Elevator pitch

Proponents of minimum wage increases have argued that such hikes can serve as an engine of economic growth and assist low-skilled individuals during downturns in the business cycle. However, a review of the literature provides little empirical support for these claims. Minimum wage increases redistribute gross domestic product away from lower-skilled industries and toward higher-skilled industries and are largely ineffective in assisting the poor during both peaks and troughs in the business cycle. Minimum wage-induced reductions in employment are found to be larger during economic recessions.

Key findings

Pros

Minimum wage increases are more likely to deliver income gains to low-skilled workers during peaks rather than troughs in the business cycle.

Increases in the minimum wage may stimulate macroeconomic growth if productivity is shifted toward more highly-skilled sectors, possibly by inducing additional training for low-skilled workers.

When increases in the minimum wage are indexed to inflation they do not appear to have larger adverse employment effects than non-indexed increases.

Cons

Increases to the minimum wage redistribute the composition of industry-specific productivity in ways that harm some low-skilled workers rather than produce net economic growth.

Minimum wage increases reduce employment more for less-skilled individuals during times of macroeconomic recessions as compared to expansions.

Minimum wages are not well targeted to poor or near-poor individuals across the business cycle.

Minimum wage increases are ineffective at reducing poverty during both business cycle peaks and troughs.

Author's main message

Empirical evidence provides little support for claims that higher minimum wages will: (i) serve as an engine of economic growth by redistributing income to workers with a relatively high marginal propensity to consume; or (ii) alleviate poverty during economic downturns. Therefore, policymakers wishing to aid low-skilled workers during recessions, or to spur economic growth, should not look to the minimum wage as a policy solution. Rather, means-tested, pro-work cash assistance programs and negative income tax schemes can deliver income to the working poor far more efficiently.

Motivation

“[The] twin goals of the [minimum wage] are maintaining a wage floor to keep workers out of poverty and stimulating the consumer spending necessary for economic recovery”—National Employment Law Project [2]

Since the time of US President Franklin Delano Roosevelt, policymakers advocating for higher minimum wages have argued that such increases serve both macroeconomic and microeconomic goals. The chief macroeconomic goal is to stimulate economic growth by redistributing income from those who spend a small proportion of each additional dollar in income (firm owners) toward those who spend a relatively larger proportion (low-skilled workers), thereby spurring macroeconomic growth. The central microeconomic goal is to lift low-skilled (i.e. less-experienced or less-educated) workers out of poverty, particularly during downturns in the business cycle.

Proponents of recent minimum wage increases, including US President Barack Obama, UK Prime Minister David Cameron, and—much more reluctantly—the governing coalition behind German Chancellor Angela Merkel, claim that the implementation of, or increases in minimum wages will help the working poor “make ends meet,” as well as stimulate macroeconomic growth. Opponents of minimum wage increases, however, claim that they will impede economic growth by imposing higher labor costs on firms employing low-skilled workers and by inducing adverse employment effects. Further, opponents argue that minimum wage increases poorly target workers in need and are least effective in helping poor workers during recessions. They claim that higher minimum wages result in larger adverse labor demand effects during recessions.

This contribution reviews the economic arguments underlying each side’s claims of the economic consequences of minimum wage increases and evaluates the empirical evidence behind them.

Discussion of pros and cons

Minimum wages and gross domestic product

Economic theory suggests that the macroeconomic effect of minimum wage increases on gross domestic product (GDP) is ambiguous. Minimum wage increases may increase labor costs and output prices, reduce firms’ profits and job training, and cause adverse employment and hours effects, each of which may reduce GDP. However, if minimum wage increases raise the earnings of low-skilled workers who keep their jobs—and these workers have a higher marginal propensity to consume an additional dollar of income than firm owners or low-skilled workers who lose their jobs—minimum wage increases will result in higher GDP [3].

Moreover, adverse employment effects may have the unintended consequence of leading to greater economic growth if low-skilled workers who lose their jobs take up job training or increase schooling, or if firms substitute toward higher-skilled workers. Additionally, if local labor markets have only one employer (monopsony), there is even scope for minimum wage increases to increase employment.

Finally, minimum wage increases may increase worker effort, either in an efficiency wage framework (i.e. where workers are paid more to encourage higher output and raise morale), or because those who retain jobs increase their efforts in order to forestall competition from those who have been laid off.

