Elevator pitch

Higher labor costs (higher wage rates and employee benefits) make workers better off, but they can reduce companies’ profits, the number of jobs, and the hours each person works. Overtime pay, hiring subsidies, the minimum wage, and payroll taxes are just a few of the policies that affect labor costs. Policies that increase labor costs can substantially affect both employment and hours, in individual companies as well as the overall economy.

Key findings

Pros

Increasing the minimum wage that employers must pay their workers prevents employers from exploiting workers who have few alternatives.

Increasing the minimum wage that employers must pay their workers increases earnings among low-wage workers who retain their jobs.

Increasing the penalty that employers pay for overtime work prevents employers from imposing long hours on individual employees.

Increasing the penalty that employers pay for overtime work encourages new job creation that can reduce unemployment.

Cons

Increasing the minimum wage that employers must pay their workers reduces total hours worked—jobs x hours/job—but with small impacts if minimum wage levels are low compared to average wages.

Increasing the minimum wage that employers must pay their workers reduces employment and increases unemployment if not enough people give up looking for jobs.

Increasing the minimum wage that employers must pay their workers has the biggest negative effect on the unskilled and minorities as well as young and older workers.

Increasing the penalty that employers pay for overtime work reduces total hours worked—jobs x hours/job.

Increasing the penalty that employers pay for overtime work reduces gross domestic product (GDP).

Author's main message

Higher labor costs reduce employment and/or the hours worked by individual employees. Laws that raise labor costs can either increase total employment or increase hours per worker, but they cannot do both. They lower the total amount of work performed in the market—the total number of person-hours (hours per worker multiplied by the number working). This loss must be traded off against the benefits that higher costs might provide to specific groups of workers.

Motivation

Every employer is concerned about labor costs—i.e. higher wage rates and employee benefits. An attractive package is essential for inducing people to apply for jobs and to work hard, but it will also subtract from the employer’s revenue and thus reduce profits. In any economy, policymakers confront this trade-off between imposing higher wage costs—for example, by introducing or raising a minimum wage—that benefit workers but reduce profits. Knowing how employers react to higher labor costs is essential to understanding how jobs are created and for predicting the economic impacts of labor legislation.

Discussion of pros and cons

The central question here is whether an employer’s reaction to higher labor costs differs from a consumer’s reaction to increased shirt prices? In general they should not be different: In both cases we are looking at how somebody’s demand for something reacts to an increase in its price. With shirts, we expect that higher prices will lead customers to buy fewer shirts and to wear the shirts that they do buy for longer. With workers, higher costs will lead employers to use fewer employees and to use them more productively. In a few labor markets where one employer dominates or is the sole employer, the employer might respond differently; but such markets are rare, and increasingly so as labor forces grow and transportation improves.

In fact the only important question is by how much employment falls when labor costs increase. It is not a question of whether it will fall, but rather one of how big the reduction will be. It is a more important question in the case of workers than of shirts because about 60% of all income in a modern economy is generated by employment.

Adjusting employment when you cannot adjust capital

When labor costs increase, an employer’s immediate options are to do nothing and absorb the extra cost, or to reduce the amount of labor employed. It takes time to alter capital investments in machinery, buildings, and technology, which might allow a more efficient operation. On the other hand, changing workers’ hours, or the number of workers, is quicker and easier. So an employer’s first decision when labor costs rise is whether to do nothing or to reduce employment and/or hours; and, if the latter, by how much [1].

One set of evidence on this question comes from large-scale studies examining how employment changes in industries where hourly wages increase more rapidly than in other industries in which all other conditions are essentially similar [1]. These studies, conducted for many different countries and different industries, yield—unsurprisingly—a wide variety of conclusions. Nonetheless, a reasonable consensus from this vast body of research is that higher hourly wages induce employers to cut employment and hours worked. The best inference from these studies is that a 10% increase in labor costs will lead to a 3% decrease in the number of employees (or to a 3% reduction in the hours they work, or to some combination of both). This is sometimes referred to as the “3 for 10” rule.

Much (although far from all) of this research ignores the fact that employers make wage and employment decisions at the same time. This raises the “chicken and egg” question of whether it is the rise in labor costs that causes employment to fall, or whether an increase in the demand for workers causes employers to raise wage rates. To get at the causality question, some studies focus on specific examples of the impact of shocks that alter the number of workers available to employers. Studies examine how the intifada in the Israeli-occupied territories altered wages and employment [2]; how sharp increases in payroll taxes in Colombia changed manufacturers’ demand for labor there (see Raising payroll taxes in Colombia) [3]; and how the withdrawal of able-bodied men from the American civilian workforce during World War II altered women’s employment and wages (see Labor cost and demand in the United States during World War II) [4]. Here too the evidence is varied. But higher hourly wage costs did lead employers to use fewer workers.

