Elevator pitch

The responses of working hours and employment levels to temporary negative demand shocks like those caused by the Great Recession in 2007–2008 and the Covid-19 pandemic in 2020–2022 have shown that consideration of both is important. Workers’ desired rises in working hours in times of recession also serve to modify the standard measure of unemployment. During Covid-19, both jobs and earnings were temporarily protected among workers forced into short-time work schemes, providing a useful comparison with the provision of improved unemployment insurance to unemployed workers at that time.

Key findings

Pros

Hours per worker drop sharply at the start of negative demand shocks in contrast to slower employment adjustment.

Peak-to-trough falls in UK and US hours during the Great Recession were mainly due to transitions from full-time to part-time employment under the same employer.

There are advantages in funding both job retention schemes and unemployment benefits during major recessions.

Cons

Unemployment rates underestimate the full impact of negative demand shocks since they fail to account for desired rises in working hours.

Job retention via short-time work schemes during recessions may reduce productive job reallocations.

Omitting capital and capacity utilization adjustments to demand shocks may distort the measurements of hours and employment effects.

Author's main message

Aggregate labor demand shocks temporarily increase or decrease the demand for goods and services. From a labor market perspective, the negative demand shock of the Great Recession necessitated speedy revisions of required hours and employment to counter costly productivity repercussions. The Great Recession led to significant growth in part-time and short-time jobs in the UK and the EU, which reduced hours below workers’ preferences, acting as a form of underemployment and leading to revisions of traditional unemployment rates. Governments’ main response to the negative demand shock of the Covid-19 pandemic was to protect jobs and (high proportions of) pre-Covid hourly earnings of employees who were forced to work shorter hours or experienced business lockdowns. Policymakers should note that short-time work schemes, alongside furlough and wage subsidy schemes, preserved worker–employer relationships and production post-pandemic, while significant increases in unemployment insurance helped the unemployed.

Motivation

The negative demand shocks of the Great Recession in 2007–2008 and of Covid-19 in 2020 produced varying degrees of business disruptions across national economies. Three general labor market questions are addressed in relation to these two major events. First, how did the Great Recession impact hours per worker and employment? This is explored initially with a detailed discussion of hours and employment during demand shocks, together with a brief outline of interrelated changes in capital and capacity utilization. Related empirical evidence is provided for the UK and the US. Second, why did workers’ desired numbers of work hours during the Great Recession and its recovery phase stimulate a need to revise the measurement of unemployment? Third, during the Covid-19 pandemic, what were the approaches of various national support schemes designed to avoid job separations through earnings subsidies among financially threatened businesses? The benefits and costs of protecting jobs are compared to improving unemployment insurance support for unemployed workers.

Discussion of pros and cons

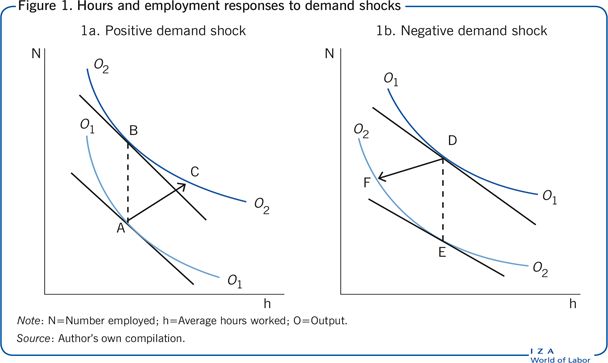

Figure 1 shows possible demand reactions of average working hours and employment to unexpected positive or negative temporary demand shocks. At a specific point in time, the employment input is referred to as the employment stock while average hours input is its per-period rate of utilization (e.g. over a working day). For the present, capital is treated as a fixed factor of production. The general objective is to meet given output demand at minimum labor cost. Output changes are assumed to be exogenous, that is, they are due to external influences.

The output curves represent isoquants or equal product curves. In Figure 1a, the curve O₁ shows all combinations of average hours and employment that produce the same level of output. The curve O₂ shows combinations that produce a higher level of output. Below or tangent to output curve O₁ is a straight line. This is a so-called isocost line; it represents all combinations of employment and average hours that can be purchased at a given total labor cost. The slope of an isocost is determined by the relative costs of hours and employment. (Changes in relative costs would alter the slope of the line but, for simplicity, this possibility is ruled out here.) The tangency point A shows the minimum hours–employment cost combination that produces O₁. This level of output cannot be achieved above or below point A on the isocost line or on lower isocost lines. It could be achieved on higher lines but this would imply greater labor costs.

