Elevator pitch

Many industrial countries are replacing conventional power plants with renewable energy sources. Green energy policies might affect employment in different ways. A policy shift toward a low-carbon green economy may create new and additional “green jobs” in renewable energy sources and energy-efficiency technologies. However, this may potentially come with the crowding out of employment in other sectors. In addition, energy prices may increase owing to feed-in tariffs subsidizing renewables. The resulting burden may in turn stifle labor demand in industrial sectors and reduce the purchasing power of private households.

Key findings

Pros

A green energy policy creates more “green jobs” in renewable energy sectors.

A shift toward more renewable energy sources improves environmental quality by reducing emissions of ambient air pollutants, beneficial for health and labor productivity.

Cons

Subsidizing renewable energies by feed-in tariffs increases energy prices for firms and private households.

Rising energy prices put industrial jobs at risk when labor and energy are complementary inputs in industrial production.

Estimates of net employment effects are, though positive, small at best.

Author's main message

Empirical studies, especially on the specific German pathway (“energy turnaround”), reveal both positive and negative employment effects related to green energy policies. They are quantitatively moderate. Job creation and job destruction seem to cancel each other out, such that the overall net employment effect is rather limited. Neither the proponents nor the opponents of green energy policies should put forward job creation or destruction as an argument in the energy policy debate—whether in Germany or in other industrial countries.

Motivation

Many industrialized countries have committed themselves to contribute more toward mitigating climate change by significantly reducing emissions of greenhouse gases and ambient air pollutants. To achieve these objectives, countries implement such environmental policies as air quality standards for industry [1]. In addition, a range of countries aim to considerably reduce the use of energy from conventional fossil sources and expand the generation of energy from renewable sources. Such a political shift toward a low-carbon, green economy may create additional employment opportunities in research and development, in production, and in the installing and maintaining of green technologies. But it may also crowd out investment-induced employment in non-green sectors.

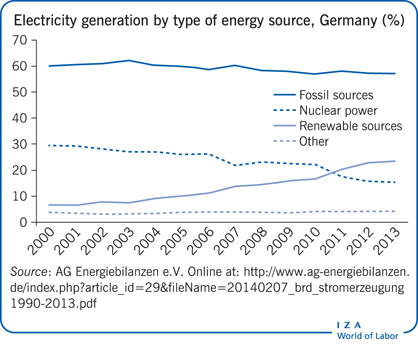

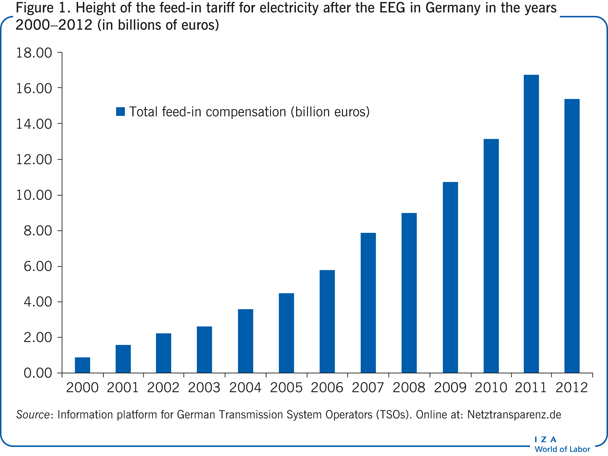

Such a switch in energy policy usually comes with subsidies for renewable energy sources, making energy more expensive for firms and private households. The extent to which this may stifle employment depends on the interrelationship of energy and labor as inputs in production technologies. For this reason, empirical evidence on the potential magnitude of positive or negative employment effects related to an energy turnaround is required to inform decision makers about the labor market effects of a switch in energy policy (see Germany’s energy turnaround and Figure 1).

Discussion of pros and cons

Employment effects of green energy policies

Mitigating global climate change is now at the top of the policy agenda in many industrial countries. The EU member states have committed themselves to the “20–20–20” targets: a reduction in greenhouse gas emissions by 20% from the 1990 level, an increase to 20% in the share of EU energy consumption generated by renewable energy sources, and an energy-efficiency improvement of 20% by 2020.