How rapidly do employers adjust to an increase in labor costs?

Employers do not react instantly when labor costs increase. It takes a while before they believe that the increase is not just a temporary aberration. They know that it takes time to find new workers if and when labor costs drop again. Furthermore, because of government restrictions on layoffs, and because reducing their workforce by waiting for employees to quit is limited by how many actually do quit, and when, employer response cannot be instantaneous. Despite these impediments, the evidence is very clear that things move fairly quickly. In the US at least half of the cuts in employment when labor costs increase occur in the first six months, while in continental Europe the adjustment is slower, but not greatly so [1].

Adjusting employment when you can change capital investment

A rise in wage costs per worker or per hour makes using more capital an attractive option for employers. If time allows, the capital investment option is increasingly taken up, thus substituting capital for labor. This takes time because it is more challenging to install new machinery or build new facilities that allow the company to operate more efficiently. This means that the 3 for 10 “best guess” at the initial response of employment levels to labor costs underestimates the eventual response. Indeed, the evidence suggests that the eventual response of employment to an increase in labor costs is much bigger [1]. A good estimate is that each 10% rise in labor costs eventually leads to a 10% drop in employment and/or hours—a 10 for 10 response.

Another way for an employer to change the amount of capital invested, as well as to reduce their need for labor when labor costs change, is to close an existing establishment. Going still further, businesses may even shut down all their operations if labor costs increase sufficiently to make the business unprofitable for the foreseeable future. The question that arises here is whether the impact on total employment of a given increase in labor costs as the result of businesses closing is the same as the impact due to business cutbacks. On the other hand—looking at what happens when labor costs fall—the question is whether jobs generated through the birth of new businesses in response to cheaper labor are in the same proportion as jobs created through expansions in existing businesses.

There is relatively little specific evidence on the impact of labor costs on job creation or destruction due to establishments or companies opening or closing. The few studies that do exist indicate that changes in labor demand caused by these more dramatic changes do not, on average, differ much from those resulting from plant expansions or contractions [1].

Not all employers respond the same way to increased labor costs

The 3 for 10 immediate and 10 for 10 eventual responses to increased labor costs are averages, but there is no such thing as an average worker. Some workers have more experience, better skills, and/or more education. Male workers differ from female workers, ethnic majority workers from ethnic minority workers, etc. The extent to which employers’ demand for workers changes when labor cost increases differs across all of these distinctions.

In one way or another, these intergroup differences distinguish the skills that workers have in the different groups. Thus, a good way to generalize about differences in how employers respond to increases in the costs of labor of various workers is to consider how skilled the workers are. Evidence demonstrates that the responses of employment levels to a particular labor-cost increase are smaller the more skilled the workers are [1]. For example, a 10% increase in labor costs leads employers to cut the employment of teenage and young adult workers by more than that of mature workers. When the labor costs of less-educated workers increase, their employment is reduced by more than that of university graduates for the same increase in labor cost.

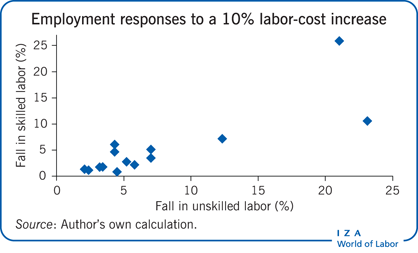

Evidence on this issue is found in many studies covering different countries, skill levels, and periods of time. The Illustration shows the results from a number of these studies. For each, the fall in skilled employment is plotted against the fall in unskilled employment when labor costs increase by 10%. In all but one of these diverse examples, the change in skilled employment is less than that in unskilled employment.

Fire employees or cut hours worked?

Whenever there is an increase in the cost of an hour of work—the worker’s wage rate—the employer faces a choice: fire employees, cut hours worked, or some combination of both? The choice matters to society: Most of us would rather see all workers lose four hours per week than see 10% of them lose their jobs while the remaining 90% keep their jobs with no changes in weekly work hours.

There is another important consideration—fixed labor costs, which do not vary if hours per worker are cut. For example, if the employer is responsible, as in the US, for providing medical insurance to his/her workers, those costs will not be reduced when hours per worker are cut with the number employed unchanged. Similarly, if employers are taxed on some small amount of a worker’s annual pay, as they are in the US by the tax that finances unemployment insurance, labor costs are not reduced if hours per worker are cut. Thus, the employer’s response to an increase in labor costs is not indifferent to its type [5].

Increases in the hourly wage rate and increases in these fixed costs reduce both employment and hours. But a rise in the fixed costs of labor increases the cost of an extra worker relative to that of an extra hour per worker. Because of that, imposing a per-worker tax causes employers to hire fewer workers and to extend the hours of existing workers [6], [7].

