Elevator pitch

The evidence is mixed on whether informal labor in developing countries benefits from trade and labor market reforms. Reforms lead to higher wages and improved employment conditions in the informal sector in some cases, and to the opposite effect in others. At a cross-country level, lifting trade protection boosts informal-sector employment. The direction and size of the impacts on informal-sector employment and wages are determined by capital mobility and the interactions between trade and labor market reforms and public policies, such as monitoring the formal sector. To guarantee best practice policymakers need to take these interdependencies into account.

Key findings

Pros

Trade reform and capital mobility have important implications for informal sector labor through direct production relationships and indirect linkages.

Trade reforms and better access to credit improve the wage and employment conditions of unskilled workers in the informal sector.

Following a phase of high capital mobility, informal firms register higher labor productivity despite an influx of workers to the sector.

Labor market reforms that follow trade reforms are expected to raise the informal wage.

Cons

Without sufficient capital mobility, job losses in formal sector industries lead to lower wages in the informal sector.

Expansion of informal activities following trade reform results in lower productivity and economic growth.

Improper implementation of labor market reforms may aggravate informality within formal units and exacerbate wage and employment conditions in informal firms.

Without unemployment insurance, trade reforms that increase foreign competition may push the government toward greater acceptance of informal arrangements.

Author's main message

Because so many people in developing countries work in the unregulated informal sector, even small gains in real wages can improve the welfare of millions. Thus, it is vital to understand the impact of economic reforms on the informal sector. Accompanied by capital mobility, trade reforms can improve wages and employment conditions among unskilled informal workers; accompanied by monitoring of formal firms, labor market reforms can improve worker welfare by reducing employment duality between formal and informal sectors. Easing credit constraints for informal businesses and discouraging formal firms from using informal labor are important.

Motivation

The informal economy has emerged as one of the most dynamic and hotly debated topics in the economics literature on developing countries. Large shares of the workforce in poor countries engage in informal sector activities. Generally, the informal sector includes unregistered firms that evade taxes, labor regulations, and environmental regulations, as well as registered firms that deliberately engage in some unrecorded activities in product and factor markets alongside their legal or registered activities. Such activities include hiring workers on temporary contracts and not paying the minimum wage or outsourcing part of the production to informal firms to cut costs. In many countries, a heavy burden of taxes, bribes, and inflexible bureaucratic regulations in the formal sector drive producers into the informal sector [1]. Despite the importance of the informal sector, however, there has not been much research on the labor market conditions, production organization, and domestic policies (labor market) and international policies (trade) that affect workers in the informal sector. Only a handful of studies have examined the welfare implications of trade and labor reforms on the informal sector, including [2], [3], [4], [5], [6], [7], [8]. These interactions should be of considerable interest to policymakers, regulators, labor unions, formal sector firms, and consumers. For example, policies to reform stringent regulations in the labor market may reduce informal activities and weaken labor unions. Such policies may simultaneously lower wages, increase formal employment, and lower prices of non-traded commodities.

Discussion of pros and cons

The informal sector absorbs a large part of the medium- and low-skilled workforce in developing and transition economies. Consequently, productivity and market-equilibrium wages are low in the informal sector.

When comprehensive trade reforms lower import barriers in a developing country, formerly protected firms producing import substitute goods are exposed to international competition, and many of them fail. Some may then relocate from formal to informal since the informal sector may offer better prices by eluding labor market, tax, and other regulations as a result of imperfect and easily corrupted monitoring systems in many poor countries.

This movement into the informal sector may be either beneficial or harmful for stayers and movers. Under some plausible conditions, trade reforms improve wages in informal firms. Especially instrumental is the mobility of capital. Greater inflow of capital, even with large inflow of labor, often improves the productivity of informal workers and raises their wages. In a typical informal unit of an unregistered manufacturing firm with fewer than 10 workers or in single-person (own-account) enterprises, the inflow of capital can lead to asset accumulation and thereby generate value added. Informal workers may benefit if the firm expands and hires more workers. If, however, the flow of capital is restricted, whether because of the problematic legal position of the informal unit or for reasons of imperfect information facing financial organizations, then trade reforms will push only workers (but not capital) into the informal sector and wages will fall as a consequence of excess supply of workers. Analogously, labor market reforms, such as the easing of hiring and firing regulations and the rationalization of unemployment insurance, are expected to raise the incentives for formal employment and hence raise wages in the informal sector. However, the general lack of monitoring of formal firms encourages the use of informal arrangements. Consequently, the impact on wages and employment in the informal sector is quite small.