Particularly in the expansion of renewable energy sources, Germany plays a pioneering role. The energy turnaround in Europe’s largest economy implies replacing conventional and nuclear power plants with renewable energy sources. The German government’s long-term objective is to generate 60% of overall energy use from renewable sources by 2050. Obviously, such a politically motivated transition toward a low-carbon economy, which requires investments in green energy technologies, must be regulated in order to be implemented, since green technologies are not cost-competitive in the early years [2]. That is why many countries subsidize the expansion of the capacities of renewable energy sources by offering feed-in tariffs [3].

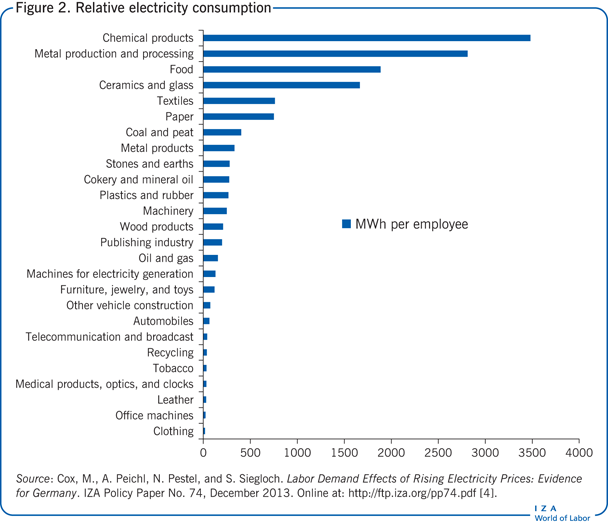

The subsidies can be expected to boost aggregate demand for research and development, production, and the installation and maintenance of renewable energy technologies, which in turn create new jobs. But subsidies may also crowd out investments in conventional energy sources or other economic activities. While the expansion of green energy may be beneficial for environmental quality, health, and labor productivity, an energy turnaround financed by feed-in tariffs typically implies increasing energy prices for both firms and private households. So a frequent argument against renewable energy expansion is that it puts jobs in energy-intensive industrial and manufacturing sectors at risk, particularly when they are very export-prone and their international competitors have significantly lower energy costs. For example, the German manufacturing industry’s expenses for electricity account for a large part of total production costs, but vary substantially across sectors. Figure 2 shows the intensity of the power usage in megawatt hours per worker (mean values between 2003 and 2007) for aggregated sectors in Germany. Clearly, the production of chemicals and metal requires most power relative to the number of workers in the sector. In contrast, the relative electricity consumption is very low in sectors like the manufacturing of textiles and clothes.

A green energy policy in an industrial country could thus have both direct positive and indirect negative effects on total employment. A conclusive estimate of the overall net employment effect of an energy turnaround must, therefore, take into account both direct and indirect effects. In addition, the assessment should distinguish potential short-term and long-term effects on the labor market. For example, investment-induced effects on creating jobs in the production and installation of renewable energy facilities in the short term may disappear in the longer term when the expansion in infrastructure has reached saturation point and only the maintenance and replacement investments of renewable energy plants require some labor input.

Firms could mitigate the negative effects of energy price increases by introducing more energy-efficient production technologies. But if a large energy gap remains, then energy-intensive firms in, say, the manufacturing sector may also decide to move their production sites abroad. Firms leaving the country or fully closing down might then heighten the negative short-term effects on labor demand in the long term.

Investment-induced employment effects and crowding-out

The direct gross employment effect of investments in renewable energy sources should always be positive: Expansions in the infrastructure of renewable technologies induce additional demand for goods and services in the respective sectors, as well as along their supply chains. This creates additional demand in turn for labor in research and development, production, and the installation and maintenance of green power plants.

