Elevator pitch

Digital payment systems can conveniently and affordably connect entrepreneurs with banks, employees, suppliers, and new markets for their goods and services. These systems can accelerate business registration and payments for business licenses and permits by reducing travel time and expenses. Digital financial services can also improve access to savings accounts and loans. Electronic wage payments to workers can increase security and reduce the time and cost of paying employees. Yet, there are challenges as many entrepreneurs and employees lack bank accounts, digital devices, and reliable technology infrastructure.

Key findings

Pros

Digital payments can increase an entrepreneur’s profitability by making financial transactions with customers, suppliers, and the government more convenient, safer, and cheaper.

Paying wages digitally benefits employees and is safer and more cost-effective for employers.

Digital payments automatically provide users with a credit history and can thus improve an entrepreneur’s access to credit.

Digital payments give women entrepreneurs greater control over their income, potentially benefiting their entire household, especially children.

Cons

A strong financial infrastructure, including access points such as mobile phones, is needed to support digital payment systems.

Many entrepreneurs and employees lack documents such as government-issued identity cards or birth certificates, which are required to use digital services.

Entrepreneurs and employees often lack financial literacy, making it harder for them to use digital financial products efficiently.

Author's main message

Digital payments improve the speed and reduce the cost of payments between entrepreneurs and suppliers, employees, customers, and governments. Digital financial systems make it easier for entrepreneurs to access credit products to start and expand their businesses and encourage formal entrepreneurship by facilitating compliance with regulatory and tax obligations. Governments in developing countries can promote digital financial services by investing in the necessary physical and regulatory infrastructure and collaborating with private entities to offer training for potential users.

Motivation

Entrepreneurship, both formal and informal, is a critical source of labor force participation and income. In 2021, 11% of adults in high-income countries were self-reported entrepreneurs versus 25% of adults in developing countries, where entrepreneurial activities might be the only source of income in nations with few formal employment opportunities [1]. Entrepreneurship also creates new wage employment and contributes to increased labor force participation.

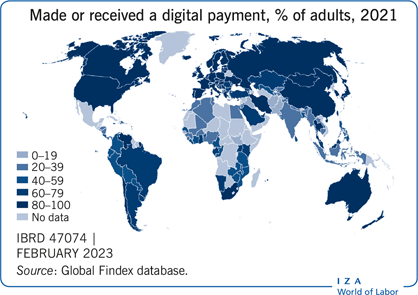

Digital payment systems allow entrepreneurs to pay for goods or services electronically, using a mobile phone, the internet, retail point of sales, and other broadly available access points instead of using cash or checks. The share of adults making or receiving digital payments in developing economies grew to 57% in 2021, from 35% in 2014 (see the Illustration) [2]. For entrepreneurs, especially in developing markets, access to digital payment platforms is more than just a convenience. For those starting a business, digital payments can speed up business registration and reduce the transfer time on payments for business licenses and permits. Access to digital platforms can increase participation in e-commerce. It can also improve supply-chain management as well as interactions with clients and vendors. Electronic wage payments to employees save time, reduce costs, increase transparency, and empower workers by giving them an account and access to financial services such as loans. Entrepreneurs can build a credit history that will improve their ability to access working and investment capital. For larger-scale entrepreneurs, digital applications like e-filing of business and employee taxes and social benefits can reduce the cost of tax compliance. Digital payments are evolving with technological advances in mobile phones/internet, contactless solutions such as QR codes, Big Data analytics, application programming interfaces (APIs), and biometric technologies. These innovations significantly simplify the payment process by developing new delivery channels and payment methods, helping in customer onboarding, and improving the precision of real-time approvals.