The argument that the state can choose the level of informality and the degree of governance assumes that governments are capable of enforcing regulations. While this may be true in some, it is far from universally true for most transition and developing countries. The persistence of informal activities is functionally related to the extent of monitoring and to the corruptibility of the monitors. If the formal sector faces higher taxes and stricter regulations, the informal sector may grow. And corrupt behavior by government monitors may even be closely linked to a political strategy of extracting bribes from companies that evade taxes and regulations. To varying degrees, this behavior applies to both large evaders and to many own-account enterprises and vendors that pay small bribes. The absence of job opportunities in the formal sector for low-skilled workers combined with weak governance may be instrumental in driving such corruption.

Why the informal labor market?

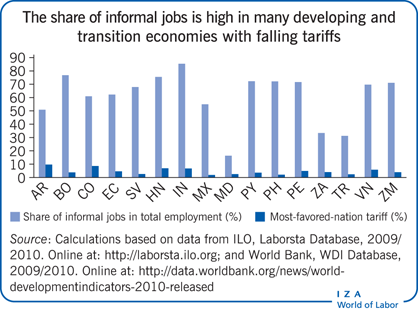

In developing and transition economies, the formal labor market is typically shallow, leaving a large share of the workforce outside of centralized collective bargaining arrangements and entitlements to institutionally recognized benefits. On average, 70% of the labor force is beyond the reach of these protections [8].

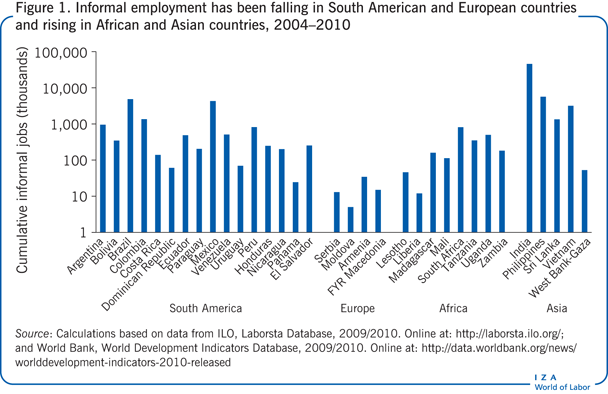

Urban informal sector employment in Southeast Asia, Eastern Europe, Africa, and Latin America ranges from 15% to 20% in Turkey and Slovakia to 80% in Zambia and about 83% in Myanmar. Figure 1 offers a cross-country comparison of informal employment between 2004 and 2010. Informal employment has been rising in African and Asian countries and falling in South American and European countries. Given this cross-country distribution, what happens to the level of informalization when economic reforms are implemented? For some countries, as discussed below, informal activities expand following reforms. The question then is whether wages fall with this expansion of the informal sector as laid-off workers in the formal sector move into the informal sector? Studies have found that when trade reforms result in the contraction of protected and often state-run formal industries and services and lead to layoffs and worker movement into the informal sector, wages can rise along with employment if capital is also able to relocate to the informal sector [3], [5].

Workers in the informal sector are sometimes identified as marginalized, underprivileged, and victims of the fallout of free-market mechanisms. However, while working conditions in the informal sector can be substantially below desirable standards and raising them to an acceptable level is important, this sector may still benefit from a more open and liberal economic environment. While many informal sector workers deal in non-traded commodities and services, such as street vending and domestic work, in many countries they produce intermediate goods, processed exports, and import substitutes under subcontract to formal firms (see [9] for a surprising array of commodities produced by informal producers in India). Other informal industries produce garments, leather goods, small tools, and machinery that they export directly—often bypassing formal regulations and procedures by trading informally across borders to adjacent areas. In addition, in most developing countries, agriculture, animal husbandry, and the production of primary commodities and non-durables are predominantly outside the formal sphere.

Industrial and trade reforms can significantly affect these extensive activities and the level of informal employment which is important for broadening the scope of policy options. Given the large share of employment in these sectors, even small positive gains in the real wage can increase the welfare of millions of people in developing and transition economies.

Effects of trade reform and capital flows on the informal labor market

Many developing countries have been experimenting with trade reforms for decades. As countries open their borders to foreign competition and governments reduce financial support to favored industries, the no longer protected industries contract, releasing large amounts of capital and labor to shift to more profitable ventures. At the same time, predominantly service-oriented industries that face less stringent labor laws and industrial regulations begin to expand. Because most of the laid-off workers in typical import-competing public or private enterprises are not a good fit for jobs in these (new) service industries, which rather recruit high-skilled professionals with advanced technical expertise, a large share of the newly available labor and capital flows into informal businesses.