While the choice between cutting workers or hours per worker depends on the cost of each, the most important consideration is the total product of workers and hours—i.e. the total amount of labor used—that is generated by any combination of fixed and per-hour labor costs. After all, it is the total number of worker-hours across the economy that determines how much is produced—the GDP. From the perspective of the economy as a whole, the evidence on this is clear: An increase in wage rates reduces employment and hours, and an increase in the fixed costs of a worker reduces the total number of hours worked. Any increase in labor costs, regardless of its source, will lead employers to cut the total number of hours that they seek to use.

Some important policy examples

Minimum wages

Many countries impose minimum-wage requirements on most employers. In the US there is a national minimum, which in 2013 was around 35% of the average hourly wage (but a lower percentage of average labor costs), while some states (and cities) set minimum wages above that. In Canada, provinces set separate minimum wages; while the United Kingdom and France have national minima. In the US the purpose of these minima was stated when the Fair Labor Standards Act was first enacted in 1938: “To take labor out of competition”—that is, to prevent companies from exploiting workers in their search for lower labor costs and higher profits.

When effectively enforced, a minimum wage increases labor costs. It does this, though, for those workers whose wage would otherwise be below the minimum. The demand for a professor who can earn $50 per hour will not be affected by a $7.25 per hour minimum wage; it is the demand for a day-laborer who might otherwise earn only $7 that will be affected. The impact of a higher minimum wage on employment therefore depends on two things: how many workers there are who might otherwise earn less than the minimum; and how much it will reduce employment among those workers.

The second effect seems pretty clear: the demand for low-wage workers—who tend to be low-skilled workers—responds more sharply (negatively) than average when labor costs are increased, as we have already noted.

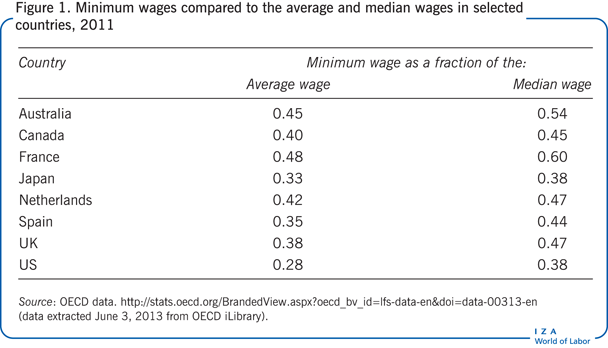

Figure 1 shows that there are substantial differences in the relative importance of statutory minimum wages across a number of major economies: The US has a low statutory minimum wage (0.28 of the average), while France has a very high minimum (0.48 of the average) relative to the average wage. The figure also implicitly makes the important point that what matters is the fraction of workers whose wages are sufficiently low that an increase in the statutory minimum might affect the demand for their services.

Research on the effects of the minimum wage has occupied economists for over half a century, probably to a much greater degree than its importance warrants. Despite all the research, the conclusions remain very controversial, in part because they deal with a policy issue that is universally contentious. A fair reading of the evidence suggests that a higher minimum wage has small negative effects on employment, and that these effects increase the more the minimum is raised relative to the average wage [8]. Also, however, raising the minimum wage does result in higher earnings for those low-wage workers who remain employed despite the higher labor costs.

Overtime pay

A second policy example is overtime pay. In effect, overtime pay is a penalty paid by the employer for hours worked by an employee beyond a statutorily specified maximum. In some countries employers must pay overtime rates for each hour a worker puts in per week beyond a standard number of hours (40 in many countries, including the US, Japan, and Korea). The extra amount paid may be 50%, as in the US, or 25% as in Japan and many other countries. In some countries the overtime rate starts low but rises after a few hours are worked; for example, in Korea the additional amount paid is 25% for the first four overtime hours worked per week and rises to 50% thereafter. In many countries there are statutory weekly and/or annual maxima on overtime work; in some the overtime penalty applies on a daily rather than a weekly basis.

All of these policies have two purposes: to “spread” work by providing employers with incentives to employ more workers, each of whom is working a shorter workweek; and to protect workers from being forced to work very long hours at undesirable times. The evidence makes it very clear that these laws are effective in inducing employers to introduce shorter workweeks and to avoid long workdays (see Imposing the 40-hour workweek in the US in the 1940s) [6], [7], [9]. Although it is not clear how much they do spread work (i.e. cause employers to employ more workers than they otherwise would), they do increase the number of employees relative to the number of hours each worker puts in. It is clear, though, that they reduce the total number of hours worked (hours x workers) by raising the cost of labor [1].