Discussion of pros and cons

Digital payments benefit customers, suppliers, and the government

Moving from cash to digital payments can increase an entrepreneur's profitability by reducing operating costs and making it easier to manage trade contracts, delivery records, and accounts receivables. Making and receiving digital payments can increase an entrepreneur's participation in e-commerce and improve their interactions with clients, vendors, and financial institutions. For instance, digital records can help entrepreneurs better manage their inventory stock and make cheaper procurement decisions. Small shop owners, for example, can track their sales by product type and day of the week and use this information to optimize inventory management. Entrepreneurs can make digital payments to suppliers more frequently, lowering the number of days of extended trade credit and working capital expenses (by reducing accumulated interest on supplier loans). Digital financial payments also facilitate record keeping and improve transparency by creating an easily traceable electronic trail that can reduce document-related fraud. A study finds use of digital payments and cards reduced manual intervention and reconciliation efforts, making them three times more cost-effective on average than traditional purchase order costs [3]. Entrepreneurs receiving digital payments have less cash on their premises and therefore face a lower risk of theft. Digital payments might be especially important for the success of female entrepreneurs. Long travel distances, social norms, and family responsibilities often prevent women from traveling to faraway suppliers or bank branches. Digital payments can help them overcome such limits on their mobility by making it easier to access money and the marketplace.

For larger-scale entrepreneurs, digital applications like e-filing and e-payment of license fees, registration fees, income taxes, and property taxes can lower the cost of tax compliance and reduce travel time and face-to-face interactions with tax officers. This can also encourage formalization of businesses and help create a larger tax base for governments. Greater formalization of labor contracts offers workers social benefits and protections, while digital technology can make it easier for entrepreneurs to make employment taxes and social security payments online. Digital financial payments can improve the efficiency of government programs to support small businesses by directly transferring money into the intended beneficiaries’ accounts. This improves the transparency of financial transfers and reduces “leakages”—the tendency for small sums of money to be pilfered by middlemen. In India, for example, researchers evaluated the impact of biometrically authenticating cash transfers to the beneficiaries of a government employment program in the state of Andhra Pradesh using only a fingerprint. They found this method of transfer was faster, less corrupt, and more predictable [4].

Digital payments of wages also benefit employees

For larger-scale entrepreneurs with employees, making the transition to digital forms of wage payments can save money and time. In 2021, 17% of adults in developing countries (61% of private sector wage recipients) received a private sector wage payment directly into an account (Illustration) [2]. These digital payments also give employees access to formal financial services including accounts and loans, thus giving them more control over their financial lives. A study in Bangladesh found that the average factory reduced wage distribution costs by more than 50% within two years after it began paying workers directly via digital bank accounts [5]. Traditionally, factory owners often spend considerable amounts of money bringing in cash-filled trucks to distribute wages to workers. Guards must be hired to safeguard the process and production time is lost when workers stand in line for their pay. Electronic wage payments eliminate these wasteful practices. They also ensure the accuracy of workers’ payments and provide the added potential to assist with audits and supply-chain accountability—for example, the timing and amount of wage payments are already documented in the monthly digital transaction records received from the bank or the mobile payments provider. This same study in Bangladesh estimated the cost of wage payments in cash to factory workers is around $0.44 per worker per month [5]. A study in Afghanistan supports these results, finding immediate and significant cost savings for employers who switch to digital wage payment methods, especially from the security benefits of eliminating cash transactions [6]. Similarly, another study has estimated that digital wage payments can save large garment factories at least $1,700 per month in Cambodia [7].

Furthermore, electronic wage payments produce great benefits for employees. A study in Bangladesh found that employees paid into an account doubled their savings, improved their risk management, and increased their ability to make transactions without assistance, relative to workers paid in cash [8]. Digital payments can also be more secure for employees than manual cash payments, which can be more easily stolen or misappropriated. While security is always a concern when traveling with large amounts of cash, this is especially salient with respect to regular cash payments—such as wages—that are received at publicly known locations and points in time. Electronic wage payments also allow employees to store money in traditional accounts or e-wallets—71% of adults who receive wages digitally store money in accounts in developing economies [2]. They can cash out their wages at their convenience or directly transfer funds to pay for electricity bills or school tuition for children. Evidence from the US shows that when the government introduced the Electronic Benefit Transfer (EBT) in the mid-1990s and thus switched from delivering social cash transfers by paper checks, which needed to be cashed, to electronic debit cards, the overall crime rate over the next 20 years was reduced by almost 10% as a direct result [9].

