Elevator pitch

Standard economic theory suggests that individuals know best how to make themselves happy. Thus, policies designed to encourage “better” behaviors will only reduce people’s happiness. Recently, however, economists have explored the role of impatience, especially difficulties with delaying gratification, in several important economic choices. There is strong evidence that some people have trouble following through on investments that best serve their long-term interests. These findings open the door to policies encouraging or requiring better behaviors, which would allow people to commit to the choices they truly want to make.

Key findings

Pros

Impatient people behave differently than patient people when making choices with implications for the labor market, including investments in education and job search.

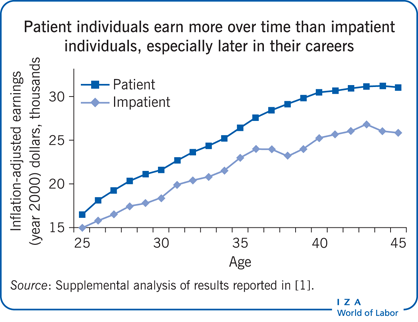

Impatient people end up earning substantially less than their patient counterparts, and the earnings gap grows larger over time.

Much of this behavior reflects “time-inconsistent” preferences, wherein people’s investment preferences change according to how soon they need to pay the costs.

Time-inconsistency makes it easier to justify policy interventions designed to increase individuals’ investment.

Cons

Policies designed to increase investment are hard to justify if people’s choices are “rational.”

Time-inconsistency is difficult to measure directly, so policies are difficult to target appropriately.

The relationship between what economists call “preferences” and what psychologists call “personality” is still incompletely understood.

It can be hard to separate the direct effects of ongoing time-inconsistent choices from the effects of lower levels of investment earlier in life, especially in education.

Author's main message

Economists tend to think that individuals know best how to spend their own resources. As a result, they view policies that are designed to change people’s investment choices as paternalistic and are reluctant to propose them. Yet the empirical evidence strongly supports the idea that a minority of individuals would be happier if they were incentivized or required to invest more for the future. Thus, policies intended to encourage additional schooling or greater job search effort can actually make people happier when the targets of the policies have difficulty with commitment or self-control.

Motivation

When economists model choices that people make over time, a key component is the individual’s level of “patience,” or the discount rate. This personal characteristic determines how much happiness (utility) a person is willing to give up today in order to increase future happiness. Many important economic decisions involve these kinds of intertemporal tradeoffs, including saving for retirement, obtaining additional schooling, and searching diligently for a new job while unemployed. A key question that has emerged in recent research is whether individuals make these decisions in a “dynamically inconsistent” way: people acting in a time-inconsistent way repeatedly intend to make the patient choice in the future, only to succumb to temptation when faced with the immediacy of the costs. This paper discusses recent evidence on the role of impatience in important investment choices affecting the labor market, with a particular focus on patterns that suggest dynamic inconsistency.

Discussion of pros and cons

Policy implications depend on the type of impatience

A classic study in personality psychology demonstrated that the ability to delay gratification strongly predicts a child’s future success across a range of outcomes [2]. For policy purposes, however, it is essential to understand whether individual differences in patience are differences in “time-consistent” preferences for consumption now or later, or whether they reflect personal difficulties committing to choices that individuals initially want to make.

A famous example illustrates the principal distinction between the two types of impatience [3]. Consider the following pair of decisions. In situation A, a person must choose between one apple today and two apples tomorrow. In situation B, a person must choose between one apple one year from today and two apples one year and one day from today. An individual with time-consistent preferences will always choose either one apple earlier or two apples later because, in both cases, getting the second apple requires waiting an additional day. Someone who always chooses the single apple is considered less patient than someone who always chooses to wait for the two apples, but both decisions are time-consistent. In contrast, someone with dynamically inconsistent impatience would initially choose two apples in situation B, but would then, after a year’s wait, give in to the temptation of the immediate gratification of the single apple when presented with situation A. These two types of preferences generate different predictions about how impatience will affect important decisions related to the labor market.

Implications of standard economic models of impatience

Standard economic theory assumes that people make investment decisions “rationally” in order to maximize their lifetime happiness. For example, teenagers choose whether to drop out of high school or to stay enrolled by weighing the future benefits of improved earnings against the costs of staying in school (such as forgone current earnings, academic effort). If two students face the same costs and benefits but one chooses to drop out and the other to continue schooling, the dropout would be considered less patient than the persistent student.