Penalties for unusual timing

Employers’ demand for labor has a temporal dimension in addition to its quantitative dimensions: When people work matters to both employers and to workers. Many employers earn higher profits by operating their businesses at nights and/or on weekends, creating a demand for workers at what might be unusual times. Their desires for increased profits conflict, though, with workers’ apparent preferences against working when most other workers are enjoying leisure, including on weekends and at night. Thus, not surprisingly, in most modern economies such work is performed disproportionately by less-skilled, minority and immigrant workers, for whom these undesirable work times are often the best they can obtain.

In many countries, employers who remain open on weekends or at nights must pay legislated penalty rates to their employees, penalties that are independent of the amount of time worked per week (which is covered by the overtime laws discussed above). For example, in Portugal, work during weekday nights is penalized at a 25% rate; work on weekend days can be penalized at up to a 100% rate, while on weekend nights the penalties can reach 150% of the usual wage rate. In some other countries, such as the US, no such legislated penalties exist.

The extra cost to employers of operating at nights or on weekends that these penalties impose does reduce such work—they shift some of the demand for labor at unusual times to more standard work times [10]. While research on this issue is still sparse, the evidence thus far suggests that employers’ scheduling of work time is quite responsive to higher penalties. Raising the cost of work scheduled at times that workers find undesirable will substantially reduce the amount of such work that is undertaken.

Payroll taxes and the demand for skill

In many countries, the payroll tax on an employer is at least partly capped: It does not apply or is reduced on earnings above some legislated amount. In the US, for example, the tax on employers that finances public retirement and medical benefits is 7.65% on annual earnings paid below $113,700 per year, but only 1.45% on additional earnings exceeding that level. The much lower tax that finances the administration of unemployment insurance is capped at earnings of only $7,000 per year.

The level of these caps affects the relative demand for workers with different skills. At the same percentage tax rate, reducing the tax cap disproportionately raises employers’ costs on low-skilled workers. Employers in many industries readily substitute skilled for unskilled workers when their relative costs vary, so that reducing the cap will reduce employers’ relative demand for less-skilled workers by raising their relative cost. Policymakers thus need to consider how any change in payroll tax rates, or in the ceilings on the amount that is taxable, will alter the employment of workers who differ by skill level.

Limitations and gaps

The question posed in the title of this article is one of the broadest in the world of labor. The reaction of the demand for workers and hours to changes in labor costs underlies both an employer’s private considerations and a wide variety of questions of public policy in every economy. Given its breadth, we cannot expect to find specific answers to specific questions. We can, and have, however, answered such general questions as:

How much does employment fall on average when labor costs rise by some amount?

How does the answer to this question change with differing worker characteristics, such as skill levels?

How does the number of workers employed and hours per worker change as various types of labor costs change?

However, we cannot answer specific questions, such as:

How would the number of workers in Bulgaria change if the Bulgarian government imposed a 10% payroll tax on the employment of all workers?

How would the number of workers in Slovakia change if the Slovakian government imposed a 10% payroll tax on the employment of skilled workers?

How many fewer hours per week would Vietnamese employers use their workers for if they were required to pay a 100% overtime rate on hours per worker beyond 40?

These particular examples are of narrow interest, but questions like them apply in each country and for each type of worker. The evidence presented here suggests general guidelines that allow policymakers a general view about the direction, and in some cases the sizes, of the impacts of proposed increases in labor costs on outcomes such as employment and hours. What it does not do is allow us to answer specific questions. To arrive at detailed answers to policy and other questions in specific (national, worker-type) instances, targeted research is required that addresses the particular example.

Summary and policy advice

Higher labor costs unaccompanied by technology changes that increase productivity reduce employers’ willingness to hire workers and reduce the total amount of work done in any economy. This fact, which is well established by the evidence, means that any attempt to make workers better off by raising their wages or giving them wage premia for longer hours of work will reduce the total amount of labor that employers will use. With less labor, less will be produced. We know roughly how much employment will drop on average for a given increase in labor costs, and how the magnitudes of these declines will differ across worker groups with different characteristics. We also know that changes in labor costs that raise the cost of an extra hour of work while leaving unchanged the cost of an extra worker will induce employers to substitute workers for hours.

Policymakers need to be aware that negative consequences are possible when increasing minimum wages or imposing other measures that increase labor costs. Some people will benefit, but each increase will reduce the number of jobs and/or the total amount of work available in the economy.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Daniel S. Hamermesh

Raising payroll taxes in Colombia

Kugler, A., and M. Kugler. “Labor market effects of payroll taxes in developing countries: Evidence from Colombia.” Economic Development and Cultural Change 57:2 (2009): 335–358.

Labor cost and demand in the United States during World War II

Acemoglu, D., D. Autor, and D. Lyle. “Women, war and wages: The effect of female labor supply on the wage structure at midcentury.” Journal of Political Economy 112:3 (2004): 497–551.