When formal sector industries feel the impact of economic reforms and shift some of their production to the informal sector, productivity and wages will fall in the informal sector if there is no new investment to support the shift in employment to the informal sector. For example, when the informal sector uses labor-intensive production techniques to produce commodities that are easily substitutable for each other, capital mobility between formal and informal sectors will be low [3]. In contrast, when capital is free to move between sectors, along with labor, productivity and wages will rise. A similar outcome occurs when foreign capital is invested in formal production and service units in low-wage countries. To remain competitive in the face of rising wages for skilled workers in formal enterprises, these firms may outsource some of their production to informal firms, along with infusions of technology and capital.

While the empirical evidence at the country level for these theoretical impacts of trade and labor market reforms on informal labor is still slight, a few studies have enriched the scope and understanding. One study posits that trade liberalization has an ambiguous effect on the informal sector based on an industry-level comparison between Brazil, where little or no connection was found between trade policy and informality, and Colombia, where liberal trade policies led to considerable expansion of the informal sector [10].

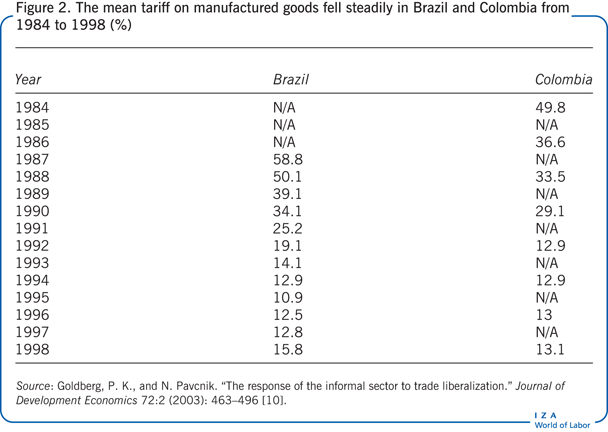

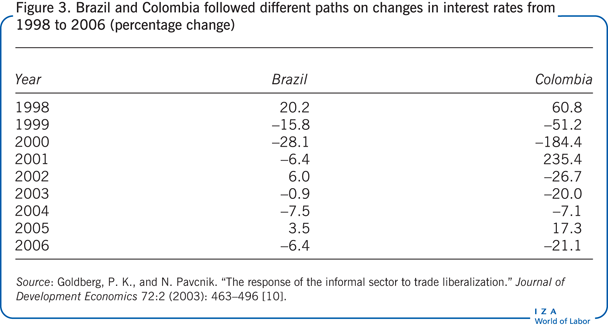

The inconclusiveness of this relationship warrants a re-evaluation of the issue both theoretically and empirically. Consider, for instance, the comparison between formal and informal production and how the interaction of two policy interventions (tariffs and interest rates) can yield different results than each policy would individually. Lowering tariffs is likely to expand informal production, while lowering interest rates is likely to expand formal production. In both Brazil and Colombia import tariffs on manufactured goods went down steadily between 1984 and 1998 (Figure 2), yet the economic performance of the informal sector in the two countries diverged. In contrast, the real interest rate behaved differently in Brazil and Colombia: while Brazil started on a path of lowering the real interest rate, with large changes between years, Colombia raised and then lowered its real interest rate as shown in Figure 3. This suggests that the gradual but clear impetus to formal entrepreneurship through cheaper credits helped the formal sector to expand in Brazil, while Colombia’s reversals of policy did not help the formal sector grow as much.

While it is possible to conclude from Figure 2 and Figure 3 that both countries reduced tariffs over time, only in Brazil did the fall in the real interest rate (and in the lending rate) offset the negative effects of trade reforms on formal sector jobs. In Colombia, cutting the real interest rate as part of the reform package has not been as influential, leading to an expansion of the informal sector following trade liberalization.

However, several other variables need to be considered as well in evaluating such results. In a large democracy like India, for example, informal activities are extensive and make a large contribution to national and regional income. With so many people directly and indirectly involved in the informal sector, further expansion of the sector as a result of economic reforms could put protection of property rights, enforcement of legal contracts, and the effectiveness of a weak legal system under heavy pressure. Many developing and transition economies around the world seem to be at risk of these outcomes [11].