The size of the gross employment effect is typically estimated using macroeconomic input–output models, capturing the flow of goods and services across detailed sectors of an economy. Such a model for Germany was extended by an additional input–output vector for the renewable energy sector to capture the interdependencies of this particular and growing industry and other sectors [5], [6]. Estimates of the employment effects of the expansion in renewable energy sources show positive gross employment effects in the renewable energy sector ranging between 23,000 and 258,000 additional jobs through 2030 [5], depending on assumptions about future developments of global energy prices and the renewable energy world market shares of German firms. The range of these gross employment effects further depends on future exports of renewable energy.

A dynamic macroeconometric model, based on marginal effects rather than average reactions as computed by input–output models, estimates investment-induced employment effects from the expansion of renewable energy [7]. The cumulative gross impact is about 100,000 additional jobs from 2004 to 2010, strongest in earlier periods and declining over time owing to a diminishing production effect.

But in a general equilibrium framework, additional demand for renewable energy sectors may have offsetting effects on other sectors. Take into account, for instance, imports and exports, the lower consumption and investments due to crowding-out in non-green sectors, and the additional production costs of the German energy policy (the Erneuerbare-Energien-Gesetz, or EEG) [5], [6]. The net employment effect is small and positive, estimated at 50,000–200,000 through 2030, depending on the underlying development of the world market for renewable energy technologies and the German export share therein. Making similar adjustments, the accumulated negative employment effect is about 50,000, owing to additional costs of renewable energy, which were increasing over 2004–2010 [7]. The conclusion is that net employment effects are positive in the short term and turn negative in the longer term.

Increasing energy prices may have a negative indirect effect on employment through another channel [2]. When energy expenses account for an increasing share of the consumer spending of private households, the purchasing power of disposable income falls and thus may reduce demand for other consumer goods, reducing employment in the respective sectors. Private households may, however, adjust their consumption after price increases and shift expenditures toward more energy-efficient goods and appliances in the long term. It is not clear how this might affect aggregate demand.

Interrelationship of energy prices and labor demand

The transition toward a green economy is typically associated with feed-in tariffs subsidizing investments in renewable energy sources, which usually trigger energy price increases for firms and private households. Any economic costs, such as negative effects on industrial activity or labor market outcomes, depend on the interrelationship between labor and energy as inputs in production technologies. But knowledge about these economic costs is limited, especially as regards any potential employment effects.

The interaction of inputs in production technologies is typically gauged by assessing whether inputs are substitutes or complements in the production process. Empirically, this is usually determined by estimating cross-price elasticities, which quantify the degree to which the demand for an input changes when the price of another input increases marginally.

A variety of studies estimate predominantly positive but small cross-price elasticities for labor demand with respect to energy prices [8]. The conclusion is that labor and energy are rather weak substitutes. This means that firms producing a fixed quantity of output can substitute manual labor for energy only to a limited extent. This characterization of the interrelationship of energy and labor seems plausible, given modern production technologies, where mechanical energy used in complex production processes cannot be easily transferred to workers. In addition, the energy required to generate process heat in production can be substituted only to a limited extent by other energy sources, such as switching from electricity to natural gas, and not at all by labor.

The findings on the substitutability or complementarity of labor and energy conditional on outputs are informative only about their characteristics as input factors and their interactions in production processes. But policymakers are more interested in the overall labor demand effect of increasing energy prices, when output is not held constant. When firms can adjust their production levels, they reduce their output because of higher overall production costs induced by higher energy prices. This reduces demand for all input factors. Again, it is not clear whether this negative scale effect dominates the small but positive substitution effect of increasing energy prices on labor demand. Only a few studies address this empirical question.

Cross-price elasticities between labor demand and electricity use for the US have been estimated for a sample covering 12 sectors (not only manufacturing), exploiting electricity price variations within states over 1976–2007. The main finding is that employment is weakly related to electricity prices: An increase of 1% reduces full-time equivalent employment by 0.10−0.16%. Another study using US data broken down by county, industry, and year for 1998–2009 reports responses of the same order of magnitude for non-manufacturing industries [9]. For electricity-intensive manufacturing firms, the response in employment is much stronger, implying a greater than 1% employment decline for a 1% price increase. But these results refer to labor as a homogeneous input factor and do not account for different skill levels.