Suppose there is an unexpected temporary rise in output demand, represented as a shift from curve O₁ to curve O₂. The new cost minimization point is B, representing the lowest total labor cost that produces this new output level. The expansion path A–B provides the least-cost route from A to B. In reality, this route cannot be taken as there are transaction costs of employing new workers and this results in impediments to speedy adjustments of employment. These include the time and money costs of searching for, hiring, and training new recruits. Moreover, employers may be cautious over the pace of workforce expansion as they initially try to form expectations of the strength and longevity of the improved business conditions. Adjusting working hours will involve costs of finding existing employees who are willing to extend their hours of work (e.g. through increased overtime working or switching from part-time to full-time hours) and these may be more speedily achieved than hiring external recruits. So how might the new output demand be met in the short term? It may be achieved by taking route A–C–B. In the initial stages, point C on O₂ will be reached primarily through speedy increases in hours of work that overshoot their eventual equilibrium at point B. Labor inputs would then be gradually adjusted between C and B through incremental increases in employment and reductions in working hours. In the short term, total labor costs of producing O₂ between C and B will be above their minimum level.

Comparing the cost-minimizing start- and end-points A and B, employment increases while average hours adjust back to their original starting value. This long-term constancy of hours is referred to as “scale invariance.” It is in fact a property of a wide class of production models adopted by economists, the most popular of which is the Cobb-Douglas production function [1]. In practice, it is unlikely to be observed precisely, but there is (as will be reported below) reasonably strong empirical support for treating it as a good approximation to what takes place.

The equivalent scenario for a temporary negative demand shock is illustrated in Figure 1b. Starting at cost minimization point D, output demand unexpectedly falls from O₁ to O₂. Again, more sluggish employment adjustment is likely to rule out moving along the least-cost expansion path D–E. First, employers may well be reluctant to incur the transaction costs of statutory and/or company-level redundancy payments until the likely severity of the downturn has been fully evaluated. Second, uncertainty over the length and depth of the fall-off in output demand could make companies hesitant about losing human capital investments in the specific skills and know-how of their existing employees. In the short term, this uncertainty will lead to retention of higher stocks of employment than required, thereby causing workers’ productivity to fall. However, a proportion of the associated costs may be offset through short-term reductions in working hours. This might be achieved by reducing overtime hours or replacing some full-time jobs with part-time jobs. So, a possible adjustment route is D–F–E. Rapid short-term cuts in hours help to accommodate the lower output demand despite slower changes in employment. Longer-term adjustments from F to E, with total labor costs above their minimum, will consist of continued reductions in employment, and rises in working hours to regain their longer-term scale invariance.

From an empirical standpoint, estimation of the demands for hours and employment would not only involve measuring changes in current output and in the relative prices of these two factor inputs but also the own-adjustment speeds of hours and employment and how they respond to one-another's disequilibrium when forced off their least-cost expansion paths.

The stock and utilization of capital

So far the focus has been on two factors of production, hours and employment. While these variables are of principal concern, the interactive role of capital cannot be ignored. Labor and capital combine to produce output, and their various combinations cause production to become more or less labor intensive. As with labor, the measure of capital should be separated into a stock dimension and a utilization dimension. Examples of capital stock at a given time include machine tools, tractors, computers, workplace buildings, and their rate of utilization refers to the intensity of machine use (and so on) per period of time.

In more general terms, production is modeled such that output is produced by combining stocks and utilization rates of labor and capital. It has been established that omitting capital utilization produces inflated estimates of the short-term productivity of hours; that is, the change in output for an incremental change in working hours [2]. Why is this? If average daily hours in a manufacturing plant are extended by increasing overtime, this will necessarily involve a more intensive daily use of capital equipment. In the absence of measuring the productivity implications of this increased machine use, overtime would act as a proxy measure for the productivity changes resulting from both working hours and capital utilization. Thus, so as to capture short-term output effects of changes in working hours in their own right, a measure of capital utilization needs to be incorporated into the analysis.

Measuring capital utilization is potentially difficult, however. Economists typically use capacity utilization as a proxy measure. This shows the extent to which installed productive capacity in a firm/industry/nation is being utilized at a point in time. It is measured in terms of actual output expressed as a percentage of potential output. An economy operating significantly below its full potential will be able to expand production quite quickly without incurring substantial time and money costs of acquiring new capital equipment and buildings.