Under this interpretation, however, individual differences in patience are no more remarkable than individual differences in any other kind of preferences. An impatient worker choosing to save little for retirement is no different from a sports-loving consumer choosing to spend a large share of income on tickets to see a favorite team play. Further, if people are making these decisions rationally, it is difficult to justify interventions that incentivize people to be more future-oriented. Even if programs manage to entice people to save more or get more schooling, they will likely decrease people’s happiness relative to letting them make free choices.

Implications of dynamically inconsistent impatience

In contrast, more recent models allow for the types of preference reversals discussed in the apple example above. There are a variety of ways of modeling this self-control problem, but many versions are centered on a conflict between two different “selves” with differing ideas of how best to spend one’s resources [4], [5], [6]. The current self, who wants to enjoy life as much as possible in the present, would like to avoid effort and to consume as much as possible. The future self would rather save and invest now in order to enjoy life more in the future. Without a means of committing to saving or investing, people in these types of models tend to underinvest in the future relative to what they truly desire.

When people have these types of self-control problems, policies that encourage them to be more future-oriented or that help them commit to additional investment can actually improve lifetime happiness. Because of the stark contrast between the two types of models’ implied scope for policies to make people happier, much of the empirical literature has concentrated on determining the importance of dynamically inconsistent impatience in labor market outcomes. Research has found substantial evidence that people suffer from commitment problems in various important choices that affect their entire labor market experience.

Identifying impatient individuals

A key challenge in this type of research is identifying impatient people in standard data sets. Measuring dynamic inconsistency directly is especially difficult. A common type of survey question asks individuals to consider a hypothetical choice between a smaller payment today and a larger payment in the future. These questions are often designed to determine the smallest future payment the survey respondent would accept in order to give up the payment today. Individuals who require large compensation in order to give up a payment today are then deemed to be more impatient.

This (already somewhat complex) measurement has the drawback, however, of conflating standard impatience with dynamically inconsistent impatience. It is not clear whether someone requiring a large payment to wait simply has a strong preference for money now or a self-control problem. To distinguish these two possibilities, researchers must ask questions analogous to the apple example above. They must present individuals with an additional hypothetical choice between receiving money a short time in the future or a longer time in the future while keeping all the other details the same, including the length of time between the early and the late payments. Individuals with time-inconsistent preferences require a larger sum to forgo payment “right now” than they demand to wait the same length of time between two future dates. With notable exceptions [7], few studies rely on this complex measure to characterize individuals’ impatience. In fact, even this well-reasoned measure is vulnerable to concerns that respondents may worry that any promised future payment is less likely to arrive than one offered “right now,” which somewhat clouds the interpretation of these responses.

Instead, multiple studies have relied on a surprisingly powerful measure of impatience: interviewer ratings. In many in-person surveys, the interviewer is asked at the conclusion of the survey to rate the respondent during the interview. Typical choices include friendly/interested, cooperative, impatient/restless/bored, and hostile. Several studies have found that survey respondents rated as “impatient” by their interviewer behave in ways suggesting a difficulty with delaying gratification [1], [8]. The roughly 10–15% of individuals coded this way are more likely to smoke, less likely to have a bank account, more likely to drink to excess, and more likely to leave military service prior to the end of their initial commitments [1].

Further, even though some groups are more likely to be coded as impatient (e.g. men, African Americans, children of less educated parents), those coded as such continue to be more likely to make these impatient choices even after adjusting for a rich set of family background characteristics, including gender, racial group, family income bracket, and parental education.

Evidence of impatience in educational choices

Deciding how much schooling to get affects the entirety of a person’s working career. This section therefore discusses how impatience affects multiple important educational choices.

High school completion

One clever study takes advantage of policy changes to the age when students can legally drop out of school to show how patience affects educational investment [9]. The study, which uses census data from Canada, the UK, and the US, finds that birth cohorts that are required to stay in school longer than previous cohorts enjoy higher earnings, less unemployment, and better health later in life. Each of these benefits was expected—educational investment is known to provide future benefits in exchange for effort and forgone earnings while in school. The most intriguing result, however, is that the affected birth cohorts reported being happier, as measured by life satisfaction questions. This result suggests that many dropouts leave school sooner than they really want to, likely due to a time-inconsistent form of impatience.