In summary, the net effect of higher minimum wages on GDP is an empirical question and depends on how minimum wages affect: (i) the demand for low-skilled workers; (ii) low-skilled workers’ wages; (iii) availability of substitutes for goods produced by minimum wage workers; (iv) workers’ effort; and (v) job training and educational attainment [3].

Simple correlational evidence on the relationship between minimum wage increases and GDP is not dispositive. For instance, the US government enacted federal minimum wage increases in 1990−1991 and 2007−2009, which were periods of sharp declines in real GDP growth. On the other hand, there was strong economic growth during the period when the federal minimum wage was raised in 1996−1997 and during a recession in the early 2000s, when the real value of the minimum wage declined.

More sophisticated empirical evidence on the effects of minimum wages on aggregate productivity is relatively new. This literature has faced a number of challenges, including: (i) how to measure overall and industry-specific productivity; (ii) disentangling the effects of minimum wage increases from other concurrently implemented economic policies or economic trends; and (iii) accounting for spillover effects of the minimum wage on productivity in “control” regions.

Three studies have empirically estimated the relationship between minimum wages and GDP [3], [4], [5]. The first examines the interaction between exports and minimum wage policy [4]. It uses data on 11 OECD countries (Austria, Belgium, Denmark, France, West Germany, Italy, Luxembourg, the Netherlands, Sweden, the UK, and the US) across four time periods (1970−1975, 1975−1980, 1980−1985, and 1985−1990) to estimate the effect of minimum wage increases on GDP growth. GDP growth is measured as the percentage change in GDP over each five-year period. The minimum wage measure is the percentage change in the ratio of the nation’s minimum wage to the average wage over the same period. The results of this study suggest that increases in the minimum wage were associated with a positive, but statistically insignificant, effect on aggregate national GDP growth [4]. Only during a time of rising exports is there some evidence that minimum wage increases lead to economic growth. However, the authors acknowledge a number of limitations of their study, including a small sample size, the use of potentially fragile cross-country growth measures, and the possibility of the omission of political or institutional variables that could lead to biased estimates of minimum wage effects. They also describe the study as “a very first stage” and call for further empirical work on this topic.

A second study examines the relationship between employment protection legislation—including the minimum wage—and productivity growth [5]. The authors use data on 11 OECD countries (Belgium, Canada, France, Greece, Ireland, Japan, the Netherlands, Portugal, Spain, the UK, and the US) over the period 1979−2003 to estimate the effect of minimum wages on productivity levels and growth. They find that a ten-percentage-point increase in the ratio of the statutory minimum wage is associated with increases in productivity levels, but not productivity growth. Specifically, the authors find that a ten percentage-point increase in the ratio of the statutory minimum wage to the median wage is associated with an approximately two percentage-point increase in long-term multi-factor (and labor) productivity.

However, the methodology employed relies on disputable assumptions, which makes it difficult to assess whether the authors are able to distinguish the effect of the minimum wage from other important differences in labor market policies, institutions, and economic trends. In addition, the authors note that there are a number of competing hypotheses that could explain their findings, with very different policy implications. For instance, if minimum wage increases induce labor−labor substitution that increases productivity via hiring more skilled labor, this may cause adverse distributional consequences. However, if minimum wage increases induce greater training and human capital acquisition among low-skilled workers, this may have advantageous distributional effects.

Finally, a new US-based study examines data on US states over a three-decade-long period (1979−2012) and estimates the effect of minimum wage increases on gross state product (GSP) or state-specific GDP [3]. The author uses an approach that exploits changes in state minimum wages over time to identify their effect on state productivity, while controlling for other state-specific economic, demographic, and policy trends, including (in some models) controls for state-specific time trends.