Two other studies suggest moderate gross complementarity, implying negative unconditional cross-elasticities. This means that higher energy or electricity prices have a negative effect on employment. Taking different qualifications into account, labor demand seems to be affected differently across skill levels, with low- and high-skilled workers affected more than the medium-skilled [4], [10]. One of the studies estimates cross-price elasticities of labor demand with respect to total energy prices for manufacturing sectors in Germany, based on 26 industries over 1978–1990 [10]. The other uses more recent administrative, linked employer–employee microdata combined with information on electricity prices and usage for the German manufacturing sector over 2003–2007 [4].

Limitations and gaps

Despite the fact that employment effects have become an important argument both for and against a transition toward a green economy, only a limited number of studies assess the labor market effects of shifting energy generation to renewable sources in industrial countries. Evidence of the employment effects of an expanding renewable energy sector is dominated by macroeconomic modeling (input–output analysis). The advantage of this approach is that it not only accounts for direct employment effects, but can also take into account indirect (employment) effects on other sectors by explicitly modeling flows of goods and services between different sectors of the economy, as well as the interdependence of an economy with the rest of the world. But macro-modeling requires a wide range of assumptions and parameters that are very difficult to make explicit and thus to make transparent in determining what drives different results.

Previous research on the macro level has been mainly in the energy economics literature, which might explain why the labor market outcomes under consideration refer mainly to aggregate employment by sector only. Evidence on other labor market outcomes of interest in labor economics, such as wages and hours worked, as well as skill formation, is limited. In addition, very little is known about worker characteristics in renewable energy sectors. In this context, previous research has not paid much attention to effects on the employment structure, especially regarding the skill composition of employment in the energy sector. This is partly due to the limited availability of detailed microdata on workers in this crucial industry when it comes to a shift toward a green energy policy. Given that there is some descriptive evidence that workers in green energy technologies are disproportionally more highly skilled, a transition from conventional energy generation to renewable energy technologies will imply a higher demand for employees with tertiary education, in particular in engineering. If the supply of labor does not adjust accordingly, this can be expected to trigger shortages of skilled labor in fast-growing green technology sectors. Given that an advantage in technology is beneficial for the overall assessment of an energy turnaround, policy coordination might be important in skill development and training activities [11].

As regards research on the interrelationship between labor demand and energy prices, one limitation is that previous studies differ substantially in the countries, periods, and types of energy under consideration. This makes comparing different findings on cross-price elasticities difficult. A range of studies, especially those on the interesting case of Germany, are based on data from the 1970s to the early 1990s, which is perhaps a problem because of changes in production technologies.

In addition, due to the limited data available, more recent research papers typically use highly aggregated industrial sector data, which could miss substantial variation between regions and firms within sectors. To fill this gap, additional high-quality microdata are required, especially on firms and individual workers. Ideally, linked employer–employee data would be merged with detailed survey information on energy usage and prices, production technologies and capital stocks. This would allow a comprehensive and detailed assessment of the relationship between firms’ labor demand and energy prices, as well as the impact of energy policies on labor markets.

Future research should pay more attention to the extreme extensive margin of firms’ potential reaction to rising energy prices, such as relocating abroad or even closing down production sites [9]. If a large-scale drain on energy-intensive production is very likely when energy prices remain high, then this margin is indeed a serious concern for policymakers. Another relevant outcome would be the investment decisions of multinational companies in energy-intensive industries and how they are affected by cross-country differences in policies affecting energy prices.

Focusing on employment as the only margin of adjustment is too narrow, particularly in the long term. There is evidence that environmental regulation also affects employment growth in regulated industries in the US [12]. Moreover, the costs of sectoral reallocation borne by individual workers may emerge not only in unemployment, but also in earnings losses after job changes [13]. In Europe, where labor markets are more regulated and layoffs more difficult, adjustment could also occur on the intensive margin of hours worked. Future research should therefore take into account the European variation in the regulatory scope of labor market institutions.