Interrelated factor demand

Two economists, Ishag Nadiri and Sherwin Rosen, provide the seminal factor demand analysis. It incorporates the notions of long-term cost-minimizing equilibrium and short-term disequilibrium among the four factors: employment, average hours, capital stock, and capital utilization [3]. This does not lend itself to two-dimensional illustrations, but the underlying logic is the same as in Figure 1. Long-term equilibrium occurs at points where combined labor and capital costs are minimized at a given output requirement. Disequilibrium paths are modelled by allowing deviations between desired and actual factor adjustment paths. Each of the four factor demands is functionally related to current output, relative factor prices (labor and capital) and to the own-adjustment speed of each factor as well as its reaction to the short-term disequilibrium of the other three factors. The authors use quarterly data for US total manufacturing during the post-war growth period between 1947 and 1962 and there is a wealth of findings, three sets of which are especially relevant to the present discussion:

The factor demand responses to a once-and-for-all unit change in output are investigated. This is conceptually the same as the positive output demand shock shown in Figure 1a. The authors find immediate and strong increases in hours and capacity utilization. Both rates overshoot their ultimate long-term equilibrium values. The response of employment is slower, although it too, over a slightly longer period, overshoots its long-term value. In contrast, the movement of capital stock is extremely sluggish. In essence, the story is one of short-term adjustments in hours, capacity utilization, and, to a lesser extent, employment to achieve the new higher output level, thereby allowing time for capital stock to adjust at its much slower rate.

Omitting capacity utilization from the analysis serves to produce unrealistically high short-term labor returns.

In the long term, after allowing for short-term factor adjustments, hours are found to be statistically scale-invariant while long-term changes in capacity utilization are very small.

Timings of labor adjustments and an important means of reducing hours per worker

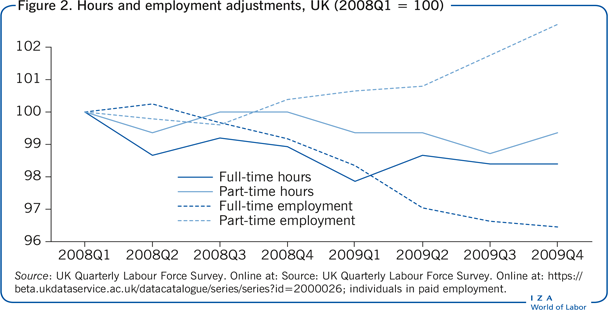

In Figure 1b it is postulated that at the start of a negative demand shock falls in hours per worker are likely to precede employment adjustments due, for example, to employers’ risk aversion in respect to redundancy payments and losses of specific investments. Partly with an eye on developments that follow, Figure 2 shows the percentage changes in the UK of both full-time and part-time hours per worker and employment over a two-year period from the start of the Great Recession. In the first quarter of the recession, full-time hours fell by 1.3%, part-time hours by 0.6%, while full-time employment rose by 0.2%, and part-time employment fell by 0.2%. The percentage fall in full-time hours over the first quarter is unequivocally greater than that of full-time employment, and while this gap narrows thereafter, the full-time hours reduction remains stronger until 2009Q1. In contrast, part-time hours return to their 2008Q1 starting point over the second quarter, stay there until the end of 2008 and then remain within 1% of the 2008Q1 start point. As for part-time employment, after changing little up to 2008Q3 it climbs to 2% above its 2008Q1 starting point by 2009Q4.

The mechanism behind the total hours reductions at the start of major recessions has been examined in considerable detail in respect of worker flows during six major recessionary periods in the US and three in the UK [4]. First, as found in Figure 2, a clear common denominator across recessions and between countries is that hours per worker fall sharply from the onset of each recession. Second, these reductions are due mainly to falls in hours related to workers transitioning from full-time to part-time working. From Figure 2, it can be seen that the full-time employment change is procyclical and part-time employment is countercyclical. As for hours reductions linked to internal full-time to part-time transitions, average weekly hours of full-time workers over the 2008–2009 period are 36.9 and those of part-time workers are 15.4. Third, changes in working time hours within full-time and part-time employment account for much less of the variation in total hours. Fourth, the full-time to part-time transitions are a demand-side phenomenon because they predominantly take place under the same employer. This contrasts with the supply-side story of unemployed workers during the Great Recession downturn gaining employment through accepting temporary part-time jobs.

