Elevator pitch

Entrepreneurship is essential for a healthy labor market. Recent evidence shows that young businesses (at most ten years old) have, on average, accounted for all of US employment growth over the past few decades. New businesses are especially important for youth employment. However, these businesses tend to borrow a lot, and the credit constraints they face limit their ability to create jobs. Historically, much of the discussion regarding the economic importance of entrepreneurship has focused on small businesses. Empirical evidence increasingly suggests that, among small businesses, those that are young create the most jobs.

Key findings

Pros

Young businesses, on average, account for all recent US employment growth.

Start-ups are especially important for the employment of younger workers.

Non-employed workers are more likely to find a job at a young business.

A continuous supply of new jobs from start-ups is critical to keeping the unemployment rate low.

An increasing number of labor market statistics by firm age allows tracking of the contribution of start-ups to job creation and employment growth.

Cons

Young businesses provide their employees with less job security because of their relatively high exit rates, as well as their high rates of job turnover and churn.

Young businesses hire relatively few older workers.

Entrepreneurs rely on their own financial resources to start businesses; such businesses are often inefficiently small because of credit constraints.

There is a lack of data on entrepreneurs and their businesses in the years before they hire their first employee.

It is difficult to know how interventions may affect the number of new employer businesses.

Author's main message

Small firms are often characterized as the engines of job creation. Yet empirical evidence increasingly shows that firm age is more important than firm size as a determinant of employment growth. New businesses drive job growth, and are especially important for the employment of younger workers. However, young firms have high demand for credit and borrow relatively more than older businesses. A well-functioning start-up economy is thus necessary to achieve a healthy labor market. In order to achieve this, it is essential that entrepreneurs have access to the credit that they need to start and grow their businesses.

Motivation

There is a consensus among economists and the public that entrepreneurs create jobs. For this reason, small businesses have been a key focus of public discourse. While economic research continues to confirm the essential role of entrepreneurship in job creation, an increasing number of studies question the focus on firm size. Newly available data for the US show that firm age, rather than firm size, is the main predictor of employment growth. Young firms are the engines of job creation.

In the early twentieth century, the economist Joseph Schumpeter emphasized the importance of new businesses [2]. He argued that economic growth is driven by a process of “creative destruction” which involves more productive businesses displacing less productive ones. A large and growing economics literature considers this subject. This process by which the inputs of production move between businesses is called “reallocation” (which also goes by the terms “fluidity” or “dynamism”). As labor is one of the primary inputs to production, many economists consider labor reallocation rates a key measure of the health of the economy.

Resources tend to reallocate from less productive to more productive businesses. New data sources have allowed economists to use empirical data to measure the causes and consequences of reallocation. Empirical data have been used to demonstrate that entering and growing businesses are more productive than the contracting and exiting businesses they displace [3]. Rapidly growing businesses tend to be recent entrants. New businesses are therefore critical for economic growth.

The importance of new businesses to reallocation, as well as to economic growth more generally, has led economists to consider the firm entry rate as a measure of the health of the economy [3]. A continuous supply of firms is especially important for the health of the labor market. When the firm entry rate declines, reallocation rates usually decline in turn [3]. Subsequent studies have linked the declines in the US firm entry rate in recent decades with lower hire, separation, job creation (growth from firm entry and expansion), and job destruction (losses from firm declines and exits) rates.

The business entry rate also has cyclical properties. During and after recessions, the firm entry rate declines. Incumbent firms do not fill in the gap left by lost start-ups, and overall hiring in the economy is lower as a result [4]. Declines in the business entry rate therefore provide an explanation for the “jobless recoveries” that have followed recent US recessions [4].

Discussion of pros and cons

How do researchers know about the economic impact of new firms?