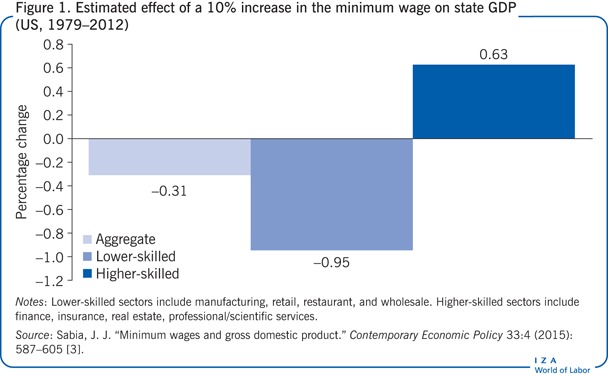

Figure 1 summarizes the findings from this study. Consistent with the first study it finds little evidence that aggregate GDP is related to minimum wage increases: the effect is small and statistically indistinguishable from zero. However, this null result masks two important underlying findings. First, minimum-wage increases cause a redistribution of productivity across industries employing workers of different skill types. The study finds that minimum wage increases reduce productivity in industries that employ relatively larger shares of low-skilled workers (e.g. manufacturing, retail, restaurant, and wholesale) relative to industries that employ relatively larger shares of high-skilled workers (e.g. finance, insurance, real estate, professional/scientific services). The results show that a 10% increase in the minimum wage is associated with a 1−2% decline in GDP generated by lower-skilled, as compared to higher-skilled, industries [3]. This finding is consistent with a redistribution of employment toward higher-skilled industries.

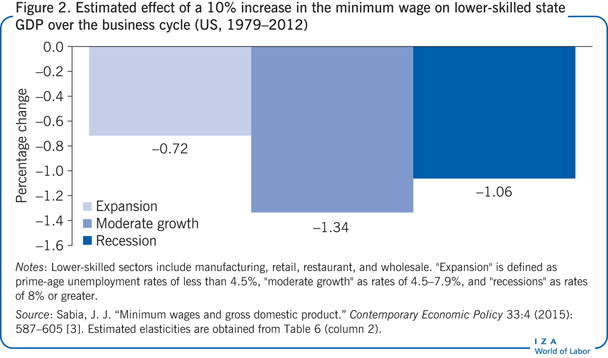

A second result masked by the null finding on aggregate GDP effects is that the adverse low-skilled productivity effects of minimum wages are larger during troughs than during peaks in the overall state business cycle. Estimates, shown in Figure 2, show that the negative low-skilled productivity effects of minimum wage increases are about 50−90% greater during non-expansionary, as compared to expansionary, periods during the business cycle. This result is consistent with emerging evidence (see below) that the adverse low-skilled labor demand effects of minimum wages are larger during economic downturns.Taken together, the existing empirical evidence suggests that minimum wage increases reduce or redistribute productivity rather than increase aggregate GDP.

Employment effects of minimum wages over the business cycle

The strongest evidence for adverse low-skilled employment effects from minimum wage increases has been found in studies of labor markets where the minimum wage is most likely to “bind” (i.e. to be set above the market-clearing wage and thus affect employment) particularly in the US, Canada, Colombia, Costa Rica, Mexico, Portugal, and the UK. However, the lack of geographic variation in minimum wages within many nations, along with relatively heavier government regulation of labor contracts, makes it challenging to isolate credible “control groups” with which to estimate policy impacts. This is because national minimum wage changes often affect many classes of low-skilled workers (directly or indirectly) across broader geographic regions.

Several recent studies have begun to explore whether the employment effects of minimum wages differ over the business cycle. There are a number of theoretical reasons to expect that this may be the case. During recessions, employers are more likely to lay off less-educated, low-skilled workers, which could result in larger negative employment effects during troughs in the business cycle. During economic expansions, increases in aggregate demand may ameliorate minimum wage-induced negative employment effects. Relatedly, because wages are more stagnant during economic downturns, minimum wages are more likely to bind for low-skilled workers, potentially leading to larger earnings gains, but also larger employment losses because of the minimum wage’s bigger “bite.”