Using yearly Labour Force Survey data on individuals in paid employment, at the start of the Great Recession in the UK, the 2008–2010 peak-to-trough fall in hours per worker was 0.51 hours with the contribution of part-time working to this fall in hours per worker amounting to 78.6%. Using yearly data on individuals in private-sector paid employment over the 2007–2009 period in the US, the fall in hours per worker was 1.09 hours with an increase in part-time working accounting for 51.8% of this fall in hours [4].

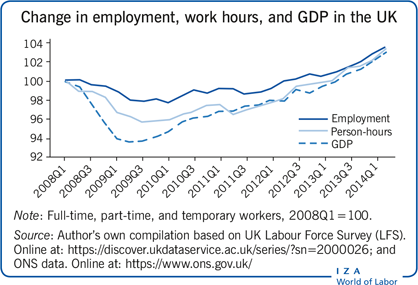

Hours, employment, and productivity in the Great Recession

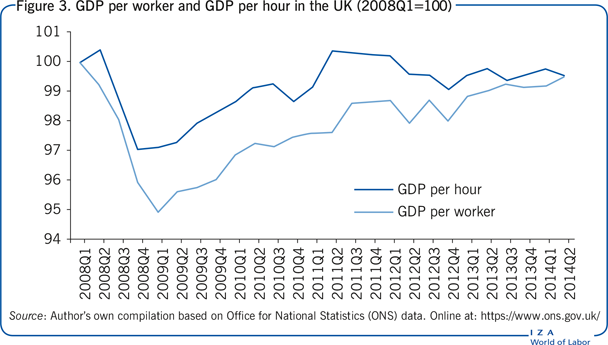

Based on quarterly labor market data, the Illustration shows UK movements of employment and person-hours (numbers employed multiplied by average hours), and real GDP. The peak-to-trough fall in employment is 2.3% from 2008Q1 to 2010Q1 in contrast with a GDP fall of 6.3% between 2008Q1 and 2009Q1 and a person-hours fall of 4.3% from 2008Q1 to 2009Q3. Far greater peak-to-trough percentage falls in GDP compared to employment translate into large reductions in productivity, measured as GDP per worker. But falls in person-hours exceed those of employment because, on average, workers worked fewer per-period hours. Hence, productivity falls measured as GDP per hour were less than those measured as GDP per worker. This is illustrated in Figure 3.

During the period from 2008Q1 to 2009Q1, GDP per worker fell by 5% and GDP per hour by 3%. As shown in one study, the UK pattern of GDP per hour is reasonably in line with Germany, France, and Italy between 2008 and 2012, in contrast to the stronger productivity growth seen in the US from 2009 [5]. The US experienced a relatively low peak-to-trough fall of 4.1% in GDP and much larger falls in employment (5.6%) and person-hours (7.6%) [6]. Suggestions for the especially steep decline in US employment include lower firing costs than in Europe and extensions to US unemployment insurance benefits [5].

Underemployment, unemployment, and desired work hours

Labor force surveys in the UK and EU countries record employees’ satisfaction with their current work hours at going wage rates. For those expressing a wish to change their hours, the amount and direction of change are recorded. Full-time workers tend on average to desire fewer hours while part-time workers on average prefer more hours. In the UK, at the onset of the Great Recession, for both full-time workers and part-time workers the number wanting fewer hours decreased while those wanting more hours increased.

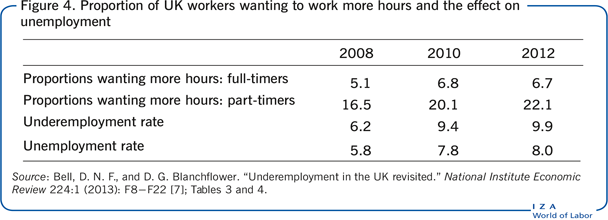

A study converts the UK's unemployment rate into an hours-equivalent measure, assuming unemployed workers work the same average hours as the currently employed [7]. (The authors estimated a series of hours regressions with personal controls including gender, qualifications, age, and so on, for each of the 47 waves of the UK Labour Force Survey. Each regression was then used to predict the hours of unemployed workers and found them to be close to actual average hours worked at each time point.) The numerator of their underemployment rate consists of total unemployed hours (unemployment multiplied by the average hours of the currently employed) plus the net number of desired hours (resulting from workers wanting more hours minus those wanting fewer) while the denominator consists of total unemployed hours plus total hours worked by employed workers. Note that if negative desired hours equal positive desired hours, the unemployment and underemployment rates are the same. Figure 4 shows estimated positive differences between underemployment rates and unemployment rates for three Great Recession years [7]. More recently, this work has been extended considerably [8]. UK underemployment rates remained higher than unemployment rates up to 2018 when the two rates converged. Before the start of the Great Recession, from 2001 to 2007, unemployment rates were higher than underemployment rates; that is, most workers desired fewer working hours.

