Elevator pitch

Whether or not international trade exposes workers to economic insecurity depends on the nature of the trade exposure of the firm, or industry, in which the worker is employed. Import-competing industries experience higher levels of risk to workers’ incomes and employment, while firms that import intermediate production stages (“offshoring”) display bigger employment responses to small changes in workers’ wages, and are more likely to shut down home factories. But offshoring also helps firms weather economic shocks. Offshoring firms are more likely to survive and provide greater employment stability to their workers.

Key findings

Pros

Employment is more stable in firms that export goods to other countries.

Shifting some production from home factories to factories located in other countries (offshoring) may protect firms against temporary economic shocks and ensure greater employment stability for their workers.

Firms that engage in international trade, either by importing or exporting, have a higher probability of long-term survival.

Cons

Offshoring makes firms more responsive to changes in cross-country economic conditions, which could lead to larger swings in employment and wages at home.

The higher the level of net imports at the sector level, the higher the rate of job turnover among workers in that sector.

Offshoring intermediate production stages makes employment more responsive to wage changes and can lead to shutdowns of home factories.

Income risk (measured as the variance of unpredictable changes in income) is higher for workers employed in import-competing sectors.

Author's main message

Although free trade results in gains in aggregate (economy-wide) welfare, the process of job creation and job destruction that it involves is not orderly or costless. The distribution of these gains is uneven across segments of the population and associated with a high level of uncertainty. This can result in higher levels of economic insecurity, with even similar types of workers experiencing very different economic outcomes. Extending the size of the social safety net necessary to insure workers against this risk, and introducing policies that ease the adjustment costs, would help address this problem and mitigate the risk.

Motivation

Evidence supports the idea that aggregate welfare improves when countries trade with one another. The increase in welfare arises from having access to a greater variety of goods and services, lower prices, and productivity gains due to the reallocation of factors of production. Despite these aggregate benefits, however, there is a widespread public apprehension that economic insecurity will increase because of trade. The intuition behind this is that an increase in competition from foreign firms can drive domestic firms out of business and destroy jobs. The firms that do not go out of business are often left in precarious situations, with razor-thin profit margins, with the possibility that they could go out of business at any time. In addition, some firms might respond to the increase in foreign competition by shifting production stages abroad (offshoring) and substituting domestic workers with cheaper foreign workers. These changes imply an increase in employment and income volatility for workers employed in these firms.

What is not so often acknowledged, however, is that by offshoring production, firms can increase their productivity and their chances of survival, which would lead to higher demand for their goods and to potentially both higher incomes and greater stability for the domestic workers who remain employed. Similarly, international trade results in an expansion of employment in exporting sectors, especially in exporting firms. Employment in these firms is more secure, since these firms are in a better position to diversify and withstand fluctuations in the domestic market.

This article provides a brief background and summary of the key empirical findings on the association between international trade and economic insecurity faced by domestic workers. Economic insecurity is discussed along four dimensions: (i) the responsiveness of labor demand to changes in wages (i.e. the “elasticity of labor demand”); (ii) employment volatility; (iii) firm survival; and (iv) wage volatility and income risk.

Discussion of pros and cons

The responsiveness of labor demand to wages

One channel through which trade in final goods and offshoring (trade in intermediate inputs) could increase long-term economic instability is through their impact on “labor-demand elasticities.” Labor demand elasticity is a measure of the responsiveness of demand for labor to changes in market wage rates. The elasticity of labor demand will be higher (i.e. more elastic) if a small increase in wage rates results in a large decrease in employment in the firm. This would be the case if the firm can easily and quickly substitute between labor and other factors of production, such as capital or intermediate inputs, in response to an increase in wages. Similarly, the labor demand of a firm will be more responsive to changes in wages if the firm is operating in a highly competitive environment where the demand for its final product is very responsive to changes in prices. Due to competitive pressures, such a firm will have little ability to pass on higher labor costs to consumers through higher prices, and it would therefore be more likely to respond to an increase in wages by cutting employment.