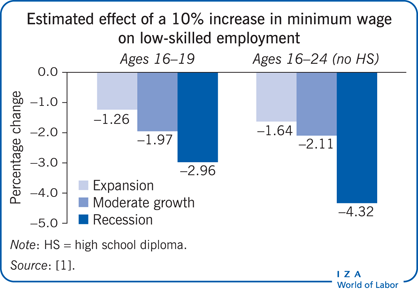

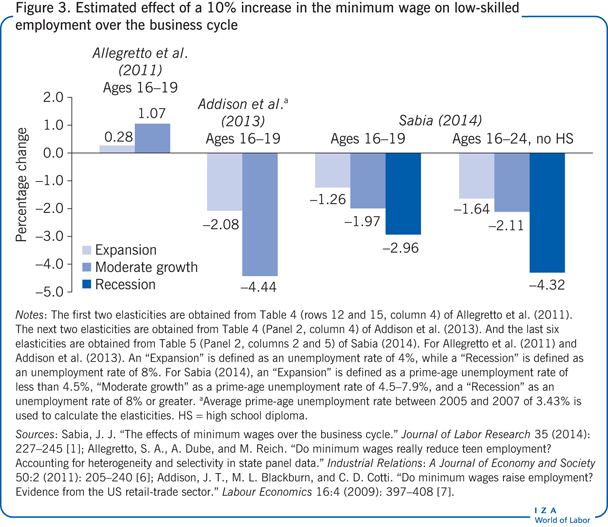

There is very little empirical evidence on the effects of minimum wage increases over the business cycle in OECD countries. However, three recent studies, all focusing on the US labor market, have examined the low-skilled employment effects of minimum wages over the business cycle. Figure 3 summarizes their findings.

One study analyses the impact of state and federal minimum wage increases on teenage employment during the 1990−2009 period, with special attention given to how effects may differ over the business cycle. Comparing differences in levels of minimum wages over time and across states, while taking into account long-term growth differences among states, the authors find no evidence that the teen employment effects of minimum wages differ over the business cycle. In fact, they provide little evidence of minimum wage-induced employment effects over the business cycle at all [6].

However, two other studies reach a different conclusion. The first examines teenagers during the Great Recession (2005−2010) and finds that minimum wage increases induce larger negative employment effects during periods of higher overall state unemployment [7]. These results also persist when using statistical methods identical to the previously discussed study. The second study examines both teenagers and 16−24 year olds without a high school diploma using census data from 1989 to 2012. The author finds that a 10% increase in the minimum wage results in a 0−2% decline in employment during state economic expansions, but a 3−5% decline in employment during recessions [1].

Indexed minimum wages

A number of new proposals to increase US federal or state minimum wages call for them to be automatically indexed to inflation (that is, changed automatically by the same percentage change in inflation), where inflation is usually measured using a geographic-specific consumer price index. Such proposals have been enacted, in part, to prevent erosion in the real value of the minimum wage over time due to legislative inaction in adjusting the nominal minimum wages.

The effects of indexed minimum wages could differ from those of non-indexed minimum wage increases for a number of reasons. Indexed increases are more permanent changes to firms’ low-skilled wage bills, as the value of the minimum wage will not be eroded by future inflation. This may result in larger adverse labor demand effects. On the other hand, to the extent that inflationary increases are easier to predict than legislative action, indexed increases might be more easily anticipated by forward-looking employers of low-skilled labor. In a dynamic labor demand framework, one might expect employers to respond more strongly to unanticipated increases [1].

The only two studies that provide empirical evidence on the employment effects of indexed minimum wages find no statistically significant differences in the low-skilled employment effects of indexed versus non-indexed minimum wages [1], [6]. However, neither study can completely rule out large differences between indexed versus non-indexed minimum wages, which limits the value of their findings. This problem can be explained, in part, by the fact that there are relatively few indexed minimum wage “experiments” to analyze and relatively few years of “post-treatment” data for those states that have enacted such policies. This area is ripe for exploration by future researchers.

While findings on indexed minimum wages are to this point inconclusive, there is a potentially important policy link between indexed minimum wages and the business cycle. Some recessions—such as the Great Recession—were largely characterized by high unemployment and deflation. Others, such as recessions in the mid-1970s, early 1980s, and early 1990s, were characterized by both rising prices and high unemployment. Therefore, if automatic, indexed minimum wages are enacted and a high inflation/high unemployment recession occurs, the adverse low-skilled employment effects of the minimum wage could be amplified.

Policymakers attempting to minimize the adverse labor demand consequences of minimum wage increases may, therefore, prefer non-indexed minimum wages to indexed ones, or tie future increases (or decreases) to broader measures of economic growth.

Poverty effects of minimum wage increases and the business cycle

A large number of recent studies explore the effects of minimum wage increases on poverty, the vast majority of which find little evidence that the minimum wage is an effective anti-poverty tool [8]. An emerging literature also finds little evidence that minimum wages are effective at reducing consumption-based deprivation, or material hardship [9]. But could the poverty effects of minimum wages differ over the business cycle?