In the study related to Figure 4, the authors also calculate underemployment rates by age groups, ethnic groups, and UK regions [7]. One especially noteworthy set of results stands out. In 2012, for example, the very high unemployment rate among the 16–24 age group of 19.5% was greatly exceeded by an underemployment rate of 30%. In the same year, for the 25–49 prime age group the rates were, respectively, 6.2% and 8.1% while the rate sizes were reversed for the over-50 age group, at 4.6% and 3.5%. Black workers also experienced very high unemployment and a large gap between underemployment and unemployment rates.

The later study provides estimates of underemployment rates for 26 EU countries together with their differences to Eurostat unemployment rates for the period 2001–2016 [8]. Underemployment rates across countries are found to be predominantly above the unemployment rates. In 2016, this was the case for 23 countries. As a test of importance of the underemployment rate, it is shown that it replaces unemployment as the main influence on wage growth in the post-recession years. German underemployment in the Great Recession is interesting. At the start of 2009, the trough year of German GDP, the country's unemployment rate peaked at 8%. Yet its estimated underemployment rate is 3.9% higher. This may be linked to its short-time work support for manufacturing industries around this time.

In the light of the earlier discussion on the importance of transitions from full-time to part-time employment under the same employer among UK and US workers in the Great Recession, it can be inferred that the reported positive gaps between underemployment and unemployment in Figure 4 are likely to be demand-side oriented. In EU countries, it would be useful to test worker flow data to find out if the demand-side is the predominant influence or, alternatively, whether underemployment effects are more supply-related due to unemployed workers gaining temporary short-time work.

Job retention, short-time working, and the Covid-19 demand shock

The Covid-19 shock in 2020 caused falls in demand for goods and services, with many businesses having difficulty financially supporting the sizes of their pre-pandemic workforces. National funding schemes consequently proliferated, designed variously to help employers retain staff, either in the workplace or when forced to be absent from work due to imposed pandemic restrictions. One of the most popular schemes supported companies’ needs to introduce short-time work given unanticipated reduced output demand. The schemes were designed to fund a part of the associated fall in employees’ pre-Covid-19 wage earnings. This preserved the employer–worker relationship along with workers’ accumulated specific skills and know-how. The short-time work schemes established a connectivity between the Great Recession and Covid-19 shocks. They had already been designed on a smaller scale and practised in various countries during the Great Recession, including in Canada, France, Germany, Korea, the Netherlands, Spain, and the US. In Germany, short-time work was strongly funded through unemployment insurance contributions in the Great Recession. The main aim was to protect the jobs of skilled workers in export-led manufacturing industries, a sector that experienced an especially large product demand downturn. In line with many other countries during the peak of the Covid-19 pandemic, the scale of the German Covid-19 short-time work interventions was expanded to embrace a far wider sectoral support, including especially hard-hit service sectors such as hospitality and retailing. In March/April 2020 German short-time work cover reached its pandemic peak of six million workers, with spending in 2020 accounting for 0.7% of GDP [9].

Alternative designs of job retention schemes were also constructed to meet the Covid-19 jobs crisis. The UK government's furlough scheme, launched in March 2020, supported employers in continuing to pay staff who were not working due to coronavirus restrictions. At first, the government covered 80% of workers’ pre-Covid-19 earnings and by the end of the scheme, in September 2021, it paid 60% of earnings, with employers covering 20%. When non-essential shops, pubs and restaurants, and other businesses were locked down in mid-2020, young workers were especially protected. This resulted in furlough cover for 41% of workers under the age of 18 and 28% of workers aged 18–24. More flexibility was introduced in July 2020 when workers could return to the workplace and be furloughed for the normal hours they did not work. Furlough support peaked at 8.9 million jobs in early May 2020, and in all a total of 11 million workers were furloughed at a total cost of £70 billion [10]. New Zealand introduced a wage subsidy job retention scheme for the periods March–November 2020 and August–December 2021. Initially, employers could apply for a wage subsidy if their turnover had fallen by more than 30%, later revised to more than 40%. The subsidy was used to ensure that qualifying employees could receive at least 80% of their pre Covid-19 incomes. This retention scheme was especially costly, reaching 4.5% of 2020 GDP, but it was shown to prevent a steep rise in unemployment (see [9] for more details).