More competition due to a decline in trade protection and to the possibility of using foreign labor in place of domestic workers could raise the responsiveness of labor demand to wages. Declining trade barriers, together with improvements in communication and information technologies that reduce monitoring and transportation costs, allow firms to import cheaper (and a larger variety of) inputs that are substitutes for the services of domestic workers. More trade openness, by increasing access to a broader variety of goods, also expands substitution possibilities in the consumption of most products, which increases the sensitivity of consumers to prices. The easier it is for consumers to substitute across final products, and for firms to substitute across inputs in the production process, the more responsive labor demand will be to changes in wages.

An increase in the responsiveness of firms to changes in labor costs has important implications for the level and perception of the insecurity that workers in an economy face. Employment and wages will become more volatile as firms react to changes in productivity or output demand with a bigger adjustment of how many workers they hire and how much they pay them. In addition, firms’ greater responsiveness to labor costs may increase the variability of wages, even for workers who do not switch employers. This is because higher labor demand elasticities weaken the bargaining power of workers and reduce labor's share of industry profits. As such, there is less scope for risk-sharing arrangements between workers and firms (e.g. firms providing stable wages to long-term employees despite fluctuations in labor market conditions).

But how much more responsive have firms become to labor costs as a result of international trade and offshoring? The empirical evidence on the effects of final goods trade on labor demand elasticities is mixed. It is known from industry-level evidence for the US that labor demand for blue-collar workers became more responsive to changes in labor costs in most manufacturing industries between 1961 and 1991, but the contribution of increased trade to this greater responsiveness is unclear [2]. Findings of studies that focus on trade liberalization periods in developing countries are similarly mixed. Following trade reforms in India, labor demand elasticities increased, in particular in industries that experienced a bigger decline in protection. A similar analysis for the trade liberalization period in Turkey yields no association between the responsiveness of employment demand and greater trade openness.

There is stronger empirical support for the existence of a positive association between offshoring and labor demand elasticities, i.e. that being able to move manufacturing processes offshore makes firms more responsive to domestic labor costs. An analysis using establishment-level data for the US manufacturing sector between 1972 and 2001 provides strong evidence that offshoring causes firms to become more responsive to the labor costs of blue-collar workers, both in the short and long term [3]. Similarly, a strong cross-sectional association between higher labor demand elasticities and higher average offshoring intensity is documented for a set of 11 OECD countries over the period 1980–2002 [4].

There are many studies showing that multinational firms with production in several countries have higher labor demand elasticities, thus providing further evidence that offshoring might lead to larger changes in labor demand. Multinational firms are more likely to engage in offshoring and may find it relatively easier to downsize employment in response to a negative shock in certain markets by simply shifting production across plants. The “footloose” nature of these firms makes them more responsive to changes in local labor costs and implies greater employment instability for industries with a high share of such firms. Analysis of data from the UK during the 1990s supports this idea: the more an industry is exposed to foreign direct investment, and the greater its share of multinational firms, the higher the workers’ perceptions of economic insecurity.

The strength of the relationship between openness and labor demand elasticities depends on the institutional environments governing the labor market. A common finding across several studies is that this association is stronger in countries (or in states within a country) that have more flexible labor markets, with little or no restrictions on hiring and firing of workers. In other words, the more flexible the labor markets, the more that trade openness is associated with greater responsiveness of employment to changes in wages [5].

Employment volatility

An important component of economic insecurity that workers face is the increased probability of displacement. An emerging strand of the literature studies the contribution of trade to employment instability in the labor market by analyzing the volatility of employment in industries and firms that differ in terms of their exposure to international trade.