In the last 15 years, an increasing number of data sources have provided information about young versus old businesses. In some cases, these newly published statistics provide information that covers several decades. A key challenge in developing these data has been determining a firm's age. Data on the ages of US firms is included in the US Census Bureau's Longitudinal Business Database (LBD), which also contains information on firm size. The LBD has been used to compare how firms of different sizes and ages grow in terms of employment; it shows that young businesses are a key source of employment growth [3]. While small businesses grow faster than larger businesses, this is primarily accounted for by small, young businesses. This relationship between firm size, firm age, and employment growth has also been confirmed using data from many countries other than the US [5].

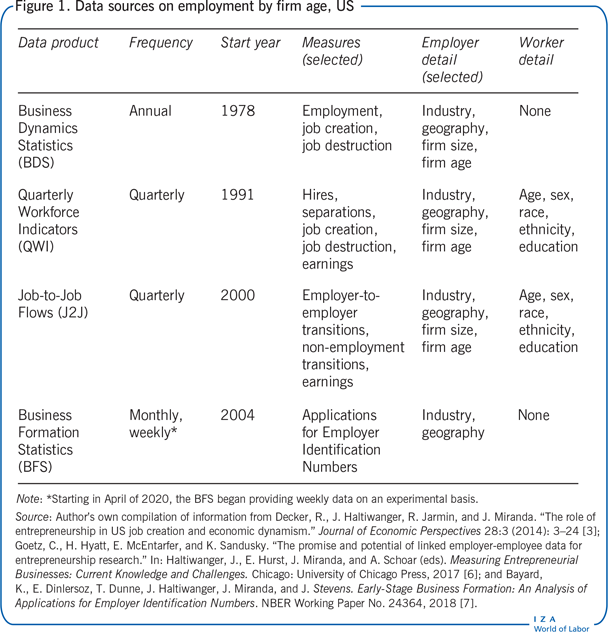

Research results from LBD microdata show the key importance of young businesses in determining economic outcomes. Motivated by these findings, an increasing number of public use data products have begun to regularly publish statistics about new and young businesses. These statistics provide rich detail on start-ups and entrepreneurship. Figure 1 describes four such data products.

The Business Dynamics Statistics (BDS) has a relatively long time series, with data available starting in 1978. The BDS provides annual data including employment, job creation, and job destruction, all categorized according to employer characteristics such as firm size and firm age [3]. The BDS provides information on the role of young businesses in labor reallocation and employment growth. A key trend apparent in the BDS time series is a long-term decline in the employer business entry rate.

The Quarterly Workforce Indicators (QWI) data product provides data starting in 1991. The QWI provides quarterly measures of job creation, job destruction, hires, separations, and earnings by detailed worker and firm characteristics including firm age and firm size [6]. One helpful feature of the QWI is that it provides information on the demographic composition of the workforce of young and old firms. It therefore is useful for measuring which subpopulations are most affected by changes in the business formation and entry rate. The QWI shows that young workers tend to be employed by younger firms.

The Job-to-Job Flows (J2J) data product is available starting in 2001; it provides information on employer-to-employer transitions, as well as transitions into and out of non-employment, by detailed worker and firm characteristics [6]. J2J provides rich detail on employment transitions and worker reallocation across employers. One particularly important feature of the J2J is that it measures the contribution of young versus old businesses in hiring non-employed workers. In other words, the J2J shows which businesses serve as entryways into the labor market.

A more recent addition to statistical data on US businesses is the Business Formation Statistics (BFS). These are data on the total number of businesses that have applied for an Employer Identification Number, by applicant characteristics [7]. This is a critical measure of businesses that have the potential to become employers and therefore identifies a subset of potential job creators. These data are available starting in 2004.

This article distinguishes between businesses based on age and size using conventional definitions that are used for published statistics. A key designation is whether a firm is “young.” Here, young firms are those that are ten years old or younger. “Old” businesses are those that are 11 or more years old. This article also considers whether a business is large or small. A “large” business is one that has 500 or more employees, while a small business has fewer than 500 employees. Results by firm size are provided to contrast with firm age.