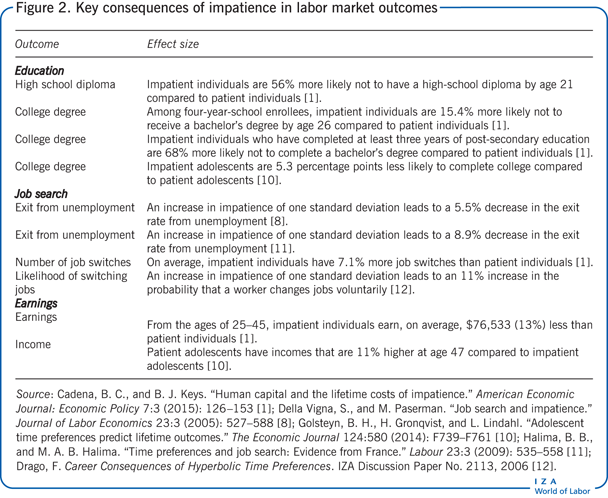

Another study uses the interviewer rating method discussed above to examine directly how impatience affects the high school dropout decision [1]. The key result is that impatient individuals are 56% more likely to drop out of high school than are patient individuals with similar characteristics. The study relies on panel data—the National Longitudinal Survey of Youth (NLSY) 1979—and takes advantage of the fact that students are asked about their educational goals and expectations in early adolescence, when they cannot yet have dropped out of school. When the analysis is limited to individuals who report wanting and expecting to complete high school, it finds similar increases in dropout risk for the impatient. This set of results reinforces the interpretation that, for many students, the decision to drop out appears to be a “mistake” or an inability to avoid temptation rather than a “rational” decision that maximizes lifetime happiness.

Post-secondary education

That same study then tracks individuals who complete high school to see how impatience affects investment in college [1]. The study is especially interested in “preference reversals,” which are the hallmark of dynamic inconsistency. Similar to the high school analysis, the panel data set allows for multiple ways of identifying individuals early in their educational careers who want to get a college degree. The respondents are asked about the highest level of schooling they desire and expect, and as the panel progresses, any college enrollment is directly observed. When the analysis is limited to individuals who say they want to get a college degree or to those who actually enroll, the analysis shows that impatient individuals are 15–20% less likely to complete the degree.

Next, the study considers and rules out alternative interpretations of these differences [1]. Perhaps impatient individuals are more likely to experience financial setbacks, are less informed about the difficulty of college coursework, or are more likely to have mistaken beliefs about how much they would enjoy additional schooling. The study first addresses these concerns by showing that impatient individuals are no more likely to report dropping out because of financial or academic difficulties than are patient individuals. It then presents a key finding that, among students with at least three years of post-secondary schooling, impatient individuals are substantially more likely (68% more) to drop out of college. Presumably, after having completed at least three years of college, individuals have figured out how qualified they are for schooling and how much they like it. After ruling out these alternatives, the most likely interpretation is that impatient individuals’ failure to complete college is a mistake rather than a carefully considered choice.

Another study finds a similar negative effect of impatience on college completion using data from Sweden and an alternative measure of impatience [10]. This study relies on a hypothetical question: asking adolescents to choose between a smaller immediate payment and a larger payment five years in the future. Although this question is not designed to distinguish between the two types of impatience, the results nevertheless reinforce the idea that impatience leads to substantially lower college completion rates.

Evidence of impatience in career paths

Job search while unemployed

After completing schooling, one of the primary ways of investing in future career growth is by changing jobs with the goal of building a career. Job search activity while unemployed presents a particularly intriguing context in which to examine the role of impatience in general and of time-inconsistency in particular.

Traditional job search theory describes individuals as making two important decisions in every time period (such as every week): how intensively they will search for a job, and what wage or salary they are willing to accept to stop searching and start working, which is known as the “reservation wage.” Each decision requires making choices about how to trade off happiness in different time periods. A very influential study shows that the two types of impatience—time-consistent and time-inconsistent—affect these two aspects differently [8]. Importantly, the two types of impatience lead to divergent predictions about differences in how long patient and impatient workers will wait to begin working again after becoming unemployed.

In thinking about whether to accept a job offer at a particular wage, an individual considers whether to reject the offer and forgo income at that salary for a chance at a higher wage by continuing to search. Differences in time-consistent patience affect individuals’ reservation wages, with those who are less willing to wait for a better offer setting a lower reservation wage than more patient individuals do. It is important to understand that the choice to accept an offer or to continue searching involves trading off utility only in the future—between the next period and the following periods. Regardless of whether an offer is accepted or rejected, the unemployed worker remains unemployed today; income from a new job arrives only after the individual starts working in the future. A key theoretical result is that an individual’s level of dynamically inconsistent impatience will not affect any utility tradeoff between two future periods [6]. Thus, differences in individuals’ reservation wages should reflect only differences in time-consistent patience.