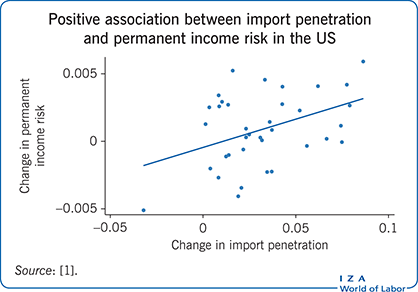

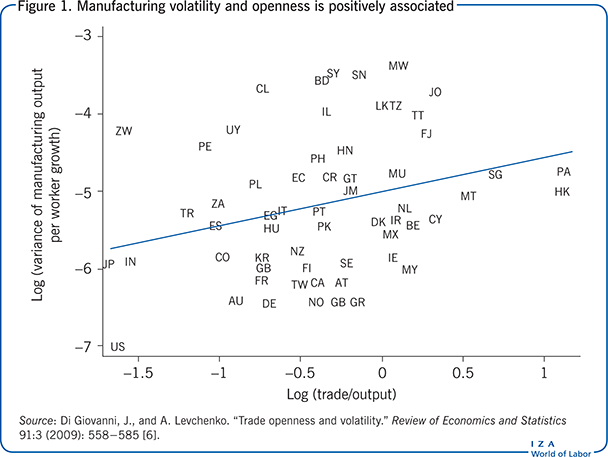

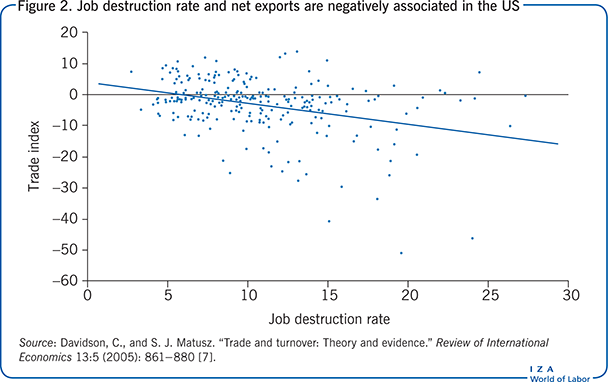

A comprehensive analysis of cross-country data at the industry level (over 1963–2003) suggests that greater trade openness is associated with an increase in the volatility of output in individual sectors (Figure 1) [6]. The higher levels of volatility arise from increased vulnerability of more open industries to fluctuations in global demand and supply. As depicted in Figure 2, there is also some evidence of a negative correlation between job destruction and net exports, and thus a positive correlation between rates of job turnover and the level of net imports, at the sector level in the US. This relationship derives mostly from job destruction and worker separation rates, and to a lesser extent, from job acquisition rates [7]. This finding is complemented by firm-level studies, with results showing that firms operating in import-competing sectors in the US face more employment volatility.

Although firms within an industry may be exposed to some common shocks, it is also well-known that within industries firms differ significantly in their level of global engagement. The majority of firms do not trade; they sell their products domestically and purchase their inputs from the home market. Some firms do, however, engage in international trade by exporting their products and by importing intermediate inputs, raw materials or machinery. Such internationally connected firms are likely to differ from firms that do not participate in international trade, in terms of both the size and the volatility of shocks to which they are exposed, as well as in their ability to diversify across markets in order to smooth out shocks. As a result, the employment stability experienced by workers employed by these globally engaged firms could be quite different from that experienced by workers employed in firms serving purely the home market.

Workers employed in exporting firms may experience higher levels of employment instability if exporting is inherently a risky activity. This may be the case since exporting firms are more subject to variation in exchange rates and transportation costs. Similarly, if the home country is more stable compared to its trading partners (i.e. volatility of shocks are lower at home compared to its trading partners), then exporting may expose workers employed in these firms to higher levels of employment volatility. This scenario is more likely in the case of firms in developed countries that export to developing countries, which tend to exhibit more intense fluctuations in GDP. In contrast, firms that export to a number of different countries, which presumably experience different business cycle conditions, may be in a better position to diversify risk and withstand fluctuations in the home market. If this latter effect dominates, workers employed in these firms will experience higher levels of job stability due to these international interactions.