Young businesses drive job creation

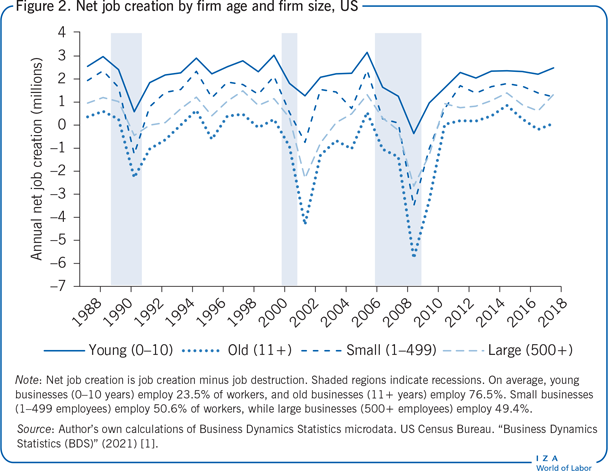

BDS data illustrate that young businesses are the main determinant of net job creation in the US. Figure 2 shows net job creation by firm age and firm size from 1988 to 2018 based on BDS data (although the BDS data start in 1978, data on whether firms are older or younger than ten years are only available starting in 1988). Net job creation is defined as the change in employment associated with a firm size or firm age category. The sum of net job creation for the two age categories equals the total year-over-year change in US employment, and likewise for the two size categories. On average, the US added about 1.5 million jobs per year from 1988 to 2018.

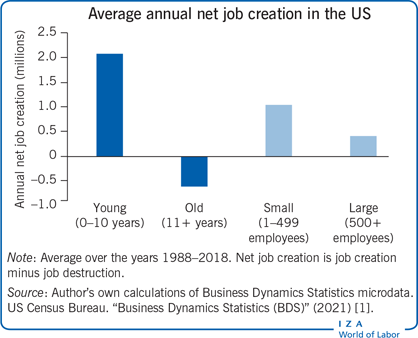

There are pronounced differences in the net job creation associated with these firm age and size categories. Despite constituting less than one-fourth of employment, young businesses are very strong job creators. These businesses provide 2.1 million additional jobs, on average, each year. In contrast, older businesses shed 0.6 million jobs per year, on average. Young businesses therefore account for more than all net job creation over this time period.

The results in Figure 2 emphasize the importance of a continuous supply of new businesses in maintaining high employment. The most rapidly growing businesses tend to be young while older businesses are more likely to contract or exit [1]. To offset the losses associated with these older businesses, it is critical for new businesses to enter, expand, and hire workers.

Firm size, on the other hand, is less of a determinant of job creation than firm age. Yet there are substantial differences in the contribution of small versus large businesses to employment growth. Small businesses account for about two-thirds of net job creation, adding about one million jobs per year. Large businesses create roughly one-third of annual average job growth, at about 0.4 million per year. These results confirm the conventional wisdom that smaller businesses create more jobs than larger ones. However, these differences are much smaller than those observed by firm age.

During economic expansions, employment increases and falls during and after recessions. Figure 2 also shows the role of firm age and size in determining such cyclical changes in employment. One striking feature is that young businesses were positive net job creators even during the 1990 and 2001 recessions and only lost jobs during the 2007–2009 recession, when they shed 0.4 million jobs in 2009.

Older businesses, on the contrary, have relatively small changes in employment during expansions. Any gains in employment were consistently less than one million jobs per year. In 2015, the net job creation of older businesses reached a series high of 0.9 million jobs. Furthermore, during and after recessions, older businesses lose jobs rapidly in the context of scarce demand. Recessions may be times when relatively less productive businesses have an especially difficult time competing with more productive recent entrants. During the 2007–2009 recession, old businesses lost an extreme of 5.8 million jobs. In contrast, cyclical differences by firm size are much more modest: both small and large businesses increase employment during expansions, and decrease employment during recessions.