The other important choice in job search is how hard to look for a new job. Search effort is costly because it requires forgoing leisure (“free time”) today in order to increase the likelihood of finding employment and thus earning higher income tomorrow. Impatient individuals will therefore choose to expend less search effort for as long as they are unemployed. In this case, because the choice of how intensively to search for work involves trading off utility between the present and the future, a decrease in search effort is predicted for both types of impatience.

Combining these two components yields the total effect of impatience on job search duration. There is a clear prediction that time-inconsistent impatience will lead to longer unemployment duration due to lower search effort because reservation wages are unaffected. For time-consistent impatience, however, the two pieces of the decision go in opposite directions. The lower search effort reduces the likelihood that an unemployed person will receive a job offer in any period, but the lower reservation wage increases the likelihood that the person will accept an offer. The study finds that, under some reasonable assumptions, the reservation wage effect dominates and less patient people will tend to have shorter unemployment durations when their impatience is time-consistent. Thus, the sign of the effect of impatience on job search duration reveals whether the impatience is time-consistent or time-inconsistent.

Using various empirical measures of impatience (including interviewer ratings), the study finds robust evidence that impatient individuals have longer unemployment spells, providing substantial support for the predictions of the time-inconsistency framework. This key empirical test and result were also confirmed using data from France [11]. These results imply, therefore, that for a minority of workers, incentives to exit unemployment earlier or to search more intensely for re-employment may end up improving individuals’ happiness rather than forcing them to accept jobs that they do not really want.

On-the-job search

Searching for a new job while employed is another important determinant of the overall trajectory of an individual’s career. One study shows that impatient individuals are more likely to switch to another employer rather than to invest in a relationship that leads to an internal promotion [12]. This fact can be interpreted as reflecting time-inconsistent impatience under two conditions. First, the rewards from switching employers must be experienced earlier, meaning that someone looking for an immediate increase in income would do better to switch jobs than to try to earn a promotion internally. Second, in the long run, maintaining a consistent relationship with a particular employer needs to lead to higher peak earnings. The study finds empirical support for each of these conditions and concludes that switching employers, even to take a raise, can be viewed as the less patient investment choice.

Another study corroborates the finding that impatient individuals are more likely to switch jobs overall [1]. In addition, it finds that, conditional on switching jobs, impatient individuals are much less likely to experience a substantial increase (at least 10%) in earnings as a result. This increased prevalence of lateral moves confirms the idea that impatient individuals fail to invest in long-term employment relationships that lead to substantial future earnings. Overall, the evidence on job-to-job switching reinforces the interpretation that much of the impatience relevant for the labor market is of the time-inconsistent variety.

Implications for lifetime earnings

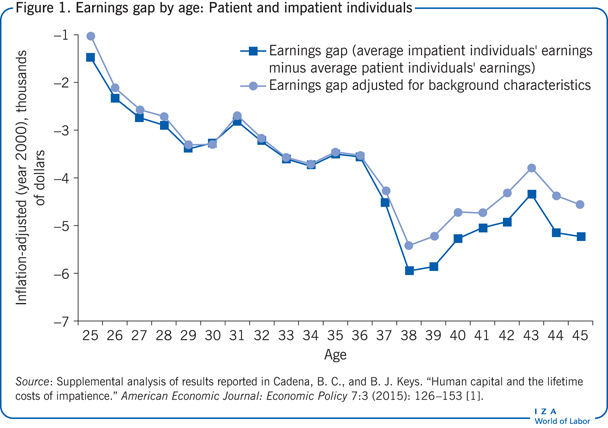

The combination of all of these factors is expected to lead to a substantial disparity in lifetime earnings between patient and impatient workers. Figure 1 presents a straightforward comparison of average annual earnings for these two types of workers using data from the NLSY 1979 and the interviewer ratings method of classifying individuals. The line with the squares shows how much less, on average, impatient individuals earn at every age than patient individuals do. Like many investment mistakes, the costs are small in the beginning, but the losses eventually compound. Early in their careers, impatient workers earn slightly less than their patient counterparts—on the order of $2,000–$3,000 less per year. By middle age, however, impatient workers are earning more than $5,000 less per year.