It is hard to draw succinctly general policy conclusions for the period 2020–2022 based on a myriad of job retention schemes, with different funding methodologies, set against varying degrees of pandemic severity. However, useful partial insights have been suggested in respect of short-time work schemes funding company insiders in comparison with unemployment insurance supporting unemployed outsiders. In the US, while there was wide state-level experience of short-time work schemes, the sheer magnitude of the Covid-19 crisis led to “aggressively extending the generosity of unemployment insurance” [11]. This gives rise to interesting questions, applying largely to a privileged sub-set of countries, on whether to insure jobs or workers or both during recessions.

Short-time work job retention schemes serve to protect insider jobs, possibly biased toward older experienced employees with good educational and/or apprenticeship backgrounds as well as accumulated specific job skills and know-how. Unemployment insurance payments lean more toward protecting individuals with relatively weak work credentials and possibly somewhat fragmented or less developed work experience. On the upside, and especially in relation to long-lasting national demand shocks, there may be advantages to economies providing relatively generous short-term work and unemployment insurance cover. Workers in jobs and workers unemployed define, on average, quite distinct populations and hence simultaneously increase the effectiveness and reach of job retention and unemployed workers’ support programs (see [11] for more elaboration).

Two downsides should be mentioned. First, generous short-time work and unemployment insurance support serve to reduce propensities to improved job reallocation. Short-time work earnings support encourages workers to remain with their existing employer while increased unemployment insurance support has been shown to reduce recipients’ job-search effort, thereby prolonging unemployment spells. It might be added that coronavirus-induced risk aversion in respect of job mobility may have served to limit propensities to search for new jobs. Second, from the start of the US Covid-19 pandemic there was a significant incidence of individuals outside of the workforce who expressed a desire to reduce their working hours even to the extent of not finding a suitable job during the relatively short pandemic time frame. In contrast, during the longer-lasting Great Recession most comparable individuals eventually found suitable employment [12].

Limitations and gaps

Apart from several comments on the plights of younger workers, little is included here on the more micro effects of the Covid-19 demand shocks. For example, what were the relative experiences of employed and unemployed workers in deprived areas where higher incidences of deaths and illnesses through Covid-19 infections tended to occur?

Also, unlike the case of the Great Recession, no attempt has been made to report on the effects of companies’ capital and capacity utilization during the Covid-19 shock. For example, were financially stressed firms with low capital-to-labor ratios especially inclined to seek short-time work support given the relative importance of labor costs within their overall factor expenditures? What were the implications for financially stressed firms with high capital-to-labor ratios having to cover both variable labor costs and the fixed costs associated with idle capital equipment and underutilized capacity?

Summary and policy advice

In relation to the Great Recession, differentiating between hours and employment responses to demand shocks has three principal implications of interest to policymakers. First, peak-to-trough output falls serve to illustrate how necessary short-term economic labor adjustments are more speedily accommodated through initial strong falls in hours per worker. Second, for at least two major economies, falls in hours per worker are demand-oriented, with an emphasis on temporary transitions from full-time to part-time working hours under the same employer. Third, accounting for an excess supply of hours during recessions due both to full-time and part-time workers desiring longer working hours raises the underemployment rate above the unemployment rate.

As for the Covid-19 pandemic, there are two principal areas of policy interest. First, temporary support of earnings via short-time work, furlough, and wage subsidy schemes helps, at high cost, to preserve worker–employer relationships and subsequently to help maintain production performances post-pandemic. Second, given distinct population characteristics between workers in jobs and unemployed workers, temporary strong financial support for both job retention schemes and unemployment insurance provision almost certainly enhances policy-effectiveness.

Acknowledgments

The author thanks three anonymous referees and the IZA World of Labor editors for their helpful suggestions on earlier drafts. Version 2 reports new research on hours and employment adjustments (with a new figure), updates underemployment research, discusses governments’ support to short-time working and unemployment caused by the Covid-19 pandemic, and adds new “Key references.”

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Robert A. Hart