Moving to digital wage payments can also contribute to women's economic empowerment in several ways. Socio-cultural issues and other factors might prevent women from controlling their own money and assets. But electronic payment can give recipients greater control over how their money will be used—particularly if the payment is tied to a stored-value product, such as a formal account or an e-wallet, which makes it harder for family and friends to access the funds. Evidence suggests that digital transfers empower women within their own households: unlike cash payments, the arrival of a digital payment is typically private information. This allows the recipient to conceal the payment, at least temporarily, from other household members or friends who may demand money that would otherwise benefit the entire household. A large body of empirical literature suggests that income in the hands of women, compared with men, is associated with larger improvements in child health and more spending on nutritious food, health, and housing.

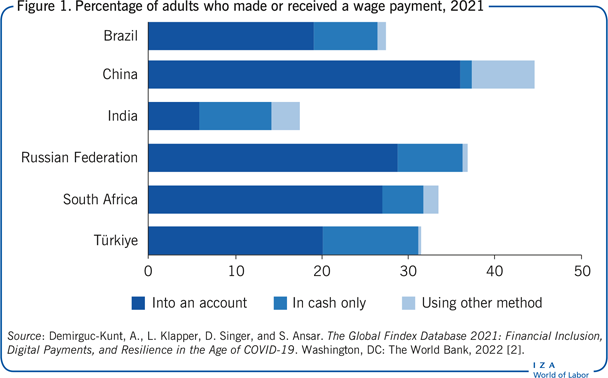

Electronic wage payments have the added benefit of drawing large numbers of previously unbanked workers—those who do not use the services of banks or similar financial institutions—who enjoy stable employment and verifiable monthly incomes, into the formal financial system. This allows these workers to become more financially competent by giving them a strong incentive to conduct regular formal financial transactions. In 2021, 32% of adults in developing economies reported first opening their account to receive wages [2]. Migrating private sector employers from paying cash to making electronic wage payments would bring an estimated 175 million unbanked adults around the world into the formal financial sector (Figure 1) [10]. This can serve as a bridge to other digital finance products such as savings, credit, and insurance services that provide greater security, convenience, and economic opportunities, especially for low-income workers. Digital wage payments also create the opportunity to embed workers in a system of automatic deposits, scheduled text reminders, and positive default options that can help people overcome psychological barriers to saving money. A substantial collection of literature shows that small “nudges” may have a significant impact on forward-looking financial and nonfinancial behaviors involving defined-contribution pension accounts and commitment savings products that allow users to save money over time. According to the Global Findex Database 2021, of the adults who receive wages digitally in developing economies, 91% of adults make digital payments (including making utility payments, merchant payments, and sending remittances), 48% borrow formally, and 51% save formally [2].

Digital payments history can improve access to credit

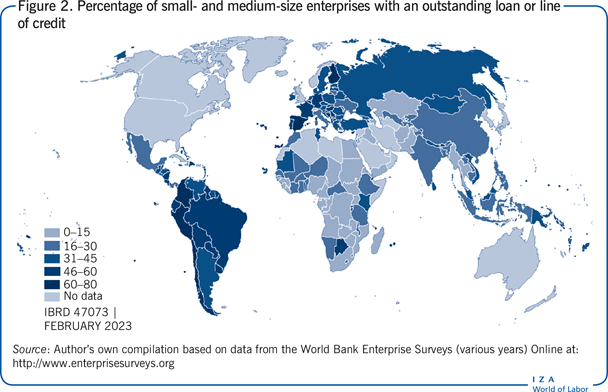

Digital payments can also increase an entrepreneur's access to formal financial services including credit. According to the most recently available World Bank Enterprise Surveys, in 154 countries, half of all small and medium firms around the world need a loan, but only 33% have a bank loan or line of credit (Figure 2) [11]. In particular, small-scale entrepreneurs often have limited access to formal credit. In many developing countries, credit information bureaus are nascent or nonexistent, making it difficult—not to mention expensive—for financial institutions to price risk when making a lending decision. In turn, these financial institutions charge high interest rates, demand significant collateral (often more than 100% of the value of the loan) and require guarantors. Thus, new and small-scale entrepreneurs—who may not have formally banked in the past or do not have the necessary collateral and guarantors—are often unable to secure credit.