The line with the circles presents regression-adjusted annual earnings gaps, controlling for a host of background characteristics. This adjustment addresses the concern that measured impatience may reflect other characteristics that are known to influence people’s investment choices and labor market experiences. These controls include parents’ education and income, gender, race/ethnicity, region of the country, urban or rural locale, and measures of parental investment in the respondent’s education. The fact that the two lines are so similar supports the idea that impatience is not simply a proxy for other socio-demographic characteristics and that patience varies substantially within each of these measures. As reported in the original study from which this figure is adapted, the cumulative differences in earnings over these ages adds up to more than $70,000 less for impatient individuals, a difference of roughly 13% [1]. The study on Swedish adolescents and the hypothetical payment question finds a similar percentage difference in income between patient and impatient individuals [10]. Overall, these studies find that many individuals make mistakes when investing in their education and careers that compound into large differences in lifetime earnings (Figure 2).

Limitations and gaps

On the whole, there is substantial evidence that dynamically inconsistent impatience affects a variety of important investments relevant for the labor market. There are, however, some important limitations in the literature. First, it is quite difficult to measure dynamic inconsistency directly, so nearly all of the empirical evidence relies on indirect ways of uncovering the importance of impatience. As a result, many of the results discussed above remain open to alternative interpretation. For example, individuals rated as impatient in an interview may lack other non-cognitive skills, and these deficiencies rather than impatience per se may lead to a lower likelihood of making internally consistent investment choices.

Relatedly, there are several strands of the economics and psychology literature investigating the importance of personality in general and the ability to delay gratification in particular to success in life. The empirical facts are common across these literatures: individuals who are able to exercise self-control and give up current pleasure for a long-term payoff are more successful. The theoretical frameworks across these disciplines, however, remain somewhat disconnected [13]. Additional work will be needed to more closely tie together the constructs of dynamically inconsistent impatience, non-cognitive skills, and conscientiousness.

Finally, one of the challenges in this line of research is that investments, especially in human capital, compound over time. As a result, impatient individuals have lower levels of cognitive ability as they approach future decisions. Especially with complex decisions, this lower cognitive ability may lead to behavior that looks like time-inconsistent choices. In fact, the observed effects of impatience on investment choices typically get smaller after controlling for a measure of cognitive skills [1], [9]. Again, this pattern is fully consistent with impatience being the ultimate cause of the difference in choices. Nevertheless, teasing apart the importance of continuing impatient preferences from that of lower cognitive ability as a result of earlier differences in investment remains a potentially fruitful area for additional research.

Summary and policy advice

On the whole, there is considerable evidence that a minority of individuals make important mistakes as they invest in education and in their careers. Studies suggest that impatient individuals fail to stick with their original plan, whether that plan was to finish a degree, to search hard for a new job, or to invest the needed time and effort to gain a promotion. As a result, impatient individuals earn less than their patient counterparts over their lifetimes.

These results suggest a greater potential role for policies designed to encourage people to do the “right” thing—to stay in school or to find a job when unemployed. In the absence of self-control problems, people would make the choices that make them happiest. In that case, government policy with the goal of changing these choices would rightly be viewed as paternalistic. Further, those affected by the policies would likely resent the additional constraints and end up less happy. The empirical results reported above, however, open the door to a number of potential policy interventions that might otherwise be difficult to justify.

Perhaps the least controversial policy prescription is to support early childhood education programs that have been shown to improve non-cognitive skills, including the ability to delay gratification. By addressing the root cause of impatience, investing in these types of programs could yield very large returns.

For older cohorts, however, evidence shows that it is difficult to change people’s ability to delay gratification. For these cohorts, alternative policy interventions that support additional investment directly are likely to be the most effective. For example, immediate monetary incentives for continued study or lowering the financial costs to complete a degree for students close to the finish line may be especially effective. Programs that pay unemployed workers to engage in consistent job search effort may also reduce time unemployed and improve workers’ satisfaction with their job search results. In fact, stricter constraints, such as raising the minimum age of compulsory schooling may even end up making the affected students happier if the share with self-control problems is larger than the share who would otherwise rationally choose to leave school. Of course, identifying impatient individuals can be difficult, and any financial incentive will likely also benefit individuals who would have completed these investments anyway. Nevertheless, the weight of the evidence suggests that these types of policies would help a substantial number of people achieve the investment goals that they desire but have trouble committing to.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Greg Madonia provided excellent research assistance. The author graciously acknowledges that many of the ideas presented in this article draw heavily on previous collaborative work with Ben Keys, including [1].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Brian C. Cadena