Elevator pitch

Standard economic theory suggests that individuals know best how to make themselves happy. Thus, policies designed to encourage “better” behaviors will only reduce people’s happiness. Recently, however, economists have explored the role of impatience, especially difficulties with delaying gratification, in several important economic choices. There is strong evidence that some people have trouble following through on investments that best serve their long-term interests. These findings open the door to policies encouraging or requiring better behaviors, which would allow people to commit to the choices they truly want to make.

Key findings

Pros

Impatient people behave differently than patient people when making choices with implications for the labor market, including investments in education and job search.

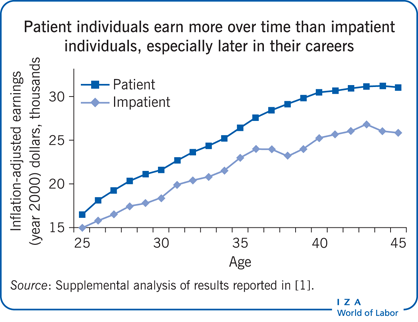

Impatient people end up earning substantially less than their patient counterparts, and the earnings gap grows larger over time.

Much of this behavior reflects “time-inconsistent” preferences, wherein people’s investment preferences change according to how soon they need to pay the costs.

Time-inconsistency makes it easier to justify policy interventions designed to increase individuals’ investment.

Cons

Policies designed to increase investment are hard to justify if people’s choices are “rational.”

Time-inconsistency is difficult to measure directly, so policies are difficult to target appropriately.

The relationship between what economists call “preferences” and what psychologists call “personality” is still incompletely understood.

It can be hard to separate the direct effects of ongoing time-inconsistent choices from the effects of lower levels of investment earlier in life, especially in education.