The onset of the Covid-19 pandemic, followed by the unprecedented government intervention and regulatory forbearance to mitigate the impact of the crisis, have reduced visibility into borrower viability and increased credit risk. Reporting practices around loan moratoria and debt restructuring are further clouding visibility into actual credit performance. Mitigation efforts, including lockdowns, further hindered access to finance. Lenders could not meet new clients, verify identities, or evaluate businesses’ operations on site, impeding in-person collections and group meetings—processes that are central to many microfinance business models.

Digitizing financial services can help entrepreneurs overcome these challenges. Data analytics of digital transactions such as digital payments to suppliers and from customers, as well as electronic payments from an account for utility and rent payments, can help create a qualifying credit score for an entrepreneur to start or grow their business. For example, in the US, the inclusion of utility and telecom payment histories reduced the share of adults who were financially “unscorable” from about 12% to 2% and reduced the estimated loan default rate. The greatest benefits accrued to lower-income Americans, members of minority communities, and younger and elderly Americans. For instance, those earning less than US$20,000 annually saw a 21% increase in loan acceptance rates [12]. Digitalized payments and real-time payment flows can be used to offer small shops working capital lines of credit and to underwrite, monitor, and collect payments for a portfolio of loans to SMEs. For-profit, peer-to-peer digital lending platforms have also emerged, which extend access to credit beyond social networks or family members. Entrepreneurs seeking these loans may have been rejected by traditional financial institutions.

There are significant challenges to expanding the use of digital payments

Countries with advanced and broadly used payment systems might already have a physical infrastructure in place to process digital payments. But in low-income countries with more rudimentary banking systems (whose infrastructure is concentrated in urban areas), developing an adequate physical network to deliver digital payments to all corners of the country is a significant challenge. Furthermore, digital payments face significant infrastructure challenges. The lack of electricity to power mobile phones and cell towers, limitations in mobile network coverage, and poor transport networks all hinder the expansion of digital financial services in rural areas. Ultimately, while digital payments can be more cost-effective in the long term, building an adequate physical infrastructure for reliable payments will require significant up-front investments.

Moreover, while 64% of adults in high-income OECD countries reported using the internet—on a mobile phone or computer—to make online payments in 2021, only 33% of adults from developing economies reported doing so [2]. Poor network quality and coverage can lead to dropped connections and transaction failures that can erode confidence among users of such services, especially in rural areas.

To open a bank or mobile money account, or to make most digital financial transactions, customers generally need to submit relevant documents like government-issued identity cards or birth certificates. However, according to the Global Findex-ID4D Dataset, an estimated one billion are without an official proof of identity. In 2021, 7% of adults did not have an ID, including 22% of adults in low-income economies. This can limit entrepreneurs’ access to formal registration, labor contracts, and financial services. It can also prevent employees from opening an account to receive electronic wage payments. Even though countries such as India, Pakistan, and Kenya are working toward creating a database using a national identity card system, many people still lack a government-issued identity document.

Low levels of financial literacy and numeracy among entrepreneurs and employees can make it harder for them to use digital financial products efficiently. As an example, only 33% of adults in more than 140 countries can answer questions correctly on three of the following four topics: inflation, risk diversification, simple interest, and compound interest [13]. Low financial capability makes it harder for entrepreneurs and their employees to make optimal financial decisions.

There is mixed evidence on whether financial knowledge can be improved through classroom or online training. A meta-analysis of 76 randomized experiments studying the impact of financial education concludes that such schooling can influence some financial behaviors, including savings and record keeping. In addition, consumer protection laws and dispute resolution mechanisms related to digital financial transactions are critical to bolster consumer confidence and the proper use of such services. Effective consumer protections include: education about financial safety, such as the importance of keeping PIN numbers private; disclosure policies to ensure financial service providers have clear and easily accessible information; and legally authorized redress mechanisms to dispute any unauthorized transactions.