Figure 2 concerns the evolution of overall employment for young versus old and small versus large firms. There is an important distinction between changes in net employment and the changes in employment that happen at individual businesses. While young businesses tend to grow faster than older businesses, young businesses are also more likely to exit. The jobs that new businesses provide are therefore less stable than those at older businesses.

The results in Figure 2 offer insights into the conventional wisdom that small businesses drive job creation. The empirical data are indeed consistent with small businesses creating more jobs than large ones. In this context, the results on firm age help provide a reason for why this occurs: young businesses are especially strong job creators—their contribution outpaces that of the entire economy. And there is a strong relationship between firm size and firm age, indicating that young businesses usually start out small [3]. Since there are also many small, old businesses that do not create jobs as rapidly, it follows that the small businesses that matter most for job creation tend to be those that are young.

Young businesses are gateways into the labor market

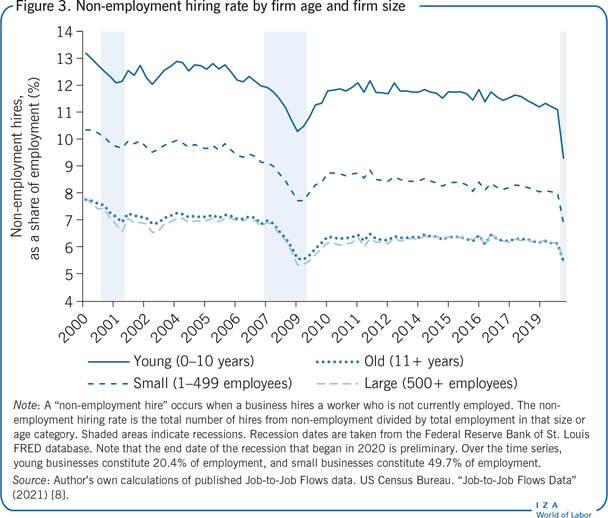

Not only do young businesses play an outsized role in job creation, they also provide a critical entryway for workers as they enter employment. Figure 3 shows the quarterly rate at which firms hire workers who are not employed (i.e. “non-employed” workers) [8]. Specifically, Figure 3 shows the ratio of the total number of non-employment hires in a given quarter divided by total employment. This is an important measure because it indicates the share of a firm's employment that was recently hired from non-employment. A greater non-employment hiring rate indicates that firms draw workers from non-employment more quickly for a given level of employment. Figure 3 shows results from the second quarter of 2000 to the first quarter of 2020 by firm size and firm age.

The frequency with which firms hire non-employed workers varies dramatically by firm age. Young firms are the most likely to hire non-employed workers. Non-employed workers are disproportionately young and include many recent graduates of high school or college. The non-employment hire rate at young firms averaged 11.8% from 2000 to 2020. The non-employment hiring rate at older firms was lower, averaging only 6.6%. These results show that young firms provide valuable opportunities for workers without jobs to enter employment.

While small firms are more likely to hire non-employed workers than large firms, there is less of a difference between their non-employment hire rates than exists for young versus old firms. The non-employment hiring rate for small businesses was 8.9%, whereas the rate for large businesses was 6.5%.

The cyclical properties of Figure 3 highlight the role of young businesses in the increases in unemployment that occur during recessions. Around recessions, the non-employment hire rate for young businesses exhibits the largest drops. It fell particularly sharply during the recession that began in the first quarter of 2020, from 11.1% to 9.3%. Not surprisingly, the overall hiring rate also declines during recessions. It declines the most among businesses that hire the most non-employed workers. It appears that stabilization of the unemployment rate during recessions is difficult to achieve without a steady supply of new businesses willing to enter the market even during economic downturns.

In sum, these results provide rich detail on the nature of firm age and firm size in hiring non-employed workers, and are therefore important when considering how to keep unemployment low. Small businesses hire workers without jobs more rapidly than large businesses. Yet firm age is an even more powerful determinant of how quickly unemployed workers find jobs. The subset of small businesses that are young and rapidly growing is therefore critical for keeping the unemployment rate low.