Summary and policy advice

The shift to a low-carbon green economy in many industrial countries is intended to meet political objectives for the mitigation of climate change. Both supporters and opponents of green energy policies put forward the potential employment effects as arguments.

A change in energy policy may have a positive gross employment effect, creating additional green jobs, but it could also crowd out investment-induced employment in non-green sectors. This change usually comes with subsidies for renewable energy sources, making energy more expensive for firms and private households. The extent to which this may reduce employment depends on the interrelationship of energy and labor as inputs in production technologies. For this reason, empirical evidence on the potential magnitude of positive as well as negative employment effects is required in order to inform decision makers about the overall net effects of a switch in energy policy on labor markets.

Existing empirical studies, especially on the German case, reveal both positive and negative employment effects from a green energy policy. But the effects are quantitatively moderate, so the overall net employment effect is rather limited. Therefore, neither job creation nor job destruction are adequate arguments to put forward in the energy policy debate, neither in Germany nor in other industrial countries. At the end of the day, green energy policies should be judged on whether they are able to reduce the emission of ambient air pollutants while securing a reliable supply of energy for industrial production at a reasonable cost.

Acknowledgments

The author thanks an anonymous referee, the IZA World of Labor editors, and Michael Cox for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Nico Pestel

Germany’s energy turnaround

In Germany, the operators of renewable electricity sources are granted feed-in connections to public electricity grids and guaranteed fixed compensation per unit of electricity supplied over a period of 20 years under the Renewable Energy Sources Act (Erneuerbare-Energien-Gesetz, or EEG), the most important legislative instrument steering the country’s energy turnaround (Energiewende). The subsidy is financed by electricity consumers through a surcharge on their electricity bills—a so-called “feed-in tariff”—known as the EEG-Umlage. Revenues from this surcharge are transferred to the operators of renewable energy facilities, thus subsidizing their investments in the renewable energy infrastructure.

The feed-in tariff triggered massive investments in solar panels, wind power stations, and power stations based on biomass. The share of renewable electricity generated rose from 6.6% in 2000 to 23.4% in 2013. The total remuneration for renewable electricity, less than €1 billion in 2000, increased to more than €15 billion in 2012, as the EEG surcharge rose from 0.41 cents per kilowatt hour in 2003 to 6.24 cents in 2014, making electricity substantially more expensive for firms and private households. Only very energy-intensive production, which is exposed to fierce international competition, is exempt from the surcharge. The exemption clauses have been extended several times since 2013, a fact that has recently been scrutinized by the European Commission, since these exemptions could be interpreted as subsidies, which may not be in line with the EU’s common market rules. The price increases, which lower the purchasing power of disposable income, especially for low-income households, have gained wide attention in the public debate on Germany’s energy policy and pose a challenge to the public’s acceptance of the Energiewende.

The German government and environmental associations emphasize the positive effects of green job creation in renewable energy and energy-efficient technologies. But industrial business associations stress that high energy prices constitute a threat to Germany’s export-oriented manufacturing and may thus cost jobs in the long term. So, the potential employment effects, either positive or negative, have become important arguments both for and against the Energiewende.

Feed-in tariffs

For example, the German version of a feed-in tariff, the EEG-Umlage, has proved to be a successful policy tool to attract investments in renewable energy sources. Interestingly, while consumer prices for electricity have increased owing to the EEG-Umlage (currently a surcharge of 6.24 cents per kilowatt hour added to consumers’ bills), it has led to decreasing market prices for electricity at, for example, the European Power Exchange (EPEX). This is due to the so-called “merit–order effect” at the spot markets, where electricity produced at the lowest marginal cost is traded first.

Since renewable technologies typically generate electricity at lower marginal costs, electricity generated from conventional power plants is crowded out, which lowers spot market prices. Mechanically, this widens the gap between guaranteed compensation of renewable electricity generation and the market prices, which in turn raises the total amount of EEG compensation. This channel has contributed even more toward increasing consumer prices for electricity in Germany.