Despite the benefits of digital payments for labor force participation, most developing countries overestimate the capacity of entrepreneurs, employees, and customers to adopt such programs. When a new type of payment instrument is introduced, such as point-of-sale payments, success requires simultaneous development of both the supply and demand sides for the product. Otherwise, payment providers will face a dilemma: without a large number of entrepreneurs that accept the product, customers will not be interested in signing up; but without a large number of customers who want to pay with it, entrepreneurs will not be interested in accepting it—particularly if they have to pay for using the digital service.

Reluctance among workers to adopt technologies such as electronic wage payments can also be a big challenge. Transitioning to electronic wage payments requires investments in technology, employee training, and providing on-site support agents, given that workers who are accustomed to cash sometimes struggle with the switch to digital payrolls. Digital payments were a lifeline to many small businesses during Covid-19 mobility restrictions and the perception of cash as unsanitary. However, micro-, small-, and medium-sized enterprises in many countries faced challenges to digital adoption during the pandemic. For instance, firms in eight large economies reported challenges to digitalization in 2020 including a shortage of workers with digital skills and cultural resistance [14]. Similar challenges were echoed by Singaporean businesses surveyed in 2020: 56% noted high implementation cost as the top barrier to digitalization, followed by 40% who reported the lack of a digitally skilled workforce as a barrier [15].

Limitations and gaps

Despite rising interest, there is still a gap in the data available to researchers and policymakers on the cost of making and receiving digital payments, especially cost measurements of merchant payments. Better data on merchants is also needed—for example, the number of merchants paid electronically, the volume of payments, and the relative share paid electronically (as compared to cash). The data could be disaggregated by profiling characteristics, such as the size, sector, and urban/rural location of the merchant. This is necessary to rigorously study the barriers to usage, such as price, availability, and poor service, and the economic risk and other barriers to the provision of digital payment services.

Summary and policy advice

Entrepreneurial opportunities supported by well-functioning digital payment systems can play a key role in encouraging labor force participation in developing countries. Governments and financial service providers both have an important role to play to improve access and encourage the adoption of digital payments by entrepreneurs as well as their customers and employees. It is critical that governments ensure safe and reliable digital payments infrastructure. An electronic payment system should be supported by an appropriate financial consumer protection framework. Without such a framework, there is a risk that recipients could lose trust in the system and financial inclusion objectives may not be achieved. Furthermore, it is important to recognize that digital payment mechanisms can have security breaches—for example, card numbers or account numbers can be stolen. A reliable payment system should have safeguards to protect against fraud and cyberattacks—and an emergency contingency plan in case of a breach. Governments should also ensure an enabling regulatory environment that encourages innovation and competition and work with the private sector to develop reliable infrastructure that can reach rural areas. They should also ensure robust and secure digital networks as well as interoperability and competition among providers. To accomplish these goals, governments can reform their banking and telecom policies to support digital financial services.

Banks and other financial service providers, for their part, should create new products and services that cater to small-scale entrepreneurs, especially those in rural areas. They should develop innovative ways of capturing the creditworthiness of new businesses and design user-friendly financial applications. It would also be fitting for them to increase awareness among entrepreneurs about the advantages of digital payments and launch special programs to improve potential users’ levels of financial capability. Banks and service providers should ensure that workers receiving electronic wage payments understand, for example: how the electronic payment program works; the importance of PIN numbers; and what to do if something goes wrong. Successful innovations in digital payment systems have shown that entrepreneurs and employees adjust rapidly to their introduction, quickly gaining competence and comfort when using appropriately designed, convenient, and efficient systems.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [2], [5], [8], [10], and [13]. Financial support was provided by the World Bank Development Research Group and outstanding assistance from Sri Sravya Raaga Akkineni, Mansi Panchamia, and Jijun Wang. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank Group, its Board of Executive Directors, or the governments they represent. Version 2 of the article updates the figures, includes discussion on how the Covid-19 pandemic affected the use of digital payments, and significantly updates the references.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© The World Bank