces the payments that compensate workers for NCAs to align with the timing of the potential harm created by NCAs. Regulating the timing of payments in this way provides a form of insurance against NCAs causing extreme destitution to workers. Post-employment compensation regulations in Argentina, Belgium, China, France, Germany, Hungary, Sweden, and the Czech Republic require firms to pay between 20% to 100% of salary during the restricted period, with most countries requiring 30–70% of salary. Moreover, some of these countries forbid employers from voluntarily waiving the restriction, thereby ensuring that employers must pay post-employment compensation once the NCA is signed. The idea behind such a policy is to deter employers from initiating NCAs except in cases where they are highly valuable.

Economic theory suggests that workers must be compensated for accepting NCA restrictions. It follows that requiring separate line-item compensation for NCAs is likely to reduce the non-NCA component of earnings. However, it is not clear whether the transparency associated with line-item compensation might affect the total level of compensation. Similarly, post-employment compensation requirements are likely to reduce earnings during employment, but the net effect on total earnings is unclear. The primary economic motivation for considering such regulations is not necessarily to change total compensation, but to promote transparency or to ensure that workers are protected from extreme economic harm during post-employment periods.

Occupation restrictions

Policymakers, for a variety of reasons, have imposed an array of occupational restrictions on the use of NCAs. Among the broadest set of occupation-specific restrictions are those in China, where NCAs are typically restricted to senior managers and senior technical staff. In the US, several states have banned the use of NCAs among physicians, frequently justifying the bans by the concern that NCAs may disrupt the continuity of patient care and restrict patient choice. Some occupations also self-regulate. The American Bar Association forbids the use of NCAs among lawyers under its code of ethics, again citing client choice as a prevailing motive.

Occupational restrictions on NCAs can seem appealing to policymakers by allowing narrowly targeted consumer protections in areas of high importance, such as healthcare. At the same time, it is important for policymakers to recognize that empirical research on the impacts of NCAs is still relatively nascent. Only recently have extensive data on NCAs been collected. These data have disrupted the traditional (anecdotal) view of NCAs as being primarily concentrated among executives and high-skilled researchers in R&D intensive sectors. However, researchers are still trying to understand why NCAs are used in such a broad range of settings, let alone the full set of welfare implications of NCAs in each occupational or industry setting. These welfare implications include impacts on employers that use NCAs, workers bound by NCAs, other workers and firms operating in the same labor market, as well as consumers.

Strengthening or unifying existing restrictions

Nearly all jurisdictions that allow NCAs regulate the maximum allowable scope and duration of restrictions. For example, regulators could impose that NCAs can never restrict workers for more than one year. Though limited empirical research is available to inform regulators on this topic, strengthening these existing forms of restrictions could further protect workers.

Another regulation that some jurisdictions require is a mandatory pre-specified buyout option for workers. For example, workers can agree to pay a pre-specified share of their earnings during the restricted period to their former employee to cover any harm caused by the job change. This form of regulation builds in some risk protection against NCAs causing extreme earnings losses for workers. It also reduces the chance that NCAs might cause workers to exit the labor force temporarily.

Limitations and gaps

Despite substantial recent interest by labor economists, there remain important gaps in the empirical understanding of the effects of NCAs. Datasets documenting the incidence of NCAs are still very new, limited to the US context, and typically record cross-sectional information that can make it difficult to directly observe the effects of NCAs over a worker's career. With a lack of geographic breadth in studies outside the US, it is not yet known how other institutions or policies aimed at protecting workers may interact with NCAs.

The scope of research on NCAs has also largely focused on workers and firms, while less is known about impacts on consumers. Moreover, the majority of research on this topic has taken a microeconomic perspective, and few studies have investigated macroeconomic implications for aggregate growth. Understanding the comprehensive impacts of NCA regulations on welfare depends upon integrating knowledge from a broader set of applications and contexts than is currently available.

Summary and policy advice

There is strong consensus that NCAs, on average, tend to reduce earnings of low-income workers, and may have disproportionate impacts on the most vulnerable segments of the workforce. For this reason, regulating the use and scope of NCAs may be warranted even though empirical research is still developing.

Regulations can be designed in ways that balance the need to protect vulnerable workers, while still allowing NCAs in other segments of the labor market. Specifically, regulators can impose minimum wages for jobs with NCAs, regulate information disclosure requirements, and potentially mandate that firms compensate workers during the period in which NCAs are likely to harm workers.

Given the potential value of NCAs in some settings, the standard of evidence to support a broader ban, or occupational bans (other than those initiated by professional organizations), should be quite high. Policymakers should await clarity from research specific to occupations or industries in the absence of very compelling motivations that may not require evidence. Subsequent regulations may then consider the new empirical findings that become available as data on NCAs continues to expand.

Acknowledgments

Previous work of the author (together with Matthew Johnson, Michael Lipsitz, William D. White, and Carol Simon) contains a larger number of background references for the material presented here and has been used intensively in parts of this article [3], [6]. This work is based in part upon prior research that was financially supported by: the Russell Sage Foundation, the W.K. Kellogg Foundation, the Robert Wood Johnson Foundation, the Agency for Healthcare Research and Quality, and The California Endowment.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Kurt Lavetti

Noncompete agreements and enforceability

Noncompete agreements (NCAs) are one common type of post-employment restriction. They are designed to prevent workers from exiting a firm and moving to a rival firm, potentially taking valuable intellectual property with them. Most countries that allow noncompetes regulate the maximum allowable scope and duration of restrictions that can be imposed on workers. For example, in service sectors, NCAs may restrict a worker from providing a service within a 15-mile radius around the prior employer for a duration of 12–24 months. In tradable goods sectors, NCAs may restrict employment in an entire industry, regardless of geographic location, for a finite amount of time.