The government’s role in the emergence and growth of the informal sector

In a democracy, the threshold between legal and extralegal can be a political choice, a thesis that has been somewhat neglected in discussions about the creation and persistence of dual (formal and informal) labor markets. One argument posits that lack of property rights and legal contracts in the informal sector blocks development [1]. Policies that guarantee property rights and enforce legal contracts, therefore, would release capital for investment and growth. Another study examines the intricacies of contractual arrangements to reflect on the boundaries between legality and extra-legality, which are often porous [11]. Other studies focus on the political rationale for perpetuating informal arrangements, proposing that democratic states with a high incidence of poverty and weak social welfare institutions may use the informal sector as a substitute for social security and a testing ground for innovative redistribution strategies other than tax policies. In that context, how strongly property rights are enforced becomes a strategic political variable. Allowing extralegal activities to flourish in a thriving informal sector may be a deliberate government strategy in a poor country since it helps to reduce problems of unemployment and poverty. In such cases, government policies can determine to some extent the size of the informal economy [12].

Thus, the jury is still out on whether the state as an authority can set limits on the use of public space for private consumption in developing countries. Multiple channels have been proposed as leading to informality among firms. For example, the quality of the legal framework is crucial for determining the size of the informal sector. If the legal system functions properly, then taxes and regulations are of limited importance to the size of existing informal firms or to expansion of the whole sector. Firm size and the degree of informality have been found to be negatively correlated, although stringent legal norms may still push larger firms into the informal sector. Examination of tax registration for firms in Bolivia, which has the largest informal sector in South America, finds that it leads to lower profits for smaller and larger firms but higher profits for mid-size firms. Very small (one-person) firms have little to gain from formalization. Neither do firms with up to six workers, which end up paying more in taxes without benefiting from an expansion in customers. The firms in the middle, in contrast, can grow bigger and reap higher profits as a result of the boost to their reputation and consumer confidence that comes from demonstrating compliance with tax laws.

Because the nature of informality is not the same in every society, neither is the appropriate role for government. In some societies, the level of governance has a substantial impact on the incomes of informal workers, while in others it has little impact. The fear of social unrest and political collapse may drive policies of extensive patronage of the informal sector. A democratic government facing a high level of poverty might choose lower taxes and weak governance as instruments to increase informalization of the economy. Such policies would then be an instrument of redistribution, working where lower taxes might not, and serving as a back-door approach to development. In societies where a change in the degree of governance has negligible impact on the incomes of informal workers, however, governments might choose higher levels of governance and tax rates.

Role of monitoring in the formal and informal sectors

Labor markets in many developing countries suffer from a range of rigidities, from regulations governing the hiring and dismissal of workers and working hours to minimum wage legislation and the strength of labor unions. If hiring and firing workers is costly and if businesses cannot easily be dissolved, for example, employment in the formal sector may decline and firms may resort to hiring workers under informal arrangements, especially if monitoring is weak and corruption is common. Thus, labor market reforms are expected to boost formal industrial employment by making labor market regulation more flexible. Although such policies apply directly only to the formal sector, which is small in developing countries, a more employer-friendly policy will lead to a rise in the informal wage by boosting demand for labor in the formal sector and drawing workers from the pool of informal workers.

The picture is more complex than this, however. Whether a particular reform benefits informal workers depends on whether and how capital moves across sectors. Formal and informal labor markets are closely linked in many ways, through the separation of different stages of production, outsourcing, and movement of labor and capital between the two segments.

If capital is homogeneous and freely mobile between the formal and the informal sectors, then labor market reforms that are favorable to capital will increase the relative return to capital in the formal sector, drawing in more capital and labor from the informal sector. Depending on the degree and speed with which capital relocates, reforms may lead to a rise or a fall in informal wages and employment. But when capital movement between the sectors is restricted by legal requirements or by information shortcomings, stringent labor market regulations also hurt informal workers. The logic is simple. With inadequate employment options in underdeveloped formal sectors, workers crowd into the informal sector, and with inadequate movement of capital, productivity and wages fall. However, if capital can move freely, aggressive action by trade unions in the organized sector will push capital toward the informal sector, thereby raising the informal wage despite the sector’s large absorption of workers. In that case, the interests of organized and unorganized workers will converge.

How well this process works also depends on the extent of government monitoring of regulations and the quality of governance. Additionally, in monitoring compliance, policymakers need to consider differences in worker productivity and skills. Where productivity and skills differ, and workers with high productivity and skills are matched with formal sector jobs while workers with low productivity and skills are matched with informal jobs, perfect substitution of workers across firms in response to changes in formal or informal sector wages would not be possible. However, if informal workers are less productive than the formal sector workers, stricter enforcement will reduce employment in both formal and informal sector firms. Consequently, the state as monitoring authority would need to be concerned with minimizing the fall in employment if it chooses to implement stricter enforcement.