Young businesses employ young workers

Each year, a new cohort of workers enters the labor market. A challenge for any economy is to find jobs for these new workers. Recent research highlights the importance of young firms in providing jobs for recent labor market entrants.

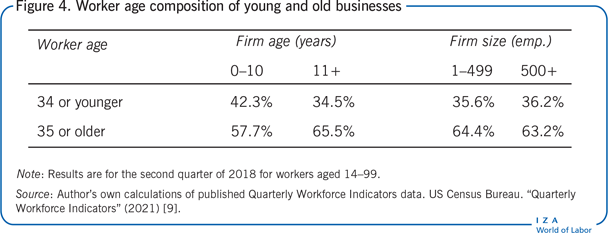

Young firms provide valuable opportunities for younger workers to enter the labor market, as they are more likely to employ younger workers [6]. Data on the age of the workforces of young and old businesses are available from the QWI [6]. Employment by worker and firm age in the second quarter of 2018 is shown in Figure 4 It lists the employment share of workers aged below or above 35—by firm age [9]. Businesses that entered ten years ago or less employ roughly one-fifth of all workers, but 42.3% of these workers are under the age of 35. In contrast, for businesses that are 11 years or older, only 34.5% of workers are under the age of 35.

While there are substantial differences between the workforce ages of young versus old businesses, there is much less of a differential by firm size. Of the workforce of small businesses, 35.6% comprises workers under the age of 35, while large businesses employ slightly more young workers, who constitute 36.2% of their workers.

Start-up access to credit is vital for employment growth

Because of the importance of entrepreneurship to economic growth and low unemployment, policymakers have sought ways to provide support to entrepreneurs. In the US, the Small Business Administration (SBA) provides support for loans that banks make to small businesses. A recent study explores the relationship between receipt of these SBA loans and subsequent firm growth and performance [10]. The authors find that larger firms tend to create more jobs than smaller firms for a given loan size. However, they also find evidence that younger businesses grow more upon receipt of a loan, especially after controlling for a business's size. The largest effects of loan receipt are reported for young businesses that have only just started hiring employees.

Young businesses exhibit strong demand for credit. Another recent study provides a rich description of the borrowing behavior of firms of different ages and sizes [11]. The authors demonstrate that, for a business of a given size, an entrepreneur is more highly leveraged when their business is first established. As businesses age, entrepreneurs tend to pay off their loans. This indicates that it is the newest businesses that have the greatest demand for credit. Furthermore, the results suggest that a new business that cannot get a loan will hire relatively few workers.

The results of these studies provide insight into the relationship between entrepreneurship and employment. When a business is new, it is most likely to grow rapidly. However, it is also the most likely to face credit constraints and thus require loans in order to grow to its potential. When entrepreneurs cannot access the financing needed to grow their businesses, they hire fewer workers than they otherwise would. The hiring rate of the youngest businesses is thus the most responsive to available credit. The degree to which credit is available to young businesses may therefore affect the overall level of employment.

Limitations and gaps

A steady supply of new entrepreneurs creating employer businesses is critical for a healthy labor market. Published labor market statistics that distinguish between firms by their age are a valuable resource for understanding the economy. As the statistical data products reviewed in this article are only regularly published for the US economy (although an increasing number of research papers have used microdata from other countries to produce analogous statistics), this limits researchers’ understanding of the role of start-ups outside of the US context.

But even in the context of this wealth of data on the US labor market by firm age, there are significant knowledge gaps that may be able to be addressed through microdata research and, potentially, additional published tabulations. It would be desirable to investigate what causes new businesses to create jobs. Unfortunately, research on entrepreneurship is largely silent on what happens before a business hires its first employee. Likewise, the number of new employer businesses is critical for supporting job creation and keeping unemployment low. It is therefore necessary to know the determinants of entrepreneurship.