The consensus in the empirical literature, based on firm-level data from a number of developed countries, is that the latter effect of risk diversification does indeed dominate, and that employment in exporting firms is relatively more stable compared to firms serving only the home market [8]. While part of the relative stability of employment can be explained by favorable characteristics of exporters, such as their higher shares of skilled workers, greater productivity, and bigger size, it is still the case that employment volatility in exporting firms is lower, on average, even after accounting for these different characteristics. For example, workers in two firms that are identical in terms of the share of skilled workers they employ, their productivity, and their size, will still experience different levels of employment stability depending on whether or not the firm serves the foreign market along with the domestic market. Further evidence for the diversification argument is that workers employed in firms that export to a larger number of countries are less exposed to employment fluctuations. This suggests that an exporting firm is in a better position to respond to a negative shock, such as a decline in demand in the home market, by shifting sales to foreign markets instead of simply downsizing their workforce. It is important to note however, that the greater stability of total employment in exporting firms does not necessarily suggest the absence of compositional changes within the firm (e.g. skill upgrading in response to imports from low-income countries), and hence does not rule out the possibility of welfare losses for some workers in these firms.

Similarly, workers employed in firms that import intermediate inputs could be more or less stable compared to firms that do not. On the one hand, as discussed earlier, by increasing the substitutability of domestic and foreign workers, importing may allow firms to respond to any change in domestic wages by adjusting the level of its imports, which will make employment at the firm more volatile. Similarly, importing may increase the exposure of the firm to supply chain risks or to shocks abroad that are possibly more volatile. Consistent with this argument are the findings of a novel paper of an almost one-to-one drop in output of US affiliates of Japanese firms in response to the large decrease in imported inputs from Japan after the 2011 Tohoku earthquake.

It is also possible, however, that offshoring could simultaneously decrease employment volatility in the offshoring country while it increases volatility in offshoring destinations. Multinational companies based in developed countries perform a combination of headquarter operations (such as management, marketing, and research and development) and some production activities at home, and offshore other production activities (mainly those requiring lower levels of skill). For example, the maquiladoras—assembly plants located on Mexico's northern border with the US—import parts and components produced in the US on a duty-free basis, assemble or process these intermediate inputs into final products, and then export these products back to the US. US firms in these industries specialize in component production, research and development, marketing, and other headquarter activities, while the maquiladoras mainly do assembly and low-level processing. Such global production networks may allow offshoring industries to smooth adjustments to business-cycle fluctuations in the US by shifting more production activities to Mexico during booms, and the reverse during a recession. This idea is broadly consistent with the finding that maquiladora industries in Mexico experience fluctuations in employment that are twice as large as those in the corresponding industries in the US [9]. Also consistent are findings of firm-level studies for the US and Denmark, which show lower employment volatility in firms simultaneously engaged in both importing and exporting, since these firms have multiple channels through which to mitigate risk.

Firm survival

Firm survival also contributes to the economic insecurity faced by workers through its effect on displacement risk. As is the case for employment volatility for firms that continue to operate, there are various reasons to expect firm survival to be associated with international trade. By selling in both the home market and a number of foreign destination countries, firms that export may be in a better position to survive a negative demand shock at home by shifting sales to the foreign market. Similarly, domestic firms that gain access to cheaper intermediate inputs because of trade may be in a better position to survive negative shocks. Additionally, access to more technologically sophisticated imported machinery may make firms, especially in developing countries, more productive and resilient to economic fluctuations.

A number of empirical studies have documented higher rates of survival for trading firms. Exporting firms and importing firms are less likely to shut down, which is true even when it is taken into account that trading firms tend to have more favorable characteristics (e.g. older, larger, more productive, employ more skilled workers) [10]. There is some evidence from Chile and Germany suggesting that what matters for survival is the importing activity of a firm; exporting per se does not increase survival rates unless the firm also imports.

Trade exposure at the industry level also matters. Workers employed in establishments operating in industries that face a high level of import competition, especially from low-income countries, are likely to experience greater chances of job loss due to factory closures [11]. This association is estimated to be larger in the US for labor-intensive firms. This is consistent with competition from low-wage countries forcing US factories out of product markets that are at odds with US comparative advantage.