Limitations and gaps

Cross-country data on the conditions of labor in the informal sector in developing countries are severely limited. Only recently has the International Labour Organization, in collaboration with Women in Informal Employment, Globalizing and Organizing, begun to make available some annual data on the number of firms and workers in the informal sector across countries. Data are available for some countries, mainly on the distribution of labor in agriculture and in allied, mostly informal, activities. For example, India’s Central Statistical Organization publishes, at the state level, accounts of informal units, workers by gender, assets owned by manufacturing or self-employed units, value added at the unit level, and other data at three- to five-year intervals. However, the lack of uniformity of such data across countries prevents rigorous comparison and evaluation of the impact of internal and external shocks on informal labor. Having access to harmonized country-level data could enable more rigorous analysis of the effects of economic reforms on the informal sector.

In estimating the impact of economic reforms on informal labor, additional research is still needed on other factors that affect capital mobility and economic reform and their implications for wage and employment conditions in the informal sector. For example, linking labor market reforms and conditions in the informal sector requires to account for aspects such as skill formation and credit market behavior in the country. In addition, to fully understand the impact of economic reforms and capital mobility on informal sector wages and employment, the problems arising out of inadequate flow of information between various agents cannot be neglected. Despite potentially high returns in the informal sector, the fact that formal capital does not easily relocate to the sector has a lot to do with risk and uncertainty in informal businesses. How credit market imperfections affect informal entrepreneurship in developing countries is another area that needs more attention. Differences in skills across workers in the formal and informal sectors are also important.

More research is also needed on government enforcement of regulations and on whether the state “chooses” the level of informality and the degree of governance. The persistence of informality seems to be functionally related to the extent of monitoring and the corruptibility of monitors. Corrupt behavior by monitors may even reflect a political strategy of extracting extralegal payments from informal companies. The absence of job opportunities in the formal sector for low-skilled workers combined with weak governance may be instrumental in driving such corruption.

Summary and policy advice

A number of studies contextualize and explore the channels through which economic reforms in the formal sector affect the informal sector. One of these channels, capital mobility, has a crucial role in explaining the relationship between the formal and informal sectors. For example, if the formal sector contracts and many workers lose their jobs, the informal sector can serve as a safety net in developing countries that lack social security benefits and unemployment insurance. This outcome would, however, lower wages in the informal sector and make informal sector workers worse off. However, analyses for some countries have found little or no evidence of wage cuts despite expansion of informal activities. This may be explained in part by capital mobility.

In addition, multiple country studies document the coexistence of formal and informal activities and their interactions under the same institutional arrangements, which may replace the dual-economy model of entirely separate sectors. Data for some countries, including Brazil, China, India, and South Africa, show that outsourcing and off-shoring jobs are not strictly limited to formal sector firms, which are exploring new avenues for remaining competitive by bending previous norms.

With participation in labor unions waning, formal sector firms are adopting informal employment arrangements in parallel with their more conventional models of job organization, hiring workers through contractual agreements that cover little more than salaries. New forms of production organization and demand-side effects alone are not responsible for these changes. The steady flow of jobs into such looser employment arrangements is also guided by social changes that put less emphasis on strictly formal employment practices. Other contributing factors are still unknown or are difficult to quantify.

The policy implications of these new forms of production organization that link the formal and informal sectors could be profound. Externalities—both positive and negative—are common where there are dual labor markets and production organizations. Externalities typically lead to sub-optimal choices, which may explain the growth of large informal economies. In this context, when trying to optimize policy decisions, several political-economy variables are relevant. The level of governance and tax rates then becomes the most important policy consideration for influencing the activity and location of informal labor. Thus tax and governance policies have the power to affect whether a larger share of the workforce becomes part of the formal sector or whether strict regulations will create fewer formal jobs. Informal activities influence many other decisions at the individual and household levels, including labor market participation, job search, and work effort.

Overall, policies to promote free trade may lead to an expansion of informal jobs in an economy. The specific policy recommendation then might be to enable credit to flow into the informal sector to counter the negative impact on informal wages. Labor market reforms in the urban formal sector may expand formal employment, but unless the semi-urban or rural sector also develops, the size of urban informal sector may expand more than proportionately, lowering wages. Therefore, trade and labor market reforms must be supplemented by policies to partly or fully counteract any negative impacts on informal wages and the welfare of workers.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [3], [8].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Saibal Kar