It is argued that many poor individuals do not work and, therefore, will not directly benefit from minimum wage increases. And many more poor individuals will be unemployed during recessions, which will further undermine the poverty-alleviating effects of minimum wages during downturns. In addition, many poor (or near poor) workers earn hourly wages greater than newly proposed minimum wage levels and hence will also not directly benefit from such increases; their poverty status is more often the result of low work hours or living in a large family. For example, nearly 50% of poor workers in the US earn wages above a proposed $10.10 minimum wage [10].

Finally, even among the relatively small number of poor individuals who are affected by minimum wage increases, adverse labor demand effects may undermine attempts to raise their net earnings. Studies focusing on these workers find that those in poor families who do not lose their jobs, or have their hours substantially reduced, see their earnings rise and their households lifted out of poverty. However, other near-poor workers experience minimum wage-induced job loss or hours reductions, causing earnings losses and increased poverty [8]. And if adverse employment effects are larger during recessions, minimum wage increases may have particularly adverse distributional consequences during economic downturns.

The literature on the poverty effects of minimum wages over the business cycle is even more nascent than that on employment effects over the business cycle. The one working paper that looked at this finds little consistent evidence that poverty effects of minimum wages differ over the business cycle [11]. The results of this paper suggest that increases in minimum wages are generally ineffective at reducing poverty during expansions and recessions.

Limitations and gaps

While the literatures on the employment, targeting, and poverty effects of minimum wages are large and mature, studies exploring the effects of minimum wages on GDP and their effects on employment and poverty over the business cycle are new. Further, while studies on the aggregate productivity effects of minimum wages cover a wide set of OECD countries, almost all of the studies examining the effects of minimum wages during recessions and expansions are US-focused. Future work is necessary to better understand minimum wage effects on poverty and employment during recessions in European, Asian, and Oceanic labor markets.

A key methodological challenge for researchers in this literature is accounting for policy endogeneity—that is, separating out the economic effects of minimum wages from underlying economic trends that may lead policymakers to introduce or raise minimum wages. A number of empirical techniques—including the addition of more intensive controls for geographic-specific economic trends over time, as well as synthetic control designs—have been used to separate out the causal effects of minimum wages from associations. However, more work is still necessary to better generate “cleaner” natural experiments and more credible counterfactuals.

In addition, the literature on the effects of minimum wages over the business cycle could benefit from greater collection of firm- and household-specific longitudinal data, which would allow greater insight into the mechanisms through which higher minimum wages affect the well-being of the poor and near poor.

Finally, studies of minimum wage effects over the business cycle have focused on labor markets with relatively small informal sectors. Future work examining the interactive effects of minimum wages and the business cycle across formal and informal sectors would make an important contribution to the body of scientific knowledge.

Summary and policy advice

Policymakers advocating minimum wage increases during recessions often tout their potential to “jumpstart” the economy during recessions and to alleviate poverty during times of economic downturns. A review of the existing empirical literature provides little support for either claim. In each case, the findings are much more consistent with redistributive effects of higher minimum wages.

In studies of OECD countries, the literature provides relatively little evidence that increases in minimum wages raise aggregate GDP. Rather, the results are more consistent with redistributive effects of the minimum wage across industries. A recent study of the US finds that a 10% increase in the minimum wage is associated with a 1−2% decrease in GDP generated by lower-skilled industries relative to higher-skilled industries [1]. The mechanism at work seems to be greater substitution of low- for high-skilled labor, rather than through inducing greater skill acquisition among low-skilled workers.

Finally, the results suggest that the adverse labor demand effects of minimum wages among low-skilled workers may be greater during troughs as compared to peaks in the business cycle. There is very little evidence that minimum wage increases reduce poverty among low-skilled workers during economic recessions.

Policymakers wishing to aid low-skilled workers during economic recessions, or to spur economic growth, should not look to the minimum wage as a policy solution. Rather, means-tested, pro-work cash assistance programs and negative income tax schemes—such as the earned income tax credit—far more efficiently deliver income to the working poor [11].

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author would also like to thank Richard Burkhauser. Thanks are also due to Thanh Tam Nguyen, Taylor Mackay, and Usamah Wasif for excellent research assistance. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in major parts of the article [1], [3], [8], [9], [10]. Grant support from the Employment Policies Institute is gratefully acknowledged for previous work upon which this article is based.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Joseph J. Sabia