Even if firms that import are more likely to survive, firms that offshore certain production stages abroad may be more likely to shut down an individual plant at home. For example, an automobile manufacturer may shut down all its factories that produce wiring harnesses, or the facilities that perform assembly services, if it is more profitable to perform these stages abroad, either within or outside of the firm. Empirical findings for various countries suggest that firms with multiple production locations are more likely to use factory shutdowns as an adjustment margin. While domestic factories owned by multinationals are less likely to close down than factories in domestically owned firms, the lower probability of shutdown for these factories is entirely due to the characteristics of the factories and the industries in which they operate. In fact, once these attributes are controlled for, factories owned by multinational firms have a significantly greater likelihood of shutting down. This is especially the case for establishments that differ substantially in their production technology from the rest of the firm [12].

Wage volatility and income risk

Another dimension of economic insecurity is income risk. Workers in a given industry experience differential changes in incomes. Some variation in incomes across workers in a given industry is due to differences in worker characteristics, such as labor market experience, level of education, occupation, gender, and race. What remains unexplained after accounting for these factors is the variation in individual income that is not due to changes in returns to these observable characteristics. In this sense, the remaining unexplained component measures the unpredictable part of changes in individual incomes. The variance of unpredictable changes in incomes is considered a measure of income risk as it captures variation in income changes across workers that are otherwise very similar in terms of their observable characteristics. Such variation could result from differences in wage outcomes across two otherwise identical workers; for example, one worker might initially work in a firm that eventually shuts down and the other works in a firm that continues to operate. Future wage changes may be quite different for these otherwise identical workers simply because one of them experienced a bout of unemployment, or was forced to switch to a different industry or occupation after being laid off. Importantly, this one-time shock (firm closure in this example) could have permanent effects on the wage paths of these two workers, which are mostly unpredictable and hence considered as risk.

There are various channels through which an increase in exposure to import competition would result in higher income risk. Increase in displacement risk due to increase in employment volatility or increase in the likelihood of a factory shutdown are important factors. If the resulting job loss is short-lived and the worker finds a comparable job, then the loss of income will be temporary and may not have large long-term effects on a worker's welfare. Alternatively, trade-related displacements may force individuals to move across sectors or occupations, which may lead to permanent income losses, as their previous work experience may not be valued and not be rewarded in their new sector or occupation. Specifically, firm shutdowns, or the offshoring of various stages of production, leave workers trained in these production processes without prospects for similar jobs (potentially for the rest of their working life), as such jobs no longer exist to the same scale domestically.

Even workers who are not displaced and remain employed within a firm may experience greater wage instability. One possible reason, as previously discussed, is that trading firms may be more exposed to world demand and supply shocks, and they may respond to these by cutting the hours or compensation of their workers. Another less discussed, but related, explanation for greater wage volatility is the change in the strength of employment relationships and scope of risk-sharing arrangements between workers and firms [13]. The argument is that workers and firms engage in implicit contracts—often referred to as an “invisible handshake”—whereby wages are negotiated when workers are hired by a firm and are subsequently either partially, or completely, shielded from external labor market conditions (e.g. changes in the unemployment rate). If increased trade competition reduces the value of implicit agreements, perhaps due to a decline in long-term relationships associated with greater worker turnover, then the sensitivity of workers’ wages to the current unemployment rate should increase. This has been documented to be the case in the US for industries facing heightened import competition.

Consistent with these arguments, there is evidence that the income risk faced by US workers increased between 1993 and 2003. Workers who switched industries experienced higher income risk compared to those who remained in the same industry throughout the observation period. Among switchers, income risk for those who entered the non-manufacturing sector was higher than for those who were able to remain employed within the manufacturing sector. Most importantly, within-industry changes in income risk were strongly associated with changes in import penetration during this period [1]. It was also the case that income risk increased for workers in sectors facing larger tariff reductions during the trade liberalization with Mexico. The welfare effects of this increased income risk, measured in terms of declines in lifetime consumption for affected workers, was substantial in both countries.

Limitations and gaps

The literature that explores the link between trade and economic insecurity by studying volatility and risk fills an important gap in the empirical literature which, for the most part, has studied the “mean” effects of trade on labor markets. Although this literature has uncovered nuanced ways in which international trade can impact the displacement and income risk, the picture is still incomplete.