Causes and consequences of long-term changes in the number of new employers

There has been a long-term downward trend in the number of new employer businesses in the US, which is especially apparent in the time series from the BDS. This trend has sparked considerable interest because it has significant implications for US productivity and growth. Yet the reasons for this decline remain unknown.

Studies that have noted the decline in US entrepreneurship have discussed economic factors that may have led to this decline. A review article lists a number of potential determinants, which include globalization, technological change, and regulation [3]. While that article outlines a research agenda that is both ambitious and necessary, few studies have been able to use empirical data to assess the role of its many hypothesized mechanisms. More research is needed to understand the causes of the decline in the number of new employer businesses.

Measurement of firm age

US data on firm age is usually based on the year that a business hires its first employee. Much less is known about businesses that have not yet hired their first employee. Such “non-employer businesses” do not have employees. An open question is how firm age differs when defined by initial revenue (or other definitions of business activity) rather than initial employment. One recent effort to measure businesses before they are necessarily employers is the BFS (described in Figure 1). The BFS provides counts of the number of businesses that apply for Employer Identification Numbers. This activity sometimes coincides with the point at which a business hires its first employee, but often precedes it.

Non-employer versus employer businesses

Non-employer businesses are increasingly important because the landscape of US firms is changing. In recent decades, there has been a proliferation of new sole proprietor businesses. These new businesses are mostly non-employers. Economists have considered the relationship between the growth in the number of non-employer businesses and the rise of the “gig economy,” in which workers perform services as independent contractors (and are therefore usually non-employer sole proprietors) [12].

More research is needed on the rise of non-employer businesses because of its potential implications for how new businesses lead to increased employment. A recent study contrasts the strong growth in non-employer businesses with the tepid growth in employer businesses [13]. It explores the relationship between the decline in business entry and the coincident proliferation of non-employer businesses. Declining labor reallocation rates associated with employer businesses are somewhat offset by the rise in self-employment associated with new sole proprietor businesses. In other words, some types of workers who were previously observed to be transitioning between employers are now observed to be entering self-employment, perhaps as contract workers for the same businesses or others. An open question is how to track the dynamics of these non-employer businesses.

Summary and policy advice

Entrepreneurship is vital for economic growth and providing jobs for the workforce. Recent research has highlighted the role of new and young businesses in growing employment, especially among recent labor market entrants. Young firms create jobs rapidly, whereas older businesses tend to lose workers. As such, entrepreneurs usually have the most impact on employment when their businesses first start operating.

Because of the importance of new businesses to the health of the economy, a number of new data products provide information on firms by their age. Such statistics allow policymakers to track the contribution of start-ups over time, which provides information on the employment of young versus old businesses. There are a number of important conclusions that follow from these data, including:

Young businesses account for more than all US employment growth over the past decades, whereas old businesses, on average, have lost jobs.

Young businesses hire workers from non-employment more rapidly than older businesses.

Young businesses are especially likely to hire younger workers.

The recent emphasis on firm age contrasts with a historical focus on firm size as a measure of entrepreneurship. While small businesses tend to create jobs rapidly, it is a key subset of these—businesses that recently started operation—that are especially strong job creators. Young businesses are usually small, but not all small businesses are young.

Recent research highlights the importance of access to credit for entrepreneurs to grow their businesses and create jobs. Empirical data suggest that the newest businesses have the highest demand for credit. It also indicates that these newest businesses create the most jobs per dollar lent to them.

A growing body of economic research highlights the central importance of new businesses to employment and economic growth. When a business first enters, it tends to hire workers at its most rapid pace. A continuous supply of new businesses is therefore necessary to maintain high employment and low unemployment.

Acknowledgments

The author thanks anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Any opinions and conclusions expressed herein are those of the author and do not represent the views of the US Census Bureau. All results in this article use publicly available data from Census Bureau websites. Keith Bailey, Erika McEntarfer, and Kristin Sandusky provided helpful comments and suggestions.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.