First, most of the existing evidence is based only on a small number of countries, which makes it difficult to generalize. Part of the problem is lack of appropriate data for such analysis. The estimation of firm-level volatility or individual income risk requires longitudinal data over a long duration. Moreover, such information is needed for a large enough sample of firms or workers to allow for variation across industries or occupations that differ in terms of their exposure to international trade. Such data are available for only a small set of, mostly developed, countries.

Second, there is a disconnect between papers that study the link between economic insecurity and trade using firm-level data and those using worker-level data. These studies differ in terms of the variation in trade exposure they exploit and the measures of economic insecurity they use. Future work should take advantage of the increasing availability of worker–firm matched data sets, which will allow a more unified approach in attempting to answer this important question.

Given the empirical evidence on the positive association between trade and economic insecurity for certain segments of the population, an important next step is to both theoretically and empirically assess various policy options in reducing the welfare costs associated with increases in economic insecurity.

Summary and policy advice

Heightened public concern regarding globalization exposing workers to increased economic insecurity—both in the form of displacement risk and income risk—is not without justification. An increase in international trade may induce a reallocation of workers across industries and firms and, in the process, expose workers to a greater possibility of income losses and unemployment. But the argument is more nuanced and the empirical evidence in most cases is mixed. The evidence consistently points to higher income and displacement risks in import-competing industries, and lower levels of employment instability in exporting firms and industries. But while offshoring firms are more likely to close factories, and are more responsive to changes in wages, overall employment in these firms appears to be more stable, on average.

Quantifying the magnitude of the relationship between trade and job insecurity for different segments of the population is important for evaluating the impact of trade reform, and for generating further support for mutually beneficial trade through addressing a broadly expressed public concern.

It should be emphasized that the policy response to measured and perceived increases in economic insecurity due to openness is not protectionism—such a response would decrease welfare by restricting access to greater variety of goods and inputs, raising prices, and result in an inefficient allocation of resources. Moreover, it opens the door for retaliatory protection from other trading nations, which will negatively impact world economic growth. Rather, the policy recommendation would be to extend the size of the social safety net necessary to insure workers against this risk and introduce policies that ease the adjustment costs on affected workers. One such policy is re-training programs (e.g. subsidized community colleges, short skill-training classes) that allow workers to move away from shrinking industries or occupations that are no longer in high demand to new industries and occupations that are expanding.

Trade adjustment assistance should also be revived and expanded to provide a buffer for workers while they are unemployed and searching for a job or are back at school to get re-training. This additional insurance will allow displaced workers to afford being off the market as they search for a job that matches their existing skills, or as they get re-trained for skills that are in high demand. Without such insurance these workers are forced to take the first job they find; such jobs are often in the service sector with low wages and unstable employment.

In addition, programs that facilitate matching of workers with firms, and increased mobility of workers, would reduce the aforementioned costs by speeding up the trade-induced reallocation.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Mine Z. Senses

Income risk

Income risk is measured as the variance of unpredictable and permanent changes to worker income. An example of a permanent income loss would be losses experienced by individuals moving across sectors. These workers may experience permanent income losses since their work experience may not be valued, and thus not be rewarded, in their new sector. On the other hand, income losses experienced by workers who see changes in hours worked or sickness or a temporary job loss, may face income losses only for a brief period of time. The focus on permanent income changes arises from the observation that while workers can borrow or use their own savings to smooth consumption when faced with temporary income shocks, this is not the case for permanent income shocks. As a result, compared to transitory shocks, highly persistent income shocks will have a far more significant effect on the well-being of workers.

It is important to emphasize that income risk is a distinct concept from wage inequality. For instance, consider a situation in which the distribution of income remains unchanged between two time periods (i.e. income inequality is unchanged). It is still possible for workers to have switched positions with each other under the same income distribution in a manner that is not predictable, thus experiencing risk. This is a situation in which the variance of unpredictable income changes (income risk) increases between the two periods without an increase in the variance of income (income inequality).